Industrial Safety Market Trends

Industrial Safety Market Size, Share & Industry Analysis: By Type (Emergency Shutdown Systems (ESD), Fire & Gas Monitoring Systems, High Integrity Pressure Protection Systems (HIPPS), Burner Management Systems (BMS), Turbomachinery Control (TMC), Others), By Component (Safety Sensors, Programmable Safety Systems, Safety Controllers/Module/Relays, Safety Switches, Safety Valves, Others),...

Market Summary

As per Market Research Future Analysis, the industrial safety market was valued at USD 3,345.3 million in 2018 and is projected to reach USD 5,290.1 million by 2032, growing at a CAGR of 8.2%. The market growth is driven by increasing industrial activities, demand for higher productivity, and stringent safety regulations. The COVID-19 pandemic impacted the market, causing fluctuations in demand due to reduced production and supply chain disruptions. However, the focus on worker safety has led to an increased adoption of industrial safety measures. Key drivers include the rising awareness of safety systems, the deployment of advanced technologies like IoT and AI, and the growing need for fire and gas monitoring systems, particularly in the oil and gas sector. Challenges include high maintenance costs and a lack of awareness in developing regions.

Key Market Trends & Highlights

The industrial safety market is witnessing significant growth driven by technological advancements and regulatory compliance.

- Market value in 2018: USD 3,345.3 million; Expected value by 2032: USD 5,290.1 million.

- CAGR of 8.2% projected from 2018 to 2032.

- Increased adoption of IoT and AI technologies enhancing safety measures.

- COVID-19 led to a temporary decline in demand but increased focus on worker safety.

Market Size & Forecast

| 2018 Market Size | USD 3,345.3 million |

| 2032 Market Size | USD 5,290.1 million |

| CAGR | 8.2% |

Major Players

Automation, Inc. (US); ABB Ltd (Switzerland); Schneider Electric SE (France); GENERAL ELECTRIC (US); Yokogawa Electric Corp. (Japan); Hima Paul Hildebrandt GmbH (US); Omron Corporation (Japan); Siemens AG (Germany); Proserv Ingenious Simplicity (UK); Johnson Controls (Ireland); Balluff (US); Euchner (Germany); Fortress Interlocks (UK).

Market Trends

The ongoing emphasis on workplace safety regulations and the integration of advanced technologies are reshaping the landscape of the industrial safety market, fostering a culture of proactive risk management across various sectors.

U.S. Occupational Safety and Health Administration (OSHA)

Industrial Safety Market Market Drivers

Regulatory Compliance

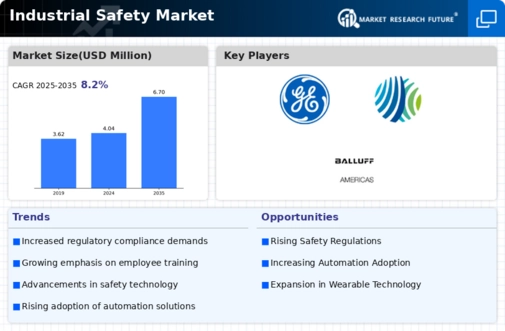

The Global Industrial Safety Market Industry is significantly influenced by stringent regulatory frameworks established by governmental bodies. These regulations mandate organizations to implement safety protocols and equipment to protect workers and minimize hazards. For instance, the Occupational Safety and Health Administration (OSHA) in the United States enforces standards that require employers to provide a safe working environment. As a result, companies are increasingly investing in safety training and equipment, contributing to the market's growth. The industry's value is projected to reach 4.04 USD Billion in 2024, reflecting the heightened emphasis on compliance and safety standards.

Market Growth Projections

The Global Industrial Safety Market Industry is projected to experience substantial growth over the coming years. With a market value anticipated to reach 4.04 USD Billion in 2024 and further expand to 6.7 USD Billion by 2035, the industry is poised for a robust trajectory. The compound annual growth rate (CAGR) of 4.71% from 2025 to 2035 suggests a sustained demand for safety solutions across various sectors. This growth is likely driven by increasing regulatory pressures, technological advancements, and a heightened focus on workplace safety, indicating a dynamic landscape for industrial safety.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Industrial Safety Market Industry. The integration of advanced safety equipment, such as smart helmets and wearable technology, enhances worker safety by providing real-time data and alerts. For example, sensors that detect hazardous gases or monitor fatigue levels are becoming commonplace in various industries. These advancements not only improve safety outcomes but also drive market growth as organizations seek to adopt cutting-edge solutions. The anticipated growth trajectory, with a projected market value of 6.7 USD Billion by 2035, underscores the potential of technology to revolutionize safety practices.

Globalization of Supply Chains

The globalization of supply chains has introduced complexities that necessitate robust safety measures, thereby influencing the Global Industrial Safety Market Industry. As companies expand their operations internationally, they encounter diverse regulatory environments and safety challenges. This has led to an increased demand for comprehensive safety solutions that can be adapted to various contexts. Organizations are investing in safety audits and compliance training to ensure adherence to local regulations. Consequently, the market is poised for growth, with projections indicating a value of 4.04 USD Billion in 2024, driven by the need for standardized safety practices across borders.

Focus on Employee Health and Well-being

The emphasis on employee health and well-being is increasingly shaping the Global Industrial Safety Market Industry. Organizations recognize that a safe work environment is integral to employee satisfaction and productivity. This realization has prompted investments in ergonomic equipment, mental health resources, and comprehensive safety training programs. By fostering a culture of safety, companies not only comply with regulations but also enhance their reputation and employee retention. The market's growth trajectory, with an expected value of 6.7 USD Billion by 2035, reflects the long-term commitment to prioritizing employee health and safety.

Increased Awareness of Workplace Safety

There is a growing awareness regarding workplace safety among organizations globally, which is a key driver for the Global Industrial Safety Market Industry. This heightened consciousness stems from various factors, including high-profile accidents and the increasing focus on employee well-being. Companies are now prioritizing safety training programs and investing in safety management systems to mitigate risks. This trend is reflected in the market's expected compound annual growth rate (CAGR) of 4.71% from 2025 to 2035, indicating a sustained commitment to enhancing safety measures across industries.

Market Segment Insights

Regional Insights

Key Companies in the Industrial Safety Market market include

Industry Developments

- Q2 2024: Honeywell to acquire Compressor Controls Corporation for $670 million Honeywell announced the acquisition of Compressor Controls Corporation, a provider of turbomachinery control and optimization solutions, to expand its industrial safety and automation portfolio.

- Q2 2024: Siemens Launches New Industrial Safety Platform for Manufacturing Sector Siemens introduced a new digital safety platform designed to enhance real-time monitoring and risk mitigation in industrial manufacturing environments.

- Q3 2024: Rockwell Automation Announces Partnership with Microsoft to Advance Industrial Safety Solutions Rockwell Automation and Microsoft entered a strategic partnership to develop cloud-based industrial safety applications leveraging AI and IoT technologies.

- Q2 2024: ABB opens new robotics and safety solutions facility in Sweden ABB inaugurated a new facility in Västerås, Sweden, focused on developing advanced robotics and industrial safety systems for European markets.

- Q1 2024: Yokogawa Launches OpreX Safety Instrumented System for Oil & Gas Sector Yokogawa introduced its latest OpreX Safety Instrumented System, targeting enhanced process safety in oil and gas operations.

- Q2 2025: MSA Safety appoints new CEO as part of leadership transition MSA Safety announced the appointment of a new Chief Executive Officer, effective July 2025, to lead the company’s next phase of growth in industrial safety equipment.

- Q1 2025: Emerson Unveils Next-Generation Gas Detection System for Industrial Facilities Emerson launched a new gas detection system designed to improve worker safety and regulatory compliance in hazardous industrial environments.

- Q3 2024: DuPont completes acquisition of SafeTrak, expanding industrial safety portfolio DuPont finalized its acquisition of SafeTrak, a company specializing in digital safety inspection and compliance solutions for industrial workplaces.

- Q2 2024: Schneider Electric and Honeywell form alliance to develop integrated industrial safety platforms Schneider Electric and Honeywell announced a strategic alliance to co-develop integrated safety platforms for industrial automation and process industries.

- Q1 2025: MSA Safety launches new connected PPE platform for industrial workers MSA Safety introduced a connected personal protective equipment (PPE) platform that enables real-time monitoring of worker safety in hazardous environments.

- Q2 2025: Siemens opens new safety technology R&D center in Singapore Siemens inaugurated a research and development center in Singapore dedicated to advancing industrial safety technologies for the Asia-Pacific region.

- Q3 2024: ABB wins contract to supply safety automation systems for major Middle East refinery ABB secured a contract to deliver safety automation and emergency shutdown systems for a large-scale refinery project in the Middle East.

Future Outlook

Industrial Safety Market Future Outlook

The Global Industrial Safety Market is projected to grow at a 4.71% CAGR from 2024 to 2035, driven by technological advancements, regulatory compliance, and increased safety awareness.

New opportunities lie in:

- Invest in AI-driven safety analytics to enhance risk assessment processes.

- Develop innovative personal protective equipment (PPE) integrating smart technology.

- Expand safety training programs leveraging virtual reality for immersive learning experiences.

By 2035, the market is expected to achieve substantial growth, reflecting heightened safety standards and technological integration.

Market Segmentation

Industrial Safety Type Outlook

- Machine Safety

- Worker Safety.

Industrial Safety Component Outlook

- Emergency Stop Controls

- Presence Sensing Safety Sensors

- Programmable Safety Systems

- Safety Controllers/Modules/Relays

- Safety Interlock Switches

- Two-Hand Safety Control

- Automation, Inc. (US)

- ABB Ltd (Switzerland)

- Schneider Electric SE (France)

- GENERAL ELECTRIC (US)

- Yokogawa Electric Corp. (Japan)

- Hima Paul Hildebrandt GmbH (US)

- Omron Corporation (Japan)

- Siemens AG (Germany)

- Proserv Ingenious Simplicity (UK)

- Johnson Controls (Ireland)

- Balluff (US)

- Euchner (Germany)

- Fortress Interlocks (UK)

- Q2 2024: Honeywell to acquire Compressor Controls Corporation for $670 million Honeywell announced the acquisition of Compressor Controls Corporation, a provider of turbomachinery control and optimization solutions, to expand its industrial safety and automation portfolio.

- Q2 2024: Siemens Launches New Industrial Safety Platform for Manufacturing Sector Siemens introduced a new digital safety platform designed to enhance real-time monitoring and risk mitigation in industrial manufacturing environments.

- Q3 2024: Rockwell Automation Announces Partnership with Microsoft to Advance Industrial Safety Solutions Rockwell Automation and Microsoft entered a strategic partnership to develop cloud-based industrial safety applications leveraging AI and IoT technologies.

- Q2 2024: ABB opens new robotics and safety solutions facility in Sweden ABB inaugurated a new facility in Västerås, Sweden, focused on developing advanced robotics and industrial safety systems for European markets.

- Q1 2024: Yokogawa Launches OpreX Safety Instrumented System for Oil & Gas Sector Yokogawa introduced its latest OpreX Safety Instrumented System, targeting enhanced process safety in oil and gas operations.

- Q2 2025: MSA Safety appoints new CEO as part of leadership transition MSA Safety announced the appointment of a new Chief Executive Officer, effective July 2025, to lead the company’s next phase of growth in industrial safety equipment.

- Q1 2025: Emerson Unveils Next-Generation Gas Detection System for Industrial Facilities Emerson launched a new gas detection system designed to improve worker safety and regulatory compliance in hazardous industrial environments.

- Q3 2024: DuPont completes acquisition of SafeTrak, expanding industrial safety portfolio DuPont finalized its acquisition of SafeTrak, a company specializing in digital safety inspection and compliance solutions for industrial workplaces.

- Q2 2024: Schneider Electric and Honeywell form alliance to develop integrated industrial safety platforms Schneider Electric and Honeywell announced a strategic alliance to co-develop integrated safety platforms for industrial automation and process industries.

- Q1 2025: MSA Safety launches new connected PPE platform for industrial workers MSA Safety introduced a connected personal protective equipment (PPE) platform that enables real-time monitoring of worker safety in hazardous environments.

- Q2 2025: Siemens opens new safety technology R&D center in Singapore Siemens inaugurated a research and development center in Singapore dedicated to advancing industrial safety technologies for the Asia-Pacific region.

- Q3 2024: ABB wins contract to supply safety automation systems for major Middle East refinery ABB secured a contract to deliver safety automation and emergency shutdown systems for a large-scale refinery project in the Middle East.

Industrial Safety Industry Vertical Outlook

- Chemicals

- Refining

- Oil & gas

- Pharmaceutical

- Paper & pulp

- Metal & mining

- Water & wastewater

- Energy & power

- Manufacturing

- Others.

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2032 | USD 5,290.1 Million |

| Compound Annual Growth Rate (CAGR) | 11% (2024-2032) |

| Base Year | 2023 |

| Market Forecast Period | 2024-2032 |

| Historical Data | 2018 |

| Market Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Component, Industry Vertical |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered | The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Emerson Electric Co. (US), Honeywell International, Inc. (US), Rockwell Automation, Inc. (US), ABB Ltd (Switzerland), Schneider Electric SE (France), GENERAL ELECTRIC (US), Yokogawa Electric Corp. (Japan), Hima Paul Hildebrandt GmbH (US), Omron Corporation (Japan), Siemens AG (Germany), Proserv Ingenious Simplicity (UK), Johnson Controls (Ireland), Balluff (US), Euchner (Germany), and Fortress Interlocks (UK). These companies are analyzed on the basis of their geographic presence, origin, products, key developments, and expertise in industrial safety solutions. Apart from the above-mentioned players, Eaton PLC (Ireland), 3M (US), TUSKER INDUSTRIAL SAFETY (UK), W.W. Grainger, Inc. (US), Ceasefire (India), Panduit (US), and DuPont (US) |

| Key Market Opportunities | Advancements in technology and proliferation of industrial IoT by plants and facilities. |

| Key Market Dynamics | The adoption of industrial safety solutions by a number of verticals. |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What are the factors flourishing the market growth in the coming years?

The factors influencing the market are directed towards the lives of workers, which include contact with exposed moving parts, electricity, manual lifting, flying chips or parts, and fire and welding hazards.

What are the segments included in the study of the market?

Type, component, vertical are the segments included in the study of the market.

What was the valuation in 2020 the market gained?

The market gained a valuation of USD 3,345.3 million in the year 2018

Mention the growth period estimated for the market to grow.

2024 to 2032 is the stated growth period for the market’s growth.

By what percentage, North American region dominated the global industrial safety market?

North American region led the global industrial safety market with occupying a share of 30% of the total market.

-

Table of Contents

-

Executive Summary

-

Scope of the Report

- Market Definition

- Scope of the Study

- Research Objectives

- Markets Structure

-

Research Methodology

-

Market Landscape

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Threat of Substitutes

- Rivalry

- Bargaining Power of Suppliers

- Value Chain/Supply Chain of the Global Industrial Safety Market

-

Porter’s Five Forces Analysis

-

Market Landscape

- Introduction

- Growth Drivers

- Impact Analysis

- Market Challenges

-

Market Trends

- Introduction

- Growth Trends

- Impact Analysis

-

Global Industrial Safety Market, by Type

- Introduction

-

Emergency Shutdown Systems (ESD)

- Market Estimates & Forecast, 2024-2032

-

Fire & Gas Monitoring Systems

- Market Estimates & Forecast, 2024-2032

-

High Integrity Pressure Protection Systems (HIPPS)

- Market Estimates & Forecast, 2024-2032

-

Burner Management Systems (BMS)

- Market Estimates & Forecast, 2024-2032

-

Turbomachinery Control (TMC)

- Market Estimates & Forecast, 2024-2032

-

Others

- Market Estimates & Forecast, 2024-2032

-

Global Industrial Safety Market, by Component

- Introduction

-

Safety Sensors

- Market Estimates & Forecast, 2024-2032

-

Programmable Safety Systems

- Market Estimates & Forecast, 2024-2032

-

Safety Controllers/Module/Relays

- Market Estimates & Forecast, 2024-2032

-

Safety Switches

- Market Estimates & Forecast, 2024-2032

-

Emergency Stop Devices

- Market Estimates & Forecast, 2024-2032

-

Safety Valves

- Market Estimates & Forecast, 2024-2032

-

Others

- Market Estimates & Forecast, 2024-2032

-

Global Industrial Safety Market, by Industry Vertical

- Introduction

-

Chemicals

- Market Estimates & Forecast, 2024-2032

-

Refining

- Market Estimates & Forecast, 2024-2032

-

Oil & Gas

- Market Estimates & Forecast, 2024-2032

-

Pharmaceutical

- Market Estimates & Forecast, 2024-2032

-

Paper & Pulp

- Market Estimates & Forecast, 2024-2032

-

Metal & Mining

- Market Estimates & Forecast, 2024-2032

-

Water & Wastewater

- Market Estimates & Forecast, 2024-2032

-

Energy & Power

- Market Estimates & Forecast, 2024-2032

-

Manufacturing

- Market Estimates & Forecast, 2024-2032

-

Others

- Market Estimates & Forecast, 2024-2032

-

Global Industrial Safety Market, by Region

- Introduction

-

North America

- Market Estimates & Forecast, by Country, 2024-2032

- Market Estimates & Forecast, by Type, 2024-2032

- Market Estimates & Forecast, by Component, 2024-2032

- Market Estimates & Forecast, by Industry Vertical, 2024-2032

- US

- Mexico

- Canada

-

Europe

- Market Estimates & Forecast, by Country, 2024-2032

- Market Estimates & Forecast, by Type, 2024-2032

- Market Estimates & Forecast, by Component, 2024-2032

- Market Estimates & Forecast, by Industry Vertical, 2024-2032

- Germany

- France

- Italy

- Spain

- UK

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, by Country, 2024-2032

- Market Estimates & Forecast, by Type, 2024-2032

- Market Estimates & Forecast, by Component, 2024-2032

- Market Estimates & Forecast, by Industry Vertical, 2024-2032

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Forecast, by Country, 2024-2032

- Market Estimates & Forecast, by Type, 2024-2032

- Market Estimates & Forecast, by Component, 2024-2032

- Market Estimates & Forecast, by Industry Vertical, 2024-2032

- Middle East & Africa

- South America

-

Competitive Landscape

-

Company Profiles

-

ABB Ltd

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Emerson Electric Co.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Yokogawa Electric Corp.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Rockwell Automation Inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Siemens AG

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hima Paul Hildebrandt GmbH

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Omron Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Schneider Electric

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Proserv Ingenious Simplicity

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Johnson Controls

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Balluff

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Euchner

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Honeywell International Inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

GENERAL ELECTRIC

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

Fortress Interlocks

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

- SWOT Analysis

- Key Strategies

-

ABB Ltd

-

Conclusion

-

-

List of Tables and Figures

- LIST OF TABLES

- Table 1 Global Industrial Safety Market, by Type, 2024-2032

- Table 2 Global Industrial Safety Market, by Component, 2024-2032

- Table 3 Global Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 4 Global Industrial Safety Market, by Region, 2024-2032

- Table 5 North America: Industrial Safety Market, by Country, 2024-2032

- Table 6 North America: Industrial Safety, Market, by Type, 2024-2032

- Table 7 North America: Industrial Safety Market, by Component, 2024-2032

- Table 8 North America: Industrial Safety, Market, by Industry Vertical, 2024-2032

- Table 9 US: Industrial Safety, Market, by Type, 2024-2032

- Table 10 US: Industrial Safety Market, by Component, 2024-2032

- Table 11 US: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 12 Canada: Industrial Safety, Market, by Type, 2024-2032

- Table 13 Canada: Industrial Safety Market, by Component, 2024-2032

- Table 14 Canada: Industrial Safety, Market, by Industry Vertical, 2024-2032

- Table 15 Mexico: Industrial Safety, Market, by Type, 2024-2032

- Table 16 Mexico: Industrial Safety Market, by Component, 2024-2032

- Table 17 Mexico: Industrial Safety, Market, by Industry Vertical, 2024-2032

- Table 18 Europe: Industrial Safety Market, by Country, 2024-2032

- Table 19 Europe: Industrial Safety Market, by Type, 2024-2032

- Table 20 Europe: Industrial Safety Market, by Component, 2024-2032

- Table 21 Europe: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 22 Germany: Industrial Safety Market, by Type, 2024-2032

- Table 23 Germany: Industrial Safety Market, by Component, 2024-2032

- Table 24 Germany: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 25 France: Industrial Safety Market, by Type, 2024-2032

- Table 26 France: Industrial Safety Market, by Component, 2024-2032

- Table 27 France: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 28 Italy: Industrial Safety Market, by Type, 2024-2032

- Table 29 Italy: Industrial Safety Market, by Component, 2024-2032

- Table 30 Italy: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 31 Spain: Industrial Safety Market, by Type, 2024-2032

- Table 32 Spain: Industrial Safety Market, by Component, 2024-2032

- Table 33 Spain: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 34 UK: Industrial Safety Market, by Type, 2024-2032

- Table 35 UK: Industrial Safety Market, by Component, 2024-2032

- Table 36 UK: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 37 Rest of Europe: Industrial Safety Market, by Type, 2024-2032

- Table 38 Rest of Europe: Industrial Safety Market, by Component, 2024-2032

- Table 39 Rest of Europe: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 40 Asia-Pacific: Industrial Safety Market, by Country, 2024-2032

- Table 41 Asia-Pacific: Industrial Safety Market, by Type, 2024-2032

- Table 42 Asia-Pacific: Industrial Safety Market, by Component, 2024-2032

- Table 43 Asia-Pacific: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 44 China: Industrial Safety Market, by Type, 2024-2032

- Table 45 China: Industrial Safety Market, by Component, 2024-2032

- Table 46 China: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 47 Japan: Industrial Safety Market, by Type, 2024-2032

- Table 48 Japan: Industrial Safety Market, by Component, 2024-2032

- Table 49 Japan: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 50 India: Industrial Safety Market, by Type, 2024-2032

- Table 51 India: Industrial Safety Market, by Component, 2024-2032

- Table 52 India: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 53 South Korea: Industrial Safety Market, by Type, 2024-2032

- Table 54 South Korea: Industrial Safety Market, by Component, 2024-2032

- Table 55 South Korea: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 56 Rest of Asia-Pacific: Industrial Safety Market, by Type, 2024-2032

- Table 57 Rest of Asia-Pacific: Industrial Safety Market, by Component, 2024-2032

- Table 58 Rest of Asia-Pacific: Industrial Safety Market, by Industry Vertical, 2024-2032

- Table 59 Rest of the World: Industrial Safety Market, by Country, 2024-2032

- Table 60 Rest of the World: Industrial Safety Market, by Type, 2024-2032

- Table 61 Rest of the World: Industrial Safety Market, by Component, 2024-2032

- Table 62 Rest of the World: Industrial Safety Market, by Industry Vertical, 2024-2032 LIST OF FIGURES

- FIGURE 1 Global Industrial Safety Market Segmentation

- FIGURE 2 Forecast Methodology

- FIGURE 3 Porter’s Five Forces Analysis of the Global Industrial Safety Market

- FIGURE 4 Value Chain of the Global Industrial Safety Market

- FIGURE 5 Share of the Global Industrial Safety Market in 2020, by Country (in %)

- FIGURE 6 Global Industrial Safety Market, 2024-2032

- FIGURE 7 Sub-Segments of Type

- FIGURE 8 Global Industrial Safety Market Size, by Type, 2020

- FIGURE 9 Share of the Global Industrial Safety Market, by Type, 2024 to 2032

- FIGURE 10 Sub-Segments of Connectivity

- FIGURE 11 Global Industrial Safety Market Size, by Component, 2020

- FIGURE 12 Share of Global Industrial Safety Market, by Component, 2024 to 2032

- FIGURE 10 Sub-Segments of Vertical

- FIGURE 11 Global Industrial Safety Market Size, by Industry Vertical, 2020

- FIGURE 12 Share of the Global Industrial Safety Market, by Industry Vertical, 2024 to 2032

Industrial Safety Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment