Market Analysis

In-depth Analysis of Milk Tank Cooling System Market Industry Landscape

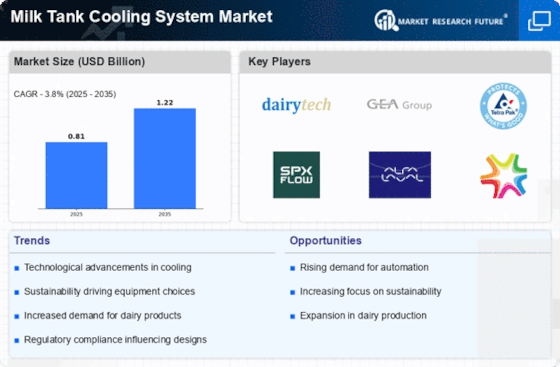

A number of factors influence the growth and development of the milk tank cooling system market. One key driver is global demand for dairy products because as population increases while dietary preferences change thereby calling for more efficient and reliable milk storage solutions. Milk tank cooling systems play an essential role in maintaining quality and freshness of milk making them indispensable in satisfying needs of this sector.

Modern cooling procedures, energy systems, and sophisticated monitoring may improve these equipment' efficiency and performance. Manufacturers are creating eco-friendly and energy-saving solutions for dairy producers as sustainability becomes a priority.

In severe or changeable conditions, milk quality must be preserved using specific chilling methods. The distribution and adoption of cooling systems adapted for local climatic conditions depends on where most dairy farms are located leading to a wide range of market opportunities as well as challenges.

Among such factors includes region’s economic health, dairy industry investments, and government support for agriculture which shape the purchasing power of farmers thereby also influencing demand for cooling solutions. Economic stability together with favorable financial conditions encourage more investment in upgrading dairy operations including switching into advanced milk tank cooling technologies.

The policies established by respective governments significantly influence the milk tank cooling system market. Cooling system design and manufacturing processes have to meet specific regulations concerning milk quality standards, environmental impact concerns, and energy efficiency. Furthermore, grants plus other forms of financial aid extended by states increase accessibility hence foster growth within this sector.

Another force shaping this market is competition within the industry itself. Established enterprises compete with new entrants causing significant shifts in the industry structure. They compete using different parameters such as product reliability, energy consumption rates (efficiency), cost or pricing , and after sale services or support. For firms that want to grow their businesses beyond their boundaries it will be vital that they form strategic alliances with other players in sectors like livestock extension officers’ organizations, cooperative societies working in cattle rearing business among others.

Consumer consciousness coupled with changing preferences is also applicable to milk tank cooling systems markets. Consumers are more cautious about eating fresh foods hence need animals feeds which are not contaminated so that there is no disease spread to the milk. Thus, milk tank cooling systems are part of a system that ensures quality milk preservation from the farm all the way to processing facilities, and this is what determines whether dairies purchase them or not.

Leave a Comment