Market Share

Construction IoT Market Share Analysis

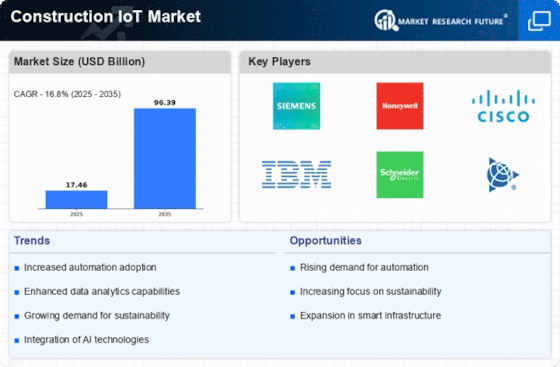

The market of the Construction Internet of Things (IoT) is the sector with a very high dynamic, in which growing role of digital technologies in the construction industry gains primacy. The market share positioning strategies do in a lot of cases serve as the one-to-one criteria for the success or the failure of companies under this challenging economic situation. Among the most popular strategies is polarization, comprised in meeting the different needs of consumers by providing unlike and innovative concepts. The development of specific and versatile IoT devices that suit constructions sector's requirements is, for instance, the implementation of sophisticated sensors capable of real-time monitoring at construction sites or use of smart technologies to ensure greater efficiency within constructions.

An important strategy that is adopted is provides the customers with the most affordable solution for their complication. This could be acting as discipline in the production procedures, using economies of scale, and perfecting the supply chain that will help bring the costs down. Cost leadership is a remarkable factor in the construction IoT market, as project budgets are very often tightening up and the clients are in more and more cases looking for the cost-efficient options that are almost never lowering quality, which is becoming a very important issue for the clients.

Additionally, Construction IoT companies’ competition could operate a focus-strategy where they focus on particular segments of market or in certain geographic regions to set a firm foundation. Through understanding the specific domains towards which it supplies products, companies gradually build their expertise and reliability reputation within that segment. Let’s say, for instance, that the business offers IoT devices specifically designed for mega projects, or concentrates entirely on the residential market, by that way, cutting a niche for itself in each segment and addressing the different requirements.

Partnership and cooperation together contribute into the market share visibility in the Construction IoT market sector. There are possibilities for firms to form strategic alliances such as software developers, data analytics companies, or construction machinery manufacturers that could be in the same ecosystem. By such partnerships managers can design integrated technology (IoT) that provides a variety of comprehensive capabilities meeting a wide range of the customer requirements. Beyond sharing services and increasing span, collaborations lead to the development of new products, and it allows these companies to utilize each other's strengths and resources for mutual development.

Leave a Comment