Military IoT Market Share

Military IoT Market Research Report Information by Component (Hardware, Software and Services), Technology (Wi-Fi, Cellular, RFID and others), Application (Training and Simulation, Health Monitoring, Real-Time Fleet Management, Inventory Management, Equipment Maintenance and others) and Region (North America, Europe, Asia-Pacific, Middle East & Africa and Latin America) - Forecast till 2035

Market Summary

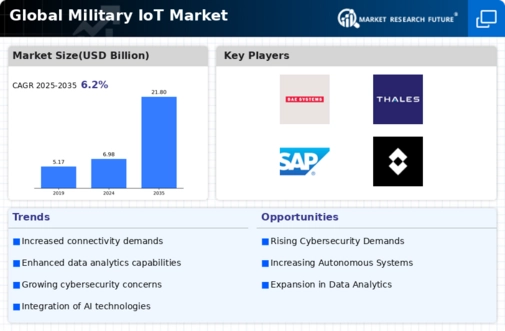

As per Market Research Future Analysis, the Global Military IoT Market is projected to reach USD 18.22 billion by 2032, growing at a CAGR of 6.20% from 2024 to 2032. The market is driven by the increasing adoption of IoT technologies in battlefield management systems (BMS) and the evolving nature of warfare. North America dominated the market in 2018, holding a share of approximately 10.64%, and is expected to continue leading due to high military spending and the integration of IoT in military operations. However, challenges such as data management issues and cybersecurity threats may hinder growth.

Key Market Trends & Highlights

The Military IoT market is characterized by significant technological advancements and strategic partnerships.

- North America is expected to register a CAGR of 10.85% during the forecast period.

- The Wi-Fi segment is projected to grow at a CAGR of 11.53% during the forecast period.

- The APAC region is anticipated to be the fastest-growing market with a CAGR of 8.5%.

Market Size & Forecast

| Market Size in 2023 | USD 18.22 Billion |

| Projected CAGR from 2024 to 2032 | 6.20% |

| Largest Regional Market Share in 2018 | North America |

| Expected CAGR for Wi-Fi Segment | 11.53% |

Major Players

Northrop Grumman Corporation (US), Honeywell International Inc. (US), BAE Systems (UK), Lockheed Martin Corporation (US), Thales Group (France)

Market Trends

The integration of Internet of Things technologies within military operations is poised to enhance situational awareness and operational efficiency, thereby transforming defense capabilities in the modern battlefield.

U.S. Department of Defense

Military IoT Market Market Drivers

Market Growth Chart

Increased Defense Budgets

The Global Military IoT Market Industry is experiencing a surge in defense budgets across various nations, driven by the need for advanced technological capabilities. Countries are investing heavily in IoT solutions to enhance their military operations and ensure national security. For instance, the United States has allocated substantial funds to modernize its military infrastructure, which includes IoT technologies. This trend is expected to contribute to the market's growth, with projections indicating that the Global Military IoT Market could reach 6.98 USD Billion in 2024, reflecting a robust demand for innovative solutions.

Growing Cybersecurity Concerns

As military operations increasingly rely on interconnected devices, cybersecurity has emerged as a critical concern within the Global Military IoT Market Industry. The potential for cyber threats to disrupt military communications and operations necessitates robust security measures. Governments are investing in advanced cybersecurity solutions to protect their IoT infrastructures from malicious attacks. This focus on cybersecurity is likely to drive innovation and investment in the market, as nations seek to safeguard their military assets and maintain operational integrity.

Enhanced Operational Efficiency

The integration of IoT technologies within military operations is likely to enhance operational efficiency significantly. By utilizing real-time data analytics and connectivity, armed forces can optimize logistics, improve situational awareness, and streamline decision-making processes. For example, IoT-enabled devices can monitor equipment health, reducing maintenance costs and downtime. This trend is indicative of the broader shift towards data-driven military strategies, which is expected to propel the Global Military IoT Market Industry forward, potentially reaching 21.8 USD Billion by 2035.

Rising Demand for Autonomous Systems

The demand for autonomous systems in military operations is driving growth within the Global Military IoT Market Industry. Unmanned aerial vehicles (UAVs), ground vehicles, and naval systems are increasingly being integrated with IoT technologies to enhance their operational capabilities. These systems can collect and analyze data autonomously, providing valuable insights for military strategists. As nations seek to leverage the advantages of automation, the market is likely to expand, with projections indicating a significant increase in investment and development in this sector.

Advancements in Communication Technologies

The rapid advancements in communication technologies, such as 5G, are poised to transform the Global Military IoT Market Industry. Enhanced connectivity allows for faster data transmission and improved communication between military assets, enabling real-time decision-making and coordination. This technological evolution is expected to facilitate the deployment of IoT solutions in various military applications, from battlefield communications to logistics management. As a result, the market is anticipated to grow at a CAGR of 10.92% from 2025 to 2035, reflecting the increasing reliance on advanced communication systems.

Market Segment Insights

Regional Insights

Key Companies in the Military IoT Market market include

Industry Developments

On Jun.22, 2023,

BT Group plc, a British multinational telecommunication company, announced securing a networks contract with the British Army to equipe its smart bases across the United Kingdom. It is a five-year contract to provide a managed Wi-Fi service known as MOD Wi-Fi. This agreement is also expandable to other defence customers, including the Royal Air Force and the Royal Navy.

On Jun.09, 2023,

QuSecure, a post-quantum cybersecurity company, announced receiving a $2M contract from the US army to develop quantum-resilient software solutions to secure tactical edge and IoT devices from quantum cyberattacks.

The funds will be used to conduct further research on quantum-resilient technologies and encryption solutions needed in battle-ready tactical edge and IoT devices. This five-year budget for research into emerging technologies like quantum computing and post-quantum cryptography (PQC) is awarded under the US Innovation and Competition Act of 2021

On Apr.13, 2023,

Smarter Technologies (the UK), a leading provider of IoT solutions, announced the successful completion of capability assessment trial of their asset tracking systems with the MoD at HMNB Devonport. Follow-on demonstrations are also planned for HMNB Portsmouth and other military establishments. The company highlighted the unique capabilities of their Orion IoT data network to defence in helping to defeat organised crime.

On Mar.15, 2023,

SpaceBridge, a leading broadband satellite communications systems provider, announced a partnership with nexTenna, a provider of advanced Ultra-thin ESA to offer satellite broadband solutions to enterprise and military. Electronically Steerable Antennas feature the industry leading lowest power consumption, to develop a new line of wireless communication systems targeting IoT, mobility IoT, and broadband & fixed broadband solutions.

On Aug.16, 2022,

American Armaments Research Company (ARC) announced that it will introduce its IoT full-stack technology in the Next Generation Squad Weapon (NGSW) program, in partnership with Sig Sauer. ARC’s embedded IoT sensors will provide unprecedented mission-critical data to ground leadership. US Army will integrate ARC’s IoT tech into next-gen squad weapons.

Future Outlook

Military IoT Market Future Outlook

The Global Military IoT Market is poised for growth at a 10.92% CAGR from 2024 to 2035, driven by advancements in connectivity, data analytics, and enhanced security measures.

New opportunities lie in:

- Develop AI-driven analytics platforms for real-time battlefield decision-making.

- Invest in secure communication technologies to enhance data integrity and operational efficiency.

- Create IoT-enabled logistics solutions to streamline supply chain management in military operations.

By 2035, the Global Military IoT Market is expected to achieve substantial growth, reflecting evolving defense strategies and technological advancements.

Market Segmentation

Report Overview:

Military IoT Market Segmentation Overview:

- Northrop Grumman Corporation (US),

- (US),

- BAE Systems (UK),

- Free-Wave Technologies, Inc. (US), and

- Lockheed Martin Corporation (US),

- Fore-scout Technologies, Inc. (US),

- ATandT Inc. (US),

- Harris Corporation (US),

- (US),

- Thales Group (France),

- SAP SE (Germany),

- FLIR Systems Inc. (US)

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 11300 Million |

| Market Size 2032 | USD 18222 Million |

| Compound Annual Growth Rate (CAGR) | 6.20% (2024-2032) |

| Base Year | 2021 |

| Market Forecast Period | 2024-2032 |

| Historical Data | 2019- 2020 |

| Market Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Component, Technology, Application, Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Northrop Grumman Corporation (US), Honeywell International Inc. (US), BAE Systems (UK), Free-Wave Technologies, Inc. (US), Lockheed Martin Corporation (US), Fore-scout Technologies, Inc. (US), ATandT Inc. (US), Harris Corporation (US), IBM Corporation (US), Thales Group (France), SAP SE (Germany), FLIR Systems Inc. (US) |

| Key Market Opportunities | Increasing use of IOT based Technology |

| Key Market Dynamics | The effect of IoT on the business world |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What are the inducements for change in the global military IoT market?

The altering nature of warfare is estimated to provide a viable impetus to the market.

What CAGR is estimated to back significantly to the military IoT market in the upcoming years?

A CAGR of 6.20% is estimated to allow the market to flourish in the forecast period.

Who are the prime candidates for the progress of the military IoT market in the approaching period?

Honeywell International Inc. (U.S.), B.A.E. Systems (U.K.), FreeWave Technologies, Inc. (U.S.), Harris Corporation (U.S.) are some to the leaders of the expansion of the market.

Which regional market is assessed to add commercially to the military IoT market in the forecast period?

The domination of the North American region is estimated to be seen in the forecast period.

What revenue level can be seen in the global military IoT market by the end of the forecast period?

A USD 18222 million by 2032 is projected to enhance the expansion potential of the market.

-

Executive Summary

-

Market Attractiveness Analysis

- Global Military IoT Market, by Component

- Global Military IoT Market, by Technology

- Global Military IoT Market, by Application

- Global Military IoT Market, by Region

-

Market Attractiveness Analysis

-

Market Introduction

- Definition

- Scope of the Study

- Market Structure

- Key Buying Criteria

-

Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Market Size Estimation

- Top-Down & Bottom-up Approaches

- Forecast Model

- List of Assumptions

-

Market Insights

-

Market Dynamics

- Introduction

-

Drivers

- Changing Nature of Warfare

- Increased Use of IoT in BMS for Special Operations

- Drivers Impact Analysis

-

Restraints

- Issues Associated with Data Management

- Threats to Cybersecurity

- Restraints Impact Analysis

-

Opportunity

- Focus on Military Modernization

-

Technological Trends

- Cloud Computing

- Artificial Intelligence

-

Market Factor Analysis

-

Supply Chain Analysis

- Systems and Component Suppliers

- Integrators and Manufacturers

- Distribution

- Operation and Maintenance

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Rivalry

-

Supply Chain Analysis

-

Global Military IoT Market, by Component

- Overview

- Global Military IoT Market, by Component, 2022-2032 (USD Million)

-

Hardware

- Hardware: Global Military IoT Market, 2022-2032 (USD Million)

- Hardware: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Software

- Software: Global Military IoT Market, 2022-2032 (USD Million)

- Software: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Services

- Services: Global Military IoT Market, 2022-2032 (USD Million)

- Services: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Global Military IoT Market, by Technology

- Overview

- Global Military IoT Market, by Technology, 2022-2032 (USD Million)

-

Wi-Fi

- Wi-Fi: Global Military IoT Market, 2022-2032 (USD Million)

- Wi-Fi: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Cellular

- Cellular: Global Military IoT Market, 2022-2032 (USD Million)

- Cellular: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

RFID

- RFID: Global Military IoT Market, 2022-2032 (USD Million)

- RFID: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Others

- Others: Global Military IoT Market, 2022-2032 (USD Million)

- Others: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Global Military IoT Market, by Application

- Overview

- Global Military IoT Market, by Application, 2022-2032 (USD Million)

-

Training & Simulation

- Training & Simulation: Global Military IoT Market, 2022-2032 (USD Million)

- Training & Simulation: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Health Monitoring

- Health Monitoring: Global Military IoT Market, 2022-2032 (USD Million)

- Health Monitoring: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Real-Time Fleet Management

- Real-Time Fleet Management: Global Military IoT Market, 2022-2032 (USD Million)

- Real-Time Fleet Management: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Inventory Management

- Inventory Management: Global Military IoT Market, 2022-2032 (USD Million)

- Inventory Management: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Equipment Maintenance

- Equipment Maintenance: Global Military IoT Market, 2022-2032 (USD Million)

- Equipment Maintenance: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Others

- Others: Global Military IoT Market, 2022-2032 (USD Million)

- Others: Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

Global Military IoT Market, by Region

-

Overview

- Global Military IoT Market, by Region, 2022-2032 (USD Million)

-

North America

- North America: Military IoT Market, 2022-2032 (USD Million)

- North America: Military IoT Market, by Country, 2022-2032 (USD Million)

- North America: Military IoT Market, by Component, 2022-2032 (USD Million)

- North America: Military IoT Market, by Technology, 2022-2032 (USD Million)

- North America: Military IoT Market, by Application, 2022-2032 (USD Million)

- US

- Canada

-

Europe

- Europe: Military IoT Market, 2022-2032 (USD Million)

- Europe: Military IoT Market, by Country, 2022-2032 (USD Million)

- Europe: Military IoT Market, by Component, 2022-2032 (USD Million)

- Europe: Military IoT Market, by Technology, 2022-2032 (USD Million)

- Europe: Military IoT Market, by Application, 2022-2032 (USD Million)

- UK

- Germany

- France

- Russia

- Rest of Europe

-

Asia-Pacific

- Asia-Pacific: Military IoT Market, 2022-2032 (USD Million)

- Asia-Pacific: Military IoT Market, by Country, 2022-2032 (USD Million)

- Asia-Pacific: Military IoT Market, by Component, 2022-2032 (USD Million)

- Asia-Pacific: Military IoT Market, by Technology, 2022-2032 (USD Million)

- Asia-Pacific: Military IoT Market, by Application, 2022-2032 (USD Million)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

-

Middle East & Africa

- Middle East & Africa: Military IoT Market, 2022-2032 (USD Million)

- Middle East & Africa: Military IoT Market, by Country, 2022-2032 (USD Million)

- Middle East & Africa: Military IoT Market, by Component, 2022-2032 (USD Million)

- Middle East & Africa: Military IoT Market, by Technology, 2022-2032 (USD Million)

- Middle East & Africa: Military IoT Market, by Application, 2022-2032 (USD Million)

- UAE

- Saudi Arabia

- Rest of the Middle East & Africa

-

Latin America

- Latin America: Military IoT Market, 2022-2032 (USD Million)

- Latin America: Military IoT Market, by Country, 2022-2032 (USD Million)

- Latin America: Military IoT Market, by Component, 2022-2032 (USD Million)

- Latin America: Military IoT Market, by Technology, 2022-2032 (USD Million)

- Latin America: Military IoT Market, by Application, 2022-2032 (USD Million)

- Brazil

- Rest of Latin America

-

Overview

-

Competitive Landscape

- Competitive Overview

- Competitor Dashboard

- Major Growth Strategies: Global Military IoT Market

- Competitive Benchmarking

- Market Share Analysis

- Leading Players (In Terms of Number of Developments) in the Global Military IoT Market

-

Key Developments & Growth Strategies

- New Product Developments

- Contracts

- Partnerships

-

Company Profiles

-

FLIR Systems Inc.

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Forescout Technologies, Inc.

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AT&T Inc.

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Northrop Grumman Corporation

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Honeywell International Inc.

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- Other Prominent Players

-

FLIR Systems Inc.

-

List of Tables and Figures

- 13 List of Tables

- TABLE 1 LIST OF ASSUMPTIONS

- TABLE 2 GLOBAL MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 3 HARDWARE: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 4 HARDWARE: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 5 SOFTWARE: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 6 SOFTWARE: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 7 SERVICES: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 8 SERVICES: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 9 GLOBAL MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 10 WI-FI: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 11 WI-FI: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 12 CELLULAR: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 13 CELLULAR: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 14 RFID: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 15 RFID: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 16 OTHERS: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 17 OTHERS: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 18 GLOBAL MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 19 TRAINING & SIMULATION: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 20 TRAINING & SIMULATION: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 21 HEALTH MONITORING: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 22 HEALTH MONITORING: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 23 REAL-TIME FLEET MANAGEMENT: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 24 REAL-TIME FLEET MANAGEMENT: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 25 INVENTORY MANAGEMENT: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 26 INVENTORY MANAGEMENT: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 27 EQUIPMENT MAINTENANCE: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 28 EQUIPMENT MAINTENANCE: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 29 OTHERS: GLOBAL MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 30 OTHERS: GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 31 GLOBAL MILITARY IOT MARKET, BY REGION, 2022-2032 (USD MILLION)

- TABLE 32 NORTH AMERICA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 33 NORTH AMERICA: MILITARY IOT MARKET, BY COUNTRY, 2022-2032 (USD MILLION)

- TABLE 34 NORTH AMERICA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 35 NORTH AMERICA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 36 NORTH AMERICA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 37 US: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 38 US: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 39 US: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 40 US: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 41 CANADA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 42 CANADA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 43 CANADA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 44 CANADA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 45 EUROPE: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 46 EUROPE: MILITARY IOT MARKET, BY COUNTRY, 2022-2032 (USD MILLION)

- TABLE 47 EUROPE: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 48 EUROPE: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 49 EUROPE: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 50 UK: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 51 UK: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 52 UK: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 53 UK: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 54 GERMANY: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 55 GERMANY: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 56 GERMANY: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 57 GERMANY: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 58 FRANCE: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 59 FRANCE: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 60 FRANCE: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 61 FRANCE: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 62 RUSSIA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 63 RUSSIA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 64 RUSSIA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 65 RUSSIA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 66 REST OF EUROPE: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 67 REST OF EUROPE: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 68 REST OF EUROPE: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 69 REST OF EUROPE: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 70 ASIA-PACIFIC: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 71 ASIA-PACIFIC: MILITARY IOT MARKET, BY COUNTRY, 2022-2032 (USD MILLION)

- TABLE 72 ASIA-PACIFIC: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 73 ASIA-PACIFIC: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 74 ASIA-PACIFIC: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 75 CHINA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 76 CHINA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 77 CHINA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 78 CHINA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 79 JAPAN: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 80 JAPAN: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 81 JAPAN: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 82 JAPAN: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 83 INDIA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 84 INDIA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 85 INDIA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 86 INDIA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 87 SOUTH KOREA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 88 SOUTH KOREA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 89 SOUTH KOREA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 90 SOUTH KOREA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 91 REST OF ASIA-PACIFIC: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 92 REST OF ASIA-PACIFIC: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 93 REST OF ASIA-PACIFIC: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 94 REST OF ASIA-PACIFIC: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: MILITARY IOT MARKET, BY COUNTRY, 2022-2032 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 100 UAE: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 101 UAE: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 102 UAE: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 103 UAE: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 104 SAUDI ARABIA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 105 SAUDI ARABIA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 106 SAUDI ARABIA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 107 SAUDI ARABIA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 108 REST OF THE MIDDLE EAST & AFRICA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 109 REST OF THE MIDDLE EAST & AFRICA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 110 REST OF THE MIDDLE EAST & AFRICA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 111 REST OF THE MIDDLE EAST & AFRICA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 112 LATIN AMERICA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 113 LATIN AMERICA: MILITARY IOT MARKET, BY COUNTRY, 2022-2032 (USD MILLION)

- TABLE 114 LATIN AMERICA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 115 LATIN AMERICA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 116 LATIN AMERICA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 117 BRAZIL: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 118 BRAZIL: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 119 BRAZIL: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 120 BRAZIL: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 121 REST OF LATIN AMERICA: MILITARY IOT MARKET, 2022-2032 (USD MILLION)

- TABLE 122 REST OF LATIN AMERICA: MILITARY IOT MARKET, BY COMPONENT, 2022-2032 (USD MILLION)

- TABLE 123 REST OF LATIN AMERICA: MILITARY IOT MARKET, BY TECHNOLOGY, 2022-2032 (USD MILLION)

- TABLE 124 REST OF LATIN AMERICA: MILITARY IOT MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 125 COMPETITOR DASHBOARD: GLOBAL MILITARY IOT MARKET

- TABLE 126 MOST ACTIVE PLAYERS IN THE GLOBAL MILITARY IOT MARKET

- TABLE 127 NEW PRODUCT DEVELOPMENTS

- TABLE 128 CONTRACTS

- TABLE 129 PARTNERSHIPS

- TABLE 130 FLIR SYSTEMS INC.: PRODUCT/SERVICES OFFERED

- TABLE 131 FLIR SYSTEMS INC.: KEY DEVELOPMENTS

- TABLE 132 FORESCOUT TECHNOLOGIES, INC.: PRODUCT/SERVICES OFFERED

- TABLE 133 FORESCOUT TECHNOLOGIES, INC.: KEY DEVELOPMENTS

- TABLE 134 AT&T INC.: PRODUCT/SERVICES OFFERED

- TABLE 135 NORTHROP GRUMMAN CORPORATION: PRODUCT/SERVICES OFFERED

- TABLE 136 NORTHROP GRUMMAN CORPORATION: KEY DEVELOPMENTS

- TABLE 137 HONEYWELL INTERNATIONAL INC.: PRODUCT/SERVICES OFFERED

- TABLE 138 HONEYWELL INTERNATIONAL INC.: KEY DEVELOPMENTS 14 List of Figures

- FIGURE 1 MARKET SYNOPSIS

- FIGURE 2 GLOBAL MILITARY IOT MARKET: MARKET ATTRACTIVENESS ANALYSIS

- FIGURE 3 GLOBAL MILITARY IOT MARKET ANALYSIS, BY COMPONENT

- FIGURE 4 GLOBAL MILITARY IOT MARKET ANALYSIS, BY TECHNOLOGY

- FIGURE 5 GLOBAL MILITARY IOT MARKET ANALYSIS, BY APPLICATION

- FIGURE 6 GLOBAL MILITARY IOT MARKET ANALYSIS, BY REGION

- FIGURE 7 GLOBAL MILITARY IOT MARKET: MARKET STRUCTURE

- FIGURE 8 KEY BUYING CRITERIA FOR MILITARY IOT SYSTEMS

- FIGURE 9 RESEARCH PROCESS OF MRFR

- FIGURE 10 NORTH AMERICA: MILITARY IOT MARKET SIZE & MARKET SHARE, BY COUNTRY, 2020 VS 2027

- FIGURE 11 EUROPE: MILITARY IOT MARKET SIZE & MARKET SHARE, BY COUNTRY, 2020 VS 2027

- FIGURE 12 ASIA-PACIFIC: MILITARY IOT MARKET SIZE & MARKET SHARE, BY COUNTRY, 2020 VS 2027

- FIGURE 13 MIDDLE EAST & AFRICA: MILITARY IOT MARKET SIZE & MARKET SHARE, BY REGION, 2020 VS 2027

- FIGURE 14 LATIN AMERICA: MILITARY IOT MARKET SIZE & MARKET SHARE, BY REGION, 2020 VS 2027

- FIGURE 15 MARKET DYNAMICS OVERVIEW

- FIGURE 16 DRIVERS IMPACT ANALYSIS: GLOBAL MILITARY IOT MARKET

- FIGURE 17 RESTRAINTS IMPACT ANALYSIS: GLOBAL MILITARY IOT MARKET

- FIGURE 18 GLOBAL MILITARY IOT MARKET: SUPPLY CHAIN

- FIGURE 19 GLOBAL MILITARY IOT MARKET: Porter's Five Forces Analysis

- FIGURE 20 GLOBAL MILITARY IOT MARKET SHARE, BY COMPONENT, 2020 (% SHARE)

- FIGURE 21 GLOBAL MILITARY IOT MARKET SHARE, BY TECHNOLOGY, 2020 (% SHARE)

- FIGURE 22 GLOBAL MILITARY IOT MARKET SHARE, BY APPLICATION, 2020 (% SHARE)

- FIGURE 23 GLOBAL MILITARY IOT MARKET SHARE, BY REGION, 2020 (% SHARE)

- FIGURE 24 NORTH AMERICA: MILITARY IOT MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

- FIGURE 25 EUROPE: MILITARY IOT MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

- FIGURE 26 ASIA-PACIFIC: MILITARY IOT MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

- FIGURE 27 MIDDLE EAST & AFRICA: MILITARY IOT MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

- FIGURE 28 LATIN AMERICA: MILITARY IOT MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

- FIGURE 29 CAPITAL MARKET RATIO AND FINANCIAL MATRIX

- FIGURE 30 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS: GLOBAL MILITARY IOT MARKET

- FIGURE 31 BENCHMARKING OF MAJOR COMPETITORS

- FIGURE 32 MAJOR PROVIDERS MARKET SHARE ANALYSIS, 2020 (%)

- FIGURE 33 FLIR SYSTEMS INC.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 34 FLIR SYSTEMS INC.: SWOT ANALYSIS

- FIGURE 35 FORESCOUT TECHNOLOGIES, INC.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 36 FORESCOUT TECHNOLOGIES, INC.: SWOT ANALYSIS

- FIGURE 37 AT&T INC.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 38 AT&T INC.: SWOT ANALYSIS

- FIGURE 39 NORTHROP GRUMMAN CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 40 NORTHROP GRUMMAN CORPORATION: SWOT ANALYSIS

- FIGURE 41 HONEYWELL INTERNATIONAL INC.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 42 HONEYWELL INTERNATIONAL INC.: SWOT ANALYSIS

Military IoT Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment