Heavy Construction Equipment Market Trends

Europe Heavy Construction Equipment Market Research Report, By Types (Earthmoving Equipment, Material Handling Equipment, Heavy Construction Vehicles, Others (Cranes, Excavator, Dozer)), By applications (Mining & Excavation, Earthmoving, Transportation, Lifting, Material Handling, Others), end-users (Oil & Gas Industry, Construction Industry, Military, Mining, Agriculture & Forestry...

Market Summary

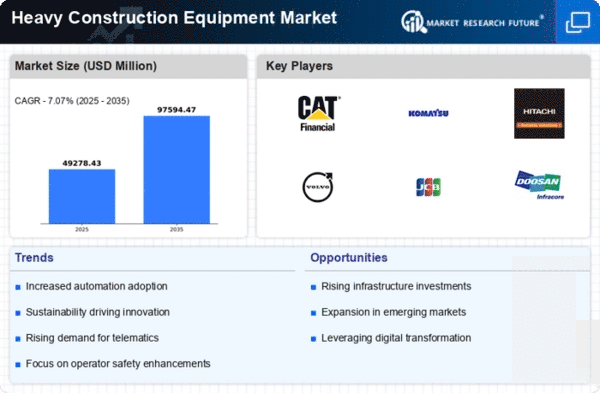

As per Market Research Future Analysis, the Global Heavy Construction Equipment Market was valued at USD 46024.50 million in 2024 and is projected to grow to USD 97594.47 million by 2035, with a CAGR of 7.07% from 2025 to 2035. The market is driven by urbanization, population growth, and technological advancements, including telematics and automation. Earthmoving equipment holds a significant market share, driven by demand in developing nations. The real estate sector is a major end-user, accounting for 29.6% of the market in 2022, with a projected CAGR of 4.99%. The Asia-Pacific region leads the market, supported by rapid economic growth and increased construction activities.

Key Market Trends & Highlights

The heavy construction equipment market is witnessing significant trends driven by technological advancements and increasing demand.

- Market Size in 2024: USD 46024.50 million; Projected Market Size by 2035: USD 97594.47 million.

- Earthmoving equipment dominated the market with a 44.0% share in 2022, expected to grow at a CAGR of 4.86% by 2032.

- Excavation & demolition applications held a 29.9% market share in 2022, with a projected CAGR of 4.9% by 2032.

- Real Estate sector accounted for 29.6% of the market in 2022, expected to grow at a CAGR of 4.99%.

Market Size & Forecast

| 2024 Market Size | USD 46024.50 million |

| 2035 Market Size | USD 97594.47 million |

| CAGR (2024-2035) | 7.07% |

| Largest Regional Market Share in 2022 | Asia-Pacific. |

Major Players

Key players include Volvo Group, Sany Heavy Industry Co., Ltd., Liebherr AG, JCB, CNH Industrial N.V, Caterpillar Inc, Xuzhou Construction Machinery Group Co., Ltd., Terex Corporation, Wacker Neuson SE, Hitachi Construction Machinery Co., Ltd., Deere & Company, Doosan Bobcat, Komatsu Ltd.

Market Trends

The European heavy construction equipment market is poised for growth, driven by increasing infrastructure investments and a shift towards sustainable construction practices.

European Commission

Heavy Construction Equipment Market Market Drivers

Market Growth Projections

The Global Europe Heavy Construction Equipment Market Industry is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 7.07% from 2025 to 2035. This growth is driven by various factors, including increased infrastructure spending, urbanization, and technological advancements. The market is expected to reach a value of 97.5 USD Billion by 2035, reflecting the ongoing demand for heavy construction equipment across Europe. These projections highlight the industry's potential and the opportunities that lie ahead for stakeholders.

Urbanization and Population Growth

Urbanization continues to be a driving force in the Global Europe Heavy Construction Equipment Market Industry, as cities expand and populations increase. The demand for residential and commercial construction is surging, leading to a heightened need for heavy machinery. As urban areas become more densely populated, the construction of high-rise buildings and infrastructure becomes imperative. This trend is likely to contribute to the market's growth, with projections indicating a market value of 97.5 USD Billion by 2035. The ongoing urbanization efforts across Europe suggest a sustained demand for heavy construction equipment.

Infrastructure Development Initiatives

The Global Europe Heavy Construction Equipment Market Industry is experiencing a notable boost due to extensive infrastructure development initiatives across various European nations. Governments are investing heavily in upgrading transportation networks, including roads, bridges, and railways, to enhance connectivity and stimulate economic growth. For instance, the European Union has allocated substantial funding for infrastructure projects, which is expected to drive demand for heavy construction equipment. This trend is reflected in the projected market value of 46.0 USD Billion in 2024, indicating a robust growth trajectory as these initiatives unfold.

Investment in Renewable Energy Projects

Investment in renewable energy projects is significantly influencing the Global Europe Heavy Construction Equipment Market Industry. As European nations strive to meet their climate goals, there is a marked increase in the construction of wind farms, solar power plants, and other renewable energy infrastructures. This trend necessitates the use of heavy construction equipment for site preparation and installation, thereby driving demand. The anticipated growth in this sector aligns with the overall market trajectory, as the industry adapts to support the transition towards sustainable energy solutions.

Technological Advancements in Equipment

Technological advancements are reshaping the Global Europe Heavy Construction Equipment Market Industry, as manufacturers increasingly integrate innovative features into their machinery. The adoption of automation, telematics, and fuel-efficient technologies enhances operational efficiency and reduces costs for construction companies. For example, the implementation of smart construction equipment allows for real-time monitoring and predictive maintenance, thereby minimizing downtime. This trend is likely to attract investments and drive market growth, as companies seek to leverage these advancements to improve productivity and competitiveness in the evolving construction landscape.

Sustainability and Environmental Regulations

The Global Europe Heavy Construction Equipment Market Industry is witnessing a shift towards sustainability, driven by stringent environmental regulations and a growing emphasis on eco-friendly practices. Governments are implementing policies that encourage the use of low-emission and energy-efficient machinery, prompting manufacturers to innovate and adapt their product offerings. This shift not only aligns with global sustainability goals but also opens new market opportunities for companies that prioritize green technologies. As the industry evolves, the demand for sustainable heavy construction equipment is expected to rise, further propelling market growth.

Market Segment Insights

Regional Insights

Key Companies in the Heavy Construction Equipment Market market include

Industry Developments

Future Outlook

Heavy Construction Equipment Market Future Outlook

The Europe Heavy Construction Equipment Market is projected to grow at a 7.07% CAGR from 2025 to 2035, driven by infrastructure investments, technological advancements, and sustainability initiatives.

New opportunities lie in:

- Invest in electric and hybrid construction equipment to meet regulatory demands.

- Leverage IoT technologies for predictive maintenance and operational efficiency.

- Expand rental services to capitalize on fluctuating project demands.

By 2035, the market is expected to exhibit robust growth, driven by innovation and strategic investments.

Market Segmentation

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 46,024.5 Million |

| Market Size 2035 | 97594.47 |

| Base Year | 2024 |

| Compound Annual Growth Rate (CAGR) | 7.07% (2025 - 2035) |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 & 2022 |

| Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Types, Applications and End-users |

| Geographies Covered | North America, Europe, Asia-Pacific, and Rest of the World (Row) |

| Key Vendors | Volvo Construction Equipment, Caterpillar Inc., J.C. Bamford Excavators Limited (JCB), Hitachi Construction Machinery Co., Ltd., Komatsu Ltd., Doosan Heavy Industries & Construction, Liebherr group, CNH Industrial, Kobe Steel, Ltd. (Kobelco), and Atlas Copco. |

| Key Market Opportunities | Government initiatives for various services like education, healthcare, public transport, infrastructure, and other facilities |

| Key Market Drivers | Increase in Demand of construction equipment Development of infrastructure |

| Market Size 2025 | 49279.36 |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the projected market value of the Europe heavy construction equipment market?

The Europe heavy construction equipment market is expected to record a substantial market valuation of 79,466.8 billion by 2032.

What is the estimated growth rate of the Europe heavy construction equipment market?

The Europe heavy construction equipment market is projected to register a moderate 7.07% CAGR in the forecast period.

Who are the key players operative in the Europe heavy construction equipment market?

A few major market players operating in the Europe heavy construction equipment market are Caterpillar Inc., AB Volvo , J C Bamford Excavators Ltd, CNH Industrial N.V., among others.

What is the end-use segment of the Europe heavy construction equipment market expected to witness the highest growth?

The construction segment is slated to expand as the fastest-growing segment.

What is the types segment of the Europe heavy construction equipment market expected to witness the highest growth?

The material handling equipment segment is slated to expand as the fastest-growing segment.

-

Table of Contents

-

1 Executive Summary

-

Market Attractiveness Analysis

- Europe Heavy Construction Equipment Market, By Type

- Europe Heavy Construction Equipment Market, By Application

- Europe Heavy Construction Equipment Market, By End User

- Europe Heavy Construction Equipment Market, By Country

-

Market Attractiveness Analysis

-

2 Market Introduction

- Definition

- Scope of the Study

- Market Structure

- List of Assumptions

- Key Buying Criteria

- Macro Factor Indicator Analysis

-

3 Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Market Size Estimation

- Forecast Model

-

4 Market Insights

-

5 Market Dynamics

- Introduction

-

Drivers

- Growing construction industry

- Rapid urbanization

- Drivers Impact Analysis

-

Restraints

- Stringent government emission regulations

- Restraints Impact Analysis

-

Opportunities

- Scope for rental services

-

Challenges

- Challenge 1

-

6 Market Factor Analysis

-

Supply/Value Chain Analysis

- Design and Development

- Raw Material

- Manufacturing

- End-Use

-

Porter’s Five Forces Model

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Intensity of Rivalry

-

Supply/Value Chain Analysis

-

7 Europe Heavy Construction Equipment Market, By Type

- Overview

-

Earthmoving Equipment

- Earthmoving Equipment: Market Estimates & Forecast by Region/Country, 2019-2027

-

Material Handling Equipment

- Material Handling Equipment: Market Estimates & Forecast by Region/Country, 2019-2027

-

Heavy Construction Vehicles

- Heavy Construction Vehicles: Market Estimates & Forecast by Region/Country, 2019-2027

-

Others

- Others: Market Estimates & Forecast by Region/Country, 2019-2027

-

8 Europe Heavy Construction Equipment Market, By Application

- Overview

-

Mining & Excavation

- Mining & Excavation: Market Estimates & Forecast by Region/Country, 2019-2027

-

Earthmoving

- Earthmoving: Market Estimates & Forecast by Region/Country, 2019-2027

-

Transportation

- Transportation: Market Estimates & Forecast by Region/Country, 2019-2027

-

Lifting

- Lifting: Market Estimates & Forecast by Region/Country, 2019-2027

-

Material Handling

- Material Handling: Market Estimates & Forecast by Region/Country, 2019-2027

-

Others

- Others: Market Estimates & Forecast by Region/Country, 2019-2027

-

9 Europe Heavy Construction Equipment Market, By End User

- Overview

-

Oil & Gas

- Oil & Gas: Market Estimates & Forecast by Region/Country, 2019-2027

-

Construction

- Construction: Market Estimates & Forecast by Region/Country, 2019-2027

-

Military

- Military: Market Estimates & Forecast by Region/Country, 2019-2027

-

Mining

- Mining: Market Estimates & Forecast by Region/Country, 2019-2027

-

Agriculture & Forestry

- Agriculture & Forestry: Market Estimates & Forecast by Region/Country, 2019-2027

-

Others

- Others: Market Estimates & Forecast by Region/Country, 2019-2027

-

10 Europe Heavy Construction Equipment Market, By Region

- Overview

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

-

Rest of the World

- Middle East & Africa

- South America

-

11 Competitive Landscape

- Competitive Overview

- Competitor Dashboard

- Major Growth Strategy

- Competitive Benchmarking

- Market Share Analysis

- The Leading Player in terms of Number of Developments in Europe Heavy Construction Equipment Market

-

Key Developments & Growth Strategies

- New Product Launch/Service Deployment

- Merger & Acquisition

- Joint Ventures

-

12 Company Profiles

-

Caterpillar Inc.

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

AB Volvo (Volvo Construction Equipment)

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

J C Bamford Excavators Ltd (JCB)

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

CNH Industrial N.V.

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

Terex Corporation

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

Liebherr AG

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

Komatsu Ltd

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

SANY Group

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hitachi Construction Machinery Co., Ltd

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

Doosan Infracore

- Company Overview

- Financial Overview

- Products Offerings

- Key Developments

- SWOT Analysis

- Key Strategies

-

Caterpillar Inc.

-

13 Appendix

- References

- Related Reports

- List of Abbreviation

-

-

List of Tables and Figures

- List of Tables

- TABLE 1 EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET BY TYPE

- TABLE 2 EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET BY APPLICATION

- TABLE 3 EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET BY END USER

- TABLE 4 EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET BY COUNTRY

- TABLE 5 GERMANY HEAVY CONSTRUCTION EQUIPMENT MARKET BY TYPE

- TABLE 6 GERMANY HEAVY CONSTRUCTION EQUIPMENT MARKET BY APPLICATION

- TABLE 7 GERMANY HEAVY CONSTRUCTION EQUIPMENT MARKET BY END USER

- TABLE 8 FRANCE HEAVY CONSTRUCTION EQUIPMENT MARKET BY TYPE

- TABLE 9 FRANCE HEAVY CONSTRUCTION EQUIPMENT MARKET BY APPLICATION

- TABLE 10 FRANCE HEAVY CONSTRUCTION EQUIPMENT MARKET BY END USER

- TABLE 11 UK HEAVY CONSTRUCTION EQUIPMENT MARKET BY TYPE

- TABLE 12 UK HEAVY CONSTRUCTION EQUIPMENT MARKET BY APPLICATION

- TABLE 13 UK HEAVY CONSTRUCTION EQUIPMENT MARKET BY END USER

- TABLE 14 ITALY HEAVY CONSTRUCTION EQUIPMENT MARKET BY TYPE

- TABLE 15 ITALY HEAVY CONSTRUCTION EQUIPMENT MARKET BY APPLICATION

- TABLE 16 ITALY HEAVY CONSTRUCTION EQUIPMENT MARKET BY END USER

- TABLE 17 REST OF EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET BY TYPE

- TABLE 18 REST OF EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET BY APPLICATION

- TABLE 19 REST OF EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET BY END USER

- TABLE 20 NEW TYPE DEVELOPMENT: - KEY DEVELOPMENT ANALYSIS, 2015 TO 2019

- TABLE 21 MAJOR ACQUISITION & EXPANSION: - KEY DEVELOPMENT ANALYSIS, 2015 TO 2019 List of Figures

- FIGURE 1 EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET: MARKET STRUCTURE

- FIGURE 2 RESEARCH PROCESS OF MRFR

- FIGURE 3 TOP DOWN & BOTTOM UP APPROACH

- FIGURE 4 DROC ANALYSIS OF EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET

- FIGURE 5 DRIVERS IMPACT ANALYSIS: HEAVY CONSTRUCTION EQUIPMENT MARKET

- FIGURE 6 RESTRAINTS IMPACT ANALYSIS: HEAVY CONSTRUCTION EQUIPMENT MARKET

- FIGURE 7 SUPPLY CHAIN: HEAVY CONSTRUCTION EQUIPMENT MARKET

- FIGURE 8 Porter's Five Forces Analysis OF THE EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET

- FIGURE 9 EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET, BY TYPE, 2018 (% SHARE)

- FIGURE 10 EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET BY APPLICATION, 2018 (% SHARE)

- FIGURE 11 EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET BY END USER, 2018 (% SHARE)

- FIGURE 12 EUROPE HEAVY CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY, 2018 (% SHARE)

- FIGURE 13 BENCHMARKING OF MAJOR COMPETITORS

- FIGURE 14 MAJOR MANUFACTURER MARKET SHARE ANALYSIS, 2018 (% SHARE)

Europe Heavy Construction Equipment Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment