Oncology Drugs Market Share

Oncology Drugs Market Research Report By Drug Type (Chemotherapy Drugs, Targeted Therapy Drugs, Immunotherapy Drugs, Hormonal Therapy Drugs), By Therapeutic Area (Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Leukemia), By Route of Administration (Oral, Intravenous, Subcutaneous, Intramuscular), By Patient Demographics (Adult, Pediatric, Geriatric) and By Regional (North Ameri...

Market Summary

As per Market Research Future Analysis, the Oncology Drugs Market was valued at 289.37 USD Billion in 2025 and is projected to grow to 751.57 USD Billion by 2035, reflecting a CAGR of 10.01% from 2025 to 2035. The market is driven by the rising incidence of cancer, technological advancements in drug development, and increased funding for cancer research.

Key Market Trends & Highlights

The Global Oncology Drugs Market is experiencing significant growth due to various factors.

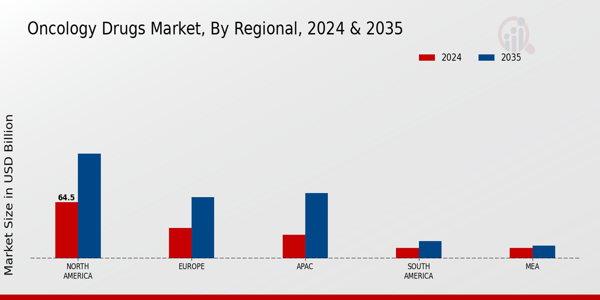

- The number of cancer cases is expected to rise to approximately 29.5 million by 2040, a 53% increase from 2020. Chemotherapy Drugs are projected to grow from 35.0 USD Billion in 2024 to 70.0 USD Billion by 2035. Immunotherapy Drugs are anticipated to rise from 50.0 USD Billion in 2024 to 100.0 USD Billion by 2035. North America is expected to hold a majority share valued at 64.5 USD Billion in 2024.

Market Size & Forecast

| 2023 Market Size | USD 141.35 Billion |

| 2024 Market Size | USD 150.5 Billion |

| 2035 Market Size | USD 751.57 Billion |

| CAGR (2025-2035) | 10.01% |

| Largest Regional Market Share in 2024 | North America |

Major Players

<p>Pfizer, Roche, Gilead Sciences, Eli Lilly, Bristol Myers Squibb, Johnson and Johnson, AbbVie, Seattle Genetics, Novartis, Celgene, Regeneron Pharmaceuticals, Merck, AstraZeneca, Amgen, Sanofi</p>

Market Trends

The Global Oncology Drugs Market is presently undergoing substantial growth, which is being fueled by a variety of critical factors. The fact that cancer has become one of the most prevalent causes of mortality in numerous regions is a significant factor contributing to the global increase in its prevalence. Governments are also playing a critical role in the enhancement of cancer care by funding research and the development of new therapies.

Pharmaceutical companies are emphasizing personalized medicine, which optimizes the efficacy of oncology medications by customizing treatment to the genetic makeup of each patient. This trend toward targeted therapies is a significant one in the market, as it enables the development of more effective treatment options with potentially fewer adverse effects. In developing economies, the Global Oncology Drugs Market offers a plethora of opportunities due to the increased demand for advanced cancer treatments that can be a result of enhanced access to medical technology and increased healthcare spending.

Additionally, there is a growing trend toward combination therapies, which involve the use of various medication classes in conjunction to enhance patient outcomes. The approach to treatment is rendered more comprehensive by these strategies, which not only optimize treatment effectiveness but also align with the evolving comprehension of cancer biology. The incorporation of artificial intelligence and data analytics in oncology drug development has been a recent trend, enabling the development of more efficient clinical trials and the acceleration of drug discovery.

<p>The Global Oncology Drugs Market is poised for robust growth, driven by advancements in precision medicine and an increasing emphasis on personalized treatment approaches.</p>

U.S. Food and Drug Administration (FDA)

Oncology Drugs Market Market Drivers

Market Growth Projections

The Global Oncology Drugs Market Industry is poised for substantial growth, with projections indicating a market value of 155.7 USD Billion in 2024 and an anticipated increase to 751.6 USD Billion by 2035. This remarkable growth trajectory suggests a compound annual growth rate of 15.39% from 2025 to 2035. Such projections highlight the increasing demand for oncology drugs driven by factors such as rising cancer incidence, advancements in treatment modalities, and expanding healthcare access globally. The market's expansion reflects the ongoing commitment to improving cancer care and developing innovative therapies to address the diverse needs of patients.

Rising Incidence of Cancer

The Global Oncology Drugs Market Industry is experiencing growth driven by the increasing incidence of cancer worldwide. According to the World Health Organization, cancer cases are projected to rise significantly, with an estimated 19.3 million new cases in 2020. This alarming trend necessitates the development of innovative oncology drugs, contributing to the market's expansion. By 2024, the market is valued at approximately 155.7 USD Billion, reflecting the urgent need for effective treatments. As the global population ages and lifestyle factors contribute to cancer prevalence, the demand for oncology drugs is likely to escalate, further propelling market growth.

Advancements in Targeted Therapies

The Global Oncology Drugs Market Industry is significantly influenced by advancements in targeted therapies, which offer more personalized treatment options for cancer patients. These therapies focus on specific molecular targets associated with cancer, leading to improved efficacy and reduced side effects. For instance, the development of monoclonal antibodies and small molecule inhibitors has transformed treatment paradigms. As a result, the market is anticipated to grow substantially, with projections indicating a value of 751.6 USD Billion by 2035. The increasing adoption of precision medicine is likely to enhance treatment outcomes, thereby driving the demand for targeted oncology drugs.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in shaping the Global Oncology Drugs Market Industry. Various countries are investing in cancer research and drug development to combat the rising cancer burden. For example, the National Cancer Institute in the United States allocates substantial funding for cancer research, fostering innovation in oncology drug development. Such initiatives not only support the discovery of new therapies but also facilitate clinical trials, accelerating the approval process for new drugs. This supportive environment is expected to contribute to the market's growth, with a projected compound annual growth rate of 15.39% from 2025 to 2035.

Emerging Markets and Economic Growth

Emerging markets are becoming increasingly important in the Global Oncology Drugs Market Industry, driven by economic growth and improving healthcare infrastructure. Countries such as India and Brazil are witnessing a rise in cancer cases, prompting investments in oncology drug development. As these nations enhance their healthcare systems, access to innovative treatments is expected to improve. This trend is likely to contribute to the overall market growth, with projections indicating a significant increase in market value by 2035. The expansion of healthcare access in these regions may lead to a greater demand for oncology drugs, further fueling the market.

Increasing Awareness and Screening Programs

The Global Oncology Drugs Market Industry benefits from increasing awareness and screening programs aimed at early cancer detection. Public health campaigns and educational initiatives have led to higher screening rates, enabling earlier diagnosis and treatment. For instance, the American Cancer Society emphasizes the importance of regular screenings, which can significantly improve survival rates. As more individuals are diagnosed at earlier stages, the demand for effective oncology drugs is likely to rise. This trend is expected to support the market's expansion, as early detection often leads to more treatment options and better patient outcomes.

Market Segment Insights

Oncology Drugs Market Drug Type Insights

<p>The Global Oncology Drugs Market exhibits a robust growth trajectory, driven primarily by the increasing prevalence of cancer and advancements in treatment methodologies. This market can be broadly segmented by Drug Type into <a href="https://www.marketresearchfuture.com/reports/chemotherapy-market-5791">Chemotherapy</a> Drugs, Targeted Therapy Drugs, Immunotherapy Drugs, and Hormonal Therapy Drugs, each contributing significantly to the overall landscape. In 2024, Chemotherapy Drugs are expected to hold a market value of 35.0 USD Billion, increasing to 70.0 USD Billion by 2035. This segment remains a cornerstone of cancer treatment, offering broad-spectrum efficacy against various cancers, thereby maintaining a significant market presence.</p>

<p>Targeted Therapy Drugs are projected to reach 45.0 USD Billion in 2024 and expand to 90.0 USD Billion by 2035, emphasizing their importance in precision medicine, where therapies are tailored to specific genetic profiles of tumors, increasing treatment efficacy and reducing side effects. The Immunotherapy Drugs segment shows remarkable growth, anticipated to rise from 50.0 USD Billion in 2024 to 100.0 USD Billion in 2035, reflecting the growing adoption of therapies that harness the body's immune system to combat cancer, a trend fueled by ongoing Research and Development that uncovers new immunotherapeutic strategies.</p>

<p>Hormonal Therapy Drugs, while relatively smaller in scale, with a valuation of 20.5 USD Billion in 2024 and growing to 40.0 USD Billion by 2035, play a crucial role in treating hormone-sensitive cancers, primarily breast and prostate cancers, thereby addressing a significant patient demographic. Together, these segments reflect the diverse therapeutic approaches in modern oncology, driven by innovation and patient-centered care, fundamentally shaping the Global Oncology Drugs Market data and statistics. </p>

Oncology Drugs Market Therapeutic Area Insights

<p>The Global Oncology Drugs Market has seen substantial growth, with a market value reaching 150.5 USD Billion in 2024. This market is significantly driven by the rising prevalence of various cancers, with specific focus areas such as Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, and Leukemia demonstrating particular importance. Notably, Breast Cancer dominates the landscape, reflecting a significant portion due to increased diagnosis and awareness programs globally. </p>

<p>Lung Cancer, characterized by high mortality rates, continues to challenge the healthcare sector, prompting advancements in targeted therapies and immunotherapies.Colorectal Cancer is also notable, with a growing global incidence and concerted efforts toward early detection. Prostate Cancer, being one of the most prevalent among men, contributes significantly to the market as well. Leukemia, encompassing a range of blood cancers, is also pivotal in shaping treatment approaches, given the innovations in drug therapies.</p>

<p>The current trends suggest a robust pipeline coupled with ongoing Research and Development, addressing not just existing challenges but also paving the way for personalized medicine within the Global Oncology Drugs Market, fueling overall market growth and enhancing patient outcomes.</p>

Oncology Drugs Market Route of Administration Insights

<p>The Global Oncology Drugs Market is experiencing significant growth, with the segment of Route of Administration playing a crucial role in this development. By 2024, the overall market is projected to be valued at approximately 150.5 USD Billion. The Route of Administration segment comprises various methods, with Oral and Intravenous routes being particularly noteworthy for their versatility and patient preference. Oral medications offer convenience and improved adherence, thereby enhancing treatment outcomes for patients preferring at-home administration.Intravenous options, on the other hand, are essential for rapid drug delivery and treatment initiation in acute cases. </p>

<p>Additionally, Subcutaneous and Intramuscular routes also contribute significantly to the market dynamics, catering to different therapeutic needs and patient demographics. The increasing incidence of cancer globally serves as a key driver for the market, alongside advancements in drug formulations and technologies. Moreover, the growing emphasis on personalized medicine is pushing the innovation of new delivery methods, further enhancing the Global Oncology Drugs Market revenue.Overall, the Global Oncology Drugs Market segmentation reflects diverse treatment methodologies aimed at improving patient outcomes while also addressing healthcare provider requirements.</p>

Oncology Drugs Market Patient Demographics Insights

<p>The Global Oncology Drugs Market is experiencing significant advancements, particularly within the Patient Demographics segment, which can be categorized into Adult, Pediatric, and Geriatric populations. As the market approaches a valuation of 150.5 USD Billion in 2024, it is essential to understand the dynamics of these demographics. Adults represent a large portion of the oncology landscape due to the higher incidence of cancer in middle-aged and older individuals, driving the demand for innovative therapies and targeted treatments.</p>

<p>Pediatric cases, although less frequent, are critical as they require tailored medications and have unique responses to therapies, which has become an area of focus for Research and Development.</p>

<p>Geriatric patients hold significant importance as they often present with comorbidities that complicate treatment regimens and require specialized care plans. The challenge of personalized care for these diverse groups enhances the complexity of the Global Oncology Drugs Market data, necessitating ongoing innovations and adaptations in treatment methodologies. With expectations for the market to grow substantially by 2035, the statistics indicate strong growth potential influenced by an aging population, increased cancer prevalence, and the need for comprehensive treatment strategies across all these demographics.</p>

Get more detailed insights about Oncology Drugs Market Research Report 2035

Regional Insights

The Global Oncology Drugs Market is projected to experience substantial growth across various regions, highlighting its broad geographical impact. In 2024, North America is expected to hold a majority share, valued at 64.5 USD Billion, reflecting its robust healthcare infrastructure and high R investments in oncology. Europe follows closely, with a projected value of 35.0 USD Billion in the same year, driven by strong regulatory frameworks and advanced healthcare systems.

The Asia-Pacific (APAC) region is anticipated to expand significantly, achieving a valuation of 27.0 USD Billion, fueled by increasing incidences of cancer, rising patient awareness, and improving access to innovative therapies.

South America and the Middle East and Africa (MEA) represent smaller yet growing markets, valued at 12.0 USD Billion and 12.0 USD Billion in 2024, respectively, highlighting opportunities for market penetration due to improving healthcare access and increased spending on oncology treatments. As the Global Oncology Drugs Market data indicates, the regional segmentation underscores distinct growth drivers and market dynamics, with North America and Europe dominating in terms of revenue, while APAC presents a significant opportunity for expansion and innovation due to its growing population and healthcare investments.

Overall, the market is influenced by increasing cancer prevalence, advancements in medical technologies, and a global focus on precision medicine, making oncology drugs a critical component of the global healthcare landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The Global Oncology Drugs Market is a dynamic segment of the pharmaceutical industry characterized by rapid advancements in drug development, regulatory frameworks, and treatment paradigms. The competitive landscape of this market is shaped by various pharmaceutical companies that strive to innovate and offer cutting-edge therapies that address unmet medical needs in cancer care. With an increasing incidence of cancer and the demand for personalized medicine, companies actively engage in research and development, partnerships, and strategic alliances.

This competitive environment is influenced by technological innovation, market access strategies, and the global regulatory landscape, all of which are crucial for success in this specialized and high-stakes market. Companies also face challenges such as pricing pressures, robust competition from generics, and evolving healthcare policies, which require them to adopt agile and adaptive strategies to maintain a competitive edge.Pfizer has established a significant presence in the Global Oncology Drugs Market through its diverse portfolio of oncology products.

The company’s strengths lie in its strong research capabilities and extensive expertise in drug development, enabling it to offer innovative solutions that cater to various cancer types. Pfizer's commitment to personalized medicine sets it apart, as the company invests in targeted therapies and combination treatments aimed at improving patient outcomes. Its pipeline of oncology drugs demonstrates a strong focus on addressing critical areas in cancer treatment, which positions Pfizer favorably in a crowded marketplace. With strategic collaborations and partnerships, Pfizer continues to strengthen its market position while effectively navigating the challenges of pricing and accessibility in the evolving oncology landscape.

Roche, a leading player in the Global Oncology Drugs Market, is renowned for its robust portfolio of targeted therapies and immunotherapies that have transformed cancer treatment. The company's strengths lie in its continuous investment in research and development, along with a comprehensive understanding of molecular biology, which enables it to innovate and bring forth therapies that are tailored to the genetic profiles of tumors. Roche's key oncology products, including those designed for breast cancer, lung cancer, and hematologic malignancies, have solidified its market presence.

The company has engaged in strategic mergers and acquisitions to enhance its offerings and expand its capabilities in oncology. Roche’s focus on diagnostics and personalized treatment approaches ensures comprehensive cancer management, allowing it to maintain a leadership position in the global market while addressing the complexities of cancer care through innovative and effective solutions.

Key Companies in the Oncology Drugs Market market include

Industry Developments

Recent developments in the Global Oncology Drugs Market have centered on ongoing advancements in treatment options, with companies like Pfizer, Roche, Gilead Sciences, and Eli Lilly leading the way in innovative therapies. Notably, in September 2023, Bristol Myers Squibb received accelerated approval for its new treatment targeting lung cancer, reflecting an increasing focus on personalized medicine. The market also observed strong growth, driven by rising incidences of cancer globally, which produced a higher demand for novel therapies from major players like Johnson and Johnson and AbbVie.

Significant mergers and acquisitions have been reported, with Novartis acquiring a biotechnology firm specializing in cancer treatments in June 2023 to bolster its oncology portfolio, while Merck and Regeneron Pharmaceuticals announced a strategic collaboration aimed at enhancing their immunotherapy development initiatives in August 2023. Seattle Genetics has also seen a surge in market valuation due to its recent FDA approvals for innovative oncology drugs. The continuous influx of investments and partnerships in the oncology sector signifies a robust and evolving landscape, with companies striving to enhance patient outcomes and expand their therapeutic frameworks globally.

Future Outlook

Oncology Drugs Market Future Outlook

<p>The Global Oncology Drugs Market is projected to grow at a 15.39% CAGR from 2024 to 2035, driven by advancements in targeted therapies, increasing cancer prevalence, and rising healthcare expenditures.</p>

New opportunities lie in:

- <p>Invest in personalized medicine to enhance treatment efficacy and patient outcomes. Develop combination therapies to improve survival rates and reduce resistance. Leverage digital health technologies for patient monitoring and adherence solutions.</p>

<p>By 2035, the oncology drugs market is expected to be robust, reflecting substantial growth and innovation.</p>

Market Segmentation

Outlook

- Adult

- Pediatric

- Geriatric

Oncology Drugs Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Oncology Drugs Market Drug Type Outlook

- Chemotherapy Drugs

- Targeted Therapy Drugs

- Immunotherapy Drugs

- Hormonal Therapy Drugs

Oncology Drugs Market Therapeutic Area Outlook

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Leukemia

Oncology Drugs Market Patient Demographics Outlook

- Adult

- Pediatric

- Geriatric

Oncology Drugs Market Route of Administration Outlook

- Oral

- Intravenous

- Subcutaneous

- Intramuscular

Report Scope

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2023 | 141.35(USD Billion) |

| MARKET SIZE 2024 | 150.5(USD Billion) |

| MARKET SIZE 2035 | 751.57 (USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 10.01% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2023 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | Pfizer, Roche, Gilead Sciences, Eli Lilly, Bristol Myers Squibb, Johnson and Johnson, AbbVie, Seattle Genetics, Novartis, Celgene, Regeneron Pharmaceuticals, Merck, AstraZeneca, Amgen, Sanofi |

| SEGMENTS COVERED | Drug Type, Therapeutic Area, Route of Administration, Patient Demographics, Regional |

| KEY MARKET OPPORTUNITIES | Personalized medicine advancements, Growing immunotherapy sector, Rising demand for combination therapies, Expanding patient populations, Increased investments in R&D |

| KEY MARKET DYNAMICS | Increasing cancer prevalence, Advancements in targeted therapies, Rising healthcare expenditure, Growing R&D investments, Expanding market access initiatives |

| COUNTRIES COVERED | North America, Europe, APAC, South America, MEA |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the expected market size of the Global Oncology Drugs Market in 2025?

The Global Oncology Drugs Market is expected to be valued at 289.37 USD Billion in 2025.

What is the projected market size for the Global Oncology Drugs Market in 2035?

The market is projected to reach a value of 751.57 USD Billion in 2035.

What is the expected CAGR for the Global Oncology Drugs Market from 2025 to 2035?

The expected CAGR for the market during this period is 10.01%.

Which region is expected to have the largest market share in 2024?

North America is expected to hold the largest market share, valued at 64.5 USD Billion in 2024.

What will be the market size for Immunotherapy Drugs by 2035?

The market size for Immunotherapy Drugs is projected to be 100.0 USD Billion by 2035.

Who are the key players in the Global Oncology Drugs Market?

Major players in the market include Pfizer, Roche, Gilead Sciences, Eli Lilly, and Bristol Myers Squibb.

What will the market size for Chemotherapy Drugs be in 2024?

The market size for Chemotherapy Drugs is expected to be 35.0 USD Billion in 2024.

What market trend is expected to drive growth in the oncology drugs sector?

The growing demand for targeted and personalized medicine is a key trend driving growth in this sector.

How is the Global Oncology Drugs Market expected to perform in the APAC region by 2035?

The market in the APAC region is expected to grow significantly, reaching 75.0 USD Billion by 2035.

What is the forecasted market size for Hormonal Therapy Drugs in 2024?

The forecasted market size for Hormonal Therapy Drugs is expected to be 20.5 USD Billion in 2024.

-

--- "TABLE OF CONTENTS

-

EXECUTIVE SUMMARY

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

MARKET INTRODUCTION

- Definition

-

Scope of the study

- Research Objective

- Assumption

- Limitations

-

RESEARCH METHODOLOGY

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

ONCOLOGY DRUGS MARKET, BY DRUG TYPE (USD BILLION)

- Chemotherapy Drugs

- Targeted Therapy Drugs

- Immunotherapy Drugs

- Hormonal Therapy Drugs

-

ONCOLOGY DRUGS MARKET, BY THERAPEUTIC AREA (USD BILLION)

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Leukemia

-

ONCOLOGY DRUGS MARKET, BY ROUTE OF ADMINISTRATION (USD BILLION)

- Oral

- Intravenous

- Subcutaneous

- Intramuscular

-

ONCOLOGY DRUGS MARKET, BY PATIENT DEMOGRAPHICS (USD BILLION)

- Adult

- Pediatric

- Geriatric

-

ONCOLOGY DRUGS MARKET, BY REGIONAL (USD BILLION)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

COMPETITIVE LANDSCAPE

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Oncology Drugs Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Oncology Drugs Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

COMPANY PROFILES

-

Pfizer

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Roche

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Gilead Sciences

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Eli Lilly

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Bristol Myers Squibb

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Johnson and Johnson

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AbbVie

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Seattle Genetics

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Novartis

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Celgene

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Regeneron Pharmaceuticals

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Merck

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AstraZeneca

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Amgen

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Sanofi

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Pfizer

-

APPENDIX

- References

- Related Reports

-

LIST OF TABLES

-

TABLE 1. LIST OF ASSUMPTIONS

-

TABLE 2. NORTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 3. NORTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 4. NORTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 5. NORTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 6. NORTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 7. US ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 8. US ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 9. US ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 10. US ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 11. US ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 12. CANADA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 13. CANADA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 14. CANADA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 15. CANADA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 16. CANADA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 17. EUROPE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 18. EUROPE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 19. EUROPE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 20. EUROPE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 21. EUROPE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 22. GERMANY ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 23. GERMANY ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 24. GERMANY ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 25. GERMANY ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 26. GERMANY ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 27. UK ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 28. UK ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 29. UK ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 30. UK ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 31. UK ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 32. FRANCE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 33. FRANCE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 34. FRANCE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 35. FRANCE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 36. FRANCE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 37. RUSSIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 38. RUSSIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 39. RUSSIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 40. RUSSIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 41. RUSSIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 42. ITALY ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 43. ITALY ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 44. ITALY ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 45. ITALY ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 46. ITALY ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 47. SPAIN ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 48. SPAIN ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 49. SPAIN ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 50. SPAIN ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 51. SPAIN ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 52. REST OF EUROPE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 53. REST OF EUROPE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 54. REST OF EUROPE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 55. REST OF EUROPE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 56. REST OF EUROPE ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 57. APAC ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 58. APAC ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 59. APAC ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 60. APAC ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 61. APAC ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 62. CHINA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 63. CHINA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 64. CHINA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 65. CHINA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 66. CHINA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 67. INDIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 68. INDIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 69. INDIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 70. INDIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 71. INDIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 72. JAPAN ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 73. JAPAN ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 74. JAPAN ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 75. JAPAN ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 76. JAPAN ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 77. SOUTH KOREA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 78. SOUTH KOREA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 79. SOUTH KOREA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 80. SOUTH KOREA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 81. SOUTH KOREA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 82. MALAYSIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 83. MALAYSIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 84. MALAYSIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 85. MALAYSIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 86. MALAYSIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 87. THAILAND ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 88. THAILAND ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 89. THAILAND ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 90. THAILAND ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 91. THAILAND ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 92. INDONESIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 93. INDONESIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 94. INDONESIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 95. INDONESIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 96. INDONESIA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 97. REST OF APAC ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 98. REST OF APAC ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 99. REST OF APAC ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 100. REST OF APAC ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 101. REST OF APAC ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 102. SOUTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 103. SOUTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 104. SOUTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 105. SOUTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 106. SOUTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 107. BRAZIL ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 108. BRAZIL ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 109. BRAZIL ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 110. BRAZIL ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 111. BRAZIL ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 112. MEXICO ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 113. MEXICO ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 114. MEXICO ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 115. MEXICO ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 116. MEXICO ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 117. ARGENTINA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 118. ARGENTINA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 119. ARGENTINA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 120. ARGENTINA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 121. ARGENTINA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 122. REST OF SOUTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 123. REST OF SOUTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 124. REST OF SOUTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 125. REST OF SOUTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 126. REST OF SOUTH AMERICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 127. MEA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 128. MEA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 129. MEA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 130. MEA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 131. MEA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 132. GCC COUNTRIES ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 133. GCC COUNTRIES ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 134. GCC COUNTRIES ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 135. GCC COUNTRIES ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 136. GCC COUNTRIES ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 137. SOUTH AFRICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 138. SOUTH AFRICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 139. SOUTH AFRICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 140. SOUTH AFRICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 141. SOUTH AFRICA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 142. REST OF MEA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY DRUG TYPE, 2019-2035 (USD BILLIONS)

-

TABLE 143. REST OF MEA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY THERAPEUTIC AREA, 2019-2035 (USD BILLIONS)

-

TABLE 144. REST OF MEA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY ROUTE OF ADMINISTRATION, 2019-2035 (USD BILLIONS)

-

TABLE 145. REST OF MEA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY PATIENT DEMOGRAPHICS, 2019-2035 (USD BILLIONS)

-

TABLE 146. REST OF MEA ONCOLOGY DRUGS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

TABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

-

TABLE 148. ACQUISITION/PARTNERSHIP

-

LIST OF FIGURES

-

FIGURE 1. MARKET SYNOPSIS

-

FIGURE 2. NORTH AMERICA ONCOLOGY DRUGS MARKET ANALYSIS

-

FIGURE 3. US ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 4. US ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 5. US ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 6. US ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 7. US ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 8. CANADA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 9. CANADA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 10. CANADA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 11. CANADA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 12. CANADA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 13. EUROPE ONCOLOGY DRUGS MARKET ANALYSIS

-

FIGURE 14. GERMANY ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 15. GERMANY ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 16. GERMANY ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 17. GERMANY ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 18. GERMANY ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 19. UK ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 20. UK ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 21. UK ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 22. UK ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 23. UK ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 24. FRANCE ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 25. FRANCE ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 26. FRANCE ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 27. FRANCE ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 28. FRANCE ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 29. RUSSIA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 30. RUSSIA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 31. RUSSIA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 32. RUSSIA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 33. RUSSIA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 34. ITALY ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 35. ITALY ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 36. ITALY ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 37. ITALY ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 38. ITALY ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 39. SPAIN ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 40. SPAIN ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 41. SPAIN ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 42. SPAIN ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 43. SPAIN ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 44. REST OF EUROPE ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 45. REST OF EUROPE ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 46. REST OF EUROPE ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 47. REST OF EUROPE ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 48. REST OF EUROPE ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 49. APAC ONCOLOGY DRUGS MARKET ANALYSIS

-

FIGURE 50. CHINA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 51. CHINA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 52. CHINA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 53. CHINA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 54. CHINA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 55. INDIA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 56. INDIA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 57. INDIA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 58. INDIA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 59. INDIA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 60. JAPAN ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 61. JAPAN ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 62. JAPAN ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 63. JAPAN ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 64. JAPAN ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 65. SOUTH KOREA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 66. SOUTH KOREA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 67. SOUTH KOREA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 68. SOUTH KOREA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 69. SOUTH KOREA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 70. MALAYSIA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 71. MALAYSIA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 72. MALAYSIA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 73. MALAYSIA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 74. MALAYSIA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 75. THAILAND ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 76. THAILAND ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 77. THAILAND ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 78. THAILAND ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 79. THAILAND ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 80. INDONESIA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 81. INDONESIA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 82. INDONESIA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 83. INDONESIA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 84. INDONESIA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 85. REST OF APAC ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 86. REST OF APAC ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 87. REST OF APAC ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 88. REST OF APAC ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 89. REST OF APAC ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 90. SOUTH AMERICA ONCOLOGY DRUGS MARKET ANALYSIS

-

FIGURE 91. BRAZIL ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 92. BRAZIL ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 93. BRAZIL ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 94. BRAZIL ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 95. BRAZIL ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 96. MEXICO ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 97. MEXICO ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 98. MEXICO ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 99. MEXICO ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 100. MEXICO ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 101. ARGENTINA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 102. ARGENTINA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 103. ARGENTINA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 104. ARGENTINA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 105. ARGENTINA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 106. REST OF SOUTH AMERICA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 107. REST OF SOUTH AMERICA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 108. REST OF SOUTH AMERICA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 109. REST OF SOUTH AMERICA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 110. REST OF SOUTH AMERICA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 111. MEA ONCOLOGY DRUGS MARKET ANALYSIS

-

FIGURE 112. GCC COUNTRIES ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 113. GCC COUNTRIES ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 114. GCC COUNTRIES ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 115. GCC COUNTRIES ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 116. GCC COUNTRIES ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 117. SOUTH AFRICA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 118. SOUTH AFRICA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 119. SOUTH AFRICA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 120. SOUTH AFRICA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 121. SOUTH AFRICA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 122. REST OF MEA ONCOLOGY DRUGS MARKET ANALYSIS BY DRUG TYPE

-

FIGURE 123. REST OF MEA ONCOLOGY DRUGS MARKET ANALYSIS BY THERAPEUTIC AREA

-

FIGURE 124. REST OF MEA ONCOLOGY DRUGS MARKET ANALYSIS BY ROUTE OF ADMINISTRATION

-

FIGURE 125. REST OF MEA ONCOLOGY DRUGS MARKET ANALYSIS BY PATIENT DEMOGRAPHICS

-

FIGURE 126. REST OF MEA ONCOLOGY DRUGS MARKET ANALYSIS BY REGIONAL

-

FIGURE 127. KEY BUYING CRITERIA OF ONCOLOGY DRUGS MARKET

-

FIGURE 128. RESEARCH PROCESS OF MRFR

-

FIGURE 129. DRO ANALYSIS OF ONCOLOGY DRUGS MARKET

-

FIGURE 130. DRIVERS IMPACT ANALYSIS: ONCOLOGY DRUGS MARKET

-

FIGURE 131. RESTRAINTS IMPACT ANALYSIS: ONCOLOGY DRUGS MARKET

-

FIGURE 132. SUPPLY / VALUE CHAIN: ONCOLOGY DRUGS MARKET

-

FIGURE 133. ONCOLOGY DRUGS MARKET, BY DRUG TYPE, 2025 (% SHARE)

-

FIGURE 134. ONCOLOGY DRUGS MARKET, BY DRUG TYPE, 2019 TO 2035 (USD Billions)

-

FIGURE 135. ONCOLOGY DRUGS MARKET, BY THERAPEUTIC AREA, 2025 (% SHARE)

-

FIGURE 136. ONCOLOGY DRUGS MARKET, BY THERAPEUTIC AREA, 2019 TO 2035 (USD Billions)

-

FIGURE 137. ONCOLOGY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2025 (% SHARE)

-

FIGURE 138. ONCOLOGY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2019 TO 2035 (USD Billions)

-

FIGURE 139. ONCOLOGY DRUGS MARKET, BY PATIENT DEMOGRAPHICS, 2025 (% SHARE)

-

FIGURE 140. ONCOLOGY DRUGS MARKET, BY PATIENT DEMOGRAPHICS, 2019 TO 2035 (USD Billions)

-

FIGURE 141. ONCOLOGY DRUGS MARKET, BY REGIONAL, 2025 (% SHARE)

-

FIGURE 142. ONCOLOGY DRUGS MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions)

-

FIGURE 143. BENCHMARKING OF MAJOR COMPETITORS

-

"

Oncology Drugs Market Segmentation

Oncology Drugs Market By Drug Type (USD Billion, 2019-2035)

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

Oncology Drugs Market By Therapeutic Area (USD Billion, 2019-2035)

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

Oncology Drugs Market By Route of Administration (USD Billion, 2019-2035)

Oral

Intravenous

Subcutaneous

Intramuscular

Oncology Drugs Market By Patient Demographics (USD Billion, 2019-2035)

Adult

Pediatric

Geriatric

Oncology Drugs Market By Regional (USD Billion, 2019-2035)

North America

Europe

South America

Asia Pacific

Middle East and Africa

Oncology Drugs Market Regional Outlook (USD Billion, 2019-2035)

North America Outlook (USD Billion, 2019-2035)

North America Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

North America Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

North America Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

North America Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

North America Oncology Drugs Market by Regional Type

US

Canada

US Outlook (USD Billion, 2019-2035)

US Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

US Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

US Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

US Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

CANADA Outlook (USD Billion, 2019-2035)

CANADA Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

CANADA Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

CANADA Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

CANADA Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

Europe Outlook (USD Billion, 2019-2035)

Europe Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

Europe Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

Europe Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

Europe Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

Europe Oncology Drugs Market by Regional Type

Germany

UK

France

Russia

Italy

Spain

Rest of Europe

GERMANY Outlook (USD Billion, 2019-2035)

GERMANY Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

GERMANY Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

GERMANY Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

GERMANY Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

UK Outlook (USD Billion, 2019-2035)

UK Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

UK Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

UK Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

UK Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

FRANCE Outlook (USD Billion, 2019-2035)

FRANCE Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

FRANCE Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

FRANCE Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

FRANCE Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

RUSSIA Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

RUSSIA Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

RUSSIA Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

ITALY Outlook (USD Billion, 2019-2035)

ITALY Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

ITALY Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

ITALY Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

ITALY Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

SPAIN Outlook (USD Billion, 2019-2035)

SPAIN Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

SPAIN Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

SPAIN Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

SPAIN Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

REST OF EUROPE Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

REST OF EUROPE Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

REST OF EUROPE Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

APAC Outlook (USD Billion, 2019-2035)

APAC Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

APAC Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

APAC Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

APAC Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

APAC Oncology Drugs Market by Regional Type

China

India

Japan

South Korea

Malaysia

Thailand

Indonesia

Rest of APAC

CHINA Outlook (USD Billion, 2019-2035)

CHINA Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

CHINA Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

CHINA Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

CHINA Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

INDIA Outlook (USD Billion, 2019-2035)

INDIA Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

INDIA Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

INDIA Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

INDIA Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

JAPAN Outlook (USD Billion, 2019-2035)

JAPAN Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

JAPAN Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

JAPAN Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

JAPAN Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

SOUTH KOREA Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

SOUTH KOREA Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

SOUTH KOREA Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

MALAYSIA Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

MALAYSIA Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

MALAYSIA Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

THAILAND Outlook (USD Billion, 2019-2035)

THAILAND Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

THAILAND Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

THAILAND Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

THAILAND Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

INDONESIA Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

INDONESIA Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

INDONESIA Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

REST OF APAC Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

REST OF APAC Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

REST OF APAC Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

South America Outlook (USD Billion, 2019-2035)

South America Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

South America Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

South America Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

South America Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

South America Oncology Drugs Market by Regional Type

Brazil

Mexico

Argentina

Rest of South America

BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

BRAZIL Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

BRAZIL Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

BRAZIL Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

MEXICO Outlook (USD Billion, 2019-2035)

MEXICO Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

MEXICO Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

MEXICO Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

MEXICO Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

ARGENTINA Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

ARGENTINA Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

ARGENTINA Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

REST OF SOUTH AMERICA Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

REST OF SOUTH AMERICA Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

REST OF SOUTH AMERICA Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

MEA Outlook (USD Billion, 2019-2035)

MEA Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

MEA Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

MEA Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

MEA Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric

MEA Oncology Drugs Market by Regional Type

GCC Countries

South Africa

Rest of MEA

GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES Oncology Drugs Market by Drug Type

Chemotherapy Drugs

Targeted Therapy Drugs

Immunotherapy Drugs

Hormonal Therapy Drugs

GCC COUNTRIES Oncology Drugs Market by Therapeutic Area Type

Breast Cancer

Lung Cancer

Colorectal Cancer

Prostate Cancer

Leukemia

GCC COUNTRIES Oncology Drugs Market by Route of Administration Type

Oral

Intravenous

Subcutaneous

Intramuscular

GCC COUNTRIES Oncology Drugs Market by Patient Demographics Type

Adult

Pediatric

Geriatric