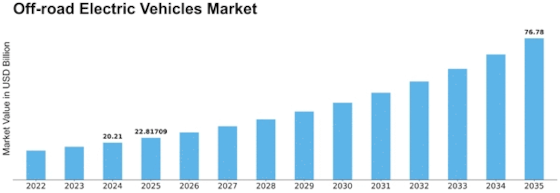

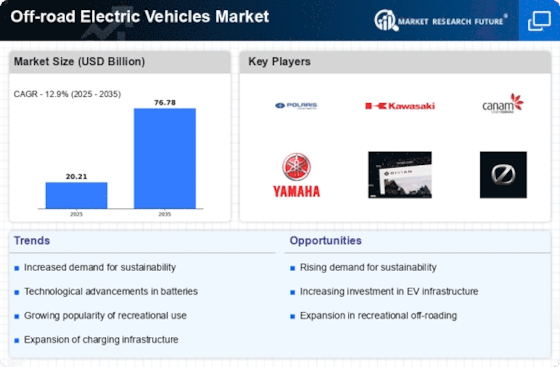

Off Road Electric Vehicles Size

Off-road Electric Vehicles Market Growth Projections and Opportunities

It is driven by sustainability and an increasing environmental awareness. Electric ATVs, UTVs and utility vehicles are quieter and cleaner in comparison to gas-burning ones. They are also sought after as more people become aware of the environment and emission controls become stricter.

The off-road EV industry is also influenced by improvements in battery technology. This has led to increased range and performance capabilities of electric off-road vehicles due to higher efficiency batteries with greater capacities. Range anxiety and recharge times are under scrutiny through battery research. As battery technology improves, this makes sense because it encourages adoption of these cars within the off road community thereby making them attractive to customers.

Furthermore, the market dynamics are shaped by the versatility and adaptability of off-road electric cars. In agriculture, forestry, construction as well as recreation, electricity utility vehicles and off-road EVs find use. Noiseless operations, low maintenance costs for business uses and ability to navigate rough terrains make such vehicles ideal for commercial or recreation purposes. Adaptation to these conditions by electric off road cars has helped grow their market as many sectors have come to realize.

Market dynamics are also influenced by government incentives for electric car adoption . Subsidies from governments tax incentives among others reduce the cost of owning an electric off road vehicle both for companies or individual buyers Governmental policies that restrict gas powered vehicle use or set pollution standards instead accelerate businesses towards embracing electrical substitutes driving market development.

Off-road EV market dynamics require additional investment in charging infrastructure.Increasing usage of electric vehicles requires strong charging infrastructures.Companies,governments,and private organizations building charging stations at remote locations including those along roadsides make it easy for owners to charge their EVs here.Expansion of off-roading charging networks helps deal with distance uncertainties while facilitating acceptance among users.

Market dynamics in the off-road EV business are affected by competitive environment ad strategic alliances. In response to consumer needs, manufacturers are making off-road EVs with different capacities and features.OFF road EVs makers collaborate with battery suppliers and technology firms for more efficient sophisticated systems in this transportation mode thus leading to market development through technology and scale.

Off-road electric vehicle market is influenced by concerns about the environment, technological advancements, application variety, government incentives, charging infrastructure improvement as well as industry competitiveness. This will lead to a growth of the off-road EV industry as people strive for cleaner and more sustainable means of mobility. Through such market dynamics, innovation, penetration and a sustainable future for off-road transport can be achieved.

Leave a Comment