-

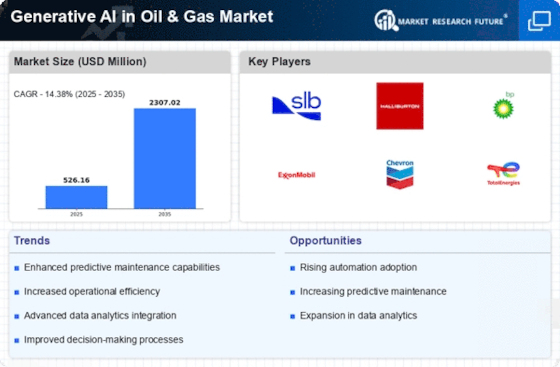

Global Generative AI in Oil & Gas Market, by Deployment Mode

-

Global

-

Generative AI in Oil & Gas Market, by End-User

-

Global Generative

-

AI in Oil & Gas Market, by Region

-

Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Macro Factor Indicator Analysis

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List of Assumptions

-

Introduction

-

Drivers

- Growing demand for

-

exploration and production optimization

-

Rising demand for data generation and augmentation

- Drivers impact analysis

-

Restraints

-

Accuracy and reliability of generative AI models heavily depend on the quality of the training data

-

Restraint impact analysis

-

Opportunities

- Increased opportunities due to Generative AI’s capability of generating tailored solutions

-

Challenges

- Regulatory and safety concerns

-

Covid-19 Impact Analysis

- Impact on Generative AI

-

in Oil & Gas Market

-

Impact on End Users during the Lockdowns

-

Value Chain Analysis/Supply Chain Analysis

-

Porter’s Five Forces Model

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

AI IN OIL & GAS MARKET, BY FUNCTION

-

Introduction

-

Data Analysis and Interpretation

-

Predictive Modelling

-

Anomaly Detection

-

Decision Support

-

Others

-

GAS MARKET, BY APPLICATION

-

Introduction

-

Asset Maintenance

-

Drilling Optimization

-

Exploration and Production

-

Reservoir Modelling

-

Others

-

Introduction

-

On-premise

-

Cloud-based

-

Introduction

-

Oil & Gas Companies

-

Drilling Contractors

-

Equipment Manufacturers

-

Service Providers

-

Consulting Firms

-

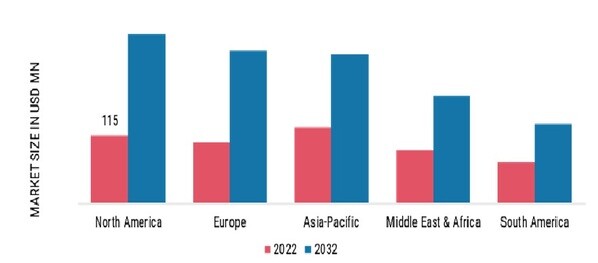

GENERATIVE AI IN OIL & GAS MARKET SIZE ESTIMATION & FORECAST, BY REGION

-

Introduction

-

North America

- Market Estimates

-

Forecast, by Country, 2018-2032

-

Market Estimates & Forecast, by Function, 2018-2032

- Market Estimates & Forecast, by Application

- Market Estimates & Forecast, by Deployment Mode, 2018-2032

- Market Estimates & Forecast, by End-User, 2018-2032

- US

-

Market Estimates & Forecast, by Application, 2018-2032

-

Market

-

Estimates & Forecast, by Deployment Mode, 2018-2032

-

Market Estimates

-

& Forecast, by End-User, 2018-2032

-

Canada

- Market

-

Estimates & Forecast, by Function, 2018-2032

-

Market Estimates

-

& Forecast, by Application, 2018-2032

-

Market Estimates

-

Forecast, by Deployment Mode, 2018-2032

-

Market Estimates & Forecast, by End-User, 2018-2032

- Mexico

-

Forecast, by Function, 2018-2032

-

Market Estimates & Forecast, by Application, 2018-2032

- Market Estimates & Forecast, by Deployment Mode, 2018-2032

-

Europe

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Function, 2018-2032

- Market

-

Estimates & Forecast, by Application, 2018-2032

-

Market Estimates

-

& Forecast, by Deployment Mode, 2018-2032

-

Market Estimates

-

Forecast, by End-User, 2018-2032

-

UK

- Market Estimates

-

& Forecast, by Function, 2018-2032

-

Market Estimates & Forecast, by Application, 2018-2032

- Market Estimates & Forecast, by Deployment Mode, 2018-2032

- Germany

-

Market Estimates & Forecast, by Deployment Mode, 2018-2032

-

Market

-

Estimates & Forecast, by End-User, 2018-2032

-

France

-

Market Estimates & Forecast, by Function, 2018-2032

-

Market Estimates

-

& Forecast, by Application, 2018-2032

-

Market Estimates

-

Forecast, by Deployment Mode, 2018-2032

-

Market Estimates & Forecast, by End-User, 2018-2032

- Italy

-

Forecast, by Function, 2018-2032

-

Market Estimates & Forecast, by Application, 2018-2032

- Market Estimates & Forecast, by Deployment Mode, 2018-2032

- Spain

-

Market Estimates & Forecast, by Deployment Mode, 2018-2032

-

Market

-

Estimates & Forecast, by End-User, 2018-2032

-

Rest of Europe

- Market Estimates & Forecast, by Function, 2018-2032

-

Market Estimates & Forecast, by Application, 2018-2032

-

Market

-

Estimates & Forecast, by Deployment Mode, 2018-2032

-

Market Estimates

-

& Forecast, by End-User, 2018-2032

-

Asia-Pacific

- Market

-

Estimates & Forecast, by Country, 2018-2032

-

Market Estimates

-

Forecast, by Function, 2018-2032

-

Market Estimates & Forecast, by Application, 2018-2032

- Market Estimates & Forecast, by Deployment Mode, 2018-2032

- Market Estimates & Forecast, by End-User, 2018-2032

- China

-

Market Estimates & Forecast, by Deployment Mode, 2018-2032

-

Market

-

Estimates & Forecast, by End-User, 2018-2032

-

Japan

-

Market Estimates & Forecast, by Function, 2018-2032

-

Market Estimates

-

& Forecast, by Application, 2018-2032

-

Market Estimates

-

Forecast, by Deployment Mode, 2018-2032

-

Market Estimates & Forecast, by End-User, 2018-2032

- India

-

Forecast, by Function, 2018-2032

-

Market Estimates & Forecast, by Application, 2018-2032

- Market Estimates & Forecast, by Deployment Mode, 2018-2032

- Australia

-

Market Estimates & Forecast, by End-User, 2018-2032

-

Rest of Asia-Pacific

- Market Estimates & Forecast, by Function, 2018-2032

-

Market Estimates & Forecast, by Application, 2018-2032

-

Market

-

Estimates & Forecast, by Deployment Mode, 2018-2032

-

Market Estimates

-

& Forecast, by End-User, 2018-2032

-

Rest of the World

-

Market Estimates & Forecast, by Function, 2018-2032

-

Market Estimates

-

& Forecast, by Application, 2018-2032

-

Market Estimates & Forecast

-

by Deployment Mode, 2018-2032

-

Market Estimates & Forecast, by End-User

- Middle East & Africa

-

& Forecast, by Function, 2018-2032

-

Market Estimates & Forecast, by Application, 2018-2032

- Market Estimates & Forecast, by Deployment Mode, 2018-2032

- South America

-

Market Estimates & Forecast, by End-User, 2018-2032

-

Introduction

-

Key Developments & Growth Strategies

-

Competitor Benchmarking

-

Vendor Share Analysis, 2022(% Share)

-

Quantifind

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

OpenAI

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Accenture

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

DataRobot

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

SAS

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

IBM

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Microsoft

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Adobe

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

NVIDIA

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Intel

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Google

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Others

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

OIL & GAS MARKET, BY FUNCTION, 2018–2032 (USD MILLION)

-

GLOBAL GENERATIVE AI IN OIL & GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

MODE, 2018–2032 (USD MILLION)

-

& GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY REGION, 2018–2032 (USD MILLION)

-

2018–2032 (USD MILLION)

-

& GAS MARKET, BY FUNCTION, 2018–2032 (USD MILLION)

-

AMERICA GENERATIVE AI IN OIL & GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

MODE, 2018–2032 (USD MILLION)

-

GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY FUNCTION, 2018–2032 (USD MILLION)

-

DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

2018–2032 (USD MILLION)

-

GAS MARKET, BY DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

FUNCTION, 2018–2032 (USD MILLION)

-

OIL & GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

END-USER, 2018–2032 (USD MILLION)

-

& GAS MARKET, BY FUNCTION, 2018–2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

2018–2032 (USD MILLION)

-

GAS MARKET, BY FUNCTION, 2018–2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

2018–2032 (USD MILLION)

-

GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY FUNCTION, 2018–2032 (USD MILLION)

-

DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

2018–2032 (USD MILLION)

-

GAS MARKET, BY DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

2018–2032 (USD MILLION)

-

GAS MARKET, BY DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

2018–2032 (USD MILLION)

-

& GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

REST OF EUROPE GENERATIVE AI IN OIL & GAS MARKET, BY DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

BY END-USER, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY COUNTRY, 2018–2032 (USD MILLION)

-

BY APPLICATION, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

(USD MILLION)

-

2018–2032 (USD MILLION)

-

GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

2018–2032 (USD MILLION)

-

GAS MARKET, BY FUNCTION, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

(USD MILLION)

-

2018–2032 (USD MILLION)

-

GAS MARKET, BY FUNCTION, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

(USD MILLION)

-

2018–2032 (USD MILLION)

-

& GAS MARKET, BY FUNCTION, 2018–2032 (USD MILLION)

-

KOREA GENERATIVE AI IN OIL & GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

BY END-USER, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY COUNTRY, 2018–2032 (USD MILLION)

-

BY APPLICATION, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

(USD MILLION)

-

GAS MARKET, BY FUNCTION, 2018–2032 (USD MILLION)

-

EAST & AFRICA GENERATIVE AI IN OIL & GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

GAS MARKET, BY DEPLOYMENT MODE, 2018–2032 (USD MILLION)

-

MIDDLE EAST & AFRICA GENERATIVE AI IN OIL & GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

BY FUNCTION, 2018–2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY APPLICATION, 2018–2032 (USD MILLION)

-

2018–2032 (USD MILLION)

-

& GAS MARKET, BY END-USER, 2018–2032 (USD MILLION)

-

EXPANSIONS/PRODUCT LAUNCHES

-

: PRODUCTS OFFERED

-

: KEY DEVELOPMENT

-

NVIDIA : KEY DEVELOPMENT

-

GLOBAL GENERATIVE AI IN OIL & GAS MARKET

-

AI IN OIL & GAS MARKET ANALYSIS, BY FUNCTION

-

AI IN OIL & GAS MARKET ANALYSIS, BY APPLICATION

-

AI IN OIL & GAS MARKET ANALYSIS, BY DEPLOYMENT MODE

-

GENERATIVE AI IN OIL & GAS MARKET ANALYSIS, BY END-USER

-

GENERATIVE AI IN OIL & GAS MARKET ANALYSIS, BY REGION

-

GENERATIVE AI IN OIL & GAS MARKET: STRUCTURE

-

AMERICA GENERATIVE AI IN OIL & GAS MARKET SIZE (USD MILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

GAS MARKET SIZE (USD MILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

& MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

& AFRICA GENERATIVE AI IN OIL & GAS MARKET SIZE (USD MILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

& GAS MARKET SIZE (USD MILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

(USD MILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

MARKET DYNAMICS ANALYSIS OF THE GLOBAL GENERATIVE AI IN OIL & GAS MARKET

-

2022 VS 2032 (USD MILLION)

-

MARKET, BY APPLICATION, 2022 (% SHARE)

-

OIL & GAS MARKET, BY APPLICATION, 2022 VS 2032 (USD MILLION)

-

(USD MILLION)

-

END-USER, 2022 VS 2032 (USD MILLION)

-

& GAS MARKET, BY END-USER, 2022 VS 2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY REGION, 2022 (% SHARE)

-

2022 (% SHARE)

-

BY COUNTRY, 2022 VS 2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY FUNCTION, 2022-2032 (USD MILLION)

-

BY END-USER, 2022-2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY END-USER, 2022-2032 (USD MILLION)

-

(USD MILLION)

-

FUNCTION, 2022-2032 (USD MILLION)

-

& GAS MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY END-USER, 2022-2032 (USD MILLION)

-

(USD MILLION)

-

BY COUNTRY, 2022 (% SHARE)

-

GAS MARKET, BY COUNTRY, 2022 VS 2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY FUNCTION, 2022-2032 (USD MILLION)

-

2022-2032 (USD MILLION)

-

GAS MARKET, BY END-USER, 2022-2032 (USD MILLION)

-

GENERATIVE AI IN OIL & GAS MARKET, BY END-USER, 2022-2032 (USD MILLION)

-

2022 (% SHARE)

-

GAS MARKET, BY COUNTRY, 2022 VS 2032 (USD MILLION)

-

& AFRICA GENERATIVE AI IN OIL & GAS MARKET, BY FUNCTION, 2022-2032 (USD MILLION)

-

MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

-

AFRICA GENERATIVE AI IN OIL & GAS MARKET, BY END-USER, 2022-2032 (USD MILLION)

-

BY END-USER, 2022-2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY COUNTRY, 2022 (% SHARE)

-

GENERATIVE AI IN OIL & GAS MARKET, BY COUNTRY, 2022 VS 2032 (USD MILLION)

-

(USD MILLION)

-

BY APPLICATION, 2022-2032 (USD MILLION)

-

AI IN OIL & GAS MARKET, BY END-USER, 2022-2032 (USD MILLION)

-

BENCHMARKING

-

QUANTIFIND : FINANCIAL OVERVIEW SNAPSHOT

-

: SWOT ANALYSIS

-

SNAPSHOT

-

OVERVIEW SNAPSHOT

-

: FINANCIAL OVERVIEW SNAPSHOT

-

: SWOT ANALYSIS

-

OVERVIEW SNAPSHOT

Leave a Comment