Market Share

Introduction: Navigating the Competitive Landscape of Data Center Structured Cabling

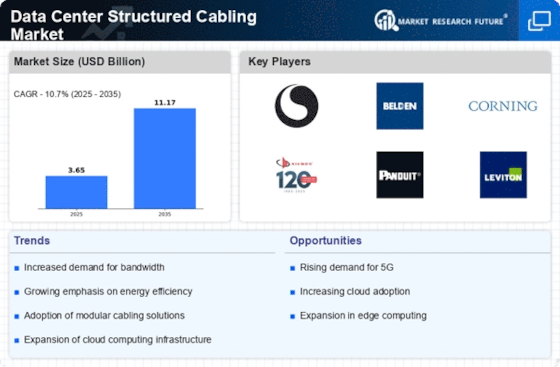

The data-center-structured-cable market is experiencing a revolution, a revolution based on the rapid development of technology, the evolution of regulatory frameworks and the growing demand for an unbroken and always-on connection. Competition is fierce between the market leaders – system builders, IT integrators and the cable companies – who are using advanced technologies such as AI-based analytics, automation and the Internet of Things to capture a share of the market. These differentiators not only improve the efficiency of operations but also enable real-time data management and preventive maintenance, which are essential for the optimization of the cable. Also, new disruptors, especially green-infrastructure initiatives and biometrics, are changing the competition and forcing traditional players to evolve or face extinction. As we look to 2024–2025, the most promising opportunities will be in Asia-Pacific and North America, where strategic deployments will focus on scalability and sustainability.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions encompassing design, installation, and management of structured cabling systems.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| CommScope | Broad portfolio and global reach | End-to-end cabling solutions | Global |

| Schneider Electric | Strong focus on energy efficiency | Integrated data center solutions | Global |

| Legrand | Diverse product range for various applications | Power and data distribution | Global |

Specialized Technology Vendors

These vendors focus on specific technologies or innovations within the structured cabling space.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| R&M | High-quality Swiss engineering | Fiber and copper cabling solutions | Europe, Asia |

| Furukawa Electric Co | Advanced fiber optic technology | Optical fiber solutions | Asia, Americas |

| Corning Inc | Leader in optical fiber innovation | Fiber optic cables and solutions | Global |

Infrastructure & Equipment Providers

These vendors supply essential infrastructure components and equipment for structured cabling systems.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Belden Inc | Robust and reliable connectivity solutions | Cabling and connectivity products | North America, Europe |

| Panduit Corp | Innovative solutions for data centers | Network infrastructure solutions | Global |

| Siemon | Focus on high-performance cabling | Structured cabling systems | Global |

| Nexans S.A. | Strong presence in cable manufacturing | Cabling and connectivity solutions | Europe, Asia, Americas |

Emerging Players & Regional Champions

- Nexans (France): Specializes in high-performance cabling solutions and has recently secured contracts for data center projects in Europe, challenging established vendors like Belden with innovative fiber optic technologies.

- CommScope (USA): Offers advanced structured cabling systems and has implemented several large-scale data center projects in North America, positioning itself as a strong competitor to traditional players by focusing on smart building integrations.

- Known for its quality cabling and connection solutions, Siemon has recently teamed up with several cloud service providers to improve their data center architecture, complementing existing solutions with its own.

- Legrand (France): Focuses on intelligent infrastructure solutions and has made significant inroads in the European market with recent contracts for energy-efficient cabling systems, challenging established players by emphasizing sustainability.

- R&M (Switzerland): Offers innovative cabling solutions and has recently expanded its presence in Asia-Pacific, complementing established vendors by providing localized support and customized solutions for regional data centers.

Regional Trends: In 2023, the adoption of structured cabling solutions is expected to increase significantly in the Asia-Pacific and European regions, due to the increasing popularity of cloud computing and the expansion of data centers. Also, companies are increasingly focusing on energy conservation and resource conservation, which is expected to increase the demand for advanced cable technology to support smart data center operations.

Collaborations & M&A Movements

- CommScope and Cisco announced a partnership to integrate their technologies for enhanced data center infrastructure management, aiming to improve operational efficiency and reduce costs in a competitive market.

- Nexans acquired the structured cabling division of a regional competitor to expand its product offerings and strengthen its market position in Europe amidst increasing demand for high-speed connectivity.

- Belden and Panduit entered into a collaboration to develop next-generation cabling solutions that support 5G and IoT applications, positioning themselves as leaders in the evolving data center landscape.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| High-Density Cabling Solutions | Corning, CommScope | Corning has advanced fiber-optic solutions for high-density environments, which are in use in large data centers like Google. CommScope’s SYSTIMAX solutions are widely used for their scalability and efficiency in high-density applications. |

| Modular Cabling Systems | Siemon, Panduit | In addition, Siemon’s modular systems are easy to adapt to changes in business needs, as shown by their work for large enterprises. The same is true of Panduit’s products, which are recognized for their easy installation and flexibility. |

| Sustainability Initiatives | Legrand, Schneider Electric | Legrand has introduced into its wiring systems an approach that is eco-friendly, focusing on reducing the carbon footprint. Schneider Electric’s commitment to energy-efficiency and the environment is shown by its wiring systems, which are used in green data-centre projects. |

| Smart Cabling Management | NetZoom, Nlyte Software | Its products are the result of a combination of advanced hardware and software, and they provide real-time monitoring and management of the cabling network, which enables the optimum operation of the network. Nlyte Software's solutions have been shown to optimize the use of cabling and reduce downtime in several large-scale implementations. |

| Enhanced Security Features | Belden, Molex | Belden’s cabling solutions include the most advanced security features to prevent unauthorized access to data. Belden has installed them in the most sensitive government data centers. They meet the most demanding industry standards and are a reliable supplier for high-security applications. |

Conclusion: Navigating the Data Center Cabling Landscape

In 2023 the data center structured cabling market will be characterized by an extremely competitive and fragmented market. The market is characterized by a strong competition between the large companies and the small ones. There is a growing trend towards sustainable and flexible solutions, as organizations focus more and more on the environment and the ability to adapt. The suppliers must therefore strategically position themselves by deploying advanced capabilities such as automation and artificial intelligence to increase efficiency and customer satisfaction. The suppliers who are able to integrate these new technologies into their business models and at the same time maintain a sustainable focus will probably become the future market leaders and will shape the future of data center connections.

Leave a Comment