Fiber Reinforced Plastic Grating Size

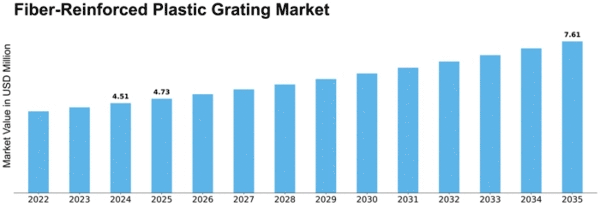

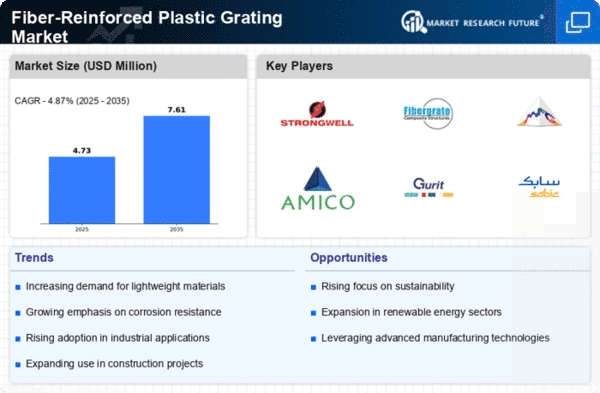

Fiber-Reinforced Plastic Grating Market Growth Projections and Opportunities

The Fiber-Reinforced Plastic (FRP) Grating Market is shaped by various market factors that contribute to its dynamics and growth. A significant driver is the increasing demand for lightweight, corrosion-resistant, and durable materials in industries such as construction, oil and gas, and transportation. FRP grating, composed of reinforced fibers within a plastic matrix, offers high strength-to-weight ratio and resistance to chemicals and corrosion. The versatility of FRP grating in applications such as walkways, platforms, and trench covers contributes to its growing demand.

Raw material availability and pricing play a crucial role in the FRP grating market. The primary raw materials for FRP include fiberglass reinforcements and thermosetting resins. Fluctuations in the prices of these raw materials, influenced by factors such as resin prices and supply-demand dynamics, impact the overall production cost of FRP grating. The availability of high-quality raw materials is essential for maintaining the performance and durability of FRP products.

Technological advancements in FRP manufacturing processes contribute to market growth. Innovations in molding techniques, resin formulations, and fiber reinforcements lead to the development of FRP grating with improved strength, durability, and design flexibility. Continuous research and development in the industry drive advancements, expanding the range of applications for FRP grating and influencing the market's expansion.

End-user industries significantly impact the demand for FRP grating. For instance, in the oil and gas sector, FRP grating is widely used in offshore platforms and chemical processing plants due to its corrosion resistance. Similarly, the construction industry employs FRP grating in applications requiring lightweight and durable flooring solutions. Companies in the FRP grating sector need to understand the specific requirements of these end-user industries to tailor their products accordingly and meet market demands.

Global economic conditions and trade policies also play a role in shaping the FRP grating market. Changes in international trade agreements, tariffs, and geopolitical factors can impact the supply chain, affecting both producers and consumers. Companies in the market must navigate these global economic dynamics to ensure stability in their operations and explore new opportunities in emerging markets.

Environmental considerations and sustainability play an increasingly important role in the FRP grating market. As industries and consumers prioritize eco-friendly and recyclable materials, the demand for sustainable FRP products grows. Companies that adopt green manufacturing processes, use recycled materials, and promote the environmental benefits of FRP grating can gain a competitive edge in the market.

Consumer preferences for high-performance and aesthetically pleasing products influence the FRP grating market. Industries and end-users seek materials that not only meet technical specifications but also contribute to the overall visual appeal of structures. FRP grating, with its design flexibility and color options, caters to these preferences. Companies focusing on product design, customization, and aesthetic features can attract a broader consumer base.

Weather conditions and climate considerations are essential factors in the FRP grating market, especially in applications exposed to outdoor environments. FRP's resistance to corrosion makes it suitable for use in marine environments, but extreme weather events or harsh conditions can impact the longevity and performance of FRP grating. Companies in the sector need to consider these weather-related factors in product development and applications.

Leave a Comment