-

Bargaining Power of Suppliers

-

Bargaining Power of Buyers

-

Threat of New Entrants

-

Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

Handheld Equipment

-

Power Tools

-

Riding Equipment

-

Walk-Behind Equipment

-

Lawn Mowers

-

Trimmers and Edgers

-

Chainsaws

-

Blowers and Vacuums

-

Tillers

-

MARKET, BY POWER SOURCE (USD BILLION)

-

Electric

-

Gasoline

-

Battery Operated

-

Residential

-

Commercial

-

Public Sector

-

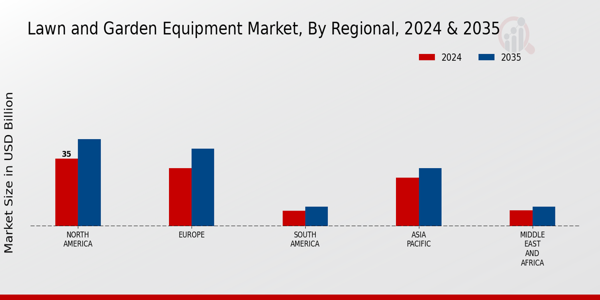

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

Overview

-

Competitive Analysis

-

Market share Analysis

-

Major Growth Strategy in the Lawn

-

and Garden Equipment Market

-

Competitive Benchmarking

-

Leading

-

Players in Terms of Number of Developments in the Lawn and Garden Equipment Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

Toro Company

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Stihl AG

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Black & Decker

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ryobi

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Snapper

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Masport

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Echo

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

John Deere

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Husqvarna

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Stanley Black & Decker

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Briggs & Stratton

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Craftsman

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Landscapers Supply

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ariens Company

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Kubota Corporation

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

References

-

Related Reports

-

AMERICA LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY TYPE

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE

-

2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) EUROPE LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) GERMANY LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) BY END USE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) TYPE, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) POWER SOURCE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) FRANCE LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) BY END USE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) BY TYPE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) BY POWER SOURCE, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) BY REGIONAL, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS)

-

CATEGORY, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) BY END USE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) BY TYPE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) BY POWER SOURCE, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) BY REGIONAL, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) EUROPE LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) FORECAST, BY END USE, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) BY TYPE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) BY POWER SOURCE, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) BY REGIONAL, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS)

-

CATEGORY, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) BY END USE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) BY TYPE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) BY POWER SOURCE, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) BY REGIONAL, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) KOREA LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

BY REGIONAL, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS)

-

EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS)

-

END USE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) BY TYPE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS)

-

BY POWER SOURCE, 2019-2035 (USD BILLIONS) GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS)

-

BY POWER SOURCE, 2019-2035 (USD BILLIONS) GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) BRAZIL LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) MEXICO LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) BY END USE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) BY TYPE, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) REST OF SOUTH AMERICA LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) MARKET SIZE ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS) & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) AMERICA LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL

-

2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) LAWN AND GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY

-

2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS)

-

USE, 2019-2035 (USD BILLIONS) SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

BY TYPE, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS)

-

BY END USE, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS)

-

BY END USE, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) FORECAST, BY TYPE, 2019-2035 (USD BILLIONS) GARDEN EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY EQUIPMENT CATEGORY, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY POWER SOURCE, 2019-2035 (USD BILLIONS)

-

BY END USE, 2019-2035 (USD BILLIONS) EQUIPMENT MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) LIST OF FIGURES AND GARDEN EQUIPMENT MARKET ANALYSIS MARKET ANALYSIS BY TYPE BY EQUIPMENT CATEGORY BY POWER SOURCE END USE

-

CANADA LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY REGIONAL LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS EQUIPMENT MARKET ANALYSIS BY TYPE MARKET ANALYSIS BY EQUIPMENT CATEGORY MARKET ANALYSIS BY POWER SOURCE MARKET ANALYSIS BY END USE ANALYSIS BY REGIONAL BY TYPE CATEGORY SOURCE

-

LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY EQUIPMENT CATEGORY FRANCE LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY POWER SOURCE FRANCE LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY END USE LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY REGIONAL AND GARDEN EQUIPMENT MARKET ANALYSIS BY TYPE EQUIPMENT MARKET ANALYSIS BY EQUIPMENT CATEGORY GARDEN EQUIPMENT MARKET ANALYSIS BY POWER SOURCE GARDEN EQUIPMENT MARKET ANALYSIS BY END USE EQUIPMENT MARKET ANALYSIS BY REGIONAL MARKET ANALYSIS BY TYPE ANALYSIS BY EQUIPMENT CATEGORY MARKET ANALYSIS BY POWER SOURCE MARKET ANALYSIS BY END USE ANALYSIS BY REGIONAL BY TYPE CATEGORY SOURCE CATEGORY BY POWER SOURCE ANALYSIS BY END USE ANALYSIS BY REGIONAL

-

CHINA LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY REGIONAL LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY TYPE GARDEN EQUIPMENT MARKET ANALYSIS BY EQUIPMENT CATEGORY AND GARDEN EQUIPMENT MARKET ANALYSIS BY POWER SOURCE AND GARDEN EQUIPMENT MARKET ANALYSIS BY END USE GARDEN EQUIPMENT MARKET ANALYSIS BY REGIONAL EQUIPMENT MARKET ANALYSIS BY TYPE MARKET ANALYSIS BY EQUIPMENT CATEGORY MARKET ANALYSIS BY POWER SOURCE MARKET ANALYSIS BY END USE ANALYSIS BY REGIONAL ANALYSIS BY TYPE BY EQUIPMENT CATEGORY ANALYSIS BY POWER SOURCE MARKET ANALYSIS BY END USE MARKET ANALYSIS BY REGIONAL MARKET ANALYSIS BY TYPE ANALYSIS BY EQUIPMENT CATEGORY MARKET ANALYSIS BY POWER SOURCE MARKET ANALYSIS BY END USE ANALYSIS BY REGIONAL ANALYSIS BY TYPE BY EQUIPMENT CATEGORY ANALYSIS BY POWER SOURCE ANALYSIS BY END USE BY REGIONAL BY TYPE EQUIPMENT CATEGORY BY POWER SOURCE BY END USE BY REGIONAL BY TYPE BY EQUIPMENT CATEGORY ANALYSIS BY POWER SOURCE MARKET ANALYSIS BY END USE MARKET ANALYSIS BY REGIONAL MARKET ANALYSIS BY TYPE CATEGORY SOURCE USE

-

MEXICO LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY REGIONAL LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY TYPE AND GARDEN EQUIPMENT MARKET ANALYSIS BY EQUIPMENT CATEGORY LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY POWER SOURCE LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY END USE LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY REGIONAL SOUTH AMERICA LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY TYPE REST OF SOUTH AMERICA LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY EQUIPMENT CATEGORY BY POWER SOURCE MARKET ANALYSIS BY END USE EQUIPMENT MARKET ANALYSIS BY REGIONAL MARKET ANALYSIS ANALYSIS BY TYPE ANALYSIS BY EQUIPMENT CATEGORY MARKET ANALYSIS BY POWER SOURCE EQUIPMENT MARKET ANALYSIS BY END USE EQUIPMENT MARKET ANALYSIS BY REGIONAL EQUIPMENT MARKET ANALYSIS BY TYPE EQUIPMENT MARKET ANALYSIS BY EQUIPMENT CATEGORY AND GARDEN EQUIPMENT MARKET ANALYSIS BY POWER SOURCE LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY END USE LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY REGIONAL MEA LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY TYPE MEA LAWN AND GARDEN EQUIPMENT MARKET ANALYSIS BY EQUIPMENT CATEGORY

-

AND GARDEN EQUIPMENT MARKET, BY TYPE, 2025 (% SHARE) GARDEN EQUIPMENT MARKET, BY TYPE, 2019 TO 2035 (USD Billions) LAWN AND GARDEN EQUIPMENT MARKET, BY EQUIPMENT CATEGORY, 2025 (% SHARE)

-

TO 2035 (USD Billions)

-

USE, 2025 (% SHARE)

-

2019 TO 2035 (USD Billions)

-

BY REGIONAL, 2025 (% SHARE) BY REGIONAL, 2019 TO 2035 (USD Billions) COMPETITORS

Leave a Comment