Rapid Expansion of Clothing Industry is Driving the Market growth

The textile coating market CAGR is anticipated to grow at a faster rate in the future due to the expanding apparel sector. The production of garments and clothing made of textiles is referred to as the clothing industry. The material layers provided by the textile coatings adhere to the textile structures. Polymeric binders and additional additives (such colorants, adhesion promoters, biocide, plasticizers, etc.) are frequently found in a normal textile coating formulation. These additives are applied to a textile fabric through a spreading process in the form of a solution, dispersion, paste, or another similar method.

For instance, the value added production of textile manufacturing in the United States increased from $9.5 billion in 2019 to $16.59 billion in 2021. As a result, the textile coating market is anticipated to be driven by the expanding apparel industry.

Textile coatings are utilized extensively in the medical field to create instruments such as medical gloves, implants, and extracorporeal devices. Consequently, there is an expectation that the healthcare industry would have very high demand during the assessment period. Hospitals are employing coating and laminating technologies to create clothing that is more comfortable, lighter, and better suited for protecting patients and operating room workers. A sizable and expanding percentage of the textile coating industry is made up of the medical, healthcare, and hygiene industries. Uses for barrier materials in operating rooms can be as intricate as those for a cleaning cloth.

The operating room atmosphere is protected against bacterial, viral, and bodily fluid incursions using creative, economical methods that simultaneously safeguard hospital employees and patients. Thus, driving the textile coatings market revenue.

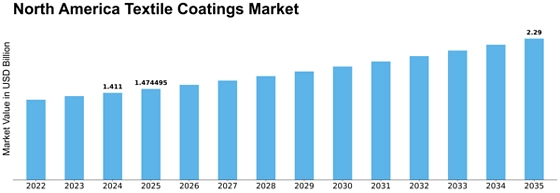

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment