Market Trends

Key Emerging Trends in the Education PC Market

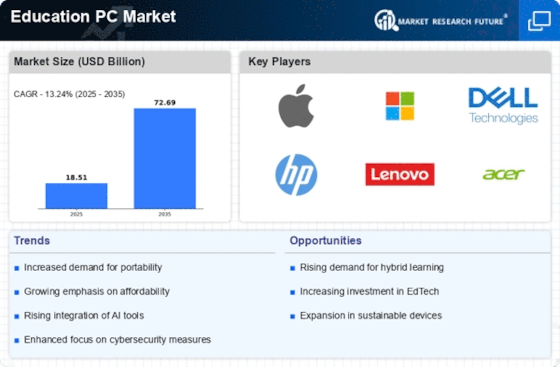

The education PC market is in the process of full-size transformations shaped by evolving technological wishes within the schooling sector. One outstanding trend is the growing demand for flexible and inexpensive devices that cater to numerous getting-to-know environments. Traditional computing device computers are being supplemented and, in a few instances, changed by greater portable and flexible alternatives, together with laptops and a couple of-in-1 gadgets. The shift in the direction of mobility in education PCs aligns with the growing emphasis on faraway and hybrid learning models, permitting students and educators to engage in virtual mastering studies both inside and outside the lecture room. Another key driver inside the education PC market is the integration of cloud computing and online collaboration tools. Education PCs are increasingly designed to leverage cloud-primarily based services, allowing the seamless right of entry to academic resources, collaboration structures, and storage solutions. This fashion supports the evolving nature of training, where students and educators require a clean right of entry to a whole lot of virtual content material and collaborative equipment to enhance the knowledge of enjoyment. The education PC market is likewise responding to the developing importance of cybersecurity in educational institutions. With the increasing reliance on digital structures and online knowledge, there's a heightened consciousness of the need for robust safety features to protect sensitive student and institutional information. Education PCs are being prepared with improved safety capabilities, consisting of biometric authentication, encrypted garage, and steady boot procedures, to guard against cyber threats and ensure steady mastering surroundings. Moreover, the integration of digital and augmented truth (VR/AR) technologies is a notable fashion in the education PC market. These technologies are being harnessed to create immersive academic reviews, allowing students to discover digital environments, conduct digital experiments, and engage in interactive simulations. The use of VR/AR in education PCs complements the visible and experiential elements of mastering, making complex principles more accessible and fostering more student engagement.

Leave a Comment