Label Adhesives Size

Label Adhesives Market Growth Projections and Opportunities

The Market of Labeling Adhesives is determined by the set of market forces which evolve the market landscape and course of its growth. Another contributing factor is the boom in the packing industry. Industries become more and more productive and therefore it is crucially important to develop technologies giving a possibility to do labeling accurately and without mistakes. The adhesive labels do what is necessary for ensuring the labels permanently attach to different surfaces, withstand the elements and stay in place with the information they carry intact. The search for innovation and sustainability in packaging industry continues and this prompts development of label adhesives, that can be applied to different packaging materials and environment conservation is supported.

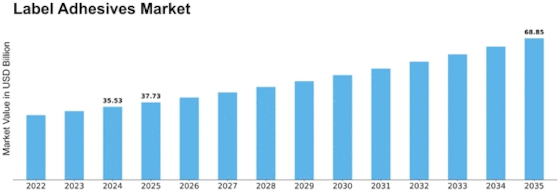

The Label Adhesives market was pegged at USD 31.5 billion for the year 2022. It is anticipated that the market of Label Adhesives will increase from USD 33.453 billion in 2023 to USD 54.12914965 billion by 2032 with a compound annual growth rate (CAGR) equal to 6.20%.

Another prominent market driver of adhesive technology is the ever-evolving of the adhesive formulation. Manufacturers are moving to the R&D wing to produce label adhesives with better performance properties. These involve advanced adhesives which offer superior adherence on difficult surfaces, and enhanced moisture and chemical resistance, and increased longevity. Thus low-migration adhesive appears to be emerging as an alternative option, gaining particularly in the food and pharmaceutical sectors where regulations demand adhesives that do not compromise product safety.

Alongside economic global trends, consumer nice also has a big part to play in defining the Label Adhesives Market. On the heels of the economic fluctuations the demand for labeled products may rise and fall in one industry or another. Consumers prefer attractive and informative labels, and this generates need for innovative labels which can endure visual and touch requirements of the market. Moreover, the popularity of ecommerce has resulted in expanded demand for labels that include the ability to withstand the travel and handling issues of shipping and distribution, thereby modifying the market dynamics.

Regulatory compliance is another determinative factor in the market that influences the trends in label adhesives. The pharmaceutical and chemical sector have become particularly stringent in terms of labeling rules to validate the product’s safety and information correctness. Regulatory authorities have prompted Label Adhesives Market to develop adhesives that meet with international rules and regulations. Producers are getting more and more involved in producing glue products that are becoming regulator friendly and at the same time maintain their performance abilities.

Leave a Comment