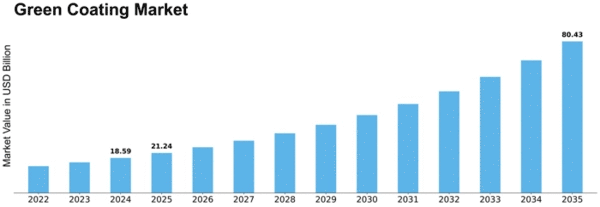

Green Coating Size

Green Coating Market Growth Projections and Opportunities

The Green Coating Market is influenced by a panoply of market facets that impact its expansion to multidimensions. The main incentive behind the growth is a generally rising level of global cognizance and eco-concern which leads to a steady demand increase. As natural resource depletion is being seen as a problem with global significance, consumers and industries now search out sustainable solutions with green coating products, this pushing the demand for such products to climb. An important external factor in driving market is public policies and government regulations. Concomitantly to the recently launched policy plans of many countries is vigorous environmental regulation imposing the green manufacturing technology and production. This pressure for the regulations not merely does compliance with standards but also it results in a market environment which is quite friendly for green coatings.

In addition, businesses have been tending to favor corporate social responsibility (CSR), which has been driving this market growth. Companies are getting aware of the fact that they have to eventually align their resonsibly environment practices with the change in the customers’ preferences and society expectations. Due to this fact, it is obvious that organic paints are gaining more popularity with a wide range of companies from construction to automotive adopting the environmental friendly coating in order to be in line with sustainability targets. This is made even worse due to the increase of consumer knowledge where they now deliberately explore those products that have a positive environmental effect.

Technological progression in the equipment area is of great importance while developing the Green Coating Market. Valuable experiences from prior investments allow the development team to build on class-leading environmentally-friendly coatings. The industry has been in the dynamics of creating recoats of painting and they do a good job at meeting environmental standards but also with optical and structural qualities like durability, protection and much more. The development of eco-friendly alternative raw materials and associated weapons such as nanotechnology allows the emergence of new sustainable coatings with modified features. This innovative approach not only improves environmental conditions but also fulfills the design features and operating characteristics demanded by numerous downstream industries.

Economic factors are also important in the play of the market. When the laundry industry booms, its growth and success are dependent on the overall economy. Economies tend to grow, which in turn leads to a stronger infrastructure development and more construction activities in order to satisfy the trend for a bigger demand of green coatings. On another note, an economic slump can also have the result of stalling the market, while sectors are struggling to decide whether to expend limited funds or to prioritize cost-cutting.

Furthermore, the behavior and preferences of consumers give transitions to the market. The eco-wise trend is becoming among consumers as they choose more carefully what they will spend money. With the single principle that makes consumers more knowledgeable about the environmental aspects of products, they are approximately to decide to purchase the type of paint that subsequently fits their values.

Leave a Comment