Market Analysis

In-depth Analysis of Contract Packaging Market Industry Landscape

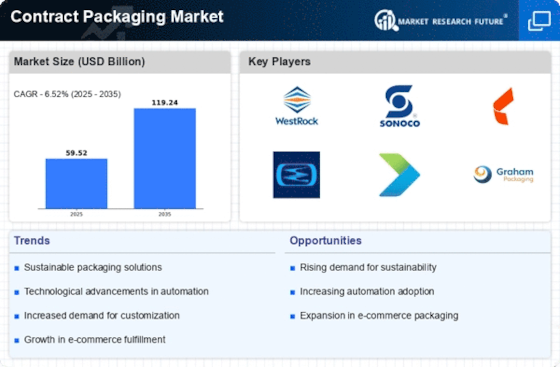

The contract packaging sector represents a segment within the general field of the packaging industry, which is a critical component on the path of a manufacturer towards meeting the specific demands of products in different sectors. Changeable factors from the market environment that contribute to the development of the contract packaging market are also affected by tendencies and contests that exist in that market.

One of the profound pullers of market dynamics in this world of globalization is the intricacy at which supply chains are structured. The most efficient way of running packaging operations could be done by involving a contract packaging company, as businesses get more diversified and start to offer more than one products. These businesses mainly focus on the provision of packing services that include even picking out the scheme and material, labeling, and closing. As many companies are nowadays shifting their packaging function to these providers, the attachment of CDPs are increasingly booming.

One of the yardsticks of tech market evolution is the fact that the consumers always change, their tastes and behaviors being another factor that shapes the dynamics of the market. Similarly, as consumers worldwide evolve and become more conscious about waste especially plastics, the packaging thrown away by consumers undergoes significant changes. Contract packaging companies has to accommodate themselves to these shifts by providing packages that are sustainable, modern in design and the materials usage which are in accordance with the trends in this market. This flexibility with regard to marketing communication tactics is essentially human because it is the only way of staying competitive and holding up to the requests of the brands and consumers.

Cost efficiency remains a pressing problem for companies involved in a packaging contract market. In many cases, there is an effort by manufacturers to outsource contract packaging services for efficient utilization of production resources. Through the delegating packaging processes, corporations can capitalize on the economies of scale, salaries’ reduction and enhanced efficacy in the entire supply chain. Contract packaging companies, however, have to deal with the complex and subjective issue of finding the right balance between cost-effective solutions, and the client's desire for his products to retain appealing packaging which can only be ensured through the production of well-designed packages.

The regulatory compliance for the industry dynamics creation is also a very important feature. The packaging industry is regulated on a very broad scale. For example, product safety and labeling are very significant examples of these regulations. It is an imperative for contract packaging industries to continuously expand their knowledge of such rules and regulations, in order to supply high quality services that meet the set standards. More strict regulatory frameworks includes the need for more investment in technology and training which in turn affect the overall competitiveness of companies with costs which require them to pay market with such costs.

The role of technological advancements in redefining the contract packaging industry is becomes much more important at every stage. Automation, robotics, and digital technology can spark new wave of revolutions in the field of packaging with its ability to transform the packaging processes in terms of efficiency, accuracy and speed. The contract packaging companies that invest in those technologies are prove to be more competitive as they give customer the opportunities to obtain the state-of-the-art solutions.

Leave a Comment