Market Analysis

In-depth Analysis of Molecular Modeling Market Industry Landscape

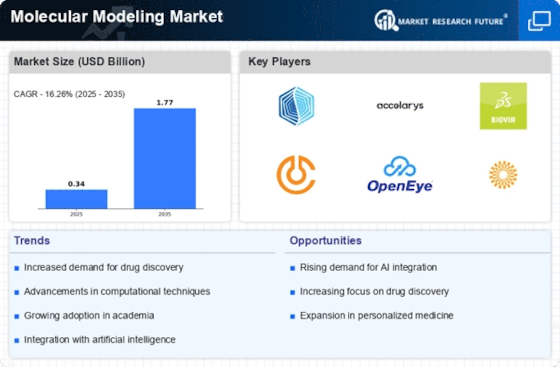

The Molecular Modeling Market dynamics are shaped by the convergence of computational technologies, drug discovery advancements, and the increasing importance of predictive modeling in molecular research. Stakeholders in pharmaceuticals, biotechnology, and research institutions must understand these dynamics to leverage molecular modeling tools effectively for drug design, molecular simulations, and understanding biological systems. This is so because it the changes in computational technologies contribute to dynamics. The advancement of high performance computers combined with the development in algorithms and software, provide a better accuracy level as well as efficiency for molecular modeling simulation. This moves makes users interested to adopt those tools are their applications within lifelogical science research . Healthcare industries that grapple to develop the niche for personalized medicine are guided significantly by molecular modeling, and thus dynamics in market stead. Techniques of modeling are aimed at adaptation the treatments individually to genetic profiles, prediction drug responses and optimization therapeutic effects contributing thereby into paradigm shift towards precision medicine. The dynamics are the application of molecular modeling in virtual screening and hit identification. In the initial phases, researcher utilizes computational tools that allow them to virtually screen millions of chemicals from some chemical libraries which will help in identifying potential drug candidates and shrink a list down for compounds needed for tests as well. The use of simulations in order to understand biomolecular interactions is what that gives the shape to market dynamics. Advanced technique through the use of molecular dynamics simulations enables researchers to investigate the dynamic behavior of biological molecules from an atomic level perspective, offering avenues into protein folding models, ligand binding mechanisms and insights as regards to mechanics in regard tot interactions amongst these relevant biomolecular units. This covers dynamics such as greater collaboration in molecular modeling services. Pharmaceutical firms and research institutes partner up with specialized service provider, five to acquire profoundness of acumen as well a discussion for computational resources that help in the creation of such series refers collaborative world which helps hendred efficiently rercahces being we also mdieshare knowledge. Dynamics include regulatory compliance within drug discovery. Due to the significance of molecular modeling in pharmacokinetics, it follows that adherence to regulatory guidelines is imperative. Aligning the modeling results with experimental data increases the credit rating and acceptance of in silico studies by regulatory agencies while submitting. The market drivers comprise the increase in computational toxicology and ADMET prediction. The early determination of the ADMET profiles and potential toxicity facilitated by molecular modeling helps avoid late-stage failures.

Market dynamics involve ethical considerations in AI-driven modeling. As AI and ML algorithms become integral to molecular modeling, ethical frameworks are evolving to address concerns related to bias, transparency, and responsible use of computational approaches in scientific research.

Leave a Comment