Medical Devices Market Trends

Medical Devices Market Research Report By Device Type (Diagnostic Devices, Therapeutic Devices, Monitoring Devices, Surgical Instruments, Implantable Devices), By End Use (Hospitals, Clinics, Home Healthcare, Research Laboratories, Diagnostic Centers), By Application (Cardiology, Orthopedics, Neurology, Ophthalmology, General Surgery), By Distribution Channel (Direct Sales, Distributors, Online...

Market Summary

As per Market Research Future Analysis, the Medical Devices Market was valued at 571.80 USD Billion in 2024 and is projected to grow to 1207.52 USD Billion by 2035, with a CAGR of 7.03% from 2025 to 2035. The market is driven by the increasing incidence of chronic diseases, an aging population, and technological advancements in medical devices.

Key Market Trends & Highlights

Key trends driving the Medical Devices Market include technological innovations and demographic shifts.

- The global aging population is expected to double from 12% to 22% by 2050, increasing demand for medical devices. Chronic diseases account for approximately 71% of all deaths globally, necessitating advanced medical devices for management. Diagnostic Devices are projected to grow from 120.0 USD Billion in 2024 to 150.0 USD Billion by 2035. Home Healthcare is gaining traction, driven by an aging population and preference for personalized care.

Market Size & Forecast

| 2024 Market Size | USD 571.80 Billion |

| 2035 Market Size | USD 1207.52 Billion |

| CAGR (2025-2035) | 7.03% |

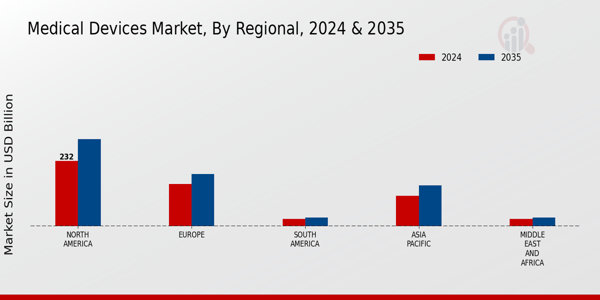

| Largest Regional Market Share in 2024 | North America. |

Major Players

<p>Key players include Abbott Laboratories, Zimmer Biomet, Hologic, Baxter International, Johnson and Johnson, B. Braun Melsungen, Medtronic, and Siemens Healthineers.</p>

Market Trends

There are big changes happening in the Medical Devices Market that are changing the way healthcare works. The rising number of people with chronic illnesses is a major market driver since it increases the need for sophisticated diagnostic and treatment equipment. This effect is made even stronger by the fast pace of technical progress, especially in fields like telemedicine and less invasive treatments. These new technologies not only make patients better, but they also make healthcare facilities run more smoothly.

Some opportunities to look into include the rise of developing economies, where growing healthcare costs and better access to medical facilities provide a good atmosphere for growth.

As consumers seek more customized healthcare solutions, there is also a clear move toward linked devices and individualized treatment. This development gives manufacturers an opportunity to produce new ideas and make products that work for each patient. There has been a lot more attention on making sure that medical devices are made and sold in accordance with the rules and standards of quality in recent years. Governments throughout the world are making their rules better to protect patients while also encouraging new ideas.

More and more, providers are using data analytics and artificial intelligence to make better decisions and offer better service.

The COVID-19 pandemic has also sped up the use of remote monitoring technologies and home healthcare solutions, which shows how important it is to have strong healthcare systems. Overall, the Medical Devices Market is set to develop quickly because of these trends and the changing needs of healthcare.

<p>The Global Medical Devices Market is poised for robust growth, driven by advancements in technology and an increasing demand for innovative healthcare solutions.</p>

U.S. Food and Drug Administration (FDA)

Medical Devices Market Market Drivers

Aging Population

The demographic shift towards an aging population significantly influences the Global Medical Devices Market Industry. As individuals age, the prevalence of chronic diseases such as diabetes, cardiovascular disorders, and arthritis rises, necessitating advanced medical devices for effective management. This trend is particularly pronounced in developed nations, where the proportion of elderly citizens is increasing. The demand for devices like glucose monitors and orthopedic implants is expected to surge, contributing to the market's expansion. By 2024, the market is projected to reach 540.2 USD Billion, with a notable increase to 700 USD Billion by 2035, driven by the healthcare needs of an aging demographic.

Market Growth Projections

The Global Medical Devices Market Industry is poised for substantial growth, with projections indicating a market size of 540.2 USD Billion in 2024 and an anticipated increase to 700 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 2.38% from 2025 to 2035. Factors contributing to this expansion include technological advancements, an aging population, rising healthcare expenditure, and increased demand for home healthcare solutions. The market's evolution reflects broader trends in healthcare, emphasizing the importance of innovation and accessibility in medical device development.

Technological Advancements

The Global Medical Devices Market Industry experiences a robust growth trajectory driven by rapid technological advancements. Innovations in areas such as minimally invasive surgical techniques, telemedicine, and wearable health monitoring devices are transforming patient care. For instance, the integration of artificial intelligence in diagnostic tools enhances accuracy and efficiency, thereby improving patient outcomes. As of 2024, the market is valued at approximately 540.2 USD Billion, reflecting the increasing adoption of these technologies. Furthermore, the anticipated growth to 700 USD Billion by 2035 indicates a compound annual growth rate of 2.38% from 2025 to 2035, underscoring the pivotal role of technology in shaping the industry.

Rising Healthcare Expenditure

Increased healthcare expenditure across various regions is a crucial driver for the Global Medical Devices Market Industry. Governments and private sectors are investing more in healthcare infrastructure and technology, aiming to enhance patient care and outcomes. This trend is particularly evident in emerging markets, where rising disposable incomes lead to greater access to medical devices. The market's valuation of 540.2 USD Billion in 2024 reflects this growing investment, with projections indicating a rise to 700 USD Billion by 2035. Such financial commitment is likely to foster innovation and accessibility, thereby expanding the market further.

Regulatory Support and Reforms

Regulatory support and reforms play a vital role in shaping the Global Medical Devices Market Industry. Governments worldwide are implementing policies that streamline the approval processes for new medical devices, thereby encouraging innovation and market entry. Initiatives aimed at enhancing patient safety and device efficacy are also being prioritized. For instance, the U.S. Food and Drug Administration has introduced programs to expedite the review of breakthrough devices. This supportive regulatory environment is expected to contribute to the market's growth, with a valuation of 540.2 USD Billion in 2024 and a projected increase to 700 USD Billion by 2035, reflecting the positive impact of these reforms.

Increased Demand for Home Healthcare Solutions

The Global Medical Devices Market Industry is witnessing a surge in demand for home healthcare solutions, driven by changing patient preferences and advancements in technology. Patients increasingly prefer receiving care in the comfort of their homes, leading to a rise in the adoption of home monitoring devices, telehealth platforms, and portable diagnostic tools. This trend is particularly relevant in the context of chronic disease management, where continuous monitoring is essential. The market's growth, from 540.2 USD Billion in 2024 to an anticipated 700 USD Billion by 2035, is indicative of this shift towards home-based care, highlighting the evolving landscape of healthcare delivery.

Market Segment Insights

Medical Devices Market Device Type Insights

<p>The Medical Devices Market, focusing on the Device Type segment, showcases a diverse range of applications that play a critical role in transforming healthcare delivery. In 2024, the market is projected to be valued at 571.80 USD Billion, with the Diagnostic Devices segment expected to lead the way at 120.0 USD Billion. This segment is significant as it facilitates early disease detection and supports informed decision-making for treatment plans.</p>

<p>Following closely is the Therapeutic Devices segment, anticipated to be valued at 130.0 USD Billion in the same year, emphasizing its importance in delivering effective solutions for patient care.Monitoring Devices, with a projected value of 100.0 USD Billion in 2024, plays a crucial role in tracking patient health metrics, ensuring timely interventions. The Surgical Instruments segment, valued at 90.17 USD Billion, is imperative for performing a range of surgical procedures, thereby contributing significantly to improving patient outcomes.</p>

<p>Implantable Devices are of increasing significance, with a valuation of 100.0 USD Billion, showcasing a strong growth trajectory as they cater to long-term therapeutic needs. As we transition to 2035, the importance of these segments will only grow, with Diagnostic Devices projected to reach 140.0 USD Billion and Therapeutic Devices anticipated at 160.0 USD Billion.The Monitoring Devices segment is expected to increase to 120.0 USD Billion, while the Surgical Instruments and Implantable Devices are projected at 90.0 USD Billion and 190.0 USD Billion respectively. This underscores the dominance and growing adoption of various medical devices in the healthcare landscape.</p>

Medical Devices Market End Use Insights

<p>The Medical Devices Market revenue focuses significantly on various end use segments, particularly Hospitals, Clinics, Home Healthcare, Research Laboratories, and Diagnostic Centers. By 2024, the market is expected to be valued at 571.80 USD Billion, demonstrating a notable emphasis on these sectors as they cater to diverse healthcare needs across the globe.</p>

<p>Hospitals play a crucial role, considering they are often the primary point of patient care and advanced treatment, leveraging an array of medical devices to enhance surgical outcomes and <a href="https://www.marketresearchfuture.com/reports/patient-monitoring-devices-market-2484">patient monitoring</a>.Clinics contribute to the market by providing essential outpatient services and preventive care, while Home Healthcare has emerged as a vital segment, reflecting the shift towards patient-centric models and the increasing preference for at-home treatments. Research Laboratories support innovation and development of new medical technologies, driving advancements in patient care. Diagnostic Centers are significant as they provide accurate and timely testing, leading to prompt medical interventions.</p>

<p>The market growth will be fueled by technological advancements and an aging population, alongside challenges such as regulatory compliance and cost management.However, opportunities abound in expanding telemedicine and wearable devices, emphasizing how the Medical Devices Market segmentation is central to meeting changing healthcare demands.</p>

Medical Devices Market Application Insights

<p>The Medical Devices Market revenue for 2024 is projected to reach 571.80 USD Billion, showcasing robust growth across various applications. The market segmentation highlights key areas including Cardiology, Orthopedics, Neurology, Ophthalmology, and General Surgery, each playing a critical role in the healthcare system. Cardiology devices are increasingly essential due to the rising prevalence of heart diseases, while Orthopedics continues to dominate with advancements in joint replacement technologies. Neurology applications are significant as they address the increasing incidence of neurological disorders globally.Ophthalmology devices also reflect substantial market growth due to the aging population and heightened awareness about eye health.</p>

<p>General Surgery remains a fundamental segment, encompassing a wide range of devices that enhance surgical procedures. The trends driving the Medical Devices Market include technological innovations, increasing healthcare expenditure, and a rise in chronic diseases. However, challenges such as regulatory hurdles and high production costs may affect the market dynamics. The Medical Devices Market Statistics indicate promising opportunities for growth in these applications, supported by ongoing Research and Development efforts aimed at enhancing patient outcomes and operational efficiency.</p>

Medical Devices Market Distribution Channel Insights

<p>In the Medical Devices Market, the Distribution Channel segment plays a critical role, reflecting an evolving landscape with significant implications for market growth. By 2024, the overall market is valued at 571.80 USD Billion, with various channels facilitating access to medical devices. Direct Sales remain a dominant channel, enabling manufacturers to maintain control over marketing and customer relationships, which is crucial in an industry where education and support are vital.</p>

<p>Distributors also hold a significant position, acting as essential intermediaries that ensure timely delivery and breadth of reach across diverse geographies.The rise of Online Sales has transformed the way medical devices are marketed and sold, driven by increasing digital adoption and the shift towards e-commerce, which offers convenience and broad accessibility, particularly during the recent global health challenges. Retail Pharmacies provide another important avenue, giving patients easy access to devices and related products, which is pivotal for consumer convenience.</p>

<p>Understanding these Distribution Channels enhances insights into the Medical Devices Market data and illuminates key growth drivers and challenges, including regulatory pressures and the need for robust logistics networks.</p>

Get more detailed insights about Medical Devices Market Research Report — Global Forecast till 2035

Regional Insights

The Medical Devices Market revenue is experiencing notable segmentation across various regions, with North America holding the majority share, valued at 232.0 USD Billion in 2024, and projected to reach 310.0 USD Billion by 2035. This region's dominance can be attributed to its advanced healthcare infrastructure and significant investment in medical innovations. Europe follows, with a valuation of 150.0 USD Billion in 2024, rising to 185.0 USD Billion by 2035, driven by stringent regulations and a highly developed healthcare system.

The Asia Pacific region, valued at 108.0 USD Billion in 2024 and expected to rise to 145.0 USD Billion by 2035, is becoming increasingly significant due to a growing population and rising healthcare expenditure.South America, while smaller, shows steady growth from 25.0 USD Billion in 2024 to 30.0 USD Billion in 2035, reflecting improvements in healthcare access. Lastly, the Middle East and Africa are valued at 25.17 USD Billion in 2024, increasing to 30.0 USD Billion by 2035, influenced by expanding healthcare needs and investments in medical technology.

These Medical Devices Market statistics illustrate the varied growth potential across regions, with opportunities for innovation and market entries.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The Medical Devices Market has become a highly competitive landscape characterized by rapid advancements in technology, increasing healthcare expenditure, and a growing aging population. The market comprises a diverse range of products including diagnostic devices, surgical instruments, and therapeutic equipment. A key factor contributing to the market's vibrancy is the constant innovation driven by both established companies and startups. Regulatory frameworks across various regions also play a significant role in determining the competitive strategies of market players.

Companies are focusing on not only enhancing their product offerings but also exploring strategic collaborations, research and development initiatives, and mergers and acquisitions to maintain a competitive edge. As consumer awareness of health technologies rises, the demand for advanced medical devices is expected to grow, driving market participants to devise strategies that cater to evolving needs.Becton Dickinson is recognized as a leader within the Medical Devices Market, leveraging its robust portfolio that focuses on critical areas including medication management, infection prevention, and diagnostics. The company has established a formidable market presence driven by its commitment to innovation and quality.

Becton Dickinson's strengths lie in its extensive research and development capabilities, allowing for the continual introduction of breakthrough products to enhance patient care. By strategically positioning itself in key healthcare segments, the company has built a strong brand reputation and customer loyalty. Its robust distribution network and global reach enable Becton Dickinson to effectively respond to market demands while meeting regulatory standards, further solidifying its competitive position in the market.Thermo Fisher Scientific also plays a significant role in the Medical Devices Market by offering a comprehensive range of products and services across various segments.

The company's key offerings include a wide selection of diagnostic tools, laboratory equipment, and life sciences solutions that cater to diverse healthcare needs. Thermo Fisher Scientific benefits from a strong global presence, ensuring its products and services are accessible to a broad spectrum of healthcare providers. This company stands out due to its sizable investments in research and development, enabling it to remain at the forefront of technological advancements and innovation. Additionally, strategic mergers and acquisitions have allowed Thermo Fisher Scientific to expand its capabilities and portfolio effectively.

This positions it favorably within the market, and the company’s commitment to quality and efficiency further enhances its reputation as a trusted provider in the medical devices sector.

Key Companies in the Medical Devices Market market include

Industry Developments

The Medical Devices Market has experienced significant advancements and changes recently. In September 2023, Siemens Healthineers announced a major expansion in its imaging capabilities with the launch of its latest MRI machine, enhancing diagnostic accuracy. In August 2023, Medtronic acquired Mazor Robotics, furthering its ambition in robotic surgery, bolstering its market position. The current valuation growth trends have seen Becton Dickinson and Boston Scientific reporting increased market shares due to their innovative product launches and strategic partnerships. In July 2023, Hologic's new breast imaging technology gained European regulatory approval, which is expected to enhance their foothold in the European market.

Additionally, in June 2023, Johnson and Johnson revealed plans to spin off its medical device segment, aiming to sharpen focus on pharmaceuticals while significantly impacting market dynamics. The Medical Devices Market is projected to grow at a substantial rate, with increased demand for home healthcare and digital health solutions further driving expansion in various sectors. Industry collaborations and the ongoing integration of advanced technologies, such as artificial intelligence and robotics, are shaping the current landscape, positioning key players like Stryker Corporation and Thermo Fisher Scientific as leaders in innovation.

Future Outlook

Medical Devices Market Future Outlook

<p>The Global Medical Devices Market is projected to grow at a 7.03% CAGR from 2025 to 2035, driven by technological advancements, increasing healthcare expenditure, and an aging population.</p>

New opportunities lie in:

- <p>Invest in telehealth solutions to enhance remote patient monitoring capabilities. Develop AI-driven diagnostic tools to improve accuracy and efficiency in healthcare. Expand into emerging markets with tailored medical device offerings to meet local needs.</p>

<p>By 2035, the market is expected to demonstrate robust growth, reflecting advancements in technology and increased healthcare demands.</p>

Market Segmentation

Medical Devices Market End Use Outlook

- Hospitals

- Clinics

- Home Healthcare

- Research Laboratories

- Diagnostic Centers

Medical Devices Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Medical Devices Market Application Outlook

- Cardiology

- Orthopedics

- Neurology

- Ophthalmology

- General Surgery

Medical Devices Market Device Type Outlook

- Diagnostic Devices

- Therapeutic Devices

- Monitoring Devices

- Surgical Instruments

- Implantable Devices

Medical Devices Market Distribution Channel Outlook

- Direct Sales

- Distributors

- Online Sales

- Retail Pharmacies

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | 571.80 (USD Billion) |

| Market Size 2035 | 1207.52 (USD Billion) |

| Compound Annual Growth Rate (CAGR) | 7.03% (2025 - 2035) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2023 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Becton Dickinson, Thermo Fisher Scientific, Smith & Nephew, Zimmer Biomet, GE Healthcare, Siemens Healthineers, Hologic, Stryker Corporation, Medtronic, Cardinal Health, 3M Company, Johnson & Johnson, Philips Healthcare, Abbott Laboratories, Boston Scientific |

| Segments Covered | Device Type, End Use, Application, Distribution Channel, Regional |

| Key Market Opportunities | Telehealth integration advancement, Innovative wearable devices, AI-driven diagnostics development, Cloud-based data management solutions, Customized implants and prosthetics. |

| Key Market Dynamics | Technological advancements, Aging population, Regulatory challenges, Increasing healthcare expenditure, Rising prevalence of chronic diseases |

| Countries Covered | North America, Europe, APAC, South America, MEA |

| Market Size 2025 | 612.01 (USD Billion) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the expected market size of the Medical Devices Market in 2024?

The Medical Devices Market is expected to be valued at 571.80 USD Billion in 2024.

What is the projected market size for the Medical Devices Market by 2035?

By 2035, the Medical Devices Market is anticipated to reach a value of 700.0 USD Billion.

What is the expected compound annual growth rate (CAGR) for the Medical Devices Market from 2025 to 2035?

The Medical Devices Market is expected to grow at a CAGR of 2.38% from 2025 to 2035.

Which region is expected to dominate the Medical Devices Market in 2024?

North America is expected to dominate the Medical Devices Market with a valuation of 232.0 USD Billion in 2024.

What will be the market size of Europe in the Medical Devices Market by 2035?

The market size for Europe in the Medical Devices Market is projected to be 185.0 USD Billion by 2035.

What are the expected market values for Diagnostic Devices in 2024 and 2035?

Diagnostic Devices are expected to be valued at 120.0 USD Billion in 2024 and 140.0 USD Billion in 2035.

How much is the Implantable Devices segment expected to be valued by 2035?

The Implantable Devices segment is anticipated to reach a market value of 190.0 USD Billion by 2035.

Who are the key players in the Medical Devices Market?

Major players in the Medical Devices Market include Becton Dickinson, Medtronic, Siemens Healthineers, and Johnson & Johnson.

What is the market size for Monitoring Devices in 2024?

In 2024, the market size for Monitoring Devices is valued at 100.0 USD Billion.

What is the expected growth for the South America region in the Medical Devices Market from 2024 to 2035?

The South America region is expected to grow from 25.0 USD Billion in 2024 to 30.0 USD Billion by 2035.

-

--- "Table of Contents

-

Executive Summary

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumption

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

MEDICAL DEVICES MARKET, BY DEVICE TYPE (USD BILLION)

- Diagnostic Devices

- Therapeutic Devices

- Monitoring Devices

- Surgical Instruments

- Implantable Devices

-

MEDICAL DEVICES MARKET, BY END USE (USD BILLION)

- Hospitals

- Clinics

- Home Healthcare

- Research Laboratories

- Diagnostic Centers

-

MEDICAL DEVICES MARKET, BY APPLICATION (USD BILLION)

- Cardiology

- Orthopedics

- Neurology

- Ophthalmology

- General Surgery

-

MEDICAL DEVICES MARKET, BY DISTRIBUTION CHANNEL (USD BILLION)

- Direct Sales

- Distributors

- Online Sales

- Retail Pharmacies

-

MEDICAL DEVICES MARKET, BY REGIONAL (USD BILLION)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Medical Devices Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Medical Devices Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

COMPANY PROFILES

-

Abbott Laboratories

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Zimmer Biomet

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hologic

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Thermo Fisher Scientific

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Baxter International

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Johnson and Johnson

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

B. Braun Melsungen

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Olympus Corporation

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Medtronic

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Boston Scientific

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Philips Healthcare

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Stryker Corporation

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Cardinal Health

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Siemens Healthineers

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

General Electric

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Abbott Laboratories

-

APPENDIX

- References

- Related Reports

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1. LIST OF ASSUMPTIONS

- TABLE 2. NORTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 3. NORTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 4. NORTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 5. NORTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 6. NORTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 7. US MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 8. US MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 9. US MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 10. US MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 11. US MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 12. CANADA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 13. CANADA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 14. CANADA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 15. CANADA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 16. CANADA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 17. EUROPE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 18. EUROPE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 19. EUROPE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 20. EUROPE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 21. EUROPE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 22. GERMANY MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 23. GERMANY MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 24. GERMANY MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 25. GERMANY MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 26. GERMANY MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 27. UK MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 28. UK MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 29. UK MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 30. UK MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 31. UK MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 32. FRANCE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 33. FRANCE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 34. FRANCE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 35. FRANCE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 36. FRANCE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 37. RUSSIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 38. RUSSIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 39. RUSSIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 40. RUSSIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 41. RUSSIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 42. ITALY MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 43. ITALY MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 44. ITALY MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 45. ITALY MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 46. ITALY MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 47. SPAIN MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 48. SPAIN MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 49. SPAIN MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 50. SPAIN MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 51. SPAIN MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 52. REST OF EUROPE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 53. REST OF EUROPE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 54. REST OF EUROPE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 55. REST OF EUROPE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 56. REST OF EUROPE MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 57. APAC MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 58. APAC MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 59. APAC MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 60. APAC MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 61. APAC MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 62. CHINA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 63. CHINA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 64. CHINA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 65. CHINA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 66. CHINA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 67. INDIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 68. INDIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 69. INDIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 70. INDIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 71. INDIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 72. JAPAN MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 73. JAPAN MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 74. JAPAN MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 75. JAPAN MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 76. JAPAN MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 77. SOUTH KOREA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 78. SOUTH KOREA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 79. SOUTH KOREA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 80. SOUTH KOREA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 81. SOUTH KOREA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 82. MALAYSIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 83. MALAYSIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 84. MALAYSIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 85. MALAYSIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 86. MALAYSIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 87. THAILAND MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 88. THAILAND MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 89. THAILAND MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 90. THAILAND MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 91. THAILAND MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 92. INDONESIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 93. INDONESIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 94. INDONESIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 95. INDONESIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 96. INDONESIA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 97. REST OF APAC MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 98. REST OF APAC MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 99. REST OF APAC MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 100. REST OF APAC MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 101. REST OF APAC MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 102. SOUTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 103. SOUTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 104. SOUTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 105. SOUTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 106. SOUTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 107. BRAZIL MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 108. BRAZIL MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 109. BRAZIL MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 110. BRAZIL MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 111. BRAZIL MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 112. MEXICO MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 113. MEXICO MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 114. MEXICO MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 115. MEXICO MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 116. MEXICO MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 117. ARGENTINA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 118. ARGENTINA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 119. ARGENTINA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 120. ARGENTINA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 121. ARGENTINA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 122. REST OF SOUTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 123. REST OF SOUTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 124. REST OF SOUTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 125. REST OF SOUTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 126. REST OF SOUTH AMERICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 127. MEA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 128. MEA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 129. MEA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 130. MEA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 131. MEA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 132. GCC COUNTRIES MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 133. GCC COUNTRIES MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 134. GCC COUNTRIES MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 135. GCC COUNTRIES MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 136. GCC COUNTRIES MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 137. SOUTH AFRICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 138. SOUTH AFRICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 139. SOUTH AFRICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 140. SOUTH AFRICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 141. SOUTH AFRICA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 142. REST OF MEA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD BILLIONS)

- TABLE 143. REST OF MEA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

- TABLE 144. REST OF MEA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

- TABLE 145. REST OF MEA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLIONS)

- TABLE 146. REST OF MEA MEDICAL DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- TABLE 148. ACQUISITION/PARTNERSHIP LIST OF FIGURES

- FIGURE 1. MARKET SYNOPSIS

- FIGURE 2. NORTH AMERICA MEDICAL DEVICES MARKET ANALYSIS

- FIGURE 3. US MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 4. US MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 5. US MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 6. US MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 7. US MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 8. CANADA MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 9. CANADA MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 10. CANADA MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 11. CANADA MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 12. CANADA MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 13. EUROPE MEDICAL DEVICES MARKET ANALYSIS

- FIGURE 14. GERMANY MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 15. GERMANY MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 16. GERMANY MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 17. GERMANY MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 18. GERMANY MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 19. UK MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 20. UK MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 21. UK MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 22. UK MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 23. UK MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 24. FRANCE MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 25. FRANCE MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 26. FRANCE MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 27. FRANCE MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 28. FRANCE MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 29. RUSSIA MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 30. RUSSIA MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 31. RUSSIA MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 32. RUSSIA MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 33. RUSSIA MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 34. ITALY MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 35. ITALY MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 36. ITALY MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 37. ITALY MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 38. ITALY MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 39. SPAIN MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 40. SPAIN MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 41. SPAIN MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 42. SPAIN MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 43. SPAIN MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 44. REST OF EUROPE MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 45. REST OF EUROPE MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 46. REST OF EUROPE MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 47. REST OF EUROPE MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 48. REST OF EUROPE MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 49. APAC MEDICAL DEVICES MARKET ANALYSIS

- FIGURE 50. CHINA MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 51. CHINA MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 52. CHINA MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 53. CHINA MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 54. CHINA MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 55. INDIA MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 56. INDIA MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 57. INDIA MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 58. INDIA MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 59. INDIA MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 60. JAPAN MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 61. JAPAN MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 62. JAPAN MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 63. JAPAN MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 64. JAPAN MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 65. SOUTH KOREA MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 66. SOUTH KOREA MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 67. SOUTH KOREA MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 68. SOUTH KOREA MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 69. SOUTH KOREA MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 70. MALAYSIA MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 71. MALAYSIA MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 72. MALAYSIA MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 73. MALAYSIA MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 74. MALAYSIA MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 75. THAILAND MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 76. THAILAND MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 77. THAILAND MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 78. THAILAND MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 79. THAILAND MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 80. INDONESIA MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 81. INDONESIA MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 82. INDONESIA MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 83. INDONESIA MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 84. INDONESIA MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 85. REST OF APAC MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 86. REST OF APAC MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 87. REST OF APAC MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 88. REST OF APAC MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 89. REST OF APAC MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 90. SOUTH AMERICA MEDICAL DEVICES MARKET ANALYSIS

- FIGURE 91. BRAZIL MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 92. BRAZIL MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 93. BRAZIL MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 94. BRAZIL MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 95. BRAZIL MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 96. MEXICO MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 97. MEXICO MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 98. MEXICO MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 99. MEXICO MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 100. MEXICO MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 101. ARGENTINA MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 102. ARGENTINA MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 103. ARGENTINA MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 104. ARGENTINA MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 105. ARGENTINA MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 106. REST OF SOUTH AMERICA MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 107. REST OF SOUTH AMERICA MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 108. REST OF SOUTH AMERICA MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 109. REST OF SOUTH AMERICA MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 110. REST OF SOUTH AMERICA MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 111. MEA MEDICAL DEVICES MARKET ANALYSIS

- FIGURE 112. GCC COUNTRIES MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 113. GCC COUNTRIES MEDICAL DEVICES MARKET ANALYSIS BY END USE

- FIGURE 114. GCC COUNTRIES MEDICAL DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 115. GCC COUNTRIES MEDICAL DEVICES MARKET ANALYSIS BY DISTRIBUTION CHANNEL

- FIGURE 116. GCC COUNTRIES MEDICAL DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 117. SOUTH AFRICA MEDICAL DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FIGURE 118. SOUTH AFRI"

Medical Devices Market Segmentation

Medical Devices Market By Device Type (USD Billion, 2019-2035)

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

Medical Devices Market By End Use (USD Billion, 2019-2035)

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

Medical Devices Market By Application (USD Billion, 2019-2035)

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

Medical Devices Market By Distribution Channel (USD Billion, 2019-2035)

Direct Sales

Distributors

Online Sales

Retail Pharmacies

Medical Devices Market By Regional (USD Billion, 2019-2035)

North America

Europe

South America

Asia Pacific

Middle East and Africa

Medical Devices Market Regional Outlook (USD Billion, 2019-2035)

North America Outlook (USD Billion, 2019-2035)

North America Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

North America Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

North America Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

North America Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

North America Medical Devices Market by Regional Type

US

Canada

US Outlook (USD Billion, 2019-2035)

US Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

US Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

US Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

US Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

CANADA Outlook (USD Billion, 2019-2035)

CANADA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

CANADA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

CANADA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

CANADA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

Europe Outlook (USD Billion, 2019-2035)

Europe Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

Europe Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

Europe Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

Europe Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

Europe Medical Devices Market by Regional Type

Germany

UK

France

Russia

Italy

Spain

Rest of Europe

GERMANY Outlook (USD Billion, 2019-2035)

GERMANY Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

GERMANY Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

GERMANY Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

GERMANY Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

UK Outlook (USD Billion, 2019-2035)

UK Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

UK Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

UK Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

UK Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

FRANCE Outlook (USD Billion, 2019-2035)

FRANCE Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

FRANCE Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

FRANCE Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

FRANCE Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

RUSSIA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

RUSSIA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

RUSSIA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

ITALY Outlook (USD Billion, 2019-2035)

ITALY Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

ITALY Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

ITALY Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

ITALY Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

SPAIN Outlook (USD Billion, 2019-2035)

SPAIN Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

SPAIN Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

SPAIN Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

SPAIN Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

REST OF EUROPE Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

REST OF EUROPE Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

REST OF EUROPE Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

APAC Outlook (USD Billion, 2019-2035)

APAC Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

APAC Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

APAC Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

APAC Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

APAC Medical Devices Market by Regional Type

China

India

Japan

South Korea

Malaysia

Thailand

Indonesia

Rest of APAC

CHINA Outlook (USD Billion, 2019-2035)

CHINA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

CHINA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

CHINA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

CHINA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

INDIA Outlook (USD Billion, 2019-2035)

INDIA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

INDIA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

INDIA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

INDIA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

JAPAN Outlook (USD Billion, 2019-2035)

JAPAN Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

JAPAN Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

JAPAN Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

JAPAN Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

SOUTH KOREA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

SOUTH KOREA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

SOUTH KOREA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

MALAYSIA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

MALAYSIA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

MALAYSIA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

THAILAND Outlook (USD Billion, 2019-2035)

THAILAND Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

THAILAND Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

THAILAND Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

THAILAND Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

INDONESIA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

INDONESIA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

INDONESIA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

REST OF APAC Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

REST OF APAC Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

REST OF APAC Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

South America Outlook (USD Billion, 2019-2035)

South America Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

South America Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

South America Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

South America Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

South America Medical Devices Market by Regional Type

Brazil

Mexico

Argentina

Rest of South America

BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

BRAZIL Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

BRAZIL Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

BRAZIL Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

MEXICO Outlook (USD Billion, 2019-2035)

MEXICO Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

MEXICO Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

MEXICO Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

MEXICO Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

ARGENTINA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

ARGENTINA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

ARGENTINA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

REST OF SOUTH AMERICA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

REST OF SOUTH AMERICA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

REST OF SOUTH AMERICA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

MEA Outlook (USD Billion, 2019-2035)

MEA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

MEA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

MEA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

MEA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

MEA Medical Devices Market by Regional Type

GCC Countries

South Africa

Rest of MEA

GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

GCC COUNTRIES Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

GCC COUNTRIES Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

GCC COUNTRIES Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

SOUTH AFRICA Outlook (USD Billion, 2019-2035)

SOUTH AFRICA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

SOUTH AFRICA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

SOUTH AFRICA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

SOUTH AFRICA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

REST OF MEA Outlook (USD Billion, 2019-2035)

REST OF MEA Medical Devices Market by Device Type

Diagnostic Devices

Therapeutic Devices

Monitoring Devices

Surgical Instruments

Implantable Devices

REST OF MEA Medical Devices Market by End Use Type

Hospitals

Clinics

Home Healthcare

Research Laboratories

Diagnostic Centers

REST OF MEA Medical Devices Market by Application Type

Cardiology

Orthopedics

Neurology

Ophthalmology

General Surgery

REST OF MEA Medical Devices Market by Distribution Channel Type

Direct Sales

Distributors

Online Sales

Retail Pharmacies

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment