Market Trends

Key Emerging Trends in the Diffusion Equipment Market

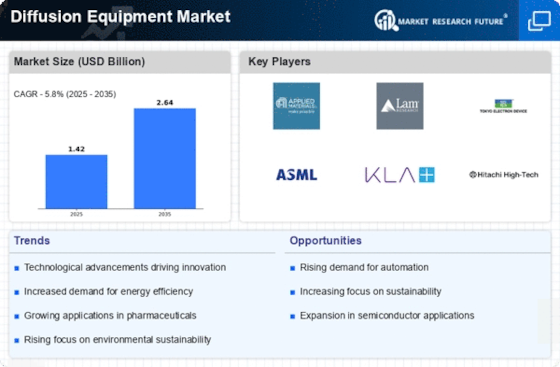

The trends in the diffusion equipment market are marked with a significant level of growth related to changing technologies and emerging needs by different industries. A notable development is greater need for diffusion innovations in manufacturing practices. With the industries striving harder and ranging each other trying to achieve better efficiency in materials coating, diffusion equipment is proving itself a necessity for many. Some of these include Chemical vapor deposition (CVD) and physical vapor deposition (PVD) technologies that are having a growing uptake. These methods allow the formation of thin films over surfaces which leads to improvement in their hardness, durability, and characteristics for widespread use by industries such as electronics, optics, and aerospace. Additionally, ALD is widely adopted to meet the demand for newer materials due to which the market for diffusion equipment registers a sharp rise.

ALD is becoming increasingly popular because of its ability to deliver homogeneous and conformal ultrathin films with the high level of precision regarding the film deposition thickness. This trend is consistent with the increasing necessity of miniaturization in the new generation of electronics, as ALD makes it possible to deposit required thin film coatings on intricate and fragile surfaces. As a result, this will ensure best functionality on semiconductor manufacturing devices. Another remarkable tendency nowadays is the commitment to environmental diffusion processes. Following increasing demand for sustainability and economical methods of manufacturing, industries are looking for machinery or diffusion equipment that causes very few environmental problems. Green chemistry and water-based diffusion processes become a popular topic that principle is part of the global tendency to involve more responsibly in manufacturing business with regard to ecological factors. This trend is distinctively observed in industries such as textiles and their products where environmentally responsible diffusion processes have become increasingly part of addressing the consumer expectations for green materials. Moreover, the evolution of diffusion technology involves automation and digitalization.

Automation brings a greater degree of precision, proficiency, and effectiveness to diffusion processes. Some of the key characteristics of innovative equipment are real-time monitoring, predictive maintenance, use of analytics among many others as this initiative gain popularity due to Industry 4.0. This phenomenon is not only beneficial for the overall control of process but also makes its impact in cutting down the downtime and achieving optimum utilization of resources inside a manufacturing set up. Additionally, the diffusion equipment market is expending in customization to seek different industries’ specific needs. Manufacturers are coming up with diffusion systems that have modular design so that the users can customize their need from these designing panels. This customization tendency is, however, even more common in research and development environments where the flexibility of diffusion processes requires adaptability as experimental and innovation-altering mechanisms.

Leave a Comment