Insulin Delivery Devices Market Share

Insulin Delivery Devices Market Research Report By Device Type (Insulin Syringes, Insulin Pens, Insulin Pumps, Smart Insulin Devices), By End User (Hospitals, Home Care Settings, Diabetes Clinics), By Product Type (Analogue Insulin Delivery Devices, Pen-Needle Systems, Continuous Glucose Monitoring Systems), By Mode of Delivery (Subcutaneous Injection, Intravenous Injection, Inhaled Insulin) an...

Market Summary

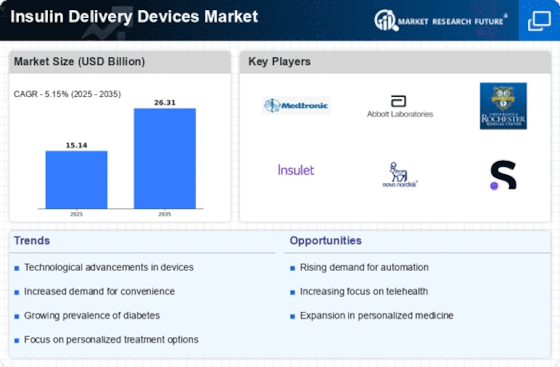

As per Market Research Future Analysis, the Insulin Delivery Devices Market was valued at 13.69 USD Billion in 2023 and is projected to grow to 25 USD Billion by 2035, with a CAGR of 5.15% from 2025 to 2035. The market is driven by the rising prevalence of diabetes, technological advancements, and increasing investments in diabetes management programs.

Key Market Trends & Highlights

The Insulin Delivery Devices Market is witnessing significant growth due to various factors.

- The number of adults living with diabetes is expected to rise from 537 million in 2021 to 783 million by 2045.

- Insulin Syringes market is projected to grow from 4.5 USD Billion in 2024 to 7.9 USD Billion by 2035.

- Insulin Pens are anticipated to increase from 5.0 USD Billion in 2024 to 8.5 USD Billion by 2035.

- North America is expected to hold a market share of 6.0 USD Billion in 2024, rising to 10.5 USD Billion by 2035.

Market Size & Forecast

| 2023 Market Size | USD 13.69 Billion |

| 2024 Market Size | USD 14.4 Billion |

| 2035 Market Size | USD 25 Billion |

| CAGR (2025-2035) | 5.15% |

| Largest Regional Market Share in 2024 | North America |

Major Players

Insulet, Roche, Novo Nordisk, Ypsomed, Johnson and Johnson, Eli Lilly, Abbott, Parker Hannifin, TraceLink, Tandem Diabetes Care, Medtronic, Becton Dickinson, Valeritas, Sanofi

Market Trends

The Global Insulin Delivery Devices Market is experiencing substantial growth as a result of the global rise in diabetes prevalence. The increasing number of patients requiring insulin therapy is a significant market driver, as governments and health organizations underscore the significance of effectively managing diabetes. Furthermore, the convenience and precision of diabetes management are being improved by technological advancements, including the creation of wearable insulin pumps and smart insulin devices.

These advancements address the increasing demand for more user-friendly devices by providing real-time data monitoring and insulin delivery. There has been a recent trend toward the development of more personalized diabetes management solutions. The integration of insulin delivery devices with digital health technologies is a significant opportunity that warrants further investigation. For example, patients can enhance their compliance with treatment regimens by monitoring their blood glucose levels and insulin usage through mobile applications that are integrated with devices.

This emphasis on personalized medicine is consistent with a more general trend of patient-centered care in healthcare systems worldwide, as governments strive to enhance health outcomes for their populations. Additionally, the market dynamics are influenced by the proliferation of insulin options and the emergence of biosimilars, which have the potential to reduce costs and increase the accessibility of insulin delivery devices for patients.There is potential for growth in regions that are presently underserved due to the varying healthcare policies and advancements in emerging markets.

In general, the future of the Global Insulin Delivery Devices Market is significantly influenced by technological advancements, the demand for personalized therapies, and regional healthcare initiatives.

The increasing prevalence of diabetes globally necessitates advancements in insulin delivery technologies, which are evolving to enhance patient adherence and improve glycemic control.

U.S. Department of Health and Human Services

Insulin Delivery Devices Market Market Drivers

Aging Population

The aging population is a crucial factor driving the Global Insulin Delivery Devices Market Industry. As individuals age, the risk of developing diabetes increases, leading to a higher demand for insulin management solutions. The World Health Organization indicates that the global population aged 60 years and older is expected to reach 2.1 billion by 2050. This demographic shift necessitates the development and distribution of effective insulin delivery devices tailored to the needs of older adults. Consequently, the market is poised for growth, reflecting the increasing requirement for innovative solutions to manage diabetes in an aging society.

Market Growth Projections

The Global Insulin Delivery Devices Market Industry is projected to experience robust growth over the next decade. With a market value of 14.4 USD Billion in 2024, it is expected to reach 25 USD Billion by 2035, indicating a significant expansion. The anticipated compound annual growth rate of 5.14% from 2025 to 2035 highlights the increasing demand for insulin delivery solutions. This growth is driven by various factors, including technological advancements, rising diabetes prevalence, and supportive government initiatives. As the market evolves, it is likely to witness the introduction of innovative products that cater to the diverse needs of patients.

Rising Prevalence of Diabetes

The increasing incidence of diabetes globally serves as a primary driver for the Global Insulin Delivery Devices Market Industry. As of 2024, the number of individuals diagnosed with diabetes is projected to reach approximately 537 million, a figure that is expected to rise significantly in the coming years. This surge in diabetes cases necessitates effective insulin management solutions, thereby propelling the demand for advanced insulin delivery devices. The market is anticipated to grow from 14.4 USD Billion in 2024 to an estimated 25 USD Billion by 2035, reflecting a growing need for innovative delivery systems to manage this chronic condition.

Increased Awareness and Education

Growing awareness regarding diabetes management and the importance of insulin therapy is driving the Global Insulin Delivery Devices Market Industry. Educational initiatives by healthcare organizations and government bodies aim to inform patients about the benefits of using modern insulin delivery devices. This heightened awareness is likely to lead to increased adoption rates among patients, particularly in developing regions where diabetes prevalence is rising. As patients become more informed about their treatment options, the demand for user-friendly and efficient insulin delivery devices is expected to grow, further supporting market expansion.

Government Initiatives and Support

Government initiatives aimed at improving diabetes care significantly influence the Global Insulin Delivery Devices Market Industry. Various countries are implementing policies to enhance access to diabetes management tools, including insulin delivery devices. For example, subsidies and reimbursement programs for insulin pumps and continuous glucose monitoring systems are becoming more common. Such support not only alleviates the financial burden on patients but also encourages the adoption of advanced technologies. As a result, the market is likely to experience substantial growth, aligning with the projected increase in market value from 14.4 USD Billion in 2024 to 25 USD Billion by 2035.

Technological Advancements in Delivery Devices

Technological innovations in insulin delivery devices are transforming the Global Insulin Delivery Devices Market Industry. The introduction of smart insulin pens, continuous glucose monitors, and insulin pumps equipped with advanced algorithms enhances the precision of insulin delivery. These devices not only improve patient adherence but also facilitate better glycemic control. For instance, the integration of mobile applications with insulin delivery systems allows for real-time monitoring and data sharing with healthcare providers. Such advancements are likely to attract more users, contributing to the projected compound annual growth rate of 5.14% from 2025 to 2035.

Market Segment Insights

Insulin Delivery Devices Market Device Type Insights

The Global Insulin Delivery Devices Market is experiencing notable growth, particularly within the Device Type segment that encompasses various delivery mechanisms such as Insulin Syringes, Insulin Pens, Insulin Pumps, and Smart Insulin Devices. In 2024, the market for Insulin Syringes is projected to be valued at 4.5 USD Billion, increasing to 7.9 USD Billion by 2035, showcasing a robust demand strongly driven by their affordability and established usage among patients. Following closely, Insulin Pens are anticipated to be valued at 5.0 USD Billion in 2024 and reach 8.5 USD Billion by 2035.

These devices are gaining popularity due to their user-friendly design and convenience, which are critical factors for individuals managing diabetes. The Insulin Pumps segment holds a valuation of 3.5 USD Billion in 2024, with prospects of growing to 7.0 USD Billion in 2035, underlining the increasing adoption of advanced technologies in diabetes management, as these provide continuous insulin delivery, improving control over blood glucose levels.

Furthermore, Smart Insulin Devices, although currently valued at 1.4 USD Billion in 2024 and projected to rise to 1.6 USD Billion by 2035, represent a growing trend towards digital health solutions that enable users to monitor and adjust their insulin delivery more effectively through wireless connectivity and mobile applications.

The continual evolution and innovation within the Global Insulin Delivery Devices Market signify a shift towards more patient-centric approaches, effectively supporting diabetes management. As patient needs and preferences evolve, the Device Type segment stands out as a critical area of focus within the broader healthcare landscape, offering numerous opportunities for growth and development.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Insulin Delivery Devices Market End User Insights

The Global Insulin Delivery Devices Market is rapidly evolving, primarily driven by its diverse End-user segments, which include Hospitals, Home Care Settings, and Diabetes Clinics. As of 2024, the market is expected to be valued at 14.4 USD Billion, reflecting a significant shift towards more effective diabetes management solutions. Hospitals are crucial in this market as they provide advanced insulin delivery systems and specialized care, leading to improved patient outcomes. Meanwhile, Home Care Settings are becoming increasingly popular, offering convenience and self-management capabilities for patients, thus enhancing their quality of life.

Diabetes Clinics play an essential role as well, providing tailored treatment plans and education to patients, which fosters better disease management. The need for innovative devices that can improve usability and safety remains a significant driver, with opportunities arising from ongoing advancements in technology tailored for each end-user segment. Overall, the Global Insulin Delivery Devices Market showcases a multifaceted landscape that is continually adapting to meet the needs of diabetic patients across various settings.

Insulin Delivery Devices Market Product Type Insights

The Global Insulin Delivery Devices Market is evolving swiftly, demonstrating robust growth in its Product Type segment. By 2024, the market is projected to reach a valuation of 14.4 billion USD, highlighting the demand for effective insulin delivery solutions. Within this segment, Analogue Insulin Delivery Devices hold a notable position due to their ability to more closely mimic the body's natural insulin response, thereby enhancing patient compliance and management of diabetes. Pen-needle systems are another essential category, favored for their convenience and comfort, which encourages proper usage among patients.

Continuous Glucose Monitoring Systems have emerged as a game-changer, enabling real-time glucose tracking and better glycemic control, making them increasingly significant for diabetes management in the global landscape. Rising diabetes prevalence, technological advancements, and a growing emphasis on personalized healthcare solutions drive the market. Nevertheless, challenges such as high costs and regulatory hurdles persist. The ongoing developments and innovations in these product types underscore their pivotal role in shaping the future of the Global Insulin Delivery Devices Market, ultimately aiming to improve the quality of life for individuals living with diabetes.

Insulin Delivery Devices Market Mode of Delivery Insights

The Global Insulin Delivery Devices Market, particularly within the Mode of Delivery segment, encompasses various methods, including Subcutaneous Injection, Intravenous Injection, and Inhaled Insulin. As of 2024, the overall market is projected to be valued at 14.4 billion USD, reflecting the increasing prevalence of diabetes and the subsequent demand for effective insulin delivery methods. Subcutaneous Injection represents a widely adopted method due to its ease of use and patient-friendly approach, facilitating self-administration.

Intravenous Injection is critical in hospital settings for patients who require immediate and precise insulin delivery, thereby addressing acute medical needs.Inhaled Insulin, though a newer delivery method, is gaining traction as it offers a non-invasive alternative that may enhance compliance among patients who dislike needles.

The growing emphasis on patient-centric outcomes and convenient treatment options fuels the market growth for these delivery modes. However, challenges such as product insurance coverage, training for proper usage, and the need for more research on new delivery technologies remain prevalent. The ongoing expansion of technology and innovative design in insulin delivery devices opens significant opportunities in the Global Insulin Delivery Devices Market, supporting effective diabetes management globally.

Get more detailed insights about Insulin Delivery Devices Market Research Report-Forecast to 2035

Regional Insights

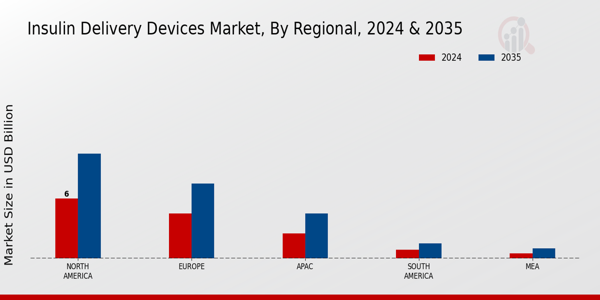

The Global Insulin Delivery Devices Market has shown substantial valuations across various regions, reflecting diverse market dynamics. In 2024, the North American region is expected to hold a significant market share valued at 6.0 USD Billion, and it is projected to rise to 10.5 USD Billion by 2035, primarily driven by advanced healthcare infrastructure and increased prevalence of diabetes. Europe follows closely with a valuation of 4.5 USD Billion in 2024, expanding to 7.5 USD Billion in 2035, fueled by growing awareness and adoption of insulin delivery technologies.

The APAC region's market value is 2.5 USD Billion in 2024, anticipated to reach 4.5 USD Billion by 2035, as regional healthcare improvements and rising disposable incomes enhance access to diabetes management solutions. In South America, the market is set at 0.9 USD Billion in 2024 and is estimated to grow to 1.5 USD Billion by 2035, reflecting a gradual increase in healthcare investment.

Meanwhile, the MEA region, valued at 0.5 USD Billion in 2024, is expected to double to 1.0 USD Billion by 2035, indicating a slow yet steady growth as healthcare infrastructures develop.Each region presents unique growth drivers, challenges, and opportunities, contributing to the overall Global Insulin Delivery Devices Market statistics as it adapts to the increasing global health needs associated with diabetes management.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Key Players and Competitive Insights

The Global Insulin Delivery Devices Market is characterized by a rapidly evolving landscape driven by technological advancements, increasing prevalence of diabetes, and rising awareness about diabetes management. Companies operating in this market are engaged in intense competition, focused on innovation and differentiation to capture market share. The overall aim is to enhance patient compliance, improve glycemic control, and ensure ease of use for consumers. The market harbors several key players, each contributing distinct features to its products while addressing the growing demands for efficiency, performance, and personalized healthcare solutions.

The competitive environment also emphasizes strategic partnerships, collaborations, and acquisitions among major firms to bolster their positions and expand their product portfolios.Insulet has established a substantial foothold in the Global Insulin Delivery Devices Market, primarily recognized for its innovative Omnipod system, which offers a tubeless insulin delivery solution. This unique approach simplifies the process of insulin administration, contributing to improved patient adherence and satisfaction.

The company's strengths lie in its advanced technology, commitment to research and development, and focus on user-centric design. Insulet has successfully leveraged partnerships with healthcare providers to enhance the accessibility of its devices, thereby increasing its market share. The strong brand loyalty and positive patient feedback further solidify Insulet's competitive position within the global landscape, enabling it to stand out among other insulin delivery device manufacturers.Roche, a significant player in the Global Insulin Delivery Devices Market, is well-known for its innovative diabetes management solutions, including insulin delivery devices integrated with extensive monitoring systems.

Roche's strengths are exemplified through its focus on comprehensive diabetes care that resonates with healthcare professionals and patients alike. The company offers a range of insulin delivery systems, such as pens and pumps, paired with precise monitoring solutions that facilitate better glycemic control. Roche has a broad market presence bolstered by strategic mergers and acquisitions that have enabled it to expand its product offerings and enhance its technological capabilities.

This commitment to innovation has allowed Roche to maintain a competitive edge, ensuring that it can cater to the diverse needs of diabetes patients while fostering long-term relationships within the healthcare ecosystem.

Key Companies in the Insulin Delivery Devices Market market include

Industry Developments

The Global Insulin Delivery Devices Market has seen significant developments recently, driven by innovations in technology and a growing demand for diabetes management solutions. In October 2023, Insulet Corporation announced the launch of its new Omnipod 5 insulin delivery system, designed to streamline insulin delivery for patients with Type 1 diabetes. Roche has also made strides with the expansion of its Accu-Chek product line, enhancing connectivity with digital health apps.

Novo Nordisk reported an increase in market valuation as their new insulin formulations gained market traction, positively impacting their overall financial performance. From a mergers and acquisitions perspective, Johnson and Johnson announced plans in September 2023 to acquire a technology firm specializing in digital therapy solutions, aiming to enhance diabetes care delivery.

Additionally, Eli Lilly secured a partnership with Tandem Diabetes Care earlier this year to integrate their insulin delivery systems with new monitoring technologies, which is expected to enhance patient adherence. Ypsomed has experienced substantial growth driven by rising demand in the Asia-Pacific region, contributing to the robust development in the global landscape. Overall, advancements in automation and connectivity in insulin delivery devices are transforming diabetes management worldwide.

Future Outlook

Insulin Delivery Devices Market Future Outlook

The Insulin Delivery Devices Market is projected to grow at a 5.14% CAGR from 2024 to 2035, driven by technological advancements, increasing diabetes prevalence, and rising patient awareness.

New opportunities lie in:

- Develop smart insulin pens integrated with mobile health applications.

- Invest in biodegradable insulin delivery devices to enhance sustainability.

- Expand telehealth services for remote monitoring and management of diabetes.

By 2035, the Insulin Delivery Devices Market is expected to achieve substantial growth, reflecting evolving patient needs and technological innovations.

Market Segmentation

Insulin Delivery Devices Market End User Outlook

- Hospitals

- Home Care Settings

- Diabetes Clinics

Insulin Delivery Devices Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Insulin Delivery Devices Market Device Type Outlook

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

Insulin Delivery Devices Market Product Type Outlook

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

Insulin Delivery Devices Market Mode of Delivery Outlook

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

Report Scope

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2023 | 13.69(USD Billion) |

| MARKET SIZE 2024 | 14.4(USD Billion) |

| MARKET SIZE 2035 | 25.0(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 5.15% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2023 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | Insulet, Roche, Novo Nordisk, Ypsomed, Johnson and Johnson, Eli Lilly, Abbott, Parker Hannifin, TraceLink, Tandem Diabetes Care, Medtronic, Becton Dickinson, Valeritas, Sanofi |

| SEGMENTS COVERED | Device Type, End User, Product Type, Mode of Delivery, Regional |

| KEY MARKET OPPORTUNITIES | Advancements in wearable technology, Increasing diabetes prevalence, Rising demand for non-invasive devices, Growth in telehealth services, Expansion in emerging markets |

| KEY MARKET DYNAMICS | growing diabetes prevalence, technological advancements, increasing healthcare expenditure, demand for personalized treatment, rising awareness of diabetes management |

| COUNTRIES COVERED | North America, Europe, APAC, South America, MEA |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the expected market size of the Global Insulin Delivery Devices Market in 2024?

The Global Insulin Delivery Devices Market is expected to be valued at 14.4 USD Billion in 2024.

What is the projected market size for the Global Insulin Delivery Devices Market by 2035?

By 2035, the market is projected to reach a value of 25.0 USD Billion.

What is the expected CAGR for the Global Insulin Delivery Devices Market between 2025 and 2035?

The expected CAGR for the market from 2025 to 2035 is 5.15%.

Which region is expected to dominate the Global Insulin Delivery Devices Market in 2024?

North America is expected to dominate the market with a value of 6.0 USD Billion in 2024.

What will be the market size of the Insulin Pens segment in 2035?

The Insulin Pens segment is projected to reach a market size of 8.5 USD Billion by 2035.

What is the anticipated market size for Insulin Pumps in 2024?

The market size for Insulin Pumps is anticipated to be 3.5 USD Billion in 2024.

Who are the key players in the Global Insulin Delivery Devices Market?

Major players in the market include Insulet, Roche, Novo Nordisk, and Medtronic.

What is the expected market size for the Smart Insulin Devices segment by 2035?

The Smart Insulin Devices segment is expected to be valued at 1.6 USD Billion in 2035.

What will be the market size for the APAC region by 2035?

The APAC region is projected to reach a market size of 4.5 USD Billion by 2035.

What is the value of the Insulin Syringes segment expected to be in 2024?

The Insulin Syringes segment is expected to be valued at 4.5 USD Billion in 2024.

-

Table of Contents

-

EXECUTIVE SUMMARY

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

MARKET INTRODUCTION

- Definition

-

Scope of the study

- Research Objective

- Assumption

- Limitations

-

RESEARCH METHODOLOGY

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

Insulin Delivery Devices Market, BY Device Type (USD Billion)

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

-

Insulin Delivery Devices Market, BY End User (USD Billion)

- Hospitals

- Home Care Settings

- Diabetes Clinics

-

Insulin Delivery Devices Market, BY Product Type (USD Billion)

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

-

Insulin Delivery Devices Market, BY Mode of Delivery (USD Billion)

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

-

Insulin Delivery Devices Market, BY Regional (USD Billion)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Insulin Delivery Devices Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Insulin Delivery Devices Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

Company Profiles

-

Insulet

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Roche

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Novo Nordisk

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ypsomed

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Johnson and Johnson

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Eli Lilly

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Abbott

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Parker Hannifin

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

TraceLink

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Tandem Diabetes Care

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Medtronic

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Becton Dickinson

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Valeritas

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Sanofi

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Insulet

-

Appendix

- References

- Related Reports

-

List of Tables and Figures

- LIST OF ASSUMPTIONS

- North America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- North America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- North America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- North America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- North America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- US Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- US Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- US Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- US Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- US Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Canada Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Canada Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Canada Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Canada Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Canada Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Europe Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Europe Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Europe Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Europe Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Europe Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Germany Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Germany Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Germany Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Germany Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Germany Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- UK Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- UK Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- UK Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- UK Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- UK Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- France Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- France Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- France Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- France Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- France Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Russia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Russia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Russia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Russia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Russia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Italy Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Italy Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Italy Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Italy Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Italy Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Spain Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Spain Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Spain Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Spain Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Spain Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Rest of Europe Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Rest of Europe Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Rest of Europe Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Rest of Europe Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Rest of Europe Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- APAC Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- APAC Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- APAC Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- APAC Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- APAC Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- China Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- China Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- China Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- China Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- China Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- India Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- India Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- India Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- India Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- India Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Japan Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Japan Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Japan Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Japan Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Japan Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- South Korea Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- South Korea Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- South Korea Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- South Korea Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- South Korea Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Malaysia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Malaysia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Malaysia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Malaysia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Malaysia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Thailand Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Thailand Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Thailand Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Thailand Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Thailand Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Indonesia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Indonesia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Indonesia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Indonesia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Indonesia Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Rest of APAC Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Rest of APAC Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Rest of APAC Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Rest of APAC Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Rest of APAC Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- South America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- South America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- South America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- South America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- South America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Brazil Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Brazil Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Brazil Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Brazil Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Brazil Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Mexico Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Mexico Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Mexico Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Mexico Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Mexico Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Argentina Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Argentina Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Argentina Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Argentina Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Argentina Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Rest of South America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Rest of South America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Rest of South America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Rest of South America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Rest of South America Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- MEA Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- MEA Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- MEA Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- MEA Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- MEA Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- GCC Countries Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- GCC Countries Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- GCC Countries Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- GCC Countries Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- GCC Countries Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- South Africa Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- South Africa Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- South Africa Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- South Africa Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- South Africa Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- Rest of MEA Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY DEVICE TYPE, 2019-2035 (USD Billions)

- Rest of MEA Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)

- Rest of MEA Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)

- Rest of MEA Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY MODE OF DELIVERY, 2019-2035 (USD Billions)

- Rest of MEA Insulin Delivery Devices Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

- PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- ACQUISITION/PARTNERSHIP

- MARKET SYNOPSIS

- NORTH AMERICA INSULIN DELIVERY DEVICES MARKET ANALYSIS

- US INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- US INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- US INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- US INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- US INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- CANADA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- CANADA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- CANADA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- CANADA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- CANADA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- EUROPE INSULIN DELIVERY DEVICES MARKET ANALYSIS

- GERMANY INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- GERMANY INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- GERMANY INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- GERMANY INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- GERMANY INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- UK INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- UK INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- UK INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- UK INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- UK INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- FRANCE INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- FRANCE INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- FRANCE INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FRANCE INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- FRANCE INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- RUSSIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- RUSSIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- RUSSIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- RUSSIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- RUSSIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- ITALY INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- ITALY INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- ITALY INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- ITALY INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- ITALY INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- SPAIN INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- SPAIN INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- SPAIN INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- SPAIN INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- SPAIN INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- REST OF EUROPE INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- REST OF EUROPE INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- REST OF EUROPE INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- REST OF EUROPE INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- REST OF EUROPE INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- APAC INSULIN DELIVERY DEVICES MARKET ANALYSIS

- CHINA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- CHINA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- CHINA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- CHINA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- CHINA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- INDIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- INDIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- INDIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- INDIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- INDIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- JAPAN INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- JAPAN INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- JAPAN INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- JAPAN INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- JAPAN INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- SOUTH KOREA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- SOUTH KOREA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- SOUTH KOREA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- SOUTH KOREA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- SOUTH KOREA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- MALAYSIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- MALAYSIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- MALAYSIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- MALAYSIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- MALAYSIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- THAILAND INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- THAILAND INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- THAILAND INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- THAILAND INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- THAILAND INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- INDONESIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- INDONESIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- INDONESIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- INDONESIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- INDONESIA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- REST OF APAC INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- REST OF APAC INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- REST OF APAC INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- REST OF APAC INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- REST OF APAC INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- SOUTH AMERICA INSULIN DELIVERY DEVICES MARKET ANALYSIS

- BRAZIL INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- BRAZIL INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- BRAZIL INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- BRAZIL INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- BRAZIL INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- MEXICO INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- MEXICO INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- MEXICO INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- MEXICO INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- MEXICO INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- ARGENTINA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- ARGENTINA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- ARGENTINA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- ARGENTINA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- ARGENTINA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- REST OF SOUTH AMERICA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- REST OF SOUTH AMERICA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- REST OF SOUTH AMERICA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- REST OF SOUTH AMERICA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- REST OF SOUTH AMERICA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- MEA INSULIN DELIVERY DEVICES MARKET ANALYSIS

- GCC COUNTRIES INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- GCC COUNTRIES INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- GCC COUNTRIES INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- GCC COUNTRIES INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- GCC COUNTRIES INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- SOUTH AFRICA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- SOUTH AFRICA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- SOUTH AFRICA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- SOUTH AFRICA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- SOUTH AFRICA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- REST OF MEA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY DEVICE TYPE

- REST OF MEA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY END USER

- REST OF MEA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- REST OF MEA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY MODE OF DELIVERY

- REST OF MEA INSULIN DELIVERY DEVICES MARKET ANALYSIS BY REGIONAL

- KEY BUYING CRITERIA OF INSULIN DELIVERY DEVICES MARKET

- RESEARCH PROCESS OF MRFR

- DRO ANALYSIS OF INSULIN DELIVERY DEVICES MARKET

- DRIVERS IMPACT ANALYSIS: INSULIN DELIVERY DEVICES MARKET

- RESTRAINTS IMPACT ANALYSIS: INSULIN DELIVERY DEVICES MARKET

- SUPPLY / VALUE CHAIN: INSULIN DELIVERY DEVICES MARKET

- INSULIN DELIVERY DEVICES MARKET, BY DEVICE TYPE, 2025 (% SHARE)

- INSULIN DELIVERY DEVICES MARKET, BY DEVICE TYPE, 2019 TO 2035 (USD Billions)

- INSULIN DELIVERY DEVICES MARKET, BY END USER, 2025 (% SHARE)

- INSULIN DELIVERY DEVICES MARKET, BY END USER, 2019 TO 2035 (USD Billions)

- INSULIN DELIVERY DEVICES MARKET, BY PRODUCT TYPE, 2025 (% SHARE)

- INSULIN DELIVERY DEVICES MARKET, BY PRODUCT TYPE, 2019 TO 2035 (USD Billions)

- INSULIN DELIVERY DEVICES MARKET, BY MODE OF DELIVERY, 2025 (% SHARE)

- INSULIN DELIVERY DEVICES MARKET, BY MODE OF DELIVERY, 2019 TO 2035 (USD Billions)

- INSULIN DELIVERY DEVICES MARKET, BY REGIONAL, 2025 (% SHARE)

- INSULIN DELIVERY DEVICES MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions)

- BENCHMARKING OF MAJOR COMPETITORS

Insulin Delivery Devices Market Segmentation

Insulin Delivery Devices Market By Device Type (USD Billion, 2019-2035)

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

Insulin Delivery Devices Market By End User (USD Billion, 2019-2035)

- Hospitals

- Home Care Settings

- Diabetes Clinics

Insulin Delivery Devices Market By Product Type (USD Billion, 2019-2035)

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring System

Insulin Delivery Devices Market By Mode of Delivery (USD Billion, 2019-2035)

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

Insulin Delivery Devices Market By Regional (USD Billion, 2019-2035)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Insulin Delivery Devices Market Regional Outlook (USD Billion, 2019-2035)

North America Outlook (USD Billion, 2019-2035)

North America Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

North America Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

North America Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

North America Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

North America Insulin Delivery Devices Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2035)

US Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

US Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

US Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

US Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- CANADA Outlook (USD Billion, 2019-2035)

CANADA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

CANADA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

CANADA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

CANADA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

Europe Outlook (USD Billion, 2019-2035)

Europe Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

Europe Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

Europe Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

Europe Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

Europe Insulin Delivery Devices Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2035)

GERMANY Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

GERMANY Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

GERMANY Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

GERMANY Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- UK Outlook (USD Billion, 2019-2035)

UK Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

UK Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

UK Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

UK Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- FRANCE Outlook (USD Billion, 2019-2035)

FRANCE Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

FRANCE Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

FRANCE Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

FRANCE Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

RUSSIA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

RUSSIA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

RUSSIA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- ITALY Outlook (USD Billion, 2019-2035)

ITALY Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

ITALY Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

ITALY Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

ITALY Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- SPAIN Outlook (USD Billion, 2019-2035)

SPAIN Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

SPAIN Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

SPAIN Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

SPAIN Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

REST OF EUROPE Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

REST OF EUROPE Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

REST OF EUROPE Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

APAC Outlook (USD Billion, 2019-2035)

APAC Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

APAC Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

APAC Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

APAC Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

APAC Insulin Delivery Devices Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2035)

CHINA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

CHINA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

CHINA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

CHINA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- INDIA Outlook (USD Billion, 2019-2035)

INDIA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

INDIA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

INDIA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

INDIA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- JAPAN Outlook (USD Billion, 2019-2035)

JAPAN Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

JAPAN Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

JAPAN Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

JAPAN Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

SOUTH KOREA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

SOUTH KOREA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

SOUTH KOREA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

MALAYSIA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

MALAYSIA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

MALAYSIA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- THAILAND Outlook (USD Billion, 2019-2035)

THAILAND Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

THAILAND Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

THAILAND Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

THAILAND Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

INDONESIA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

INDONESIA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

INDONESIA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

REST OF APAC Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

REST OF APAC Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

REST OF APAC Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

South America Outlook (USD Billion, 2019-2035)

South America Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

South America Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

South America Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

South America Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

South America Insulin Delivery Devices Market by Regional Type

- Brazil

- Mexico

- Argentina

- Rest of South America

- BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

BRAZIL Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

BRAZIL Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

BRAZIL Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- MEXICO Outlook (USD Billion, 2019-2035)

MEXICO Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

MEXICO Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

MEXICO Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

MEXICO Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

ARGENTINA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

ARGENTINA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

ARGENTINA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

REST OF SOUTH AMERICA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

REST OF SOUTH AMERICA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

REST OF SOUTH AMERICA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

MEA Outlook (USD Billion, 2019-2035)

MEA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

MEA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

MEA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

MEA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

MEA Insulin Delivery Devices Market by Regional Type

- GCC Countries

- South Africa

- Rest of MEA

- GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

GCC COUNTRIES Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

GCC COUNTRIES Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

GCC COUNTRIES Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- SOUTH AFRICA Outlook (USD Billion, 2019-2035)

SOUTH AFRICA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

SOUTH AFRICA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

SOUTH AFRICA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

SOUTH AFRICA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

- REST OF MEA Outlook (USD Billion, 2019-2035)

REST OF MEA Insulin Delivery Devices Market by Device Type

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Smart Insulin Devices

REST OF MEA Insulin Delivery Devices Market by End User Type

- Hospitals

- Home Care Settings

- Diabetes Clinics

REST OF MEA Insulin Delivery Devices Market by Product Type

- Analogue Insulin Delivery Devices

- Pen-Needle Systems

- Continuous Glucose Monitoring Systems

REST OF MEA Insulin Delivery Devices Market by Mode of Delivery Type

- Subcutaneous Injection

- Intravenous Injection

- Inhaled Insulin

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment