Market Analysis

In-depth Analysis of Diffusion Equipment Market Industry Landscape

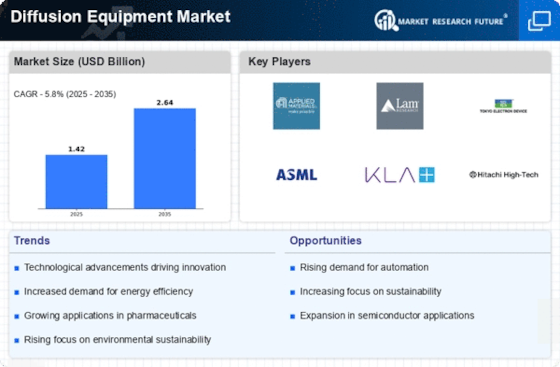

The global diffusion equipment market is set to reach US$ 1.993 BN by 2032, at a 5.80% CAGR between years 2023-2032. In terms of market dynamics, the common features in diffusion equipment market show how these fields are model toward change. A range of sensitive industries like semiconductor manufacturing, healthcare, and environmental monitoring requires diffusion materials. Since the propelling factor that lubricates the growth of this market is demand in advanced technologies, which enact proper diffusion processes, timely and specifically. On the growth of the market dynamics, one major aspect worth stating is the fast development in the semiconductor industry. New developments in the electronic devices that are tinier and complex make diffusion gases control more critical as trajectories of such diffusion diminishes. The given manufacturing process is impossible to use without such diffusion equipment as diffusion furnaces and systems that suffices for the deposition of various materials on semiconductor wafers. Therefore, the market is closely related to more rapid growth of the semiconductor market as well as ongoing technological evolution in this sector.

The diffusion equipment market is deeply influenced by the technological innovation that has been characterized as one of the chief driving forces for developing this sector. Diffusion processes are benefited by investment of the manufacturers into R&D and this leads to improved efficiency, accuracy, and reliability aspects that such process encompasses in their functioning. These include design and production of sophisticated advanced diffusion furnaces, CVD equipment, and other diffusions that are capable of meeting present day tough manufacturing benchmarks. The chemicals industry is in competition with itself because the search for better solutions brings about uniformity of dissolution, faster processing speeds and compatibility with numerous materials. Additionally, global problems which are related to the environment facilitate dynamics of the diffusion equipment market. This is consistent with the fact that it has become apparent for industries to use environmentally protective diffusion technologies so as to minimize their impact on nature.

This would involve use of alternative gases, development and utilization of diffusion apparatuses which minimize emissions Hence. With sustainability taking center stage in the world of business, market players such as those that specialize in diffusion equipment rise to the occasion through innovations that reflect green manufacturing ethos. Apart from the landscape insights, it is also essential to refer to market dynamics which are further supported by growing scenes for diffusion gear utilizations in healthcare and life sciences. Consequently, in medical research, manufacturing of pharmaceuticals and the development of technologically advanced materials used in medical devices for biosensors and biochips, diffusion processes are essential. Still, these special applications require more exact control such as the diffusion temperature and gas flow rates yet are in high demand for making various distinctive diffusion equipment adjustable to meet their specific needs.

Leave a Comment