Market Growth Projections

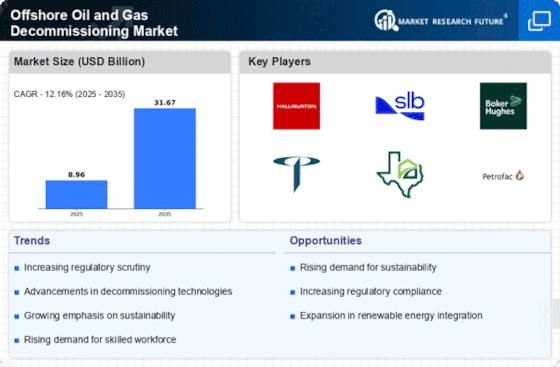

The Global Offshore Oil and Gas Decommissioning Market Industry is projected to experience robust growth, with estimates indicating a market value of 8.96 USD Billion in 2024 and a remarkable increase to 31.7 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 12.16% from 2025 to 2035. Such projections underscore the increasing importance of decommissioning services as aging infrastructure and regulatory pressures drive demand. The market's expansion is indicative of the industry's adaptation to evolving challenges and opportunities in offshore oil and gas operations.

Technological Advancements

Technological innovations are reshaping the Global Offshore Oil and Gas Decommissioning Market Industry, enhancing efficiency and reducing costs. Advanced techniques such as robotic decommissioning and remote monitoring systems are being adopted to streamline operations. For instance, the use of unmanned underwater vehicles (UUVs) allows for safer and more efficient inspections and removals of subsea structures. These advancements not only improve operational safety but also contribute to the overall reduction of decommissioning timelines. As the industry embraces these technologies, the market is poised for substantial growth, with a projected CAGR of 12.16% from 2025 to 2035.

Aging Infrastructure and Assets

The Global Offshore Oil and Gas Decommissioning Market Industry is significantly influenced by the aging of offshore infrastructure. Many oil and gas platforms are reaching the end of their operational lives, necessitating decommissioning to ensure safety and environmental protection. For example, in regions like the North Sea, numerous platforms are over 30 years old, prompting operators to initiate decommissioning projects. This trend is expected to accelerate, contributing to a market valuation of 31.7 USD Billion by 2035. The need to dismantle and safely dispose of aging assets is thus a critical driver of growth in the decommissioning sector.

Increasing Regulatory Compliance

The Global Offshore Oil and Gas Decommissioning Market Industry is experiencing heightened regulatory scrutiny, compelling operators to adhere to stringent environmental standards. Governments worldwide are implementing more rigorous decommissioning regulations to mitigate ecological impacts. For instance, the European Union has established directives that mandate the safe removal of offshore installations. This regulatory landscape not only drives the need for decommissioning services but also influences investment in sustainable practices. As a result, the market is projected to grow significantly, with estimates suggesting a value of 8.96 USD Billion in 2024, reflecting the industry's response to compliance demands.

Market Expansion in Emerging Regions

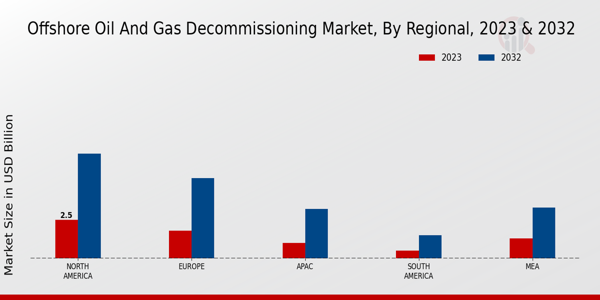

The Global Offshore Oil and Gas Decommissioning Market Industry is witnessing expansion in emerging regions, driven by increased offshore exploration and production activities. Countries in Southeast Asia and Africa are ramping up their oil and gas operations, leading to a growing need for decommissioning services as these projects mature. As these regions develop their offshore capabilities, the demand for decommissioning is expected to rise correspondingly. This trend presents opportunities for service providers to establish a foothold in new markets, further contributing to the industry's growth trajectory.

Environmental Concerns and Sustainability

Growing environmental awareness is a pivotal driver in the Global Offshore Oil and Gas Decommissioning Market Industry. Stakeholders are increasingly prioritizing sustainable practices in decommissioning processes to minimize ecological footprints. This shift is evident in initiatives aimed at recycling materials and restoring marine habitats post-decommissioning. For example, some companies are exploring options to repurpose decommissioned platforms as artificial reefs, promoting biodiversity. Such environmentally conscious approaches not only align with regulatory expectations but also resonate with public sentiment, thereby driving demand for decommissioning services in the market.