The High Power Electric Motor Market is characterized by a moderate to strong level of competition in the market. The players in the market are constantly innovating and expanding their offerings and presence. Despite the challenges, there are several factors that are driving growth in the High Power Electric Motor Market such as the automotive industry shifts towards electrification, the demand for high-power electric motors is increasing. EVs require high-performance motors for propulsion, contributing significantly to market growth. High-power electric motors are often referred to as high-torque, heavy-duty, or industrial motors.

They are crucial for demanding applications, including industrial machinery, electric vehicles, and aerospace. These motors are designed for superior power, efficiency, and durability. Thus, these advantages are key factors driving the market growth.

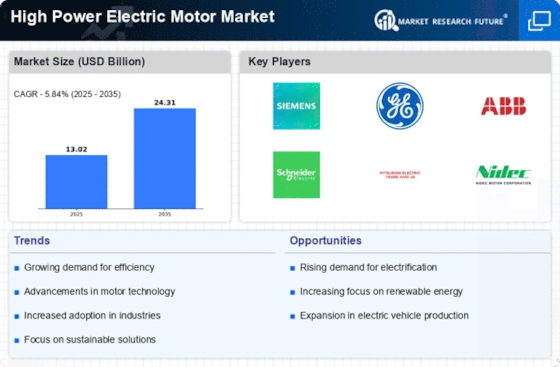

The market is benefiting from the development of new technologies. The key players in the global high-power electric motors market include Shanghai Electric, TECO, Regal Rexnord Corporation, Siemens, ABB Ltd., Toshiba Corporation, General Electric, Nidec Corporation, Wolong Electric Group, and Hoyer Motors. These companies compete based on service quality, innovation, price, customer service, and market share. Companies also engage in various strategic initiatives, such as mergers and acquisitions, contracts, partnerships, joint ventures, and expansions, to enhance their market position and expand their reach.

For instance, on 09 February 2022, Siemens AG signed an agreement to sell its 50 percent stake in the Valeo Siemens e-Automotive (VSeA) joint venture to Valeo. A positive profit impact of around 300 million Euros will be recorded in the second quarter of fiscal 2022 and closing is expected in July 2022, subject to regulatory approvals.

Shanghai Electric: Shanghai Electric manufactured motors and generators for 70 years. Since founded in 1949, Shanghai Electric Machinery Co., Ltd. (SEC) has been a key and the largest electric machinery manufacturer in China, with a broad range of more than 190 series, 950 varieties, and 10,000 kinds of specifications, which has been certificated by ISO9001, ISO14001, OHSAS18001. In terms of scale, equipment, technology and processing capacity, SEMC’s production base is second to none. SEMC’s main products include large and medium-sized AC & DC electric motors and generators, wind, steam, gas and hydro generators, etc.

All these products are widely used in key industrial sectors and exported to more than 50 countries, with a good reputation. Shanghai Electric won the China Industry Awards and boasts the highest brand value in China's machinery industry, at 215.628 billion CNY. In the smart energy field, they are creating solutions for multi-energy complementation between wind, solar, and hydrogen storage, as well as an integrated process of generation, grid, load, and storage.

Furthermore, the company also stays committed to constructing a new generation of comprehensive global electricity systems and all-round zero-carbon industrial parks. In the field of intelligent manufacturing, they provide solutions for Li-ion production lines, digital healthcare, rail transit and general equipment. In the field of digital intelligence integration, exceptional competence for extreme manufacturing enables to deliver system solutions across many industry chains, including new energy automotive, large passenger aircraft, contemporary marine and digitization.

Upholding the principles of opening up and mutually beneficial collaboration, Shanghai promote worldwide innovation and eco-friendly sustainable development through partnerships with global clients, partners, workers, and other creative minds by cooperating with more than 70 of the world's most prestigious enterprises.

Teco: TECO was initially engaged in motor production and has since stepped into the development fields of heavy electronics, home appliances, information, communications, infrastructure construction of key electronic components, financial investment, catering, and services, and has actively participated in the construction of major national projects, with a business territory spanning more than 40 countries and more than 100 cities on five continents.

In the future, TECO will continue to deepen its core business, actively develop in the direction of high value-added such as intelligent products and system solutions, and devote itself to the expansion of high-tech businesses, aiming at energy saving, emission reduction, intelligence, and automation, and building a world-class brand with macro and high quality. TECO has transformed itself from a giant manufacturer of motors into a highly competitive and globally operated conglomerate, covering industries such as heavy electronics, home appliances, information, communications, infrastructure construction of key components, investment, smart cards, catering, and home delivery services.

High Power Electric Motor Market Industry Developments

May 2023 ABB announced it has completed its acquisition of the Siemens low voltage NEMA motor business. The transaction was originally announced August 11, 2022, and financial terms of the transaction were not disclosed. The business employs around 600 people and generated revenues of approximately $63 million in 2021. The acquisition of this business is part of the Motion business area’s profitable growth strategy. It strengthens ABB’s position as a leading industrial NEMA motor manufacturer, and it provides an even stronger platform from which ABB can better serve its global customers.

September 2022: Mitsubishi Electric Corporation announced that together with Toshiba Mitsubishi-Electric Industrial Systems Corporation (TMEIC) they have developed an electrical motor-design support system incorporating Mitsubishi Electric's Maisart AI technology to dramatically shorten the time required to produce electrical motor designs that achieve the same performance as conventional design methods deployed manually by skilled engineers. TMEIC plans to adopt the system for internal operations in FY 2024. The new system can be used to design electrical motors for pumps, compressors and fans application in industries.

When designing such motors, design engineers conventionally must repeatedly adjust design specifications to balance performance versus design, such as power efficiency versus motor size.