Market Share

Military Aircraft Digital Glass Cockpit Systems Market Share Analysis

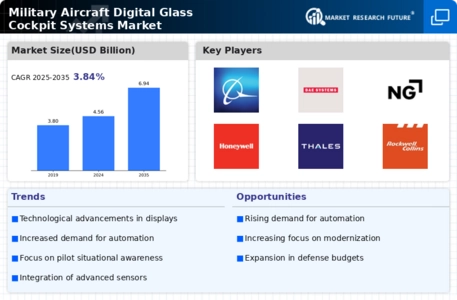

The military aircraft digital glass cockpit systems market is characterized by strategic positioning strategies that enable key players to secure a competitive edge in a rapidly evolving landscape. A prevailing trend in this market is the focus on technological advancements and innovation to differentiate products. Manufacturers of digital glass cockpit systems for military aircraft continually invest in research and development to enhance the capabilities of their products. This includes incorporating state-of-the-art avionics, advanced displays, and intuitive interfaces, providing pilots with improved situational awareness, streamlined information access, and enhanced mission effectiveness. By staying at the forefront of technological innovation, companies aim to not only meet current military requirements but also anticipate future needs, positioning themselves as leaders in the digital cockpit systems market.

Collaborations and partnerships are integral to market share positioning in the military aircraft digital glass cockpit systems sector. Companies often engage in strategic alliances with defense contractors, avionics integrators, and government agencies to strengthen their market presence. Collaborative efforts enable the sharing of expertise, resources, and technologies, leading to the development of comprehensive cockpit solutions. These partnerships are not only beneficial for addressing the complex requirements of modern military aircraft but also for gaining access to a broader customer base, including international defense markets.

Diversification of product offerings is a key strategy employed by major players in the military aircraft digital cockpit systems market. Recognizing the varied needs of different military branches and aircraft platforms, manufacturers maintain a diverse product portfolio. This includes digital cockpit systems tailored for different types of military aircraft, such as fighter jets, helicopters, and transport planes. A versatile product lineup allows companies to address the specific operational and performance requirements of various military applications, providing tailored solutions for different defense programs and platforms.

Market leaders in military aircraft digital glass cockpit systems also prioritize customer-centric approaches to secure market share. Understanding the unique requirements of defense customers, companies engage in customization and offer flexible solutions that can be adapted to specific mission profiles. This customer-centric strategy involves close collaboration with defense agencies to ensure that digital cockpit systems align with evolving military needs, regulatory standards, and cybersecurity requirements. Establishing long-term relationships with defense customers fosters trust and brand loyalty, positioning companies as reliable partners in the military aviation sector.

Cost competitiveness is a crucial aspect of market share positioning in the military aircraft digital cockpit systems market. Defense budgets are often subject to constraints, and cost-effective solutions are highly sought after by military procurement agencies. Companies aim to optimize manufacturing processes, reduce production costs, and offer affordable yet high-performance digital cockpit systems. Achieving economies of scale, efficient supply chain management, and leveraging advancements in production technologies contribute to cost competitiveness, enabling manufacturers to win contracts and secure market share.

Geographical positioning plays a strategic role in the military aircraft digital cockpit systems market. Proximity to key defense customers, strategic military bases, and regional security considerations influence the decision to establish manufacturing facilities and support infrastructure. Companies strategically position themselves to cater to specific defense markets and align with geopolitical dynamics. This approach enhances operational efficiency, facilitates timely customer support, and ensures compliance with regional regulations and standards.

In conclusion, the military aircraft digital glass cockpit systems market is characterized by dynamic strategies employed by key players to secure market share. These strategies encompass technological innovation, collaborations, diversification of product offerings, customer-centric approaches, cost competitiveness, and strategic geographical positioning. As defense agencies worldwide seek advanced and adaptable cockpit solutions, companies that effectively implement these positioning strategies are poised to thrive in the competitive landscape of military aviation.

Leave a Comment