Global Trade Dynamics

The Global Indian Palm Oil Market Industry is significantly influenced by global trade dynamics. Changes in trade policies, tariffs, and international relations can impact the flow of palm oil between countries. As India seeks to enhance its palm oil imports and exports, fluctuations in global prices and demand can create opportunities and challenges for domestic producers. The interconnectedness of global markets means that shifts in demand from major importing countries can have a direct effect on the Indian palm oil sector. This dynamic environment necessitates adaptability and strategic planning among industry stakeholders to navigate potential market fluctuations.

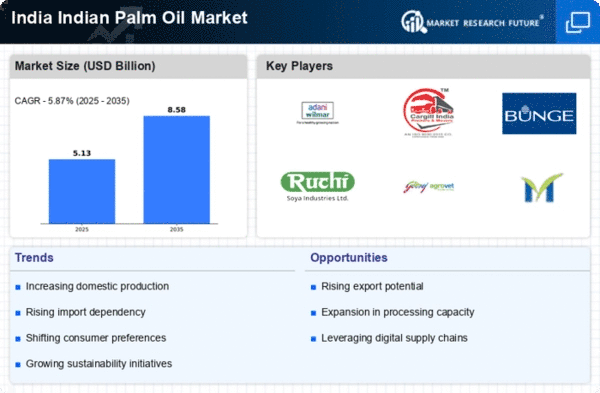

Market Growth Projections

The Global Indian Palm Oil Market Industry is poised for substantial growth, with projections indicating a market value of 20.5 USD Billion by 2035. This growth is underpinned by various factors, including rising demand for edible oils, government support, and sustainability initiatives. The anticipated compound annual growth rate (CAGR) of 3.6% from 2025 to 2035 suggests a steady upward trajectory for the industry. As consumer preferences evolve and the market adapts to changing dynamics, stakeholders must remain vigilant to capitalize on emerging opportunities and mitigate potential challenges in this expanding landscape.

Rising Demand for Edible Oils

The Global Indian Palm Oil Market Industry experiences a surge in demand for edible oils, driven by changing dietary preferences and increasing population. As consumers become more health-conscious, palm oil's versatility and cost-effectiveness make it a preferred choice among various cooking oils. In 2024, the market is projected to reach 13.9 USD Billion, reflecting a growing inclination towards palm oil in food processing and culinary applications. This trend is likely to continue, with the market expected to expand further as urbanization and disposable incomes rise, leading to increased consumption of processed foods that utilize palm oil.

Government Policies and Support

Government policies play a pivotal role in shaping the Global Indian Palm Oil Market Industry. Initiatives aimed at boosting domestic production and reducing reliance on imports are gaining traction. The Indian government has implemented various schemes to support palm oil cultivation, including subsidies and financial assistance for farmers. These measures are expected to enhance local production capabilities, thereby increasing the market size. As a result, the industry is likely to witness a steady growth trajectory, with projections indicating a market value of 20.5 USD Billion by 2035, driven by favorable policies and increased investment in palm oil plantations.

Sustainability and Certification Trends

Sustainability has emerged as a critical factor influencing the Global Indian Palm Oil Market Industry. Consumers are increasingly demanding sustainably sourced palm oil, prompting producers to adopt certification schemes such as the Roundtable on Sustainable Palm Oil (RSPO). This shift towards sustainable practices not only addresses environmental concerns but also enhances marketability. Companies that prioritize sustainability may gain a competitive edge, appealing to eco-conscious consumers. As the industry evolves, the integration of sustainable practices is likely to contribute to a compound annual growth rate (CAGR) of 3.6% from 2025 to 2035, reflecting a growing commitment to responsible sourcing.

Technological Advancements in Production

Technological advancements are transforming the Global Indian Palm Oil Market Industry by enhancing production efficiency and yield. Innovations in agricultural practices, such as precision farming and biotechnology, are enabling farmers to optimize palm oil cultivation. These advancements not only increase productivity but also reduce environmental impact, aligning with sustainability goals. As the industry embraces technology, it is likely to attract investment and improve competitiveness. The anticipated growth in production capabilities may further support the market's expansion, contributing to the overall increase in market value projected for the coming years.