Geopolitical Factors

Geopolitical dynamics play a crucial role in shaping the Global Offshore Oil and Gas Market Industry. Political stability in oil-rich regions, such as the Middle East and West Africa, directly impacts supply chains and production levels. Tensions or conflicts can disrupt operations, leading to fluctuations in oil prices and market volatility. Conversely, stable geopolitical environments can foster investment and development in offshore projects. As nations seek to secure their energy independence, the interplay of international relations and energy policies will likely influence the industry's trajectory, making it a critical driver of market growth.

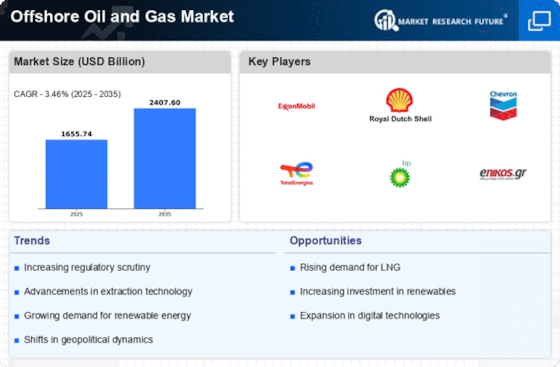

Market Growth Projections

The Global Offshore Oil and Gas Market Industry is projected to experience substantial growth over the next decade. With a market valuation of 1655.7 USD Billion in 2024, it is expected to reach 2408.5 USD Billion by 2035, reflecting a compound annual growth rate of 3.47% from 2025 to 2035. This growth trajectory suggests a robust demand for offshore resources, driven by technological advancements, rising energy needs, and geopolitical factors. The market's expansion is indicative of the industry's resilience and adaptability in the face of evolving global energy landscapes.

Technological Advancements

Technological innovations are transforming the Global Offshore Oil and Gas Market Industry, enhancing exploration and production efficiency. Advanced drilling techniques, such as horizontal drilling and hydraulic fracturing, have enabled companies to access previously unreachable reserves. Furthermore, the integration of digital technologies, including artificial intelligence and data analytics, is optimizing operations and reducing costs. These advancements not only improve productivity but also contribute to safer and more environmentally friendly practices. As the industry adapts to these technologies, it is likely to see sustained growth, with projections indicating a market value of 2408.5 USD Billion by 2035.

Rising Global Energy Demand

The Global Offshore Oil and Gas Market Industry is experiencing a surge in demand for energy, driven by population growth and industrialization. As economies expand, the need for reliable energy sources becomes increasingly critical. In 2024, the market is valued at approximately 1655.7 USD Billion, reflecting the urgent need for offshore oil and gas resources to meet this demand. Countries are investing heavily in offshore exploration and production to secure energy supplies, which is expected to continue driving growth in the sector. This trend indicates a robust future for the industry, as energy consumption is projected to rise significantly over the coming years.

Environmental Regulations and Compliance

The Global Offshore Oil and Gas Market Industry is increasingly influenced by stringent environmental regulations aimed at minimizing ecological impact. Governments worldwide are implementing policies that mandate compliance with safety and environmental standards, which can drive operational costs. Companies are investing in cleaner technologies and practices to meet these regulations, which may initially appear burdensome but ultimately lead to innovation and efficiency. As the industry adapts to these regulations, it is likely to enhance its reputation and operational sustainability, potentially attracting more investment and fostering long-term growth.

Investment in Renewable Energy Integration

The Global Offshore Oil and Gas Market Industry is increasingly integrating renewable energy sources into its operations. This shift is driven by the need to reduce carbon emissions and enhance sustainability. Companies are exploring hybrid models that combine offshore oil and gas production with wind and solar energy. Such investments not only diversify energy portfolios but also align with global sustainability goals. As the industry evolves, the integration of renewables is expected to attract significant capital, further propelling market growth. The anticipated compound annual growth rate of 3.47% from 2025 to 2035 underscores the potential for this integration to reshape the industry.