Hydraulic Excavator Size

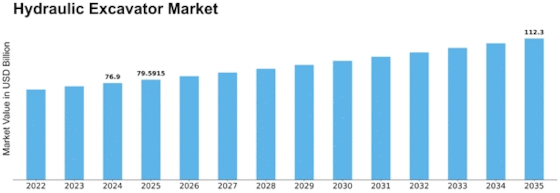

Hydraulic Excavator Market Growth Projections and Opportunities

The Hydraulic Excavator Market is influenced by a multitude of factors that collectively shape its growth and dynamics. One of the primary drivers is the booming construction and mining industries globally, which demand efficient and versatile earthmoving equipment. Hydraulic excavators, known for their high productivity, precision, and adaptability to various job sites, have become indispensable in heavy construction, infrastructure development, and mining projects. The increasing need for urbanization and infrastructure upgrades fuels the demand for hydraulic excavators, as these machines play a crucial role in excavating, grading, and material handling tasks.

Technological advancements in hydraulic excavator design and functionality significantly contribute to market dynamics. Continuous research and development efforts focus on improving fuel efficiency, operator comfort, and environmental sustainability. Innovations in hydraulic systems, control technologies, and telematics enhance the performance and overall efficiency of hydraulic excavators, making them more appealing to end-users. Advancements such as hybrid and electric excavators also address environmental concerns and align with the industry's push towards sustainable construction equipment.

Infrastructure development, urbanization trends, and government investments play a pivotal role in driving the Hydraulic Excavator Market. Rapid urbanization and infrastructure projects, especially in emerging economies, lead to increased demand for excavation and construction equipment. Government initiatives, such as infrastructure development plans and investments in public works, contribute to the growth of the hydraulic excavator market. Large-scale projects, including the construction of highways, airports, and residential complexes, boost the demand for these versatile machines.

Global economic conditions and construction activity levels significantly impact the Hydraulic Excavator Market. Economic growth and stability influence construction and infrastructure spending, directly affecting the demand for hydraulic excavators. Market conditions, including interest rates, access to financing, and economic policies, play a crucial role in determining the buying patterns of construction companies and contractors. Economic fluctuations can impact the purchasing decisions and investment plans of end-users in the construction and mining sectors.

Environmental considerations and emission regulations shape the hydraulic excavator market. Stricter emission standards and environmental regulations drive manufacturers to develop cleaner and more fuel-efficient excavators. The industry's commitment to reducing carbon footprints and adopting environmentally friendly technologies, such as advanced engine designs and emission control systems, aligns with global sustainability goals and influences purchasing decisions.

Market competition and industry collaborations are notable factors shaping the Hydraulic Excavator Market. The market features a competitive landscape with key players continually innovating to gain a competitive edge. Collaboration within the industry supply chain, including partnerships between excavator manufacturers, component suppliers, and technology providers, contributes to the development of advanced features, efficient designs, and improvements in excavator performance. Partnerships also foster advancements in safety features and operator assistance technologies.

Challenges related to high initial costs, maintenance requirements, and the impact of economic downturns are factors that the hydraulic excavator industry addresses. The upfront investment for hydraulic excavators can be substantial, posing a challenge for smaller contractors and businesses. However, the long-term efficiency, productivity gains, and durability of these machines often justify the initial costs. Maintenance requirements are another consideration, and the industry continually works on developing machines with reduced downtime and simplified maintenance procedures. Economic downturns and market uncertainties can impact the purchasing decisions of construction companies, influencing the overall demand for hydraulic excavators.

Leave a Comment