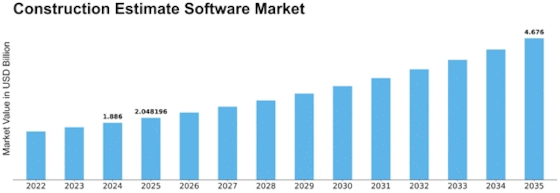

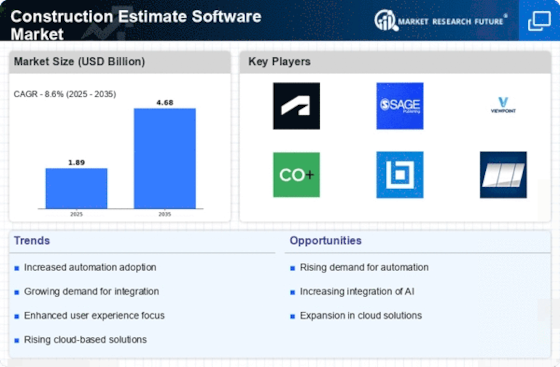

Construction Estimate Software Size

Construction Estimate Software Market Growth Projections and Opportunities

One of the factors responsible for the dynamics and growth trajectory of the Construction Estimate Software market are several market factors that shape its dynamics and growth trajectory. The demand for construction estimate software is driven by more complex construction projects. As constructions become complicated and diverse, there has been an increasing requirement for highly sophisticated tools which can simplify estimation methods and improve accuracy. Among others such as cost modeling, project visualization, and data analytics software that helps constructors to make informed decisions concerning the budgeting processes.

Another critical market factor is that digital technologies are increasingly being used in the construction industry. In this regard, it is important to note that with ongoing digital transformation in place, many construction companies have come to appreciate why they should leverage on software solutions aimed at enhancing their efficiency and productivity levels. Apart from automating estimation, Construction estimate software also links up with other projects management tools thus promoting collaboration between stakeholders involved in a project. This gives rise to one of the compelling reasons behind such a growth in this market since it involves integration via digital means.

The global emphasis on sustainability and eco-friendly construction practices is also influencing the construction estimate software market. As sustainability becomes a core consideration in construction projects, there is high demand for programs capable of assessing environmental impact and cost implications from different materials or methods used on site. For example, life cycle analysis and environmental cost tracking features are found in Construction estimate software so as to assist companies achieve sustainable objectives for their constructions as well as comply with regulatory needs.

Market factors are also shaped by the increasing trend of cloud-based solutions in the construction industry. Cloud-based systems allow real-time collaboration among team members working on a single task or project; hence it gives remote access together with scalability to users' end. That way architects can work even when they are not physically present at site which enables seamless communication between them besides enhancing project management practices while saving time. Construction firms can adjust such software according to their projects’ size or scope due to scalability feature; therefore it becomes attractive irrespective of any firm’s dimensions.

This is because accurate and timely project estimation is one of the key drivers for the construction estimate software market. Such inaccuracies lead to additional costs and delays, which are common in most building projects. This problem has been solved by the construction estimate software since it uses difficult formula and past information to come up with more reliable approximate costs. This aspect is crucial when it comes to better project planning as a result of construction firms trying to evade unforeseen economic hitches.

Leave a Comment