-

Executive Summary

-

2

-

Market Introduction

-

Market Definition

-

2.2

-

Scope of the Study

-

Market Structure

-

3

-

Research Methodology

-

Primary Research

-

3.2

-

Secondary Research

-

Market size Estimation

-

3.4

-

Forecast Model

-

List of Assumptions

-

3.6

-

Limitations of the Study

-

Market Insights

-

5

-

Market Dynamics

-

Introduction

-

5.2

-

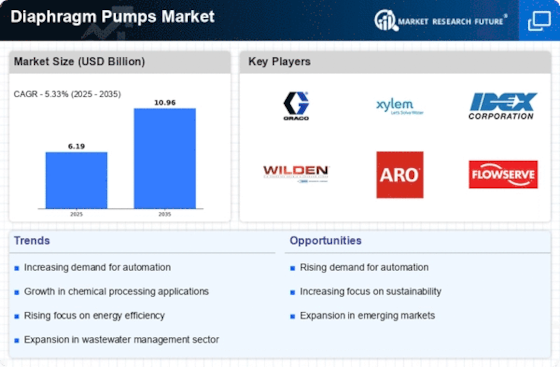

Market Drivers

-

Market Restraints

-

5.4

-

Market Opportunities

-

Value Chain/Supply Chain Analysis

- Threat of New

- Bargaining Power of Buyers

- Threat of Substitutes

-

5.6

-

Porter’s Five Forces Analysis

-

Entrants

-

5.6.3

-

Bargaining Power of Suppliers

-

5.6.5

-

Intensity of Rivalry

-

6

-

Global Diaphragm Pumps Market, By Operation

-

Introduction

- Market Estimates & Forecast,

- Market Estimates & Forecast, By Region/Country,

-

6.2

-

Single Acting

-

Double Acting

- Market

- Market Estimates

-

Estimates & Forecast, 2023-2032

-

& Forecast, By Region/Country, 2023-2032

-

Global Diaphragm

-

Pumps Market, By Mechanism

-

Introduction

- Market Estimates & Forecast,

- Market Estimates & Forecast, By Region/Country,

-

7.2

-

Air Operated

-

Electrically Operated

- Market

- Market Estimates

-

Estimates & Forecast, 2023-2032

-

& Forecast, By Region/Country, 2023-2032

-

Global Diaphragm

-

Pumps Market, By Discharge Pressure

-

Introduction

- Market Estimates & Forecast,

- Market Estimates & Forecast, By Region/Country,

-

8.2

-

Up to 80 bar

-

80 to 200 bar

- Market

- Market Estimates

-

Estimates & Forecast, 2023-2032

-

& Forecast, By Region/Country, 2023-2032

-

Above

-

bar

-

8.4.2

-

Market Estimates & Forecast, 2023-2032

-

Market Estimates & Forecast, By Region/Country, 2023-2032

-

9

-

Global Diaphragm Pumps Market, By End-Use

-

Introduction

- Market Estimates & Forecast,

- Market Estimates & Forecast, By Region/Country,

-

9.2

-

Oil & Gas

-

Food & Beverage

- Market

- Market Estimates

-

Estimates & Forecast, 2023-2032

-

& Forecast, By Region/Country, 2023-2032

-

Water

- Market Estimates & Forecast,

- Market Estimates & Forecast, By Region/Country,

-

& Wastewater

-

Chemicals

- Market

- Market Estimates

-

Estimates & Forecast, 2023-2032

-

& Forecast, By Region/Country, 2023-2032

-

Pharmaceuticals

- Market

-

9.6.1

-

Market Estimates & Forecast, 2023-2032

-

Estimates & Forecast, By Region/Country, 2023-2032

-

Power

- Market Estimates & Forecast,

- Market Estimates & Forecast, By Region/Country,

-

Generation

-

Others

- Market

- Market Estimates

-

Estimates & Forecast, 2023-2032

-

& Forecast, By Region/Country, 2023-2032

-

Global

-

Diaphragm Pumps Market, By Region

-

Introduction

- Market Estimates & Forecast,

- Market Estimates & Forecast,

- Market Estimates & Forecast,

- Market Estimates & Forecast,

- Market Estimates & Forecast,

- US

- Canada

-

10.2

-

North America

-

By Operation, 2023-2032

-

By Mechanism, 2023-2032

-

By Discharge Pressure, 2023-2032

-

By End-Use , 2023-2032

-

By Country, 2023-2032

-

Estimates & Forecast, By Operation, 2023-2032

-

Estimates & Forecast, By Mechanism, 2023-2032

-

Estimates & Forecast, By Discharge Pressure, 2023-2032

-

Estimates & Forecast, By End-Use , 2023-2032

-

10.2.7.1

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.2.7.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.2.7.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.2.7.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.2.8

-

Mexico

-

By Operation, 2023-2032

-

Forecast, By Mechanism, 2023-2032

-

Forecast, By Discharge Pressure, 2023-2032

-

Estimates & Forecast, By End-Use , 2023-2032

-

10.3.1

-

Market Estimates & Forecast,

-

Market Estimates &

-

Market Estimates &

-

Market

-

Europe

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.3.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.3.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.3.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.3.5

-

Market Estimates & Forecast, By Country, 2023-2032

-

10.3.6

-

UK

-

Pressure, 2023-2032

-

By End-Use , 2023-2032

-

10.3.7.1

-

Market Estimates & Forecast, By Operation,

-

Market Estimates & Forecast, By Mechanism,

-

Market Estimates & Forecast, By Discharge

-

Market Estimates & Forecast,

-

Germany

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.3.7.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.3.7.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.3.7.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.3.8

-

France

-

By Operation, 2023-2032

-

Forecast, By Mechanism, 2023-2032

-

Forecast, By Discharge Pressure, 2023-2032

-

& Forecast, By End-Use , 2023-2032

-

10.3.9.1

-

Market Estimates & Forecast,

-

Market Estimates &

-

Market Estimates &

-

Market Estimates

-

Italy

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.3.9.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.3.9.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.3.9.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.3.10

-

Rest of Europe

-

By Operation, 2023-2032

-

Forecast, By Mechanism, 2023-2032

-

Forecast, By Discharge Pressure, 2023-2032

-

& Forecast, By End-Use , 2023-2032

-

10.4.1

-

Market Estimates & Forecast,

-

Market Estimates &

-

Market Estimates &

-

Market Estimates

-

Asia-Pacific

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.4.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.4.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.4.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.4.5

-

Market Estimates & Forecast, By Country, 2023-2032

-

10.4.6.1

-

China

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.4.6.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.4.6.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.4.6.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.4.7

-

India

-

Pressure, 2023-2032

-

By End-Use , 2023-2032

-

10.4.8.1

-

Market Estimates & Forecast, By Operation,

-

Market Estimates & Forecast, By Mechanism,

-

Market Estimates & Forecast, By Discharge

-

Market Estimates & Forecast,

-

Japan

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.4.8.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.4.8.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.4.8.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.4.9

-

Australia

-

Forecast, By Operation, 2023-2032

-

Forecast, By Mechanism, 2023-2032

-

Forecast, By Discharge Pressure, 2023-2032

-

& Forecast, By End-Use , 2023-2032

-

10.4.10.1

-

Market Estimates &

-

Market Estimates &

-

Market Estimates &

-

Market Estimates

-

Rest of Asia-Pacific

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.4.10.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.4.10.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.4.10.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.5

-

Middle East & Africa

-

& Forecast, By Operation, 2023-2032

-

& Forecast, By Mechanism, 2023-2032

-

& Forecast, By Discharge Pressure, 2023-2032

-

Estimates & Forecast, By End-Use , 2023-2032

-

Estimates & Forecast, By Country, 2023-2032

-

Arabia

-

Pressure, 2023-2032

-

By End-Use , 2023-2032

-

10.5.7.1

-

Market Estimates

-

Market Estimates

-

Market Estimates

-

Market

-

Market

-

Saudi

-

Market Estimates & Forecast, By Operation,

-

Market Estimates & Forecast, By Mechanism,

-

Market Estimates & Forecast, By Discharge

-

Market Estimates & Forecast,

-

UAE

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.5.7.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.5.7.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.5.7.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.5.8

-

South Africa

-

Forecast, By Operation, 2023-2032

-

Forecast, By Mechanism, 2023-2032

-

Forecast, By Discharge Pressure, 2023-2032

-

& Forecast, By End-Use , 2023-2032

-

Middle East & Africa

-

Forecast, By Operation, 2023-2032

-

Forecast, By Mechanism, 2023-2032

-

Forecast, By Discharge Pressure, 2023-2032

-

& Forecast, By End-Use , 2023-2032

-

10.6.1

-

Market Estimates &

-

Market Estimates &

-

Market Estimates &

-

Market Estimates

-

Rest of the

-

Market Estimates &

-

Market Estimates &

-

Market Estimates &

-

Market Estimates

-

South America

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.6.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.6.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.6.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.6.5

-

Market Estimates & Forecast, By Country, 2023-2032

-

10.6.6.1

-

Brazil

-

Market Estimates & Forecast, By Operation, 2023-2032

-

10.6.6.2

-

Market Estimates & Forecast, By Mechanism, 2023-2032

-

10.6.6.3

-

Market Estimates & Forecast, By Discharge Pressure, 2023-2032

-

10.6.6.4

-

Market Estimates & Forecast, By End-Use , 2023-2032

-

10.6.7

-

Argentina

-

By Operation, 2023-2032

-

Forecast, By Mechanism, 2023-2032

-

Forecast, By Discharge Pressure, 2023-2032

-

& Forecast, By End-Use , 2023-2032

-

America

-

By Operation, 2023-2032

-

Forecast, By Mechanism, 2023-2032

-

Forecast, By Discharge Pressure, 2023-2032

-

& Forecast, By End-Use , 2023-2032

-

Market Estimates & Forecast,

-

Market Estimates &

-

Market Estimates &

-

Market Estimates

-

Rest of South

-

Market Estimates & Forecast,

-

Market Estimates &

-

Market Estimates &

-

Market Estimates

-

Competitive

-

Landscape

-

Competitive Scenario

-

11.2

-

Competitive Benchmarking of the Global Diaphragm Pumps Market

-

11.3

-

Major Growth Strategy in the Global Diaphragm Pumps Market

-

11.4

-

Market Share Analysis: Global Diaphragm Pumps Market

-

11.5

-

IDEX: The Leading Player in terms of Number of Developments in Global Diaphragm

-

Pumps Market

-

New Product Development

-

11.7

-

Mergers & Acquisitions

-

Contracts &

-

Agreements

-

Expansions & Investments

-

12

-

Company Profile

-

IDEX Corporation (US)

- Product/Services Offering

- Key Developments

- SWOT Analysis

-

12.1.1

-

Company Overview

-

12.1.3

-

Financial Overview

-

12.1.5

-

Strategy

-

YAMADA

- Company Overview

- Financial Overview

- Strategy

-

Corporation (Japan)

-

12.2.2

-

Product /Services Offering

-

12.2.4

-

Key Developments

-

12.2.6

-

SWOT Analysis

-

Flowserve Corporation (US)

- Product /Services Offering

- Key Developments

- SWOT Analysis

-

12.3.1

-

Company Overview

-

12.3.3

-

Financial Overview

-

12.3.5

-

Strategy

-

Ingersoll-Rand

- Company Overview

- Product

- Financial Overview

- Strategy

-

Plc (Ireland)

-

/Services Offering

-

12.4.4

-

Key Developments

-

12.4.6

-

SWOT Analysis

-

Grundfos Holding A/S (Denmark)

- Product /Services Offering

- Key Developments

- SWOT Analysis

-

12.5.1

-

Company Overview

-

12.5.3

-

Financial Overview

-

12.5.5

-

Strategy

-

Xylem,

- Company Overview

- Product

- Financial Overview

- Strategy

-

Inc. (US)

-

/Services Offering

-

12.6.4

-

Key Developments

-

12.6.6

-

SWOT Analysis

-

SPX Flow (US)

- Company

- Product /Services Offering

- Key Developments

- SWOT Analysis

-

Overview

-

12.7.3

-

Financial Overview

-

12.7.5

-

Strategy

-

Pump

- Company Overview

- Financial Overview

- Strategy

-

Solutions Group (US)

-

12.8.2

-

Product /Services Offering

-

12.8.4

-

Key Developments

-

12.8.6

-

SWOT Analysis

-

LEWA GmbH (Germany)

- Product /Services Offering

- Key Developments

- SWOT Analysis

-

12.9.1

-

Company Overview

-

12.9.3

-

Financial Overview

-

12.9.5

-

Strategy

-

Verder

- Company Overview

- Financial Overview

- Strategy

-

International B.V. (The Netherlands)

-

12.10.2

-

Product /Services Offering

-

12.10.4

-

Key Developments

-

12.10.6

-

SWOT Analysis

-

TAPFLO AB (Sweden)

- Product /Services Offering

- Key Developments

- SWOT Analysis

-

12.11.1

-

Company Overview

-

12.11.3

-

Financial Overview

-

12.11.5

-

Strategy

-

Leak-Proof

- Company Overview

- Financial Overview

- Strategy

-

Pumps (I) Pvt. Ltd. (India)

-

12.12.2

-

Product /Services Offering

-

12.12.4

-

Key Developments

-

12.12.6

-

SWOT Analysis

-

All-Flo Pump Co. (US)

- Product /Services Offering

- Key Developments

- SWOT Analysis

-

12.13.1

-

Company Overview

-

12.13.3

-

Financial Overview

-

12.13.5

-

Strategy

-

AxFlow

- Company Overview

- Financial Overview

- Strategy

-

Holding AB (Sweden)

-

12.14.2

-

Product /Services Offering

-

12.14.4

-

Key Developments

-

12.14.6

-

SWOT Analysis

-

KNF Neuberger (Germany)

- Product /Services Offering

- Key Developments

- SWOT Analysis

-

12.15.1

-

Company Overview

-

12.15.3

-

Financial Overview

-

12.15.5

-

Strategy

-

Appendix

-

13.1

-

References

-

Related Reports

-

13.3

-

List of Abbreviations

-

List of Tables

-

Table 1

-

Global Diaphragm Pumps Market, By Operation,

-

Table 2

-

Global Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD

-

Million)

-

Table 3

-

Global Diaphragm Pumps Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table

-

Global Diaphragm

-

Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Table 5

-

Global Diaphragm Pumps Market, By Region, 2023-2032

-

(USD Million)

-

Table 6

-

North America Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table

-

North America

-

Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Table 8

-

North America Diaphragm Pumps

-

Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table 9

-

North America Diaphragm Pumps

-

Market, By End-Use, 2023-2032 (USD Million)

-

North

-

America Diaphragm Pumps Market, By Country, 2023-2032 (USD Million)

-

Table 11

-

US Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table

-

US Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

US Diaphragm Pumps Market, By Discharge

-

Pressure, 2023-2032 (USD Million)

-

US Diaphragm

-

Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Table 15

-

Canada Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table

-

Canada Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD

-

Million)

-

Canada Diaphragm Pumps

-

Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table 18

-

Canada Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Table

-

Mexico Diaphragm Pumps Market, By Operation, 2023-2032 (USD

-

Million)

-

Mexico Diaphragm Pumps Market, By Mechanism,

-

Mexico Diaphragm

-

Pumps Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table

-

Mexico Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Europe Diaphragm Pumps Market, By Operation,

-

Europe Diaphragm Pumps

-

Market, By Mechanism, 2023-2032 (USD Million)

-

Europe

-

Diaphragm Pumps Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table

-

Europe Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Europe Diaphragm Pumps Market, By Country,

-

UK Diaphragm Pumps Market,

-

By Operation, 2023-2032 (USD Million)

-

UK

-

Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Table

-

UK Diaphragm Pumps Market, By Discharge Pressure, 2023-2032

-

(USD Million)

-

UK Diaphragm Pumps Market,

-

By End-Use, 2023-2032 (USD Million)

-

Germany

-

Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table 33

-

Germany Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Germany Diaphragm Pumps Market, By Discharge

-

Pressure, 2023-2032 (USD Million)

-

Germany

-

Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Table

-

France Diaphragm Pumps Market, By Operation, 2023-2032 (USD

-

Million)

-

France Diaphragm Pumps Market, By Mechanism,

-

France

-

Diaphragm Pumps Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table

-

France Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Italy Diaphragm Pumps Market, By Operation,

-

Italy Diaphragm Pumps

-

Market, By Mechanism, 2023-2032 (USD Million)

-

Table 42

-

Italy Diaphragm Pumps Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Italy Diaphragm Pumps Market, By End-Use,

-

Rest of Europe

-

Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table 45

-

Rest of Europe Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Rest of Europe Diaphragm Pumps

-

Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table 47

-

Rest of Europe Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Asia-Pacific Diaphragm Pumps Market, By

-

Operation, 2023-2032 (USD Million)

-

Asia-Pacific

-

Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Table 50

-

Asia-Pacific Diaphragm Pumps Market, By Discharge Pressure, 2023-2032 (USD

-

Million)

-

Asia-Pacific Diaphragm Pumps

-

Market, By End-Use, 2023-2032 (USD Million)

-

Asia-Pacific

-

Diaphragm Pumps Market, By Country, 2023-2032 (USD Million)

-

China

-

Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table 54

-

China Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

China Diaphragm Pumps Market, By Discharge

-

Pressure, 2023-2032 (USD Million)

-

China

-

Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million

-

Table 57

-

India Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table

-

India Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD

-

Million)

-

India Diaphragm Pumps Market,

-

By Discharge Pressure, 2023-2032 (USD Million)

-

India

-

Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million

-

Table 61

-

Japan Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table

-

Japan Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD

-

Million)

-

Japan Diaphragm Pumps

-

Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table 64

-

Japan Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million

-

Table

-

Australia Diaphragm Pumps Market, By Operation, 2023-2032 (USD

-

Million)

-

Australia Diaphragm Pumps Market, By Mechanism,

-

Australia

-

Diaphragm Pumps Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table

-

Australia Diaphragm Pumps Market, By End-Use, 2023-2032 (USD

-

Million

-

Rest of Asia-Pacific Diaphragm Pumps Market,

-

By Operation, 2023-2032 (USD Million)

-

Rest

-

of Asia-Pacific Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Table

-

Rest of Asia-Pacific Diaphragm Pumps Market, By Discharge Pressure,

-

Rest of Asia-Pacific

-

Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million

-

Table 73

-

South America Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table

-

South America Diaphragm Pumps Market, By Mechanism, 2023-2032

-

(USD Million)

-

South America Diaphragm Pumps

-

Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table 76

-

South America Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million)

-

South America Diaphragm Pumps Market, By

-

Country, 2023-2032 (USD Million)

-

Brazil Diaphragm Pumps

-

Market, By Operation, 2023-2032 (USD Million)

-

Brazil

-

Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Table

-

Brazil Diaphragm Pumps Market, By Discharge Pressure, 2023-2032

-

(USD Million)

-

Brazil Diaphragm Pumps

-

Market, By End-Use, 2023-2032 (USD Million)

-

Argentina

-

Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table 83

-

Argentina Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Argentina Diaphragm Pumps Market, By Discharge

-

Pressure, 2023-2032 (USD Million)

-

Argentina

-

Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Table

-

Rest of South America Diaphragm Pumps Market, By Operation,

-

Rest of South America

-

Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Table

-

Rest of South America Diaphragm Pumps Market, By Discharge

-

Pressure, 2023-2032 (USD Million)

-

Rest

-

of South America Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Table

-

Middle East & Africa Diaphragm Pumps Market, By Operation,

-

Middle East & Africa

-

Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Table 92

-

Middle East & Africa Diaphragm Pumps Market, By Discharge Pressure, 2023-2032

-

(USD Million)

-

Middle East & Africa Diaphragm

-

Pumps Market, By End-Use, 2023-2032 (USD Million)

-

Saudi

-

Arabia Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table

-

Saudi Arabia Diaphragm Pumps Market, By Mechanism, 2023-2032

-

(USD Million)

-

Saudi Arabia Diaphragm

-

Pumps Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table

-

Saudi Arabia Diaphragm Pumps Market, By End-Use, 2023-2032

-

(USD Million)

-

UAE Diaphragm Pumps Market,

-

By Operation, 2023-2032 (USD Million)

-

UAE

-

Diaphragm Pumps Market, By Mechanism, 2023-2032 (USD Million)

-

Table

-

UAE Diaphragm Pumps Market, By Discharge Pressure, 2023-2032

-

(USD Million)

-

UAE Diaphragm Pumps Market,

-

By End-Use, 2023-2032 (USD Million)

-

Table 102

-

South Africa Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table

-

South Africa Diaphragm Pumps Market, By Mechanism, 2023-2032

-

(USD Million)

-

South Africa Diaphragm

-

Pumps Market, By Discharge Pressure, 2023-2032 (USD Million)

-

Table

-

South Africa Diaphragm Pumps Market, By End-Use, 2023-2032

-

(USD Million)

-

Rest of the Middle East

-

& Africa Diaphragm Pumps Market, By Operation, 2023-2032 (USD Million)

-

Table

-

Rest of the Middle East & Africa Diaphragm Pumps Market,

-

By Mechanism, 2023-2032 (USD Million)

-

Rest

-

of the Middle East & Africa Diaphragm Pumps Market, By Discharge Pressure, 2023-2032

-

(USD Million)

-

Rest of the Middle East

-

& Africa Diaphragm Pumps Market, By End-Use, 2023-2032 (USD Million)

-

-

List of Figures

-

FIGURE

-

RESEARCH PROCESS OF MRFR

-

TOP

-

DOWN & BOTTOM UP APPROACH

-

MARKET DYNAMICS

-

FIGURE

-

IMPACT ANALYSIS: MARKET DRIVERS

-

IMPACT

-

ANALYSIS: MARKET RESTRAINTS

-

PORTER’S FIVE FORCES

-

ANALYSIS

-

SUPPLY CHAIN ANALYSIS

-

FIGURE 8

-

GLOBAL DIAPHRAGM PUMPS MARKET SHARE, BY OPERATION, 2032 (%)

-

FIGURE 9

-

GLOBAL DIAPHRAGM PUMPS MARKET SHARE, BY MECHANISM, 2032 (%)

-

FIGURE 10

-

GLOBAL DIAPHRAGM PUMPS MARKET, BY MECHANISM, 2023-2032 (USD Million)

-

FIGURE

-

GLOBAL DIAPHRAGM PUMPS MARKET SHARE, BY DISCHARGE PRESSURE,

-

GLOBAL DIAPHRAGM PUMPS MARKET, BY DISCHARGE

-

PRESSURE, 2023-2032 (USD Million)

-

GLOBAL DIAPHRAGM

-

PUMPS MARKET SHARE, BY END-USE , 2032 (%)

-

GLOBAL

-

DIAPHRAGM PUMPS MARKET, BY END-USE , 2023-2032 (USD Million)

-

GLOBAL

-

DIAPHRAGM PUMPS MARKET SHARE (%), BY REGION, 2032

-

GLOBAL

-

DIAPHRAGM PUMPS MARKET, BY REGION, 2023-2032 (USD Million)

-

NORTH

-

AMERICA DIAPHRAGM PUMPS MARKET SHARE (%), 2032

-

NORTH

-

AMERICA DIAPHRAGM PUMPS MARKET, BY COUNTRY, 2023-2032 (USD Million)

-

FIGURE 19

-

EUROPE DIAPHRAGM PUMPS MARKET SHARE (%), 2032

-

EUROPE

-

DIAPHRAGM PUMPS MARKET, BY COUNTRY, 2023-2032 (USD Million)

-

ASIA

-

PACIFIC DIAPHRAGM PUMPS MARKET SHARE (%), 2032

-

ASIA

-

PACIFIC DIAPHRAGM PUMPS MARKET, BY COUNTRY, 2023-2032 (USD Million)

-

FIGURE 23

-

MIDDLE EAST & AFRICA DIAPHRAGM PUMPS MARKET SHARE (%), 2032

-

FIGURE

-

MIDDLE EAST & AFRICA DIAPHRAGM PUMPS MARKET, BY REGION,

-

SOUTH AMERICA DIAPHRAGM

-

PUMPS MARKET SHARE (%), 2032

-

SOUTH AMERICA DIAPHRAGM

-

PUMPS MARKET, BY REGION, 2023-2032 (USD Million)

-

BENCHMARKING

-

OF MAJOR COMPETITORS

-

CONTRACTS & AGREEMENTS:

-

THE MAJOR STRATEGY ADOPTED BY KEY PLAYERS

-

MAJOR

-

MANUFACTURER MARKET SHARE ANALYSIS, 2032 (% SHARE)

Leave a Comment