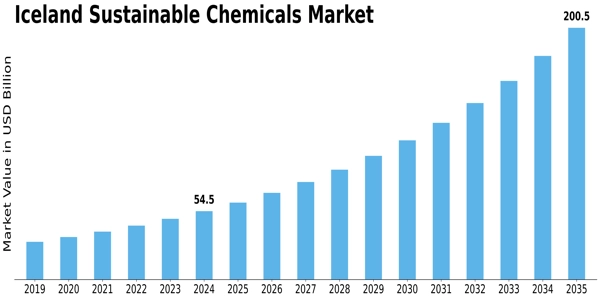

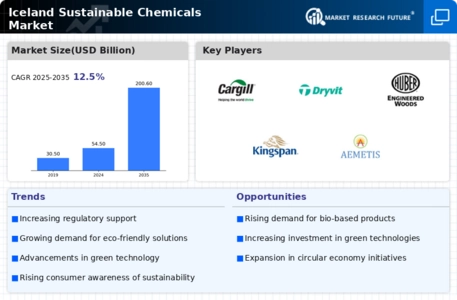

Market Growth Projections

The Global Iceland Sustainable Chemicals Market Industry is projected to experience robust growth, with estimates indicating a market size of 54.5 USD Billion in 2024 and a remarkable increase to 200.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 12.57% from 2025 to 2035, highlighting the increasing importance of sustainable chemicals in various sectors. The anticipated expansion is driven by factors such as rising consumer demand for eco-friendly products, regulatory support, and technological advancements in production processes. These projections underscore the potential for sustainable chemicals to play a crucial role in addressing environmental challenges while meeting market needs.

Growing Demand for Eco-Friendly Products

The increasing consumer awareness regarding environmental sustainability drives the Global Iceland Sustainable Chemicals Market Industry. As consumers become more conscious of their purchasing decisions, they tend to favor products that are derived from sustainable sources. This shift in consumer behavior is reflected in the market's projected growth, with the industry expected to reach 54.5 USD Billion in 2024. Companies are responding by innovating and developing eco-friendly alternatives to traditional chemicals, thereby enhancing their market presence and competitiveness. This trend not only supports environmental goals but also aligns with global initiatives aimed at reducing carbon footprints.

Rising Global Awareness of Climate Change

The escalating global awareness of climate change and its impacts is a driving force behind the Global Iceland Sustainable Chemicals Market Industry. As climate-related issues gain prominence, there is a collective push towards adopting sustainable practices across industries. This awareness translates into increased demand for sustainable chemicals that contribute to reducing carbon emissions and promoting environmental stewardship. The market's growth trajectory, projected to reach 54.5 USD Billion in 2024, reflects this heightened consciousness. Companies are increasingly aligning their strategies with sustainability goals, recognizing that addressing climate change is not only a moral imperative but also a business opportunity.

Increased Investment in Renewable Resources

The Global Iceland Sustainable Chemicals Market Industry is witnessing a surge in investments directed towards renewable resources. Investors are increasingly recognizing the potential of sustainable chemicals as a viable alternative to conventional products. This influx of capital is facilitating research and development initiatives aimed at enhancing the efficiency and scalability of sustainable chemical production. As a result, the market is poised for substantial growth, with projections indicating a rise to 200.6 USD Billion by 2035. This trend not only supports the transition towards a circular economy but also encourages collaboration among stakeholders to innovate and implement sustainable practices across various sectors.

Regulatory Support for Sustainable Practices

Government regulations promoting sustainable practices significantly influence the Global Iceland Sustainable Chemicals Market Industry. Policies aimed at reducing greenhouse gas emissions and encouraging the use of renewable resources create a favorable environment for sustainable chemical production. For instance, Iceland's commitment to sustainability is evident in its legislative framework that incentivizes the adoption of green technologies. This regulatory support is likely to propel the market forward, as companies adapt to comply with these regulations while also capitalizing on the growing demand for sustainable products. The anticipated market growth to 200.6 USD Billion by 2035 underscores the impact of these supportive measures.

Technological Advancements in Chemical Production

Innovations in chemical production technologies are pivotal in shaping the Global Iceland Sustainable Chemicals Market Industry. Advances such as biotechnological processes and green chemistry techniques enable the development of sustainable chemicals with reduced environmental impact. These technologies not only improve efficiency but also lower production costs, making sustainable options more accessible to manufacturers. As a result, the market is likely to experience a compound annual growth rate of 12.57% from 2025 to 2035. This technological evolution fosters a competitive landscape where companies can differentiate themselves through sustainable offerings, ultimately benefiting both the environment and their bottom lines.

Leave a Comment