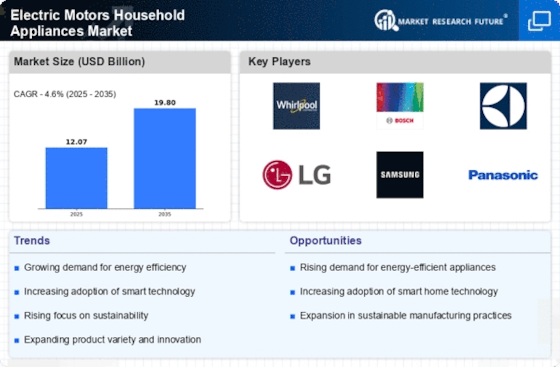

Leading market players invested heavily in research and Development (R&D) to scale up their manufacturing units and develop technologically advanced solutions, which will help the Electric Motors Household Appliances market grow worldwide. Market participants are also undertaking various organic or inorganic strategic approaches to strengthen and expand their global footprint, with significant market developments including new product portfolios, contractual deals, mergers and acquisitions, capital expenditure, higher investments, and strategic alliances with other organizations. Businesses are also coming up with marketing strategies such as digital marketing, social media influencing, and content marketing to increase their scope of profit earnings.

The Electric Motors Household Appliances industry must offer cost-effective and sustainable options to survive in a highly fragmented and dynamic market climate.

Manufacturing locally to minimize operational expenses and offer aftermarket services to customers is one of the critical business strategies organizations use in the global Electric Motors Household Appliances industry to benefit customers and capture untapped market share and revenue. The Electric Motors Household Appliances industry has recently offered significant advantages to the Industrial Motors, Pumps, and Control Devices industry. Moreover, more industry participants are utilizing and adopting cutting-edge Technology has grown substantially.

Major players in the Electric Motors Household Appliances market, including Johnson Electric Holdings Limited (Hong Kong), EBM-PAPST (Germany), Nichibo DC Motor (China), Sunonwealth Electric Machine Industry Co., Ltd. (Taiwan), Nidec Motor Corporation (Japan), Cebi Group (Luxembourg), Elica S.p.A. (Italy), Newmotech Co., Ltd (South Korea), Diehl Stiftung & Co. KG (Germany), Dumore Motors (US), CG Power and Industrial Solutions Limited (India), NMB (US), Panasonic Corporation (Japan), Keli Motor Group Co., Ltd. (China), and Sanhua Aweco (Germany) are attempting to expand market share and demand by investing in R&D operations to produce sustainable and affordable solutions.

General Electric Company is a multinational technology & financial services organization. It works in four categories: power, renewable energy, aerospace, and finance. Thomas Alva Edison created the corporation in 1878, and it has its headquarters in Boston, Massachusetts. GE Appliances confirmed proposals to spend 450 million dollars in its huge Kentucky plants to increase production and introduce novel offerings on October 29, 2021.

Siemens is a worldwide powerhouse focused on electricity production and shipping, smart technologies for building and renewable power systems, and manufacturing and manufacturing automation & digitalization. Siemens stated in March 2021 that the Simotics SD motor series versions would now be developed to deliver Superior Efficiency level performance by the requirements of the European ErP Directive. The business also indicated that its electrical motors would be offered in the IE4 spectrum, with power ratings ranging from roughly 3 HP to over 1,300 HP and varied pole designs.