Europe low carbon hydrogen market Analysis

Europe Low-carbon Hydrogen Market Research Report Information By Processes (Steam Methane Reforming (SMR), Auto-thermal Reforming Biomass Reforming, Electrolysis, Photo Electric Chemical (PEC) Water Splitting, Thermochemical Water Splitting, Biomass Gasification, Coal Gasification, And Methane Pyrolysis), By Energy Source (Natural Gas, Solar, Wind, Hybrid, Biomass, Geothermal, Hydro Energy, and...

Market Summary

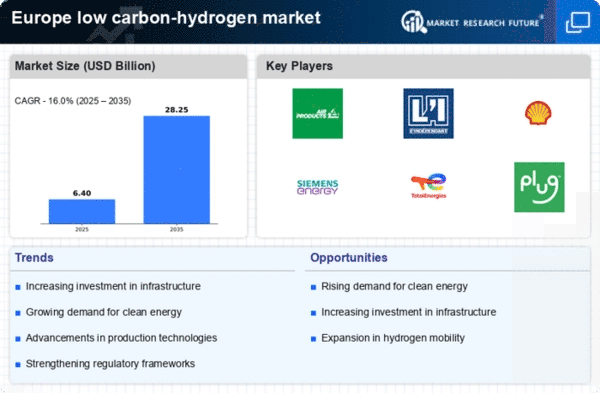

The Europe Low-carbon Hydrogen market is poised for substantial growth, projected to reach 45.3 USD Billion by 2035 from a base of 10.5 USD Billion in 2024.

Key Market Trends & Highlights

Europe Low-carbon Hydrogen Key Trends and Highlights

- The market valuation is expected to grow from 10.5 USD Billion in 2024 to 45.3 USD Billion by 2035.

- A compound annual growth rate (CAGR) of 14.21% is anticipated from 2025 to 2035.

- The increasing focus on sustainable energy solutions is driving the demand for low-carbon hydrogen in Europe.

- Growing adoption of low-carbon hydrogen technologies due to regulatory support is a major market driver.

Market Size & Forecast

| 2024 Market Size | 10.5 (USD Billion) |

| 2035 Market Size | 45.3 (USD Billion) |

| CAGR (2025 - 2035) | 14.21% |

| Largest Regional Market Share in 2024 | Europe) |

Major Players

Nestle (CH), Volkswagen (DE), LVMH (FR), BP (GB), Unilever (GB), Siemens (DE), Allianz (DE), Daimler (DE), Airbus (FR)

Market Trends

Growing investment in electrolysis technologies is driving market growth

Companies are scaling their electrolysis capacities, and technological advancements are reducing capital and operational costs, making low-carbon Hydrogen more competitive with conventional hydrogen production methods. The increasing investment in electrolysis technologies is expected to contribute significantly to the growth of the low-carbon hydrogen market in Europe, aligning with the region's commitment to a sustainable and carbon-neutral future.

This favorable regulatory environment attracts attention from various industries, fostering collaboration between public and private entities to advance the development and deployment of low-carbon hydrogen technologies. Thus driving the Low-carbon Hydrogen market revenue.

Europe low carbon hydrogen market Market Drivers

Market Segment Insights

Low-carbon Hydrogen Processes Insights

The Europe Low-carbon Hydrogen market segmentation, based on processes, includes Steam Methane Reforming (SMR), Auto-thermal Reforming, Biomass Reforming, Electrolysis, Photo Electric Chemical (PEC) Water Splitting, Thermochemical Water Splitting, Biomass Gasification, Coal Gasification, and Methane Pyrolysis. The steam methane reforming (SMR) segment dominated the market. It involves reacting methane with steam to produce Hydrogen and carbon dioxide. Despite its prevalence, the process emits CO2, prompting the pursuit of carbon capture and storage technologies to enhance its environmental profile. SMR remains a key contributor to Europe's evolving landscape of low-carbon hydrogen production.

Low-carbon Hydrogen Energy Source Insights

The Europe Low-carbon Hydrogen market segmentation, based on energy sources, includes Natural Gas, Solar, Wind, Hybrid, Biomass, Geothermal, Hydro Energy, and Tidal. The natural gas segment dominated the market. Natural gas, a key feedstock for hydrogen production through processes like steam methane reforming (SMR), contributes significantly to the region's low-carbon hydrogen production. This source emphasizes the transition towards cleaner energy solutions, aligning with Europe's commitment to reducing carbon emissions and fostering sustainable energy practices.

Low-carbon Hydrogen End-product Insights

The Europe Low-carbon Hydrogen market segmentation, based on end-product, includes Hydrogen, Ammonia, Liquefied Hydrogen, Methane, and Methanol. The hydrogen category generated the most income. In its various forms, Hydrogen emerges as a major company in the transition towards a low-carbon economy. The market showcases increasing applications of Hydrogen across industries, highlighting its role as a versatile and sustainable energy carrier for diverse end-users in Europe.

Figure 1: Europe Low-carbon Hydrogen Market, by End-product, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Low-carbon Hydrogen Country Insights

The rapid expansion of the hydrogen infrastructure has resulted in a boom in demand for Low-carbon Hydrogen in Europe in recent years. Germany's National Hydrogen Strategy aims to establish the country as a global leader in hydrogen technologies. At the same time, the UK's Hydrogen Strategy focuses on expanding production capacity and integrating Hydrogen into various sectors. The Netherlands is investing in offshore wind projects to produce green Hydrogen. Additionally, collaboration between European nations through initiatives like the European Clean Hydrogen Alliance fosters a pan-European approach to developing a low-carbon hydrogen economy.

This concerted effort reflects the region's commitment to reducing carbon emissions and getting a more sustainable energy future.

Figure 2: Europe Low-carbon Hydrogen Market Share By Region 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Get more detailed insights about Europe Low-carbon Hydrogen Market Research Report – Forecast till 2032

Regional Insights

Key Players and Competitive Insights

Leading market players are investing majorly in research and development to spread their product lines, which will help the Europe Low-carbon Hydrogen market grow even more. The participants are also undertaking various strategic activities to spread their footprint with new market developments, including product launches, contractual agreements, mergers and acquisitions, major investments, and collaboration with other organizations. The low-carbon Hydrogen industry must offer cost-effective items to spread and survive in a competitive and rising market climate.

Major players in the Europe Low-carbon Hydrogen market are attempting to raise market demand by investing in research and development operations, including Green Hydrogen International, H2 Clean Energy, Intercontinental Energy Corp, and Fortescue Future Industries Pty Ltd.

Key Companies in the Europe low carbon hydrogen market market include

Industry Developments

September 2022:the Commission agreed with "IPCEI Hy2Use", which complements IPCEI Hy2 Tech and will support the construction of hydrogen-related infrastructure and developing new and more sustainable technologies for integrating Hydrogen into the industrial sector.

Market Segmentation

Low-carbon End-Product Outlook

- Hydrogen

- Ammonia

- Liquefied Hydrogen

- Methane

- Methanol

Low-carbon Hydrogen Regional Outlook

- Germany

- France

- UK

- Italy

- Spain

- Sweden

- Denmark

- Luxembourg

- Norway

- Austria

- Rest of Europe

Low-carbon Hydrogen Processes Outlook

- Steam Methane Reforming (SMR)

- Auto-thermal Reforming Biomass Reforming

- Electrolysis

- Photo Electric Chemical (PEC) Water Splitting

- Thermochemical Water Splitting

- Biomass Gasification

- Coal Gasification

- Methane Pyrolysis

Low-carbon Hydrogen Energy Source Outlook

- Natural Gas

- Solar

- Wind

- Hybrid

- Biomass

- Geothermal

- Hydro Energy

- Tidal

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2022 | USD XX Billion |

| Market Size 2023 | USD XX Billion |

| Market Size 2032 | USD XX Billion |

| Compound Annual Growth Rate (CAGR) | 5.20% (2023-2032) |

| Base Year | 2022 |

| Market Forecast Period | 2023-2032 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Processes, Energy Source, End-product, and Region |

| Region Covered | Europe |

| Countries Covered | Germany, France, UK, Italy, Spain, Sweden, Denmark, Luxembourg, Norway, Austria, and Rest of Europe |

| Key Companies Profiled | Green Hydrogen International, H2 Clean Energy, Intercontinental Energy Corp, and Fortescue Future Industries Pty Ltd. |

| Key Market Opportunities | Growing demand for cleaner alternatives |

| Key Market Dynamics | Growth in corporate awareness of the need for sustainable energy solutions Increasing use of Hydrogen in industries such as steel and chemicals |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Low-carbon hydrogen market?

The Europe Low-carbon Hydrogen market size was valued at USD XX Billion in 2022.

What is the growth rate of the Low-carbon Hydrogen market?

The market is projected to grow at a CAGR of 5.20% during the forecast period, 2023-2032.

Who are the key players in the Low-carbon Hydrogen market?

The key players in the market are Green Hydrogen International, H2 Clean Energy, Intercontinental Energy Corp, and Fortescue Future Industries Pty Ltd.

Which processes led to the Low-carbon Hydrogen market?

The steam methane reforming category dominated the market in 2022.

Which energy source had the largest market share in the Low-carbon Hydrogen market?

The natural gas category had the largest share of the market.

Which end-product had the largest market share in the Low-carbon Hydrogen market?

The hydrogen category had the largest share of the market.

-

List of Tables and Figures

- Table of Contents 1. Executive Summary 2. Market Introduction 2.1. Definition 2.2. Scope of the Study 2.2.1. Research Objective 2.2.2. Assumptions 2.2.3.Limitations 3. Research Methodology 3.1. Overview 3.2. Data Mining 3.3. Secondary Research 3.4. Primary Research 3.4.1. Primary Interviews and Information Gathering Process 3.4.2.Breakdown of Primary Respondents 3.5. Forecasting Model 3.6. Market Size Estimation 3.6.1. Bottom-up Approach 3.6.2. Top-Down Approach 3.7. Data Triangulation 3.8. Validation 4. MARKET DYNAMICS 4.1. Overview 4.2. Drivers 4.3. Restraints 4.4. Opportunities 5. MARKET FACTOR ANALYSIS 5.1. Value Chain Analysis 5.2. Porter’s Five Forces Analysis 5.2.1. Bargaining Power of Suppliers 5.2.2. Bargaining Power of Buyers 5.2.3. Threat of New Entrants 5.2.4. Threat of Substitutes 5.2.5. Intensity of Rivalry 5.3. COVID-19 Impact Analysis 5.3.1. Market Impact Analysis 5.3.2. Regional Impact 5.3.3. Opportunity and Threat Analysis 6. EUROPE LOW-CARBON HYDROGEN MARKET, BY PROCESSES 6.1. Overview 6.2. Steam Methane Reforming (SMR) 6.3. Auto-thermal Reforming Biomass Reforming 6.4. Electrolysis 6.5. Photo Electric Chemical (PEC) Water Splitting 6.6. Thermochemical Water Splitting 6.7. Biomass Gasification 6.8. Coal Gasification 6.9. Methane Pyrolysis 7. EUROPE LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE 7.1. Overview 7.2. Natural Gas 7.3. Solar 7.4. Wind 7.5. Hybrid 7.6. Biomass 7.7. Geothermal 7.8. Hydro Energy 7.9. Tidal 8. EUROPE LOW-CARBON HYDROGEN MARKET, BY END PRODUCT 8.1. Overview 8.2. Hydrogen 8.3. Ammonia 8.4. Liquefied Hydrogen 8.5. Methane 8.6. Methanol 9. EUROPE LOW-CARBON HYDROGEN MARKET, BY REGION 9.1. Overview 9.2. Europe 9.2.1. Germany 9.2.2. France 9.2.3. UK 9.2.4. Italy 9.2.5. Spain 9.2.6. Sweden 9.2.7. Denmark 9.2.8. Luxembourg 9.2.9. Norway 9.2.10. Austria 9.2.11. Rest of Europe 10. Competitive Landscape 10.1. Overview 10.2. Competitive Analysis 10.3. Market Share Analysis 10.4. Major Growth Strategy in the Europe Low-carbon Hydrogen Market, 10.5. Competitive Benchmarking 10.6. Leading Players in Terms of Number of Developments in the Europe Low-carbon Hydrogen Market, 10.7. Key developments and Growth Strategies 10.7.1. New Product Launch/Service Deployment 10.7.2. Merger & Acquisitions 10.7.3. Joint Ventures 10.8. Major Players Financial Matrix 10.8.1. Sales & Operating Income, 2022 10.8.2. Major Players R&D Expenditure. 2022 11. COMPANY PROFILES 11.1. Green Hydrogen International 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Products Offered 11.1.4. Key Developments 11.1.5. SWOT Analysis 11.1.6. Key Strategies 11.2. H2 CLEAN ENERGY 11.2.1. Company Overview 11.2.2. Financial Overview 11.2.3. Products Offered 11.2.4. Key Developments 11.2.5. SWOT Analysis 11.2.6. Key Strategies 11.3. INTERCONTINENTAL ENERGY CORPORATION 11.3.1. Company Overview 11.3.2. Financial Overview 11.3.3. Products Offered 11.3.4. Key Developments 11.3.5. SWOT Analysis 11.3.6. Key Strategies 11.4. FORTESCUE FUTURE INDUSTRIES PTY LTD. 11.4.1. Company Overview 11.4.2. Financial Overview 11.4.3. Products Offered 11.4.4. Key Developments 11.4.5. SWOT Analysis 11.4.6. Key Strategies 12. APPENDIX 12.1. References 12.2. Related Reports LIST OF TABLES

- TABLE 1 EUROPE LOW-CARBON HYDROGEN MARKET, SYNOPSIS, 2018-2032

- TABLE 2 EUROPE LOW-CARBON HYDROGEN MARKET, ESTIMATES & FORECAST, 2018-2032 (USD BILLION)

- TABLE 3 EUROPE LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 4 EUROPE LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 5 EUROPE LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 6 GERMANY: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 7 GERMANY: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 8 GERMANY: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 9 FRANCE: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 10 FRANCE: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 11 FRANCE: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 12 ITALY: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 13 ITALY: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 14 ITALY: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 15 SPAIN: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 16 SPAIN: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 17 SPAIN: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 18 UK: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 19 UK: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 20 UK: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 21 SWEDEN: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 22 SWEDEN: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 23 SWEDEN: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 24 DENMARK: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 25 DENMARK: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 26 DENMARK: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 27 LUXEMBOURG: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 28 LUXEMBOURG: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 29 LUXEMBOURG: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 30 NORWAY: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 31 NORWAY: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 32 NORWAY: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 33 AUSTRIA: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 34 AUSTRIA: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 35 AUSTRIA: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION)

- TABLE 36 REST OF EUROPE: LOW-CARBON HYDROGEN MARKET, BY PROCESSES, 2018-2032 (USD BILLION)

- TABLE 37 REST OF EUROPE: LOW-CARBON HYDROGEN MARKET, BY ENERGY SOURCE, 2018-2032 (USD BILLION)

- TABLE 38 REST OF EUROPE: LOW-CARBON HYDROGEN MARKET, BY END PRODUCT, 2018-2032 (USD BILLION) LIST OF FIGURES

- FIGURE 1 RESEARCH PROCESS

- FIGURE 2 MARKET STRUCTURE FOR THE EUROPE LOW-CARBON HYDROGEN MARKET

- FIGURE 3 MARKET DYNAMICS FOR THE EUROPE LOW-CARBON HYDROGEN MARKET

- FIGURE 4 EUROPE LOW-CARBON HYDROGEN MARKET, SHARE (%), BY PROCESSES, 2021

- FIGURE 5 EUROPE LOW-CARBON HYDROGEN MARKET, SHARE (%), BY ENERGY SOURCE, 2021

- FIGURE 6 EUROPE LOW-CARBON HYDROGEN MARKET, SHARE (%), BY END PRODUCT, 2021

- FIGURE 7 EUROPE LOW-CARBON HYDROGEN MARKET, SHARE (%), BY REGION, 2021

- FIGURE 8 EUROPE LOW-CARBON HYDROGEN MARKET: COMPANY SHARE ANALYSIS, 2021 (%)

- FIGURE 9 GREEN HYDROGEN INTERNATIONAL: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 10 GREEN HYDROGEN INTERNATIONAL: SWOT ANALYSIS

- FIGURE 11 H2 CLEAN ENERGY: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 12 H2 CLEAN ENERGY: SWOT ANALYSIS

- FIGURE 13 INTERCONTINENTAL ENERGY CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 14 INTERCONTINENTAL ENERGY CORPORATION: SWOT ANALYSIS

- FIGURE 15 FORTESCUE FUTURE INDUSTRIES PTY LTD.: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 16 FORTESCUE FUTURE INDUSTRIES PTY LTD.: SWOT ANALYSIS

Europe Low-carbon Hydrogen Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment