Market Share

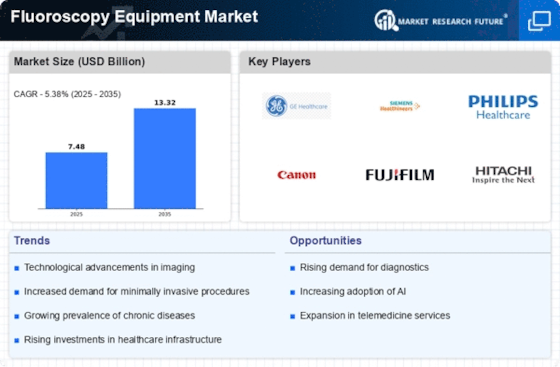

Fluoroscopy Equipment Market Share Analysis

One major trend is towards digital fluoroscopy systems. Key advantages of digital fluoroscopy over traditional analog systems include better picture quality, reduced radiation exposure and improved data handling capacity. As a result, there is increased demand for digital fluoroscopic procedures that are less expensive and patient-centered when compared to other approaches utilized within health care provider settings.

Furthermore, the market for Fluoroscopy Equipment is surging as more people are using mobile C-arm fluoroscopy devices. Mobile C-arms offer flexible imaging during surgical interventions, enabling orthopedic, cardiovascular and interventional radiology procedures to be guided by real-time visualization. Portability and versatility of Mobile C-arms enable them to be applied in various medical disciplines supporting a trend towards minimally invasive surgery and image guided procedures.

Moreover, the market for fluoroscopy equipment has seen an influx of innovations aimed at enhancing radiation safety among patients and healthcare professionals. Other functionalities such as dose monitoring, image noise reduction algorithms or pulsed fluoroscopy modes contained in advanced fluoroscopic systems minimize patients’ exposure to radiation during diagnosis and treatment. This concentration on the safety measures associated with radioactive materials is in line with regulations established by relevant authorities but also reflects the general intention of healthcare providers to optimize care.

The demand for specialized applications like cardiology, gastroenterology or urology drives change at Fluoroscopy Equipment Market. Manufacturers design their fluoro machines specifically for different medical procedures making it easier for doctors working within specific specialties being able to access them. More often than not these days fluoroscopes have been incorporated into many diagnostic as well as interventional practices.

In addition, there is a response from the market towards AI integration into fluoroscopy equipment. These include AI applications that enhance diagnostic performance through image enhancement or automated measurements as well as real-time guidance. The inclusion of artificial intelligence driven features makes it possible to make decisions much faster but still accurate thereby enhancing precision medicine and patient centered care.

Leave a Comment