Market Trends

Key Emerging Trends in the High Temperature Coatings Market

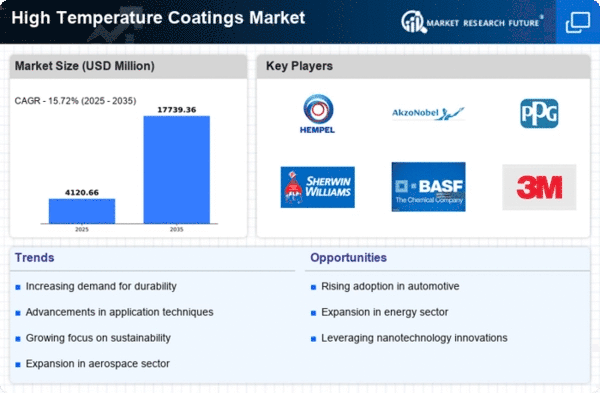

The market trends in high-temperature coatings clearly define an ever-changing terriform as well as the expanding need of protective paints to oppose the changing extreme temperatures in almost all the undertaken industries. Many diverse applications of heatproof, wear-resistant and other environmentally-resistant high temperature coating materials include: aerospace, automotive, oil and gas, and industrial fields. There is an important tendency for development of high-temperature coatings market from the aerospace industry which requires highest demand. Along with the demand for coating materials that are resistant to the high temperatures during flight and space exploration, manufacturers are now adopting the more heat sparing coatings for aircraft components, spacecraft, and some equipment that are being used in related to improved performance and prolonged service life.

Furthermore, automotive industry and the other market players such as coating industries and motor manufacturers are one of the key influences to the present market trends of the high-temperature paints. From engine performance and efficiency to heat-exposed exhaust systems and engine parts, manufacturers increasingly resort to high-temperature coatings for protecting the components of the overall system. These paints are becoming an adopted trend in the automotive industry because their need is to increase the fuel efficiency, lower emissions and extend the durability of crucial components.

Another potential application area is the utilization of high resistance to the above the oil and gas sectors. Utilize of equipments like pipelines, valves and processing units that work under extreme temperatures and environment are supported by the role of such coatings in order to prevent corrosion and maintain the integrity of infrastructure. High-temperature coating technologies application in oil and gas sector strongly correlates with the ever-demanding requirements of flame and corrosion resistant coatings which last for prolong period even in toughest working conditions.

Environmental factors are shaping the directions of markets, now creating more awareness about naturally based formulations produced under high temperatures with the same technical performance but the additional benefits of being eco-friendly. Manufacturers designs are traveling towards low-VOC (volatile organic compound) and eco-friendly products as production process have serious sustainability issues and conformity with the worlds' green economy. The industry trend to embrace a cleaner technology is a true testimony of the desire of the industry to minimize its environmental pollution and the development of painting that will pass through stringent regulatory hurdles.

Industrial sector, including manufacturing and process plants, too plays role in development of high heat coatings trend in the market. These coatings are sprayed on equipment, machinery and industrial complexes where ,for example, in steel, cement and chemical processing industries, such a harsh environment is frequent. The market demand for prolonged service life of high-temperature coatings used in industrial applications is likely boosted by manufacturers who seek long-lasting and effective protection against corrosion and high heat.

Leave a Comment