Medical Device Testing Services Size

Market Size Snapshot

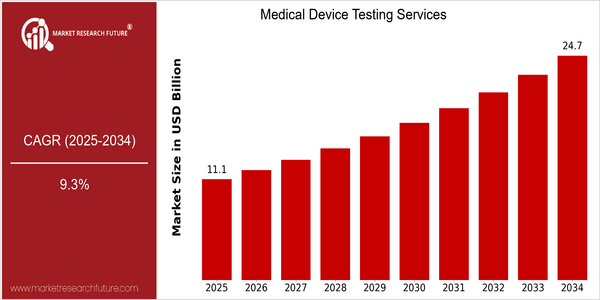

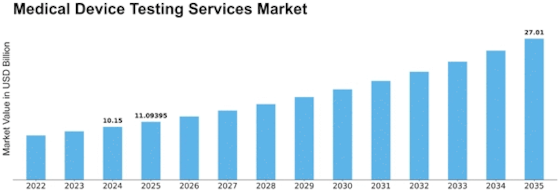

| Year | Value |

|---|---|

| 2025 | USD 11.1 Billion |

| 2034 | USD 24.71 Billion |

| CAGR (2025-2034) | 9.3 % |

Note – Market size depicts the revenue generated over the financial year

The medical devices testing services market is expected to grow at a CAGR of about 7% from now to 2025, and it is expected to reach $24.7 billion by 2034. This growth rate represents a strong CAGR of 9.3 percent from now to 2025. Increasing demand for medical devices and stringent regulatory requirements have led to the need for comprehensive testing to ensure their safety and effectiveness. As patient safety and product reliability continue to be the top priorities of health care systems worldwide, the market is experiencing a significant surge in investment and the development of new testing methods. This upward trend is due to several factors, including the rapid development of medical devices technology, such as the integration of artificial intelligence and the Internet of Things, which requires more sophisticated testing methods. Also, the growing number of chronic diseases and the aging of the population are driving the demand for advanced medical solutions, which is boosting the demand for testing services. The major players in the market, such as SGS SA, Intertek Group, and Eurofins Scientific, are focusing on strategic initiatives, such as mergers and acquisitions, to strengthen their service offerings and market positions. Recent collaborations to develop new testing methods also indicate the industry's commitment to ensuring compliance with changing regulatory requirements and enhancing patient safety.

Regional Market Size

Regional Deep Dive

The medical device testing services market is experiencing considerable growth across all regions, owing to the increasing regulatory requirements, technological advancements, and the growing demand for novel medical devices. North America is characterized by a strong health care system and a high concentration of leading medical device manufacturers, while Europe is characterized by stringent regulations to ensure high-quality standards. The Asia-Pacific region is expected to grow at a high rate, owing to the increasing availability of health care and the increasing investment in medical technology. The Middle East and Africa are gradually developing their testing capabilities, while Latin America is focusing on regulatory compliance to enhance its market potential.

Europe

- The implementation of the Medical Device Regulation (MDR) in the EU has led to increased demand for testing services, as manufacturers must comply with more stringent requirements for safety and efficacy.

- Organizations such as TÜV SÜD and BSI are enhancing their testing capabilities to support manufacturers in navigating the complex regulatory landscape, which is expected to drive innovation in testing methodologies.

Asia Pacific

- Countries like China and India are investing heavily in healthcare infrastructure, leading to a surge in demand for medical device testing services as local manufacturers seek to meet international standards.

- The rise of telemedicine and digital health solutions in the region is prompting testing services to adapt to new technologies, with companies like SGS and Eurofins expanding their offerings to include software and cybersecurity testing.

Latin America

- Regulatory bodies in Brazil and Mexico are working to harmonize their medical device regulations with international standards, which is increasing the demand for accredited testing services.

- Local companies are beginning to invest in advanced testing technologies, with firms like DNV GL expanding their presence in the region to support the growing need for compliance and quality assurance.

North America

- The FDA has recently updated its guidelines for medical device testing, emphasizing the need for more rigorous pre-market evaluations, which is pushing companies to seek comprehensive testing services.

- Key players like UL and Intertek are expanding their testing facilities in North America to accommodate the growing demand for advanced medical device testing, particularly in areas like biocompatibility and cybersecurity.

Middle East And Africa

- The establishment of the Gulf Cooperation Council (GCC) regulatory framework is enhancing the standardization of medical device testing in the region, encouraging local manufacturers to improve their testing processes.

- Collaborations between local governments and international testing organizations are emerging, such as the partnership between the UAE Ministry of Health and WHO, aimed at improving medical device safety and efficacy.

Did You Know?

“Approximately 70% of medical device recalls are due to design flaws, highlighting the critical importance of thorough testing services in ensuring device safety and efficacy.” — FDA Medical Device Recall Data

Segmental Market Size

The medical devices testing business plays a key role in ensuring the safety and efficacy of medical devices. It is currently experiencing a period of steady growth. Demand is being driven by the strict regulatory requirements of the FDA and EMA, which require devices to be tested thoroughly to ensure that they meet safety standards. Moreover, the increasing complexity of medical devices, especially in the field of wearables and implantables, is driving the need for increasingly sophisticated testing to verify performance and reliability. TÜV SÜD and Intertek are currently the leading companies in this field, offering a comprehensive range of testing solutions. Biocompatibility testing, electrical safety testing and software testing are the most important applications in regions where the regulatory framework is well established, such as North America and Europe. The trend towards telehealth and remote monitoring devices, which was further fuelled by the pandemic of CovId-X9, is also driving growth in this field. Artificial intelligence and machine learning are also influencing the development of testing procedures, enabling the testing process to be performed more quickly and accurately.

Future Outlook

The Medical Device Testing Services Market is set to grow at a robust CAGR of 9.3 per cent from 2025 to 2034. The escalating complexity of medical devices, which require rigorous testing to ensure safety and efficacy, will fuel this growth. The regulatory authorities in the world, such as the Food and Drug Administration and the European Medicines Agency, are expected to further tighten their compliance standards, thus driving up the demand for comprehensive testing services. By 2034, it is expected that over 70 per cent of medical device manufacturers will be using third-party testing services to meet regulatory requirements, a rise from an estimated 50 per cent in 2025. Furthermore, technological advancements, especially in the fields of biocompatibility testing, software validation, and cyber security testing, will further shape the landscape of the medical device testing services market. Artificial intelligence and machine learning in the testing procedures will improve their efficiency and accuracy, thus enabling the devices to reach the market more quickly. The growing demand for digitized health devices, and the rise of the Internet of Things, will create new testing requirements, which will necessitate specialized testing services. The market players will have to remain agile to take advantage of the expanding opportunities in this rapidly evolving market.

Leave a Comment