Global Energy Transition

The Global Main Automation Contractor MAC in the Oil and Gas Market Industry is also shaped by the ongoing energy transition towards more sustainable practices. As the world shifts towards renewable energy sources, oil and gas companies are increasingly adopting automation technologies to enhance efficiency and reduce carbon footprints. This transition necessitates the integration of advanced automation systems to optimize resource management and minimize environmental impact. The projected CAGR of 2.83% from 2025 to 2035 suggests that the MAC sector will play a crucial role in facilitating this transition while maintaining operational effectiveness.

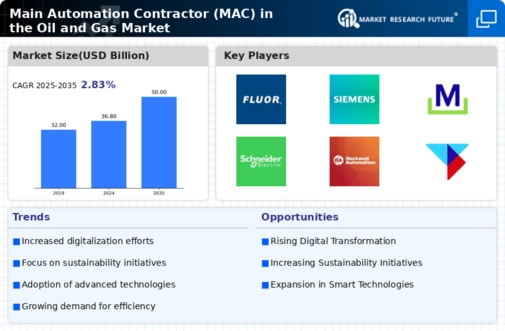

Market Growth Projections

The Global Main Automation Contractor MAC in the Oil and Gas Market Industry is projected to experience substantial growth, with estimates indicating a market value of 36.8 USD Billion in 2024 and a potential increase to 50 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate CAGR of 2.83% from 2025 to 2035. Such projections highlight the increasing reliance on automation solutions within the oil and gas sector, driven by the need for efficiency, safety, and compliance.

Technological Advancements

The Global Main Automation Contractor MAC in the Oil and Gas Market Industry is experiencing a surge in technological advancements that enhance operational efficiency. Innovations such as artificial intelligence, machine learning, and advanced data analytics are being integrated into automation systems. These technologies facilitate predictive maintenance, reducing downtime and operational costs. As a result, companies are likely to invest more in automation solutions, contributing to the market's growth. The industry's projected value of 36.8 USD Billion in 2024 underscores the importance of these advancements in driving demand for MAC services.

Regulatory Compliance and Safety Standards

The Global Main Automation Contractor MAC in the Oil and Gas Market Industry is heavily influenced by stringent regulatory compliance and safety standards. Governments worldwide are enforcing regulations that mandate the implementation of advanced automation systems to ensure safety and environmental protection. This regulatory landscape compels companies to invest in MAC services to meet compliance requirements. As the industry evolves, the need for sophisticated automation solutions to adhere to these regulations is expected to drive market growth, reinforcing the importance of MAC in maintaining safety and compliance.

Increasing Demand for Operational Efficiency

In the Global Main Automation Contractor MAC in the Oil and Gas Market Industry, the relentless pursuit of operational efficiency is a primary driver. Companies are increasingly adopting automation solutions to streamline processes, reduce human error, and enhance productivity. This trend is particularly evident in upstream operations, where automation can significantly lower costs and improve safety. The anticipated growth to 50 USD Billion by 2035 indicates that the demand for MAC services will likely rise as companies seek to optimize their operations through automation.

Market Consolidation and Strategic Partnerships

In the Global Main Automation Contractor MAC in the Oil and Gas Market Industry, market consolidation and strategic partnerships are emerging as significant drivers. As companies seek to enhance their competitive edge, mergers and acquisitions are becoming more prevalent. These consolidations enable firms to pool resources, share technology, and expand their service offerings. Strategic partnerships with technology providers also facilitate the development of innovative automation solutions tailored to industry needs. This trend is likely to foster a more robust MAC landscape, contributing to the overall growth of the market.