Market Analysis

In-depth Analysis of Off-road Electric Vehicles Market Industry Landscape

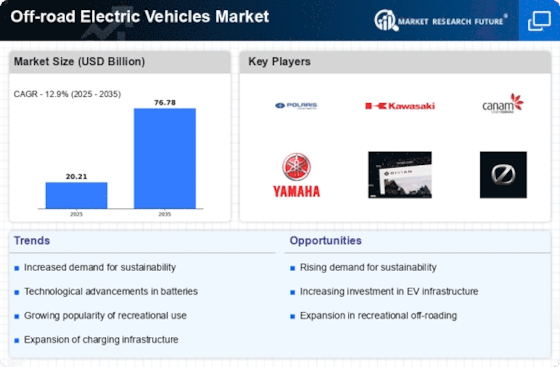

The off-road electric vehicles market has been influenced by various factors that have shaped its growth direction in recent years. One of the major drivers of this market is the global move towards sustainable and friendly transportation. This increased consciousness about environmental effects coupled with a desire for greener transport options has fuelled interest in and demand for electric off road vehicles.

Additionally, technological strides in battery technology as well as electric drivetrains have played a great role in expanding the market for off-road electric vehicle. The development of high-performance lithium-ion batteries with enhanced energy density and longer life cycles addresses one of the main challenges to successful EV adoption – range anxiety. That being said, better batteries can enable an off-road electrical automobile to cover more ground when only charged once thus making it more practical for harsh terrains use over an extended span.

Further still, diverse groups from different walks of life are attracted by versatility alongside capabilities offered by these types of cars away from home in roads. They cost very low to maintain and offer quieter operation with less vibration as compared to gasoline powered ones. Sectors such as agriculture, mining, forestry, and recreation activities have seen increased usage of these cars due to their efficiency, reliability and eco-friendly nature. Not only individual enthusiasts but even commercial users are beginning to see sense in adopting sustainable and cost effective options in the off-road electric vehicles market.

Additionally, changing consumer tastes and increasing interest in adventurous outdoor recreational activities have contributed to the growing demand for off road electric vehicles. Adventure seekers are attracted towards quiet operations, instant torque delivery and the ability of electric off-road vehicles to explore nature without noise or air pollution. The need for lower environmental impact while exploring off-road terrains has increased the demand for Electric ATVs, UTVs, among other types of leisure off road vehicles.

The global shift toward sustainability; technological advances related to batteries and drivetrains; attractive government incentives; using versatility and capabilities of electric-off-road vehicles; evolving customer preferences for environmentally friendly recreational and commercial alternatives all greatly affect the off-road electric vehicle market. Meanwhile, an ongoing interest in cleaner more efficient backcountry transport supported by eco-consciousness as well as advancements in technologies is expected to make the market for such kinds of goods bigger on a permanent basis."

Leave a Comment