Market Analysis

In-depth Analysis of IOT Node Gateway Market Industry Landscape

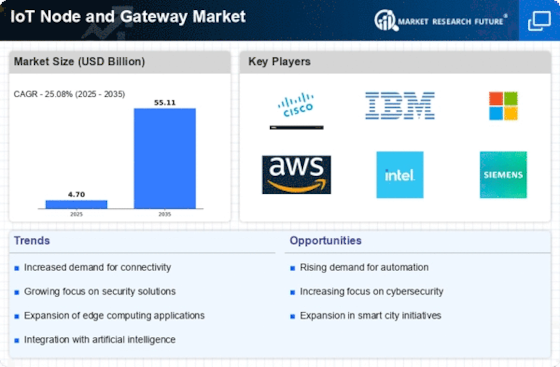

The Internet of Things (IoT) Node and Gateway market exhibits a complex interplay of market dynamics that significantly influence its trajectory. One key dynamic is the continuous expansion of the IoT ecosystem across various industries. As businesses increasingly recognize the potential of IoT technologies to enhance operational efficiency and gather valuable insights, the demand for IoT nodes and gateways experiences a consistent upswing. This expansion is driven by the integration of smart devices in diverse sectors, ranging from healthcare and manufacturing to agriculture and smart cities.

Technological advancements play a pivotal role in shaping the market dynamics of IoT nodes and gateways. The evolution of edge computing, improved connectivity options, and enhanced security features continually redefine the capabilities of these devices. Companies that stay at the forefront of technological innovation are better positioned to meet the evolving needs of customers, driving market growth. The dynamics of technological advancements also foster competition, as companies strive to outpace each other in offering more sophisticated and efficient solutions.

Interoperability is a critical dynamic influencing the IoT Node and Gateway market. The seamless communication and integration of diverse IoT devices require nodes and gateways to be interoperable. As the number of connected devices from different manufacturers increases, the market dynamics push towards standardization and compatibility. Interoperability ensures that devices can work cohesively within an IoT ecosystem, promoting a more integrated and collaborative network of connected devices.

Security concerns are another significant dynamic shaping the market landscape. With the escalating volume of data generated by IoT devices, the need for robust security measures intensifies. The market dynamics reflect a growing emphasis on implementing secure IoT solutions, with nodes and gateways at the forefront of ensuring data integrity and confidentiality. Companies that prioritize and address security concerns effectively are likely to gain a competitive advantage in the market.

Market regulations and standards act as a guiding force in the IoT Node and Gateway market dynamics. Governments and industry bodies play a crucial role in establishing guidelines to ensure the reliability, interoperability, and security of IoT devices. Compliance with these regulations becomes a key consideration for businesses, shaping their product development and market strategies. The dynamics of regulatory compliance influence the market by creating a level playing field and fostering consumer trust in IoT solutions.

The role of data analytics is a dynamic force that significantly impacts the IoT Node and Gateway market. As the volume of data generated by IoT devices increases, the ability to analyze and derive actionable insights becomes paramount. Companies that offer nodes and gateways with advanced analytics capabilities gain a competitive edge. The dynamics of data analytics influence the market by driving the demand for devices that not only facilitate data exchange but also contribute to informed decision-making through comprehensive data analysis.

Moreover, the cost dynamics of IoT nodes and gateways are instrumental in market growth. The economies of scale, technological advancements, and competitive pressures contribute to the gradual reduction in the cost of these devices. This cost dynamics opens up opportunities for a wider range of businesses to adopt IoT solutions, fostering market expansion. Affordable pricing structures become a catalyst for increased adoption and market penetration, especially in sectors where cost considerations play a significant role.

Leave a Comment