Natural Antimicrobials Market Share

Natural Antimicrobials Market Research Report Information By Source (Plants, Animals and Microorganisms), By Application (Bakery & Confectionery, Dairy & Frozen Desserts, Beverages, Snacks, Meat Products, Oils & Fats and Others) And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2035

Market Summary

As per Market Research Future Analysis, the Global Natural Antimicrobials Market was valued at USD 0.80 Billion in 2024 and is projected to reach USD 1.59 Billion by 2035, growing at a CAGR of 6.37% from 2025 to 2035. The market is driven by increasing demand in the food and beverage industry for natural antimicrobials due to their efficacy, eco-friendliness, and health benefits. Rising consumer awareness regarding organic and clean-label products further fuels this growth, alongside a growing preference for convenience foods.

Key Market Trends & Highlights

The natural antimicrobials market is witnessing significant growth driven by health-conscious consumer trends.

- Market Size in 2024: USD 0.80 Billion

- Projected Market Size by 2035: USD 1.59 Billion

- CAGR from 2025 to 2035: 6.37%

- Dominant Source Segment: Microorganisms

Market Size & Forecast

| 2024 Market Size | USD 0.80 Billion |

| 2035 Market Size | USD 1.59 Billion |

| CAGR (2025-2035) | 6.37% |

| Largest Regional Market Share in 2024 | North America |

Major Players

Key players include Royal DSM NV, Dow DuPont Inc., Univar Inc., Galactic S.A., Kemin Industries Inc., Brenntag AG, Chr. Hansen A/S, Cargill Incorporated, Siveele B.V., and BASF SE.

Market Trends

The market CAGR for natural antimicrobials has greater growth potential as a result of rising health awareness among consumers of organic food and clean-label products. As consumers become more conscious of natural ingredients and food additives, the demand for chemical-free products is increasing. Furthermore, it has inspired producers to incorporate natural antimicrobials in their range of food goods. This will probably increase market size during the projected term.

In addition, consumers' preferences for convenience foods are growing, which is anticipated to result in a larger natural antimicrobials share in the food and beverage sector over the course of the forecast period. Additionally, the rise in the working population's impact on the demand for food products for consumption on the go is a significant factor in the expansion of the industry.

Furthermore, due to increasing consumer preferences for organic food and products with clean labels among the population, the industry is anticipated to have a higher market value. In addition, one of the key elements driving the need for natural antimicrobials is consumer knowledge of natural components and food additives. According to the India Brand Equity Foundation, the food processing sector is one of the biggest in India and is ranked fifth in terms of exports, anticipated growth, production, and consumption. The food processing sector in India is thought to account for 32% of the nation's overall food market.

As a result, it contributes up to 6% of all industrial investment, 13% of India's exports, and close to 8.80% and 8.39% of the Gross Value Added (GVA) in manufacturing and agriculture, respectively. As a result, the market share is increasing together with the expansion of the local industry. Thus, driving the natural antimicrobials market revenue.

The increasing consumer preference for natural and organic products is driving a notable shift towards the adoption of natural antimicrobials in various industries, suggesting a potential transformation in product formulations and safety standards.

U.S. Department of Agriculture

Natural Antimicrobials Market Market Drivers

Market Growth Projections

The Global Natural Antimicrobials Market Industry is poised for substantial growth, with projections indicating an increase from 0.8 USD Billion in 2024 to 1.59 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 6.38% from 2025 to 2035, driven by various factors including rising consumer demand for natural products, regulatory support, and advancements in extraction technologies. The market's expansion is indicative of a broader shift towards sustainability and health-consciousness across multiple sectors. As industries adapt to these trends, the role of natural antimicrobials is likely to become increasingly prominent, shaping the future landscape of food safety and preservation.

Growing Awareness of Health Benefits

The Global Natural Antimicrobials Market Industry is propelled by increasing awareness of the health benefits associated with natural antimicrobials. Consumers are becoming more informed about the potential adverse effects of synthetic preservatives, leading to a shift towards products that utilize natural alternatives. This trend is particularly evident in personal care and cosmetics, where natural antimicrobials are favored for their skin-friendly properties. The rise in health-conscious consumer behavior is likely to drive market growth, with projections indicating a compound annual growth rate of 6.38% from 2025 to 2035. This awareness not only influences purchasing decisions but also shapes product development strategies across various sectors.

Innovation in Extraction Technologies

Innovation in extraction technologies significantly influences the Global Natural Antimicrobials Market Industry, enabling the efficient extraction of bioactive compounds from natural sources. Advances in methods such as supercritical fluid extraction and cold pressing enhance the yield and purity of natural antimicrobials, making them more viable for commercial applications. This technological progress not only improves product quality but also reduces production costs, thereby encouraging wider adoption across various industries. As extraction technologies continue to evolve, the market is likely to experience sustained growth, with projections indicating a compound annual growth rate of 6.38% from 2025 to 2035. This innovation is crucial for meeting the rising demand for effective natural solutions.

Rising Demand for Natural Ingredients

The Global Natural Antimicrobials Market Industry experiences a notable surge in demand for natural ingredients, driven by consumer preferences for clean label products. As awareness of synthetic additives diminishes, consumers gravitate towards natural alternatives that promise safety and efficacy. This trend is particularly pronounced in the food and beverage sector, where natural antimicrobials are increasingly utilized to enhance product shelf life without compromising quality. The market is projected to reach 0.8 USD Billion in 2024, reflecting a growing inclination towards natural solutions. This shift not only aligns with health-conscious consumer behavior but also supports the industry's expansion as manufacturers adapt to these evolving preferences.

Expansion of the Food and Beverage Sector

The Global Natural Antimicrobials Market Industry benefits from the expansion of the food and beverage sector, which increasingly seeks natural solutions to enhance product safety and quality. As food safety regulations tighten globally, manufacturers are turning to natural antimicrobials to meet compliance while catering to consumer preferences. This sector's growth is evidenced by the rising number of products featuring natural preservatives, which are perceived as healthier alternatives. The market's trajectory is promising, with an anticipated increase to 1.59 USD Billion by 2035, driven by the food and beverage industry's commitment to sustainability and health. This expansion underscores the pivotal role of natural antimicrobials in modern food production.

Regulatory Support for Natural Antimicrobials

Regulatory bodies worldwide are increasingly endorsing the use of natural antimicrobials, thereby fostering growth within the Global Natural Antimicrobials Market Industry. Initiatives aimed at promoting food safety and public health have led to the establishment of guidelines that favor natural over synthetic preservatives. For instance, the European Food Safety Authority has recognized several natural antimicrobials as safe for use in food products. This regulatory support not only enhances consumer confidence but also encourages manufacturers to innovate and incorporate natural solutions into their offerings. As a result, the market is expected to grow significantly, potentially reaching 1.59 USD Billion by 2035.

Market Segment Insights

Natural Antimicrobials Source Insights

The natural antimicrobials market segmentation, based on source includes Plants, Animals and Microorganisms. The microorganisms segment dominated the market. The microscopic organisms that make up natural antimicrobials are capable of creating substances like antibiotics, antivirals, antifungals, and antiprotozoals, among other naturally occurring antimicrobials. Various microorganisms, such as bacteria, fungi, viruses, and parasites, can cause infection, which can be fought off and prevented with the help of these substances.

Figure 1: Natural Antimicrobials Market, by Source, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Natural Antimicrobials Application Insights

The natural antimicrobials market segmentation, based on application, includes Bakery & Confectionery, Dairy & Frozen Desserts, Beverages, Snacks, Meat Products, Oils & Fats and Others. The bakery & confectionery category generated the most income. This can be ascribed to growing consumer awareness of the health advantages of whole grains and to an increase in demand for baked goods made with organic ingredients due to concerns over animal welfare and environmental sustainability. Furthermore, over the predicted period, industry growth would also be aided by strict government requirements on hygiene in manufacturing facilities.

Get more detailed insights about Natural Antimicrobials Market Research Report - Global Forecast till 2032

Regional Insights

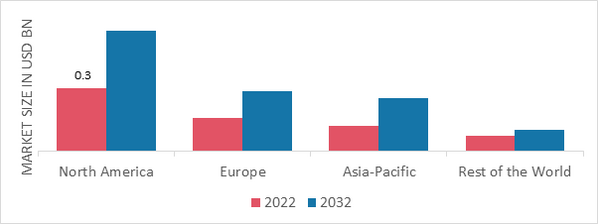

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American natural antimicrobials market area will dominate this market. The increased demand for natural food additives among producers of natural antimicrobials is a major factor driving this region's growth in North America. Furthermore, the North American market is thought to be significantly influenced by a nation like the US.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: NATURAL ANTIMICROBIALS MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe natural antimicrobials market accounts for the second-largest market share due to the quick rise in popularity of convenience foods. In addition, the region has been experiencing an increase in demand for bakery, dairy, meat, and other products due to population growth and rising consumer awareness of health and hygiene issues. Further, the German natural antimicrobials market held the largest market share, and the UK natural antimicrobials market was the fastest growing market in the European region

The Asia-Pacific natural antimicrobials market is expected to grow at the fastest CAGR from 2023 to 2032 because there is an increase in local awareness of natural antimicrobials. The desire for organic food products among the demographic is also fueling the growth of the Asia Pacific natural antimicrobials market. Moreover, China’s natural antimicrobials market held the largest market share, and the Indian natural antimicrobials market was the fastest growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the natural antimicrobials market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, natural antimicrobials industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the natural antimicrobials industry to benefit clients and increase the market sector. In recent years, the natural antimicrobials industry has offered some of the most significant advantages to market. Major players in the natural antimicrobials market attempting to increase market demand by investing in research and development operations include Royal DSM NV (Netherlands), Dow DuPont Inc. (US), Univar Inc. (US), Galactic S.A. (Belgium), Kemin Industries Inc.(US), Brenntag AG (Germany), Chr. Hansen A/S (Denmark), Cargill Incorporated (US), Siveele B.V. (Netherlands), and BASF SE (Germany).

Kemin Industries Inc. produces and distributes substances linked to human nutrition and animal health. Its product line includes, among other things, enzymes, probiotics, carotenoids, natural extracts, mould inhibitors, forage preservatives, toxin binders, liquid antibacterial formulations, and antioxidant formulations. These goods are used in a variety of sectors, such as biofuels, personal care, commercial greenhouses, pet food technology, rendering, dietary ingredients, food technologies, and animal nutrition and health.

Formerly known as Univar Inc., Univar Solutions Inc. is a chemical distribution business that offers a variety of industrial chemicals, additives, and customized services. The company's product line consists of inorganic substances, alcohol, acids, bases, surfactants, glycols, and general chemicals. Additionally, the business offers services including digital advertising, also known as e-marketing, of chemicals for its producers, on-site chemical storage for its clients, support services for agricultural retailers, and environmental solutions.

Numerous industries are served by Univar Solutions, including those in agricultural, mining, oil and gas, personal care, coatings and adhesives, domestic and industrial cleaning, environmental sciences, food additives, pharmaceuticals, and water treatment.

Key Companies in the Natural Antimicrobials Market market include

Industry Developments

February 2021: DuPont reported that the merger of its subsidiary International Flavors & Fragrances Inc. with its subsidiary Nutrition & Bioscience business operation, valued at USD 45.4 billion, had been completed. With the addition of categories for enzymes, nutrition, soy proteins, cultures, and probiotics, IFF's product line will be expanded by this merger.

June 2020: In Singapore, the well-known business Cargill opened its first innovation hub. It has sought to alter customer perceptions of food safety, flavor, and nutrition while anticipating market dynamics. Additionally, this centre links the company's local clients to ten additional innovation hubs and a network of 2,000 food scientists. By the end of 2020, it is anticipated that this centre would employ close to 20 food scientists.

Future Outlook

Natural Antimicrobials Market Future Outlook

The Global Natural Antimicrobials Market is projected to grow at a 6.37% CAGR from 2025 to 2035, driven by increasing consumer demand for natural products and stringent regulations on synthetic antimicrobials.

New opportunities lie in:

- Develop innovative formulations incorporating natural antimicrobials for food preservation.

- Expand distribution channels targeting organic and health-conscious consumers.

- Invest in R&D for new antimicrobial compounds derived from plants and herbs.

By 2035, the market is expected to achieve substantial growth, reflecting a robust demand for natural antimicrobial solutions.

Market Segmentation

Natural Antimicrobials Source Outlook (USD Billion, 2018-2032)

- Plants

- Animals

- Microorganisms

Natural Antimicrobials Regional Outlook (USD Billion, 2018-2032)

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

Natural Antimicrobials Application Outlook (USD Billion, 2018-2032)

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 0.804 Billion |

| Market Size 2035 | 1.59 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 6.37% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Source, Application and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Royal DSM NV (Netherlands), Dow DuPont Inc. (US), Univar Inc. (US), Galactic S.A. (Belgium), Kemin Industries Inc.(US), Brenntag AG (Germany), Chr. Hansen A/S (Denmark), Cargill Incorporated (US), Siveele B.V. (Netherlands), and BASF SE (Germany) |

| Key Market Opportunities | Awareness regarding natural ingredients and food additives |

| Key Market Dynamics | Increasing consumer preferences for organic food and products |

| Market Size 2025 | 0.86 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the natural antimicrobials market?

The natural antimicrobials market size was valued at USD 0.75 Billion in 2023.

What is the growth rate of the natural antimicrobials market?

The market is projected to grow at a CAGR of 6.37% during the forecast period, 2024-2032.

Which region held the largest market share in the natural antimicrobials market?

North America had the largest share in the market.

Who are the key players in the natural antimicrobials market?

The key players in the market are Royal DSM NV (Netherlands), Dow DuPont Inc. (US), Univar Inc. (US), Galactic S.A. (Belgium), Kemin Industries Inc.(US), Brenntag AG (Germany), Chr. Hansen A/S (Denmark), Cargill Incorporated (US), Siveele B.V. (Netherlands), and BASF SE (Germany).

Which source led the natural antimicrobials market?

The microorganisms category dominated the market in 2023.

Which application had the largest market share in the natural antimicrobials market?

The bakery & confectionery category had the largest share in the market.

-

Table of Contents

-

1 Executive Summary

-

Market Attractiveness Analysis

- Global Natural Antimicrobials Market, by Source

- Global Natural Antimicrobials Market, by Application

- Global Natural Antimicrobials Market, by Region

-

Market Attractiveness Analysis

-

Market Introduction

- Definition

- Scope of the Study

- Market Structure

- Key Buying Criteria

- Macro Factor Indicator Analysis

-

Impact of COVID-19 on the market

- Impact on raw material availability

- Impact on supply chain

- Impact on product pricing

- Impact on store-based vs online sales

- Impact on buying decision of customers/consumers

- Impact on end-use industries

-

Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Market Size Estimation

- Forecast Model

- List of Assumptions

-

MARKET DYNAMICS

- Introduction

- Drivers

- Restraints

- Opportunities

- Challenges

-

MARKET FACTOR ANALYSIS

- Value Chain Analysis

- Supply Chain Analysis

-

Porter’s Five Forces Model

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

GLOBAL NATURAL ANTIMICROBIALS MARKET, BY SOURCE

- Introduction

-

Plants

- Plants: Market Estimates & Forecast, by Region/Country, 2023–2032

-

Animals

- Animals: Market Estimates & Forecast, by Region/Country, 2023–2032

-

Microorganisms

- Microorganisms: Market Estimates & Forecast, by Region/Country, 2023–2032

-

GLOBAL NATURAL ANTIMICROBIALS MARKET, BY APPLICATION

- Introduction

-

Bakery & Confectionery

- Bakery & Confectionery: Market Estimates & Forecast, by Region/Country, 2023–2032

-

Dairy & Frozen Desserts

- Dairy & Frozen Desserts: Market Estimates & Forecast, by Region/Country, 2023–2032

-

Beverages

- Beverages: Market Estimates & Forecast, by Region/Country, 2023–2032

-

Snacks

- Snacks: Market Estimates & Forecast, by Region/Country, 2023–2032

-

Meat Products

- Meat Products: Market Estimates & Forecast, by Region/Country, 2023–2032

-

Oils & Fats

- Oils & Fats: Market Estimates & Forecast, by Region/Country, 2023–2032

-

Others

- Others: Market Estimates & Forecast, by Region/Country, 2023–2032

-

GLOBAL NATURAL ANTIMICROBIALS MARKET, BY REGION

- Introduction

-

North America

- Market Estimates & Forecast, by Source, 2023–2032

- Market Estimates & Forecast, by Application, 2023–2032

- Market Estimates & Forecast, by Country, 2023–2032

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, by Source, 2023–2032

- Market Estimates & Forecast, by Application, 2023–2032

- Market Estimates & Forecast, by Country, 2023–2032

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, by Source, 2023–2032

- Market Estimates & Forecast, by Application, 2023–2032

- Market Estimates & Forecast, by Country, 2023–2032

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Forecast, by Source, 2023–2032

- Market Estimates & Forecast, by Application, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

- South America

- Middle East

- Africa

-

Competitive Landscape

- Introduction

- Competitive Benchmarking

- Development Share Analysis

- Key Developments & Growth Strategies

-

COMPANY PROFILES

-

Dow DuPont Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Royal DSM NV

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Univar Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Kemin Industries, Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Galactic S.A.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Chr. Hansen A/S

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Brenntag AG

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Siveele B.V.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Cargill, Incorporated

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Handary SA

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

BASF SE

- Company Overview

-

Celanese Corp.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Akzo Nobel N.V.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Kerry Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Biosecur Lab Inc.

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Dow DuPont Inc.

-

APPENDIX

- General Sources & References

- List of Abbreviation

-

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 Global Natural Antimicrobials Market, by Region, 2023–2032 (USD Million)

- TABLE 2 Global Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 3 Global Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 4 North America: Natural Antimicrobials Market, by Country, 2023–2032 (USD Million)

- TABLE 5 North America: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 6 North America: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 7 US: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 8 US: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 9 Canada: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 10 Canada: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 11 Mexico: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 12 Mexico: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 13 Europe: Natural Antimicrobials Market, by Country, 2023–2032 (USD Million)

- TABLE 14 Europe: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 15 Europe: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 16 Germany: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 17 Germany: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 18 France: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 19 France: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 20 Italy: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 21 Italy: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 22 Spain: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 23 Spain: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 24 UK: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 25 UK: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 26 Rest of Europe: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 27 Rest of Europe: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 28 Asia-Pacific: Natural Antimicrobials Market, by Country, 2023–2032 (USD Million)

- TABLE 29 Asia-Pacific: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 30 Asia-Pacific: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 31 China: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 32 China: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 33 India: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 34 India: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 35 Japan: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 36 Japan: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 37 Australia & New Zealand: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 38 Australia & New Zealand: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 39 Rest of Asia-Pacific: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 40 Rest of Asia-Pacific: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 41 Rest of the World (RoW): Natural Antimicrobials Market, by Country, 2023–2032 (USD Million)

- TABLE 42 Rest of the World (RoW): Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 43 Rest of the World (RoW): Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 44 South America: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 45 South America: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 46 Middle East: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 47 Middle East: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million)

- TABLE 48 Africa: Natural Antimicrobials Market, by Source, 2023–2032 (USD Million)

- TABLE 49 Africa: Natural Antimicrobials Market, by Application, 2023–2032 (USD Million) LIST OF FIGURES

- FIGURE 1 Global Natural Antimicrobials Market Segmentation

- FIGURE 2 Forecast Research Methodology

- FIGURE 3 Five Forces Analysis of the Global Natural Antimicrobials Market

- FIGURE 4 Value Chain of the Global Natural Antimicrobials Market

- FIGURE 5 Share of the Global Natural Antimicrobials Market in 2018, by Country (%)

- FIGURE 6 Global Natural Antimicrobials Market, by Region, 2023–2032,

- FIGURE 7 Global Natural Antimicrobials Market Size, by Source, 2018

- FIGURE 8 Share of the Global Natural Antimicrobials Market, by Source, 2023–2032 (%)

- FIGURE 7 Global Natural Antimicrobials Market Size, by Application, 2023

- FIGURE 8 Share of the Global Natural Antimicrobials Market, by Application, 2023–2032 (%)

Market Segmentation

Natural Antimicrobials Source Outlook (USD Billion, 2018-2032)

- Plants

- Animals

- Microorganisms

Natural Antimicrobials Application Outlook (USD Billion, 2018-2032)

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

Natural Antimicrobials Regional Outlook (USD Billion, 2018-2032)

- North America Outlook (USD Billion, 2018-2032)

- North America Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- North America Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- US Outlook (USD Billion, 2018-2032)

- US Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- US Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- CANADA Outlook (USD Billion, 2018-2032)

- CANADA Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- CANADA Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Europe Outlook (USD Billion, 2018-2032)

- Europe Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Europe Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Germany Outlook (USD Billion, 2018-2032)

- Germany Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Germany Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- France Outlook (USD Billion, 2018-2032)

- France Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- France Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- UK Outlook (USD Billion, 2018-2032)

- UK Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- UK Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- ITALY Outlook (USD Billion, 2018-2032)

- ITALY Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- ITALY Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- SPAIN Outlook (USD Billion, 2018-2032)

- Spain Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Spain Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- REST OF EUROPE Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Asia-Pacific Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- China Outlook (USD Billion, 2018-2032)

- China Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- China Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Japan Outlook (USD Billion, 2018-2032)

- Japan Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Japan Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- India Outlook (USD Billion, 2018-2032)

- India Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- India Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Australia Outlook (USD Billion, 2018-2032)

- Australia Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Australia Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Rest of Asia-Pacific Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Rest of the World Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Middle East Outlook (USD Billion, 2018-2032)

- Middle East Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Middle East Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Africa Outlook (USD Billion, 2018-2032)

- Africa Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Africa Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Latin America Outlook (USD Billion, 2018-2032)

- Latin America Natural Antimicrobials by Source

- Plants

- Animals

- Microorganisms

- Latin America Natural Antimicrobials by Application

- Bakery & Confectionery

- Dairy & Frozen Desserts

- Beverages

- Snacks

- Meat Products

- Oils & Fats

- Others

- Rest of the World Natural Antimicrobials by Source

- Asia-Pacific Natural Antimicrobials by Source

- Europe Natural Antimicrobials by Source

- North America Natural Antimicrobials by Source

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment