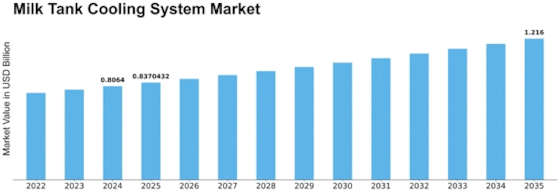

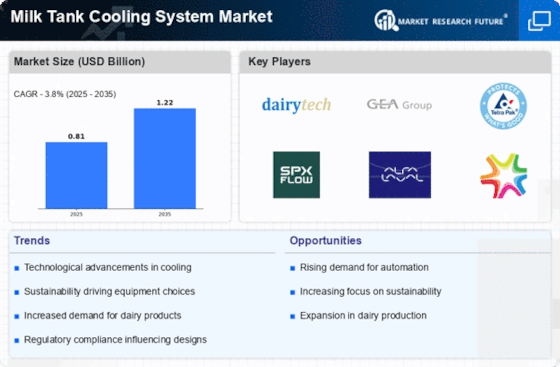

Milk Tank Cooling System Size

Milk Tank Cooling System Market Growth Projections and Opportunities

The dairy industry is a larger industry of which the milk tank cooling market is part of and it has a role to play in ensuring that milk is fresh between where it was produced and where it will be processed. This sector’s market dynamics are influenced by some factors like technology, regulations, farming practices as well as the global dairy products demand. Milk tank cooling systems are integral parts of dairy supply chain that helps keep milk at optimal temperatures while being transported or stored.

With modernization and automation of the dairy sector, there is need for innovative means of cooling, which can regulate milk temperature with precision and efficiency. State-of-the-art sensors, automatic control systems and energy efficient refrigeration technologies are some common features in modern-day milk-tank coolers. These innovations not only improve overall system performance but also save energy aligning with what currently happens in this sector.

Market dynamics for milk tank cooling systems are highly dictated by regulatory standards and compliance requirements. There exist stringent rules that govern safety and quality aspects of dairy products hence determine how such machines should be designed to be used in transporting or preserving milk. Such producers within this market must monitor the trend in standards from regulatory bodies so that their goods meet required qualities criteria hence they always have this continuous process of improvement and adaptation within the business.

Milk tank cooling system market’s changes occur due to how 6dairy farming activities are carried out. The scale and practice on farms contribute towards an adoption of efficient coolers. Huge volumes require more improved types whereas smaller ones do not necessarily need costly areas efficient enough to handle limited quantities only.Cooling needs for keeping milk intact depend on geographical variations since weather patterns differ from one region to another.

Dairy product demand across the globe shapes market dynamics for these coolers. In view of increased consumption rates globally, there is corresponding growth in demand for reliable and effective cooling solutions needed along the dairy food supply chain. The production and innovation activities in the dairy market have to be customer-responsive for them to remain relevant.

In conclusion, this market operates at the intersection of technological innovation, regulatory compliance, dairy farming practices, global demand for dairy products and environmental sustainability. The industry has continued to evolve its cooling technologies in response to a dynamic dairy landscape. With expansion and modernization of the dairy sector, there is potential growth and innovation opportunities within the milk tank cooling system market that guarantees safety as well as quality of milk across its supply chain.

Leave a Comment