Commercial Telematics Market Trends

Commercial Telematics Market Research Report By Solution Type (Fleet Management, Insurance Telematics, Vehicle Tracking, Driver Behavior Monitoring), By Telematics Type (Hardware, Software, Services), By Network Type (Dedicated Short Range Communication, Cellular, Satellite), By End Use Sector (Transportation and Logistics, Construction, Public Sector, Retail) and By Regional (North America, Eu...

Market Summary

The Global Commercial Telematics Market is projected to grow from 24.8 USD Billion in 2024 to 56.6 USD Billion by 2035.

Key Market Trends & Highlights

Commercial Telematics Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 7.78 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 56.6 USD Billion, indicating robust growth potential.

- In 2024, the market is valued at 24.8 USD Billion, reflecting a strong foundation for future expansion.

- Growing adoption of advanced telematics solutions due to increasing demand for fleet management efficiency is a major market driver.

Market Size & Forecast

| 2024 Market Size | 24.8 (USD Billion) |

| 2035 Market Size | 56.6 (USD Billion) |

| CAGR (2025-2035) | 7.78% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

TomTom, Teletrac, Zubie, Nauto, Continental, Geotab, Fleet Complete, Mix Telematics, Fleetmatics, Omnicommerce, Trimble, Verizon, Samsara, Teletrac Navman, Motive

Market Trends

The Commercial Telematics Market is driven by the increasing demand for real-time data and analytics in transportation. Companies are seeking to enhance fleet management, improve operational efficiency, and reduce costs. The rise of connected vehicles and advancements in Internet of Things (IoT) technologies further fuel the adoption of telematics solutions. Enhanced regulatory requirements for safety and tracking are also key market drivers, prompting businesses to invest in more sophisticated systems.

The ongoing shift towards electric vehicles and autonomous driving technologies presents significant opportunities for telematics providers to innovate and expand their offerings.This intersection of technology indicates a growing need for reliable and efficient data processing solutions that can adapt to changing industry standards. In recent times, the market has witnessed a shift toward integrated solutions that combine telematics with various other technologies, such as artificial intelligence and machine learning. These integrations enable companies to gain deeper insights and improve decision-making capabilities.

Moreover, there is a significant trend in the demand for customized telematics solutions tailored to specific industry needs, whether in logistics, construction, or public transportation. The focus on sustainability has also encouraged organizations to adopt telematics to monitor and reduce their environmental impact, opening avenues for green technologies.

Opportunities in the Commercial Telematics Market include the development of mobile applications and platforms that enhance user experience. The growing emphasis on cybersecurity in data handling offers a chance for telematics companies to innovate in protecting sensitive information. Additionally, as more businesses recognize the value of data analytics, there is potential for collaboration between telematics providers and data analytics firms to drive further advancements in the field, ensuring businesses can make informed decisions and remain competitive in a rapidly evolving marketplace.

Fig 1: Commercial Telematics Market Overview

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

The integration of advanced telematics solutions in commercial fleets is poised to enhance operational efficiency and safety, reflecting a broader trend towards digital transformation in the transportation sector.

U.S. Department of Transportation

Commercial Telematics Market Market Drivers

Rising Focus on Sustainability

Sustainability is becoming an increasingly prominent driver within the Global Commercial Telematics Market Industry, as organizations strive to reduce their carbon footprint and enhance environmental responsibility. Telematics solutions enable companies to monitor fuel consumption, optimize routes, and implement eco-friendly driving practices. For instance, businesses that adopt telematics report a reduction in greenhouse gas emissions by up to 15 percent. This growing emphasis on sustainability aligns with global efforts to combat climate change, prompting more companies to invest in telematics technologies. As sustainability initiatives gain traction, the demand for telematics solutions is expected to rise, contributing to market expansion.

Advancements in IoT and Connectivity

The Global Commercial Telematics Market Industry is significantly influenced by advancements in Internet of Things (IoT) technology and connectivity solutions. The integration of IoT devices in vehicles allows for real-time data collection and analysis, enabling businesses to make informed decisions regarding fleet operations. Enhanced connectivity through 5G networks further facilitates seamless communication between vehicles and telematics systems. This technological evolution is expected to drive market growth, as companies seek to leverage data analytics for predictive maintenance and operational optimization. The increasing reliance on connected devices is likely to reshape the telematics landscape, fostering innovation and efficiency.

Chart Representation of Market Growth

The Global Commercial Telematics Market Industry is poised for substantial growth, as illustrated in the accompanying charts. The market is projected to reach a value of 24.8 USD Billion in 2024, with a significant increase anticipated to 56.6 USD Billion by 2035. The compound annual growth rate of 7.78% from 2025 to 2035 highlights the robust expansion expected in this sector. These visual representations underscore the upward trajectory of the market, reflecting the increasing adoption of telematics solutions across various industries.

Regulatory Compliance and Safety Standards

Regulatory compliance is a critical driver for the Global Commercial Telematics Market Industry, as governments worldwide implement stringent safety and environmental regulations. These regulations necessitate the use of telematics solutions to ensure adherence to standards such as driver behavior monitoring and vehicle emissions tracking. For example, the European Union has mandated the installation of tachographs in commercial vehicles to monitor driving hours and rest periods. This regulatory landscape compels companies to invest in telematics systems, thereby propelling market growth. The increasing focus on safety and compliance is likely to enhance the adoption of telematics solutions across various sectors.

Increasing Demand for Fleet Management Solutions

The Global Commercial Telematics Market Industry is witnessing a surge in demand for fleet management solutions, driven by the need for enhanced operational efficiency and cost reduction. Companies are increasingly adopting telematics systems to monitor vehicle performance, optimize routes, and reduce fuel consumption. For instance, businesses utilizing telematics report an average fuel savings of 10 to 15 percent. This trend is expected to contribute to the market's growth, with projections indicating a market value of 24.8 USD Billion in 2024, and a potential increase to 56.6 USD Billion by 2035, reflecting a compound annual growth rate of 7.78% from 2025 to 2035.

Market Segment Insights

Commercial Telematics Market Solution Type Insights

The Commercial Telematics Market encompasses various solution types that cater to different needs within the transportation and logistics sectors. In 2023, the market exhibits a promising valuation, reflecting a robust demand for advanced telematics solutions aimed at improving efficiencies and safety in commercial vehicle operations. Fleet Management, valued at 8.5 USD Billion in 2023, holds a majority share as it plays a crucial role in optimizing vehicle utilization, reducing operational costs, and enhancing overall fleet performance.

This segment is vital for businesses determined to improve productivity and operational transparency, consequently driving its significant market holding.Following closely is the Insurance Telematics segment, which, with a valuation of 5.0 USD Billion, provides personalized insurance solutions based on real-time data, thus enhancing risk assessment capabilities for insurers and offering cost savings for fleet operators. Vehicle Tracking, valued at 6.56 USD Billion, is integral for logistics and transportation companies that require real-time geographic visibility of their assets. This solution facilitates not only improved operational logistics but also theft prevention and routing efficiency.

Similarly, Driver Behavior Monitoring, representing the smallest valuation of 3.0 USD Billion, is increasingly recognized for its impact on safety and fuel efficiency.Monitoring driving patterns helps in promoting safer driving habits which can lead to reduced accident rates and lower insurance premiums. Overall, the Commercial Telematics Market segmentation reveals a landscape ripe with opportunities, where the demand driven by the need for streamlined operations and enhanced safety measures supports steady market growth.

Understanding the distinct roles of each segment is essential for stakeholders aiming to capitalize on the burgeoning telematics industry, as each part contributes uniquely to the overarching market dynamics and trends.

Fig 2: Commercial Telematics Market Insights

Fig 2: Commercial Telematics Market Insights

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Commercial Telematics Market Telematics Type Insights

The market is broadly categorized into three primary types: Hardware, Software and Services. Hardware plays a pivotal role as it includes devices that physically collect and transmit data, making it essential for fleet management and logistics with the rising interest in real-time tracking technologies. Software solutions are equally important, providing necessary analytics and data management capabilities to enhance operational efficiency, thereby fostering better decision-making processes for businesses.Services, encompassing installation, maintenance, and support, represent a vital sector as they ensure that the technology remains effective and updated, thus facilitating a seamless user experience.

The Commercial Telematics Market revenue is influenced by increasing demand for advanced fleet management solutions and legislation driving the adoption of telematics in commercial vehicles. With steady investments and innovations, the market statistics reflect a promising outlook fueled by enhanced connectivity and data-driven insights.

Commercial Telematics Market Network Type Insights

This segment is crucial as it underpins the ability of telematics systems to transmit data effectively, enhancing fleet management and vehicle tracking capabilities. Dedicated Short Range Communication is known for its low-latency data transfer, making it ideal for real-time applications, while Cellular networks provide extensive coverage and are increasingly favored due to their scalability and connectivity.Satellite communication plays a vital role in remote areas where terrestrial networks may be unavailable, making it essential for diverse applications across varied geographies.

Overall, the Commercial Telematics Market segmentation highlights the importance of these network types in boosting operational efficiency, delivering real-time insights, and supporting data-driven decision-making for businesses in the transportation and logistics sectors. As the industry evolves, advancements in these technologies are expected to bolster market growth, driving innovations and new opportunities within the market framework.

Commercial Telematics Market End Use Sector Insights

The Transportation and Logistics sector plays a crucial role, with companies increasingly turning to telematics solutions to enhance fleet management, reduce operational costs, and improve delivery efficiencies. The Construction industry significantly leverages telematics for asset tracking and maintenance management, ensuring better resource allocation and project timelines. In the Public Sector, telematics systems optimize government fleet operations and enhance public safety through real-time monitoring.Retail also contributes to this market by employing telematics for better supply chain management and customer engagement.

Given the increasing focus on efficiency, safety, and cost reduction, the Commercial Telematics Market segmentation reflects a trend toward greater integration of telematics technologies in these industries. As the market continues to grow, advancements in data analytics and connectivity will likely create more opportunities within these sectors, driving further exploration of innovative solutions to meet the evolving demands.The compound annual growth rate (CAGR) for this market from 2024 to 2032 emphasizes the robust growth trajectory, reflecting substantial investments across all end-use sectors.

Get more detailed insights about Commercial Telematics Market Research Report - Global Forecast 2032

Regional Insights

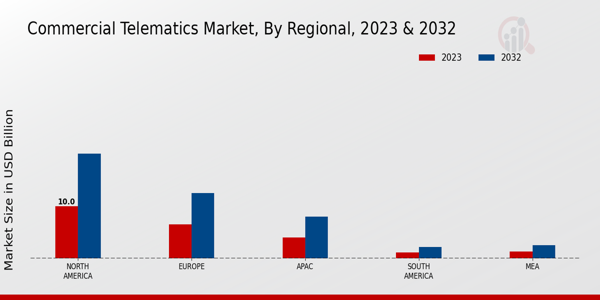

North America holds a majority stake, valued at 10.0 USD Billion and expected to rise to 20.0 USD Billion by 2032. The region’s dominance is primarily driven by advanced technology adoption and high demand for fleet management solutions. Europe follows with a significant valuation of 6.5 USD Billion in 2023 and anticipated growth to 12.5 USD Billion, supported by stringent regulations promoting vehicle tracking and safety.The APAC region, valued at 4.0 USD Billion currently, is projected to reach 8.0 USD Billion, reflecting increasing commercial vehicle usage in developing countries.

South America and the MEA regions have comparatively smaller shares, with values of 1.2 USD Billion and 1.36 USD Billion, respectively, in 2023. However, these markets are also expected to grow due to rising investment in transportation infrastructure and logistics. Each region presents unique challenges and opportunities, with regulatory changes and technological advancements playing pivotal roles in shaping the future of the Commercial Telematics Market.

Fig 3: Commercial Telematics Market Regional Insights

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The Commercial Telematics Market is experiencing significant growth, driven by the increasing demand for advanced fleet management solutions, real-time data analytics and enhanced vehicle tracking systems. The competitive landscape is characterized by a blend of established players and emerging startups, all vying for market share and innovation. Companies are focusing on harnessing cutting-edge technologies such as IoT, big data, and AI to deliver comprehensive telematics solutions that optimize operational efficiency and improve safety for commercial fleets.

These competitive insights reveal a robust environment where strategic partnerships, mergers and acquisitions play a crucial role in enhancing product offerings and expanding market reach.TomTom has established a strong foothold in the Commercial Telematics Market by leveraging its extensive experience in navigation and mapping solutions. The company is well-known for its advanced telematics services that cater specifically to the needs of fleet operators. TomTom's strengths lie in its high-quality mapping data, which provides accurate routing and real-time traffic information, enhancing the efficiency of fleet operations.

Furthermore, the company has invested heavily in research and development to create innovative solutions that integrate seamlessly with existing fleet management systems. TomTom's commitment to customer service and the provision of comprehensive analytics tools enable businesses to make informed decisions and improve overall operational efficiency.Teletrac has carved out a notable presence in the Commercial Telematics Market, providing robust fleet tracking and management solutions tailored to a variety of industries. The company’s strengths include its user-friendly platform, which is designed to deliver real-time vehicle tracking, driver performance monitoring, and detailed reporting features.

Teletrac's strong emphasis on data integration ensures that clients can access critical insights for optimizing their operations. The flexibility of Teletrac’s solutions allows businesses to scale their telematics implementation according to their needs, enhancing their adaptability in a rapidly changing market. Additionally, Teletrac’s commitment to continuous innovation keeps it at the forefront of telematics technology, enabling clients to leverage cutting-edge features and stay competitive.

Key Companies in the Commercial Telematics Market market include

Industry Developments

- Q3 2024: Samsara acquires FleetOps to expand telematics data capabilities Samsara announced the acquisition of FleetOps, a Canadian telematics and logistics data platform, to enhance its commercial telematics offerings and provide deeper analytics for fleet operators.

- Q2 2024: Geotab and Mercedes-Benz Trucks announce global telematics partnership Geotab and Mercedes-Benz Trucks entered a global partnership to integrate Geotab’s telematics solutions directly into new Mercedes-Benz commercial vehicles, aiming to streamline fleet management and compliance.

- Q2 2024: Verizon Connect launches new AI-powered fleet safety platform Verizon Connect introduced an AI-driven safety platform for commercial fleets, offering real-time driver coaching and advanced collision detection to improve road safety and reduce insurance costs.

- Q1 2024: Trimble completes acquisition of Transporeon Trimble finalized its acquisition of Transporeon, a European logistics and telematics software provider, expanding its reach in the commercial telematics and supply chain visibility market.

- Q2 2024: KeepTruckin raises $190 million in Series E funding to accelerate telematics innovation KeepTruckin secured $190 million in Series E funding to invest in new telematics hardware and AI-powered fleet management solutions for commercial vehicles.

- Q3 2024: Bridgestone acquires Azuga to boost connected fleet solutions Bridgestone acquired Azuga, a commercial telematics and fleet management platform, to strengthen its digital mobility solutions and expand its presence in the North American market.

- Q2 2024: Geotab launches new electric vehicle telematics suite for commercial fleets Geotab released a dedicated telematics suite for electric commercial vehicles, providing advanced battery analytics, charging optimization, and real-time range monitoring for fleet operators.

- Q1 2024: WABCO wins major telematics contract with European logistics group WABCO secured a multi-year contract to supply its advanced telematics and fleet management systems to a leading European logistics provider, supporting digital transformation of its commercial vehicle operations.

- Q2 2024: Mix Telematics appoints new CEO to drive global expansion Mix Telematics announced the appointment of a new Chief Executive Officer, aiming to accelerate its international growth and innovation in commercial telematics solutions.

- Q3 2024: Teletrac Navman opens new R&D center in Germany Teletrac Navman inaugurated a new research and development facility in Germany to focus on next-generation telematics technologies for commercial vehicles in the European market.

- Q2 2024: Samsara and Ryder announce strategic partnership for integrated fleet telematics Samsara and Ryder entered a strategic partnership to deliver integrated telematics and fleet management solutions to Ryder’s commercial vehicle customers across North America.

- Q1 2024: Fleet Complete secures $50 million investment to expand telematics platform Fleet Complete raised $50 million in new funding to accelerate the development of its commercial telematics platform and expand into new international markets.

Future Outlook

Commercial Telematics Market Future Outlook

The Global Commercial Telematics Market is projected to grow at a 7.78% CAGR from 2024 to 2035, driven by advancements in IoT, regulatory mandates, and demand for fleet optimization.

New opportunities lie in:

- Develop AI-driven analytics tools for predictive maintenance and operational efficiency.

- Expand telematics solutions for electric vehicles to capture emerging market segments.

- Leverage partnerships with logistics firms to enhance real-time tracking and data integration.

By 2035, the market is expected to be robust, reflecting substantial growth and innovation.

Market Segmentation

Commercial Telematics Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Commercial Telematics Market Network Type Outlook

- Dedicated Short-Range Communication

- Cellular

- Satellite

Commercial Telematics Market Solution Type Outlook

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

Commercial Telematics Market End Use Sector Outlook

- Transportation and Logistics

- Construction

- Public Sector

- Retail

Commercial Telematics Market Telematics Type Outlook

- Hardware

- Software

- Services

Report Scope

| Attribute/Metric | Details |

| Market Size 2022 | 21.4(USD Billion) |

| Market Size 2023 | 23.06(USD Billion) |

| Market Size 2032 | 45.2(USD Billion) |

| Compound Annual Growth Rate (CAGR) | 7.76% (2024 - 2032) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2023 |

| Market Forecast Period | 2024 - 2032 |

| Historical Data | 2019 - 2023 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | TomTom, Teletrac, Zubie, Nauto, Continental, Geotab, Fleet Complete, Mix Telematics, Fleetmatics, Omnicommerce, Trimble, Verizon, Samsara, Teletrac Navman, Motive |

| Segments Covered | Solution Type, Telematics Type, Network Type, End Use Sector, Regional |

| Key Market Opportunities | 1. Increased demand for fleet optimization, 2. Growth in IoT integration, 3. Expansion of AI-driven analytics, 4. Rising emphasis on safety regulations, 5. Surge in real-time tracking solutions |

| Key Market Dynamics | 1. Increasing demand for fleet efficiency, 2. Advancements in IoT technology, 3. Regulatory compliance and safety standards, 4. Insurance cost reduction strategies, 5. Growing need for real-time data analytics |

| Countries Covered | North America, Europe, APAC, South America, MEA |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the expected market size of the Commercial Telematics Market by 2032?

The Commercial Telematics Market is expected to be valued at 45.2 USD Billion by 2032.

What is the projected Compound Annual Growth Rate (CAGR) for the Commercial Telematics Market from 2024 to 2032?

The projected CAGR for the Commercial Telematics Market from 2024 to 2032 is 7.76%.

Which region is expected to dominate the Commercial Telematics Market by 2032?

North America is expected to dominate the Commercial Telematics Market with a valuation of 20.0 USD Billion by 2032.

What is the value of the Fleet Management segment in the Commercial Telematics Market for 2032?

The Fleet Management segment is expected to reach a value of 17.0 USD Billion by 2032.

How much is the Vehicle Tracking segment projected to be worth in 2032?

The Vehicle Tracking segment is projected to be worth 12.3 USD Billion by 2032.

Who are the key players in the Commercial Telematics Market?

Key players in the market include companies like TomTom, Teletrac, Geotab, and Verizon.

What was the size of the Insurance Telematics market segment in 2023?

The Insurance Telematics market segment was valued at 5.0 USD Billion in 2023.

What was the market size of the Asia-Pacific region for the Commercial Telematics Market in 2023?

The Asia-Pacific region was valued at 4.0 USD Billion for the Commercial Telematics Market in 2023.

What growth opportunity does the Driver Behavior Monitoring segment present by 2032?

The Driver Behavior Monitoring segment is expected to present a market value of 6.9 USD Billion by 2032.

What is the projected market size for South America in the Commercial Telematics Market by 2032?

South America is projected to reach a market size of 2.2 USD Billion by 2032.

-

Table of Contents

-

Executive Summary

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumption

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter''s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

COMMERCIAL TELEMATICS MARKET, BY SOLUTION TYPE (USD BILLION)

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

-

COMMERCIAL TELEMATICS MARKET, BY TELEMATICS TYPE (USD BILLION)

- Hardware

- Software

- Services

-

COMMERCIAL TELEMATICS MARKET, BY NETWORK TYPE (USD BILLION)

- Dedicated Short Range Communication

- Cellular

- Satellite

-

COMMERCIAL TELEMATICS MARKET, BY END USE SECTOR (USD BILLION)

- Transportation and Logistics

- Construction

- Public Sector

- Retail

-

COMMERCIAL TELEMATICS MARKET, BY REGIONAL (USD BILLION)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Commercial Telematics Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Commercial Telematics Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

COMPANY PROFILES

-

TomTom

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Teletrac

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Zubie

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Nauto

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Continental

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Geotab

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Fleet Complete

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Mix Telematics

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Fleetmatics

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Omnicommerce

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Trimble

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Verizon

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Samsara

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Teletrac Navman

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Motive

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

TomTom

-

APPENDIX

- References

- Related Reports

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1. LIST OF ASSUMPTIONS

- TABLE 2. NORTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 3. NORTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 4. NORTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 5. NORTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 6. NORTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 7. US COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 8. US COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 9. US COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 10. US COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 11. US COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 12. CANADA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 13. CANADA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 14. CANADA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 15. CANADA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 16. CANADA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 17. EUROPE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 18. EUROPE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 19. EUROPE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 20. EUROPE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 21. EUROPE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 22. GERMANY COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 23. GERMANY COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 24. GERMANY COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 25. GERMANY COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 26. GERMANY COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 27. UK COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 28. UK COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 29. UK COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 30. UK COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 31. UK COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 32. FRANCE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 33. FRANCE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 34. FRANCE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 35. FRANCE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 36. FRANCE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 37. RUSSIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 38. RUSSIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 39. RUSSIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 40. RUSSIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 41. RUSSIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 42. ITALY COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 43. ITALY COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 44. ITALY COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 45. ITALY COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 46. ITALY COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 47. SPAIN COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 48. SPAIN COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 49. SPAIN COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 50. SPAIN COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 51. SPAIN COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 52. REST OF EUROPE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 53. REST OF EUROPE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 54. REST OF EUROPE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 55. REST OF EUROPE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 56. REST OF EUROPE COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 57. APAC COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 58. APAC COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 59. APAC COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 60. APAC COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 61. APAC COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 62. CHINA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 63. CHINA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 64. CHINA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 65. CHINA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 66. CHINA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 67. INDIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 68. INDIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 69. INDIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 70. INDIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 71. INDIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 72. JAPAN COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 73. JAPAN COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 74. JAPAN COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 75. JAPAN COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 76. JAPAN COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 77. SOUTH KOREA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 78. SOUTH KOREA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 79. SOUTH KOREA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 80. SOUTH KOREA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 81. SOUTH KOREA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 82. MALAYSIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 83. MALAYSIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 84. MALAYSIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 85. MALAYSIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 86. MALAYSIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 87. THAILAND COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 88. THAILAND COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 89. THAILAND COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 90. THAILAND COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 91. THAILAND COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 92. INDONESIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 93. INDONESIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 94. INDONESIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 95. INDONESIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 96. INDONESIA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 97. REST OF APAC COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 98. REST OF APAC COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 99. REST OF APAC COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 100. REST OF APAC COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 101. REST OF APAC COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 102. SOUTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 103. SOUTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 104. SOUTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 105. SOUTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 106. SOUTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 107. BRAZIL COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 108. BRAZIL COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 109. BRAZIL COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 110. BRAZIL COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 111. BRAZIL COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 112. MEXICO COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 113. MEXICO COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 114. MEXICO COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 115. MEXICO COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 116. MEXICO COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 117. ARGENTINA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 118. ARGENTINA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 119. ARGENTINA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 120. ARGENTINA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 121. ARGENTINA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 122. REST OF SOUTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 123. REST OF SOUTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 124. REST OF SOUTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 125. REST OF SOUTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 126. REST OF SOUTH AMERICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 127. MEA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 128. MEA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 129. MEA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 130. MEA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 131. MEA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 132. GCC COUNTRIES COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 133. GCC COUNTRIES COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 134. GCC COUNTRIES COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 135. GCC COUNTRIES COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 136. GCC COUNTRIES COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 137. SOUTH AFRICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 138. SOUTH AFRICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 139. SOUTH AFRICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 140. SOUTH AFRICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 141. SOUTH AFRICA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 142. REST OF MEA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY SOLUTION TYPE, 2019-2032 (USD BILLIONS)

- TABLE 143. REST OF MEA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY TELEMATICS TYPE, 2019-2032 (USD BILLIONS)

- TABLE 144. REST OF MEA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY NETWORK TYPE, 2019-2032 (USD BILLIONS)

- TABLE 145. REST OF MEA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY END USE SECTOR, 2019-2032 (USD BILLIONS)

- TABLE 146. REST OF MEA COMMERCIAL TELEMATICS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- TABLE 148. ACQUISITION/PARTNERSHIP LIST OF FIGURES

- FIGURE 1. MARKET SYNOPSIS

- FIGURE 2. NORTH AMERICA COMMERCIAL TELEMATICS MARKET ANALYSIS

- FIGURE 3. US COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 4. US COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 5. US COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 6. US COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 7. US COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 8. CANADA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 9. CANADA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 10. CANADA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 11. CANADA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 12. CANADA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 13. EUROPE COMMERCIAL TELEMATICS MARKET ANALYSIS

- FIGURE 14. GERMANY COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 15. GERMANY COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 16. GERMANY COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 17. GERMANY COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 18. GERMANY COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 19. UK COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 20. UK COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 21. UK COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 22. UK COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 23. UK COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 24. FRANCE COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 25. FRANCE COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 26. FRANCE COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 27. FRANCE COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 28. FRANCE COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 29. RUSSIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 30. RUSSIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 31. RUSSIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 32. RUSSIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 33. RUSSIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 34. ITALY COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 35. ITALY COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 36. ITALY COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 37. ITALY COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 38. ITALY COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 39. SPAIN COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 40. SPAIN COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 41. SPAIN COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 42. SPAIN COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 43. SPAIN COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 44. REST OF EUROPE COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 45. REST OF EUROPE COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 46. REST OF EUROPE COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 47. REST OF EUROPE COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 48. REST OF EUROPE COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 49. APAC COMMERCIAL TELEMATICS MARKET ANALYSIS

- FIGURE 50. CHINA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 51. CHINA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 52. CHINA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 53. CHINA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 54. CHINA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 55. INDIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 56. INDIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 57. INDIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 58. INDIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 59. INDIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 60. JAPAN COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 61. JAPAN COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 62. JAPAN COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 63. JAPAN COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 64. JAPAN COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 65. SOUTH KOREA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 66. SOUTH KOREA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 67. SOUTH KOREA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 68. SOUTH KOREA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 69. SOUTH KOREA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 70. MALAYSIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 71. MALAYSIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 72. MALAYSIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 73. MALAYSIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 74. MALAYSIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 75. THAILAND COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 76. THAILAND COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 77. THAILAND COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 78. THAILAND COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 79. THAILAND COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 80. INDONESIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 81. INDONESIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 82. INDONESIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 83. INDONESIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 84. INDONESIA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 85. REST OF APAC COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 86. REST OF APAC COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 87. REST OF APAC COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 88. REST OF APAC COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 89. REST OF APAC COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 90. SOUTH AMERICA COMMERCIAL TELEMATICS MARKET ANALYSIS

- FIGURE 91. BRAZIL COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 92. BRAZIL COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 93. BRAZIL COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 94. BRAZIL COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 95. BRAZIL COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 96. MEXICO COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 97. MEXICO COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 98. MEXICO COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 99. MEXICO COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 100. MEXICO COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 101. ARGENTINA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 102. ARGENTINA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 103. ARGENTINA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 104. ARGENTINA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 105. ARGENTINA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 106. REST OF SOUTH AMERICA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 107. REST OF SOUTH AMERICA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 108. REST OF SOUTH AMERICA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 109. REST OF SOUTH AMERICA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 110. REST OF SOUTH AMERICA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 111. MEA COMMERCIAL TELEMATICS MARKET ANALYSIS

- FIGURE 112. GCC COUNTRIES COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 113. GCC COUNTRIES COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 114. GCC COUNTRIES COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 115. GCC COUNTRIES COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 116. GCC COUNTRIES COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 117. SOUTH AFRICA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 118. SOUTH AFRICA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 119. SOUTH AFRICA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 120. SOUTH AFRICA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 121. SOUTH AFRICA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 122. REST OF MEA COMMERCIAL TELEMATICS MARKET ANALYSIS BY SOLUTION TYPE

- FIGURE 123. REST OF MEA COMMERCIAL TELEMATICS MARKET ANALYSIS BY TELEMATICS TYPE

- FIGURE 124. REST OF MEA COMMERCIAL TELEMATICS MARKET ANALYSIS BY NETWORK TYPE

- FIGURE 125. REST OF MEA COMMERCIAL TELEMATICS MARKET ANALYSIS BY END USE SECTOR

- FIGURE 126. REST OF MEA COMMERCIAL TELEMATICS MARKET ANALYSIS BY REGIONAL

- FIGURE 127. KEY BUYING CRITERIA OF COMMERCIAL TELEMATICS MARKET

- FIGURE 128. RESEARCH PROCESS OF MRFR

- FIGURE 129. DRO ANALYSIS OF COMMERCIAL TELEMATICS MARKET

- FIGURE 130. DRIVERS IMPACT ANALYSIS: COMMERCIAL TELEMATICS MARKET

- FIGURE 131. RESTRAINTS IMPACT ANALYSIS: COMMERCIAL TELEMATICS MARKET

- FIGURE 132. SUPPLY / VALUE CHAIN: COMMERCIAL TELEMATICS MARKET

- FIGURE 133. COMMERCIAL TELEMATICS MARKET, BY SOLUTION TYPE, 2024 (% SHARE)

- FIGURE 134. COMMERCIAL TELEMATICS MARKET, BY SOLUTION TYPE, 2019 TO 2032 (USD Billions)

- FIGURE 135. COMMERCIAL TELEMATICS MARKET, BY TELEMATICS TYPE, 2024 (% SHARE)

- FIGURE 136. COMMERCIAL TELEMATICS MARKET, BY TELEMATICS TYPE, 2019 TO 2032 (USD Billions)

- FIGURE 137. COMMERCIAL TELEMATICS MARKET, BY NETWORK TYPE, 2024 (% SHARE)

- FIGURE 138. COMMERCIAL TELEMATICS MARKET, BY NETWORK TYPE, 2019 TO 2032 (USD Billions)

- FIGURE 139. COMMERCIAL TELEMATICS MARKET, BY END USE SECTOR, 2024 (% SHARE)

- FIGURE 140. COMMERCIAL TELEMATICS MARKET, BY END USE SECTOR, 2019 TO 2032 (USD Billions)

- FIGURE 141. COMMERCIAL TELEMATICS MARKET, BY REGIONAL, 2024 (% SHARE)

- FIGURE 142. COMMERCIAL TELEMATICS MARKET, BY REGIONAL, 2019 TO 2032 (USD Billions)

- FIGURE 143. BENCHMARKING OF MAJOR COMPETITORS

Commercial Telematics Market Segmentation

- Commercial Telematics Market By Solution Type (USD Billion, 2019-2032)

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- Commercial Telematics Market By Telematics Type (USD Billion, 2019-2032)

- Hardware

- Software

- Services

- Commercial Telematics Market By Network Type (USD Billion, 2019-2032)

- Dedicated Short Range Communication

- Cellular

- Satellite

- Commercial Telematics Market By End Use Sector (USD Billion, 2019-2032)

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- Commercial Telematics Market By Regional (USD Billion, 2019-2032)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Commercial Telematics Market Regional Outlook (USD Billion, 2019-2032)

- North America Outlook (USD Billion, 2019-2032)

- North America Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- North America Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- North America Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- North America Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- North America Commercial Telematics Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2032)

- US Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- US Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- US Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- US Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- CANADA Outlook (USD Billion, 2019-2032)

- CANADA Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- CANADA Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- CANADA Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- CANADA Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- Europe Outlook (USD Billion, 2019-2032)

- Europe Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- Europe Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- Europe Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- Europe Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- Europe Commercial Telematics Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2032)

- GERMANY Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- GERMANY Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- GERMANY Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- GERMANY Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- UK Outlook (USD Billion, 2019-2032)

- UK Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- UK Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- UK Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- UK Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- FRANCE Outlook (USD Billion, 2019-2032)

- FRANCE Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- FRANCE Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- FRANCE Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- FRANCE Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- RUSSIA Outlook (USD Billion, 2019-2032)

- RUSSIA Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- RUSSIA Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- RUSSIA Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- RUSSIA Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- ITALY Outlook (USD Billion, 2019-2032)

- ITALY Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- ITALY Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- ITALY Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- ITALY Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- SPAIN Outlook (USD Billion, 2019-2032)

- SPAIN Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- SPAIN Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- SPAIN Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- SPAIN Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- REST OF EUROPE Outlook (USD Billion, 2019-2032)

- REST OF EUROPE Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- REST OF EUROPE Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- REST OF EUROPE Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- REST OF EUROPE Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- APAC Outlook (USD Billion, 2019-2032)

- APAC Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- APAC Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- APAC Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- APAC Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- APAC Commercial Telematics Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2032)

- CHINA Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- CHINA Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- CHINA Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- CHINA Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- INDIA Outlook (USD Billion, 2019-2032)

- INDIA Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- INDIA Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- INDIA Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- INDIA Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- JAPAN Outlook (USD Billion, 2019-2032)

- JAPAN Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- JAPAN Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- JAPAN Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- JAPAN Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- SOUTH KOREA Outlook (USD Billion, 2019-2032)

- SOUTH KOREA Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- SOUTH KOREA Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- SOUTH KOREA Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- SOUTH KOREA Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- MALAYSIA Outlook (USD Billion, 2019-2032)

- MALAYSIA Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- MALAYSIA Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- MALAYSIA Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- MALAYSIA Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- THAILAND Outlook (USD Billion, 2019-2032)

- THAILAND Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- THAILAND Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- THAILAND Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- THAILAND Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- INDONESIA Outlook (USD Billion, 2019-2032)

- INDONESIA Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- INDONESIA Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- INDONESIA Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- INDONESIA Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- REST OF APAC Outlook (USD Billion, 2019-2032)

- REST OF APAC Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- REST OF APAC Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- REST OF APAC Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- REST OF APAC Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- South America Outlook (USD Billion, 2019-2032)

- South America Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- South America Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- South America Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- South America Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- South America Commercial Telematics Market by Regional Type

- Brazil

- Mexico

- Argentina

- Rest of South America

- BRAZIL Outlook (USD Billion, 2019-2032)

- BRAZIL Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- BRAZIL Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- BRAZIL Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- BRAZIL Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- MEXICO Outlook (USD Billion, 2019-2032)

- MEXICO Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- MEXICO Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- MEXICO Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- MEXICO Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- ARGENTINA Outlook (USD Billion, 2019-2032)

- ARGENTINA Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- ARGENTINA Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- ARGENTINA Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- ARGENTINA Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2032)

- REST OF SOUTH AMERICA Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- REST OF SOUTH AMERICA Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- REST OF SOUTH AMERICA Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- REST OF SOUTH AMERICA Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- MEA Outlook (USD Billion, 2019-2032)

- MEA Commercial Telematics Market by Solution Type

- Fleet Management

- Insurance Telematics

- Vehicle Tracking

- Driver Behavior Monitoring

- MEA Commercial Telematics Market by Telematics Type

- Hardware

- Software

- Services

- MEA Commercial Telematics Market by Network Type

- Dedicated Short Range Communication

- Cellular

- Satellite

- MEA Commercial Telematics Market by End Use Sector Type

- Transportation and Logistics

- Construction

- Public Sector

- Retail

- MEA Commercial Telematics Market by Regional Type

- GCC Countries

- South Africa

- Rest of MEA

- GCC COUNTRIES Outlook (USD Billion, 2019-2032)