Copper Tubes Size

Copper Tubes Market Growth Projections and Opportunities

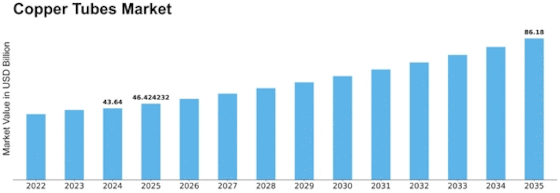

Many market aspects shape the Copper Tubes Market. Copper tube demand rises as power transmission and distribution systems become more efficient. Copper Tubes is expected to rise from USD 41.02 Billion in 2023 to USD 71.58 Billion in 2032, a CAGR of 6.38%.

Copper Tubes Market conditions depend on global economic conditions. Copper tube demand rises as emerging markets expand infrastructure. However, economic downturns can halt construction, hurting the market. Tariffs and trade disputes affect copper prices and supply, altering market dynamics.

The automobile industry also affects the Copper Tubes Market. Copper tubes' heat conductivity and corrosion resistance make them ideal for radiators, brake systems, and other components. Automotive growth or contraction influences copper tube consumption. Furthermore, technical improvements and the shift towards electric vehicles bring both obstacles and opportunities. Copper in electric car batteries and charging infrastructure presents new business opportunities despite reduced demand for traditional copper components.

Recently, environmental concerns have shaped the Copper Tubes Market. Since copper is recyclable, several businesses use copper tubes due to sustainability and environmental restrictions. To meet global sustainability goals, manufacturers are making more eco-friendly copper items.

Energy also affects the Copper Tubes Market. Power plant heat exchangers and cooling systems use copper tubes. Copper tubes are needed to make associated equipment as renewable energy sources like solar and wind power expand. Market changes due to the shift to greener energy sources are projected to last.

Market competition and alternative materials are crucial to understanding the Copper Tubes Market. Copper is adaptable, yet competing materials like plastic and aluminum can affect market dynamics. Copper price changes due to mining and geopolitical events also affect competition.

Leave a Comment