Growing E-commerce Sector

The expansion of the e-commerce sector is a crucial driver for the Global Online Payment Fraud Detection Market Industry. As more consumers turn to online shopping, the volume of digital transactions continues to surge. This trend is expected to contribute to the market's growth, with projections indicating a rise to 47.3 USD Billion by 2035. E-commerce platforms are increasingly targeted by fraudsters, necessitating the implementation of effective fraud detection measures. Consequently, businesses are investing in sophisticated solutions to protect their revenue and customer trust, suggesting that the market will experience sustained growth as e-commerce continues to thrive.

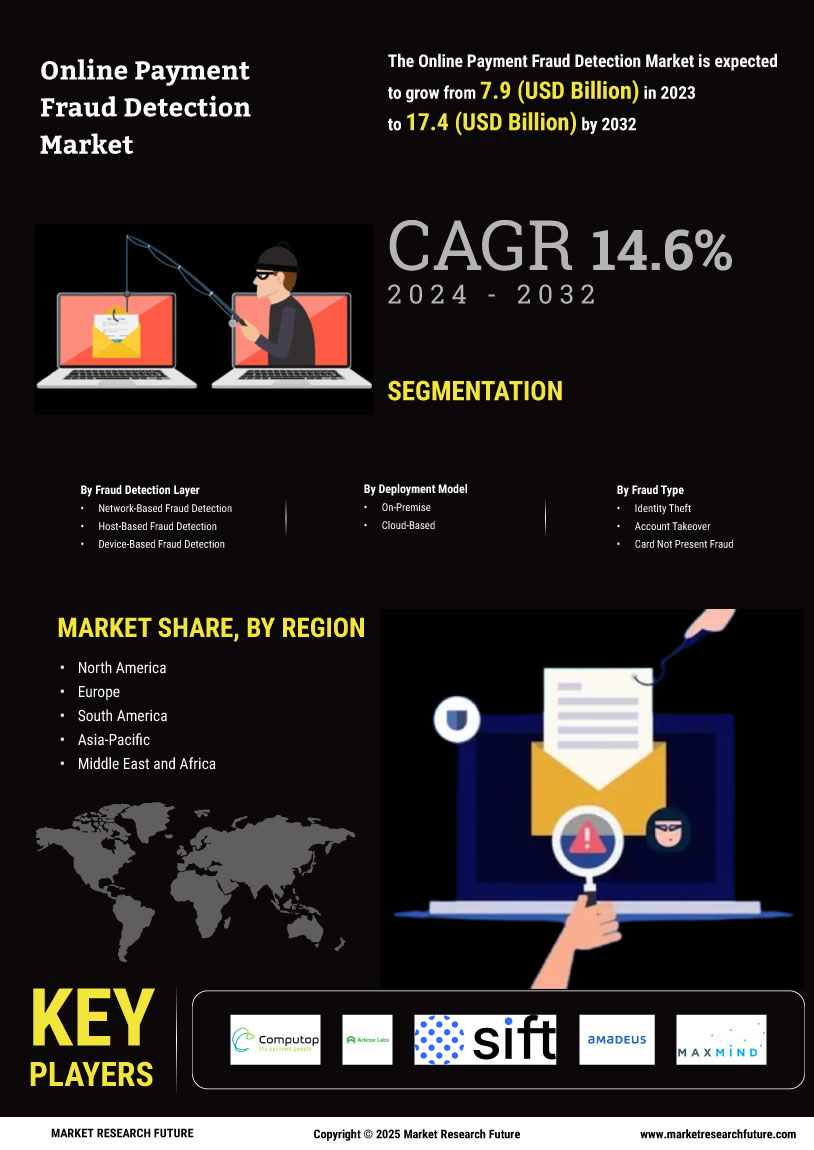

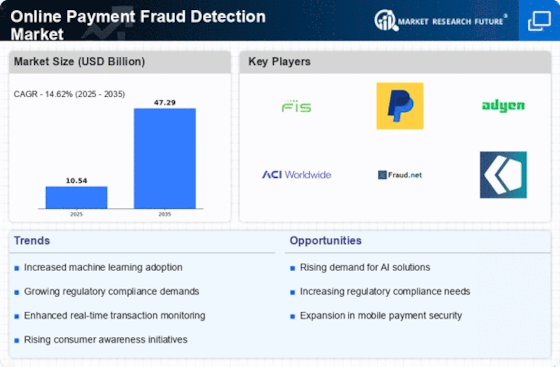

Market Growth Projections

The Global Online Payment Fraud Detection Market Industry is poised for substantial growth in the coming years. With a projected market value of 10.5 USD Billion in 2024, the industry is expected to expand significantly, reaching 47.3 USD Billion by 2035. This growth trajectory suggests a robust demand for innovative fraud detection solutions, driven by increasing digital transactions and evolving cyber threats. The anticipated CAGR of 14.62% from 2025 to 2035 further underscores the industry's potential for expansion. As businesses and consumers alike prioritize security in online payments, the market is likely to witness a surge in investment and technological advancements.

Increasing Cybersecurity Threats

The rise in cybersecurity threats is a primary driver of the Global Online Payment Fraud Detection Market Industry. As digital transactions proliferate, so do the tactics employed by cybercriminals. In 2024, the market is projected to reach 10.5 USD Billion, reflecting a growing need for robust fraud detection systems. Organizations are increasingly investing in advanced technologies such as machine learning and artificial intelligence to combat these threats. The urgency to protect sensitive financial data has led to a surge in demand for innovative solutions, indicating that the market will continue to expand as businesses seek to safeguard their operations against evolving fraud tactics.

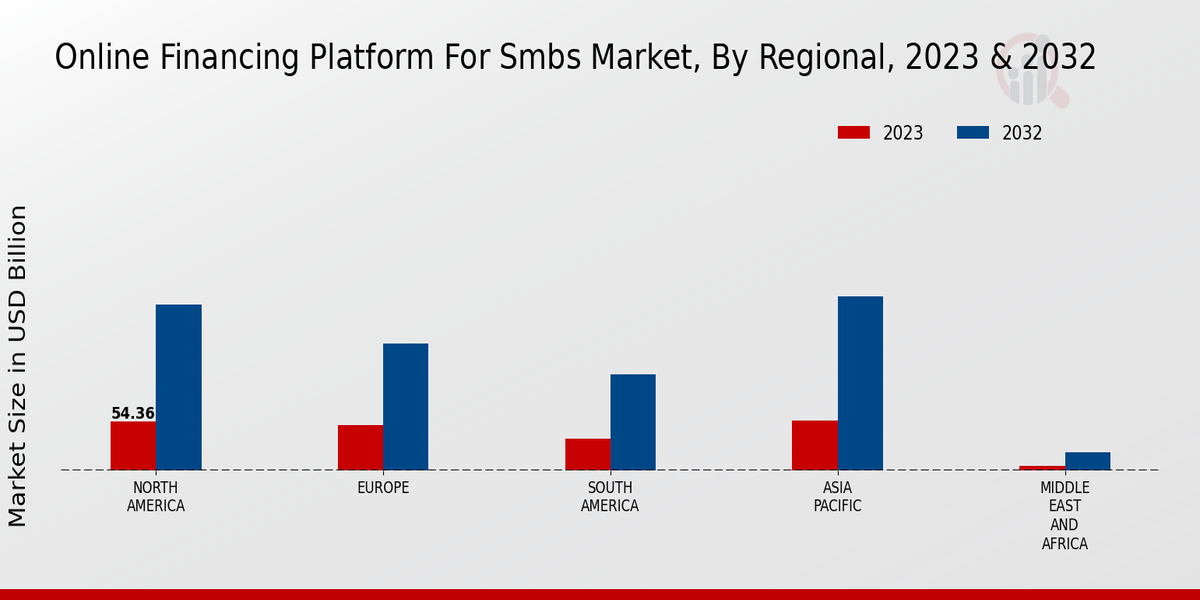

Regulatory Compliance Requirements

Regulatory compliance is a significant factor influencing the Global Online Payment Fraud Detection Market Industry. Governments worldwide are implementing stringent regulations to protect consumers and ensure secure online transactions. Compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) is mandatory for businesses handling payment data. This regulatory landscape compels organizations to adopt advanced fraud detection solutions, driving market growth. As the market evolves, the need for compliance with emerging regulations will likely create opportunities for innovative technologies, further propelling the industry's expansion in the coming years.

Consumer Awareness and Demand for Security

Consumer awareness regarding online security is increasingly influencing the Global Online Payment Fraud Detection Market Industry. As individuals become more informed about the risks associated with online transactions, they demand enhanced security measures from businesses. This heightened awareness compels organizations to invest in advanced fraud detection systems to maintain customer trust and loyalty. The growing expectation for secure payment processes is likely to drive market growth as companies prioritize the implementation of robust security measures. This trend indicates that the industry will continue to evolve in response to consumer demands for greater protection in the digital payment landscape.

Technological Advancements in Fraud Detection

Technological advancements play a pivotal role in shaping the Global Online Payment Fraud Detection Market Industry. Innovations such as artificial intelligence, machine learning, and blockchain technology are revolutionizing fraud detection capabilities. These technologies enable real-time monitoring and analysis of transactions, significantly enhancing the ability to identify fraudulent activities. As organizations seek to leverage these advancements, the market is likely to witness substantial growth, with a projected CAGR of 14.62% from 2025 to 2035. The continuous evolution of technology will drive the demand for more sophisticated fraud detection solutions, positioning the industry for future success.