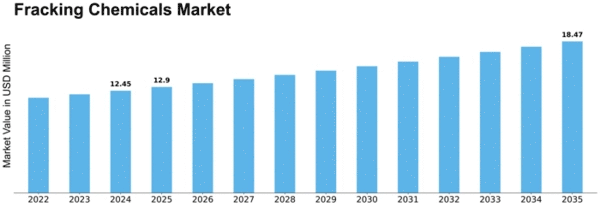

Fracking Chemicals Size

Fracking Chemicals Market Growth Projections and Opportunities

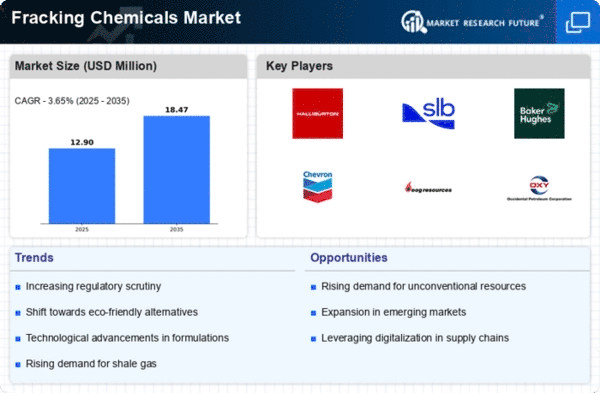

The Fracking Chemicals Market is significantly influenced by various market factors that play a pivotal role in shaping its dynamics. One of the primary drivers of this market is the increasing global demand for energy. With a growing population and industrialization, there is an escalating need for unconventional sources of oil and gas, and hydraulic fracturing, commonly known as fracking, has emerged as a key method to extract these resources. This surge in energy demand has directly contributed to the expansion of the fracking chemicals market, as these chemicals are integral to the fracking process, aiding in the extraction of hydrocarbons from underground reservoirs.

Moreover, government policies and regulations also exert a considerable impact on the fracking chemicals market. Environmental concerns related to fracking have led to the implementation of stringent regulations governing the use of chemicals in the process. As governments worldwide seek to strike a balance between energy needs and environmental sustainability, the market for fracking chemicals is influenced by the evolving regulatory landscape. Compliance with these regulations not only affects the composition of fracking chemicals but also stimulates innovation in the industry, driving the development of environmentally friendly alternatives.

Technological advancements represent another crucial factor shaping the fracking chemicals market. Continuous research and development efforts have led to the introduction of advanced fracking technologies and chemicals that enhance the efficiency and sustainability of the extraction process. Innovations such as the use of nanotechnology in fracking fluids and the development of bio-based chemicals are driving market growth and transforming the industry landscape. The adoption of these technological advancements by key players in the market plays a pivotal role in gaining a competitive edge and meeting the evolving demands of the industry.

Market dynamics are further influenced by the economic landscape. The fracking chemicals market is sensitive to fluctuations in oil and gas prices, which directly impact the level of investment in exploration and production activities. During periods of high oil and gas prices, there is an increased willingness to invest in unconventional extraction methods like fracking, leading to a surge in demand for fracking chemicals. Conversely, during periods of low prices, companies may scale back their operations, impacting the demand for these chemicals.

The geopolitical scenario also casts its shadow on the fracking chemicals market. Regions with abundant shale reserves and favorable regulatory environments tend to attract significant investments in fracking activities. Political stability and international relations play a crucial role in determining the growth prospects of the fracking chemicals market in specific geographical areas. Changes in geopolitical dynamics, trade policies, and global energy alliances can have far-reaching consequences on the market's trajectory.

Additionally, public awareness and perception of fracking practices contribute to market dynamics. Concerns about the environmental impact, water usage, and potential health hazards associated with fracking have led to public debates and activism. This heightened awareness influences public policy decisions, regulatory frameworks, and, subsequently, the market strategies of companies involved in the fracking chemicals industry.

Leave a Comment