Commercial Aircraft Cabin Interior Market Trends

Commercial Aircraft Cabin Interior Market Research Report Information By Product Type (Seating, Lighting, Windows, Galley, In-Flight Entertainment and Lavatory), By Aircraft Type (Wide Body Aircraft and Narrow Body Aircraft), By Fit (Line Fit and Retro Fit), And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2032

Market Summary

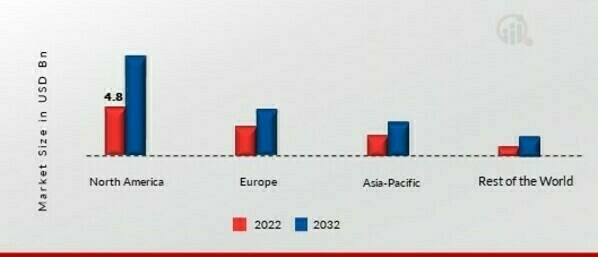

As per Market Research Future Analysis, the Global Commercial Aircraft Cabin Interior Market was valued at USD 14.83 billion in 2023 and is projected to grow to USD 18.78 billion by 2032, with a CAGR of 2.61% from 2024 to 2032. Key drivers include modernization of cabin designs and increased demand from low-cost carriers. The in-flight entertainment segment leads the market, accounting for 35% of revenue, while wide-body aircraft dominate with 70.4% of income. The North American market held USD 4.80 billion in 2022, with Asia-Pacific expected to grow the fastest due to rising aircraft deliveries.

Key Market Trends & Highlights

The Commercial Aircraft Cabin Interior market is experiencing significant growth driven by modernization and increased passenger traffic.

- Market Size in 2023: USD 14.83 billion; projected to reach USD 18.78 billion by 2032.

- In-Flight Entertainment segment accounts for 35% of market revenue.

- Wide Body Aircraft segment generated 70.4% of total income.

- North America accounted for USD 4.80 billion in 2022, with Asia-Pacific expected to exhibit the fastest growth.

Market Size & Forecast

| 2023 Market Size | USD 14.83 billion |

| 2032 Market Size | USD 18.78 billion |

| CAGR (2024-2032) | 2.61% |

| Largest Regional Market Share in 2022 | North America. |

Major Players

Key players include Safran (Zodiac Aerospace), Panasonic Avionics Corporation, Global Eagle Entertainment, United Technologies Corporation, RECARO Aircraft Seating GmbH & Co. KG, Astronics Corporation, Honeywell International Inc., Cobham plc, Gogo Inc., and Diehl Stiftung & Co. KG.

Market Trends

The emergence of low-cost airlines, expected to carry 1.3 billion passengers in 2022, has drastically changed the dynamics of global air travel, according to the International Civil Aviation Organization (ICAO). A rise is aiding the expansion of this industry in demand from low-cost carriers and regional airlines for aircraft interior renovation and space optimization. Commercial airlines modify the aircraft cabin to manage the more legroom offered for the first class and business class cabins and improve the aircraft seating layout to provide more seats in the premium economy class to increase revenue.

However, several airlines are luring customers by offering premium economy class passengers high-tech cabin furnishings comparable to first and business class, including changeable seats, mood lighting, an upgraded kitchen, in-flight entertainment, and internet access. As there has been a rise in demand for premium economy seats over the past few years, these amenities aid aircraft operators in maximizing income for each flight. As a result, the Commercial Aircraft Cabin Interior market is driven throughout the projected period by increased air passenger traffic and aircraft deliveries. Thus, this factor is driving the Commercial Aircraft Cabin Interior market CAGR.

The Boeing Commercial Market Outlook and Airbus Market Forecast, 2022 predict that by the end of the next ten years, there will be considerable growth in the demand for air travel. Almost 200 million individuals are predicted to join the middle class globally, which would encourage the expansion of the Commercial Aircraft Cabin Interior market. Particularly in developed nations, the Middle East, and the Asia Pacific area, revenue passenger kilometers (RPK) growth will eventually surpass the yearly expansion of gross domestic product (GDP).

The demand for Commercial Aircraft Cabin Interiors is anticipated to be driven by increased aircraft deliveries throughout the anticipated timeframe. For instance, Boeing's commercial market projection shows that 50% of the current fleet will be replaced over the next 20 years. As a result, demand for cabin interiors is anticipated to rise for prospective deliveries and upgrades, propelling industry development as a whole. Thus, this aspect is anticipated to accelerate Commercial Aircraft Cabin Interior market revenue globally.

The ongoing evolution of passenger preferences and technological advancements appears to be driving a transformative shift in the design and functionality of commercial aircraft cabin interiors, enhancing both comfort and efficiency.

Federal Aviation Administration (FAA)

Commercial Aircraft Cabin Interior Market Market Drivers

Regulatory Compliance

Regulatory compliance is a critical driver in the Global Commercial Aircraft Cabin Interior Market Industry. Governments and aviation authorities impose stringent regulations regarding safety, comfort, and accessibility in aircraft cabins. Compliance with these regulations necessitates continuous updates and modifications to cabin interiors, prompting airlines to invest in new designs and technologies. For instance, regulations concerning fire safety and emergency evacuation procedures require specific materials and layouts that can influence cabin design choices. As the industry adapts to these evolving regulations, the demand for compliant cabin interiors is expected to grow, further propelling market expansion.

Market Diversification

Market diversification is emerging as a key driver in the Global Commercial Aircraft Cabin Interior Market Industry. Airlines are increasingly exploring various market segments, including low-cost carriers and premium services, to cater to diverse passenger needs. This diversification leads to a broader range of cabin interior designs, from basic to luxurious, allowing airlines to target specific demographics effectively. The ability to offer tailored experiences is likely to enhance customer satisfaction and loyalty, contributing to overall market growth. As airlines continue to innovate and adapt their offerings, the market is poised for expansion, reflecting the dynamic nature of consumer preferences.

Market Growth Projections

The Global Commercial Aircraft Cabin Interior Market Industry is projected to witness substantial growth in the coming years. With a market value of 15.1 USD Billion in 2024, it is expected to reach 20.3 USD Billion by 2035, indicating a steady upward trajectory. This growth is underpinned by a compound annual growth rate of 2.7% anticipated from 2025 to 2035. Such projections highlight the increasing investments in cabin interiors as airlines strive to enhance passenger experience and operational efficiency. The market dynamics suggest a robust future, driven by evolving consumer preferences and technological advancements.

Sustainability Initiatives

Sustainability is becoming increasingly central to the Global Commercial Aircraft Cabin Interior Market Industry. Airlines are under pressure to adopt eco-friendly practices, leading to a demand for sustainable materials and designs in cabin interiors. This includes the use of recycled materials, energy-efficient lighting, and environmentally friendly manufacturing processes. As regulatory frameworks evolve and consumer awareness grows, airlines are likely to prioritize sustainability in their cabin designs. This shift not only aligns with global sustainability goals but also appeals to environmentally conscious travelers, potentially enhancing brand loyalty and market share in an increasingly competitive landscape.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Commercial Aircraft Cabin Interior Market Industry. The integration of advanced materials and smart technologies enhances passenger experience and operational efficiency. Innovations such as mood lighting, noise reduction systems, and improved seating designs are becoming standard features in modern aircraft. These advancements not only improve comfort but also contribute to weight reduction, which can lead to fuel savings for airlines. As airlines seek to differentiate themselves in a competitive market, the adoption of these technologies is expected to drive growth, with a compound annual growth rate of 2.7% anticipated from 2025 to 2035.

Increasing Passenger Demand

The Global Commercial Aircraft Cabin Interior Market Industry is experiencing a surge in passenger demand, driven by rising global air travel. In 2024, the market is projected to reach 15.1 USD Billion, reflecting the growing need for enhanced cabin interiors that prioritize comfort and aesthetics. Airlines are increasingly investing in modernizing their fleets to attract more travelers, as consumer preferences shift towards more luxurious and spacious environments. This trend is likely to continue, with projections indicating a market value of 20.3 USD Billion by 2035, suggesting a robust growth trajectory fueled by the increasing number of air passengers globally.

Market Segment Insights

Commercial Aircraft Cabin Interior Market Segment Insights

Commercial Aircraft Cabin Interior Market Segment Insights Commercial Aircraft Cabin Interior Type Insights

The Commercial Aircraft Cabin Interior Market segmentation, based on Product Type, includes Seating, Lighting, Windows, Galley, In-Flight Entertainment and Lavatory. The In-Flight Entertainment segment dominated the market, accounting for 35% of Commercial Aircraft Cabin Interior market revenue. The expansion of the in-flight entertainment & connection market is due to factors including improving the onboard passenger experience and a rise in orders for cutting-edge in-flight entertainment & connectivity systems by airline operators.

For developing cutting-edge applications and technologies, including onboard shopping, wireless in-flight entertainment (IFE), WI-FI & broadband access, and mobile connectivity, extensive R&D efforts in the field of in-flight entertainment & connectivity are being conducted. Using in-flight entertainment and communication technologies on aircraft helps airline companies make more money.

Commercial Aircraft Cabin Interior Aircraft Type Insights

Commercial Aircraft Cabin Interior Aircraft Type Insights

Based on Aircraft Type, the Commercial Aircraft Cabin Interior Market segmentation includes Wide Body Aircraft and Narrow Body Aircraft. The Wide Body Aircraft category generated the most income (70.4%). Because more wide-body aircraft are being produced for long-haul flights, the market is predicted to see the fastest CAGR growth in 2022. A nice cabin interior may increase passenger safety and comfort at high altitudes, enhancing their entire trip experience.

Commercial Aircraft Cabin Interior Fit Insights

Commercial Aircraft Cabin Interior Fit Insights

Based on Fit, the global Commercial Aircraft Cabin Interior industry has been segmented into Line Fit and Retro Fit. Retro Fit held the largest segment share in the Commercial Aircraft Cabin Interior market in 2022. As airlines worldwide work to increase passenger comfort, older aircraft are being renovated with cutting-edge technologies, including in-flight entertainment systems, aircraft seats, and cabin lighting By offering modern cabin furnishings, airline firms are attempting to entice customers.

Figure 1: Commercial Aircraft Cabin Interior Market, by Fit, 2022 & 2032 (USD billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Commercial Aircraft Cabin Interior Market Research Report -Forecast to 2032

Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North American Commercial Aircraft Cabin Interior market, accounted for USD 4.80 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. In 2022, North America was anticipated to hold the greatest market share for airplane cabin interior OEMs worldwide. This is due to the presence of significant producers of airplane cabin interiors, including Panasonic Avionics Corporation (US), Gogo Inc. (US), Collins Aerospace (US), Astronics Corporation (US), and Honeywell International Inc. (US).

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

According to our market research analysis, Asia Pacific Commercial Aircraft Cabin Interior is anticipated to expand at the quickest CAGR throughout the projection period. The considerable increase in commercial aircraft deliveries in developing nations like China and India is to blame for this trend. Long-term market expansion is anticipated in this area. Moreover, the China Commercial Aircraft Cabin Interior market held the largest market share. The India Commercial Aircraft Cabin Interior market was the fastest-growing market in the Asia-Pacific region.

Due to the growth in air passenger traffic, there may be a need for airplane cabin interiors in the European Commercial Aircraft Cabin Interior market. The market in the Europe area is anticipated to be driven by the increased investment in the tourist industry and MRO services in the Region. Further, the Germany Commercial Aircraft Cabin Interior market held the largest market share, and the UK Commercial Aircraft Cabin Interior market was the fastest-growing market in the European Region.

Key Players and Competitive Insights

Leading industry companies are making significant R&D investments to broaden their product offerings, which will spur further expansion of the market for Commercial Aircraft Cabin Interiors. Important market developments include new product releases, contractual agreements, mergers and acquisitions, greater investments, and collaboration with other organizations. Market participants also engage in several strategic actions to increase their worldwide presence. The Commercial Aircraft Cabin Interior industry must offer products at reasonable prices to grow and thrive in a more cutthroat and competitive environment.

One of the primary business strategies manufacturers employ in the worldwide Commercial Aircraft Cabin Interior industry to benefit customers and expand the market sector is local manufacturing to reduce operating costs. The Commercial Aircraft Cabin Interior industry has recently provided some of medicine's most important benefits. Major players in the Commercial Aircraft Cabin Interior market, including Safran (Zodiac Aerospace) (France), Panasonic Avionics Corporation (US), Global Eagle Entertainment (US), United Technologies Corporation (US), RECARO Aircraft Seating GmbH & Co. KG (Germany), Astronics Corporation (US), Honeywell International Inc. (US), Cobham plc (UK), Gogo Inc. (US), Diehl Stiftung & Co.

KG (Germany)., and others, are attempting to increase market demand by investing in research and development operations. With its headquarters in East Aurora, New York, Astronics Corporation is an American aerospace electronics company formed in 1968. It trades under the symbol "ATRO" on NASDAQ. It is renowned for its semiconductor test systems, lighting, and electronics integrations on corporate, commercial, and military aircraft. Southwest Airlines (US) contracted with Astronics Corporation (US) in June 2022 to supply its EMPOWER® Passenger In-Seat Power System for installation on 475 Boeing 737 MAX-7 and MAX-8 aircraft.

With its corporate headquarters in Broomfield, Colorado, Gogo Inc. is an American supplier of in-flight broadband Internet access and other connectivity services for commercial aircraft. To complete the Supplementary Type Certification (STC) for the Gogo 5G system, Gogo Inc. (US) teamed with Duncan Aviation (US), the biggest family-owned supplier of maintenance, repair, and overhaul services in the United States, in November 2021.

Key Companies in the Commercial Aircraft Cabin Interior Market market include

Industry Developments

- June 2022 Astrova is a brand-new in-flight entertainment (IFE) seat-end system from Panasonic Avionics Company (US). With IFE and connectivity, Astrova will assist airlines in boosting net promoter scores (NPS), improving passenger engagement, and delivering operational efficiencies.

- June 2022 The HypergamutTM Lighting System was introduced by Collins Aerospace (US) at the Aircraft Interiors Exhibition in Hamburg, Germany. The sophisticated full-cabin lighting system is authorized to synchronize automatically with real-time flight data to allow predictive and autonomous functioning. It is tailored to human biology to decrease passenger jetlag, color-optimized to enhance the look of materials, food, and fixtures throughout the cabin, and color-optimized to improve the appearance of fixtures.

Future Outlook

Commercial Aircraft Cabin Interior Market Future Outlook

The Commercial Aircraft Cabin Interior Market is projected to grow at a 2.7% CAGR from 2024 to 2035, driven by advancements in passenger comfort, sustainability initiatives, and technological innovations.

New opportunities lie in:

- Invest in eco-friendly materials to enhance sustainability and attract environmentally conscious airlines.

- Develop smart cabin technologies that improve passenger experience and operational efficiency.

- Expand customization options for airlines to differentiate their cabin interiors and enhance brand identity.

By 2035, the market is expected to achieve robust growth, reflecting evolving passenger preferences and technological advancements.

Market Segmentation

Commercial Aircraft Cabin Interior Fit Outlook

- Line Fit

- Retro Fit

Commercial Aircraft Cabin Interior Regional Outlook

- US

- Canada

Commercial Aircraft Cabin Interior Product Type Outlook

- Seating

- Lighting

- Windows

- Gallery

- In-Flight Entertainment

- Lavatory

Commercial Aircraft Cabin Interior Aircraft Type Outlook

- Wide Body Aircraft

- Narrow Body Aircraft

Report Scope

| Attribute/Metric | Details |

| Market Size 2023 | USD 14.83 billion |

| Market Size 2024 | USD 15.27 billion |

| Market Size 2032 | USD 18.78 billion |

| Compound Annual Growth Rate (CAGR) | 2.62% (2024-2032) |

| Base Year | 2023 |

| Market Forecast Period | 2024-2032 |

| Historical Data | 2019- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product Type, Aircraft Type, Fit, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Safran (Zodiac Aerospace) (France), Panasonic Avionics Corporation (US), Global Eagle Entertainment (US), United Technologies Corporation (US), RECARO Aircraft Seating GmbH & Co. KG (Germany), Astronics Corporation (US), Honeywell International Inc. (US), Cobham plc (UK), Gogo Inc. (US), Diehl Stiftung & Co. KG (Germany). |

| Key Market Opportunities | Augmentation of low-cost airlines |

| Key Market Dynamics | Manufacturers of aircraft and their parts are always working to create new market innovations. |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Commercial Aircraft Cabin Interior market?

The Commercial Aircraft Cabin Interior Market size was valued at USD 14.83 Billion in 2023.

What is the growth rate of the Commercial Aircraft Cabin Interior market?

The Commercial Aircraft Cabin Interior Market is projected to grow at a CAGR of 2.62% during the forecast period, 2024-2032.

Which Region held the largest market share in the Commercial Aircraft Cabin Interior market?

North America had the largest share in the Commercial Aircraft Cabin Interior Market.

Who are the key players in the Commercial Aircraft Cabin Interior market?

The key players in the Commercial Aircraft Cabin Interior market are Safran (Zodiac Aerospace) (France), Panasonic Avionics Corporation (US), Global Eagle Entertainment (US), United Technologies Corporation (US), RECARO Aircraft Seating GmbH & Co. KG (Germany), Astronics Corporation (US), Honeywell International Inc. (US), Cobham plc (UK), Gogo Inc. (US), Diehl Stiftung & Co. KG (Germany).

Which Product type led the Commercial Aircraft Cabin Interior market?

The In-Flight Entertainment Commercial Aircraft Cabin Interior category dominated the market in 2022.

Which Aircraft Type had the largest market share in the Commercial Aircraft Cabin Interior market?

The Wide Body Aircraft had the largest share in the Commercial Aircraft Cabin Interior Market.

Who are the significant players operative in the global Commercial Aircraft Cabin Interior market?

A few eminent market players operating in the global Commercial Aircraft Cabin Interior market are United Technology Corporation (US), Zodiac Aerospace (France), Jamco Corporation (Japan), Panasonic Avionics (U.S.), among others.

-

Of IFEC Systems

- Retrofit Of Existing Aircraft

-

Drivers Impact Analysis

-

Restraints

- Delays

-

Restraints

-

In Aircraft Deliveries

- Decreasing Profitability Of Airlines

-

In Developing Regions

- Restraints Impact Analysis

-

Opportunities

- Increasing Preference For Customization

-

Of Aircraft Cabins

-

Supply Chain Analysis

- Design And Development

- Raw Material/Component Supply

- Manufacturing And Assembly

- Distribution

- End Users

- Aftermarket

-

Porter’s Five Forces Model

- Threat Of New Entrants

- Bargaining Power Of Suppliers

-

Supply Chain Analysis

-

Bargaining Power Of Buyers

-

Threat Of Substitutes

- Rivalry

-

Technological Trends

- In-Flight

-

Threat Of Substitutes

-

Connectivity And Personalized Lighting Systems In Aircraft Cabin Interior

-

Advancements In Aircraft Cabin Interior Components And Materials

- Lavatories

- Smart Seats

- Anti-Bacterial

-

Advancements In Aircraft Cabin Interior Components And Materials

-

Seats And Smart Windows

-

Material

- Digital Aircraft Cabin

- Regulatory Landscape

-

Patent Analysis

- List Of Patents

-

Material

-

Interior Market, By Product Type

-

Overview

- Seating

- In-Flight Entertainment

- Lighting

- Galley

- Lavatory

- Windows

- Others

-

Overview

- Narrow-Body Aircraft

- Wide-Body Aircraft

-

Overview

-

Cabin Interior Market, By Fit

-

Overview

- Line-Fit

- Retrofit

- Overview

-

North America

- US

-

Overview

-

US By Aircraft Type

-

US By Fit

- Canada

-

Europe

- France

-

US By Fit

-

By Aircraft Type

-

France By Fit

- UK

- Germany

-

France By Fit

-

By Product Type

- Germany By Aircraft Type

-

Germany By Fit

-

Italy

- Italy By Product Type

- Rest Of Europe

-

Italy

-

Rest Of Europe By Fit

-

Asia-Pacific

- China

- India

-

Asia-Pacific

-

India By Product Type

- India By Aircraft Type

-

India By Fit

-

Japan

- Japan By Product Type

- Australia

- Rest Of Asia-Pacific

-

Japan

-

By Product Type

-

Rest Of Asia-Pacific By Aircraft Type

- Rest Of Asia-Pacific By Fit

-

Latin America

- Brazil

-

Rest Of Asia-Pacific By Aircraft Type

-

Brazil By Aircraft Type

-

Brazil By Fit

- Mexico

-

Brazil By Fit

-

By Aircraft Type

-

Mexico By Fit

- Rest Of Latin America

-

Mexico By Fit

-

Of Latin America By Fit

-

Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

-

Middle East & Africa

-

Africa By Aircraft Type

-

South Africa By Fit

- Rest Of Middle East & Africa

-

South Africa By Fit

-

& Africa By Product Type

- Rest Of Middle East & Africa

-

By Aircraft Type

- Rest Of Middle East & Africa By Fit

- Competitive Scenario

- Market Share Analysis

- Mergers & Acquisitions

- Competitor Benchmarking

-

Rockwell Collins

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

RECARO Aircraft Seating GmbH & Co. KG

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Zodiac Aerospace

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Panasonic Avionics Corporation

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Diehl Stiftung & Co. KG

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Cobham Plc

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

JAMCO Corporation

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Astronics Corporation

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

United Technologies Corporation

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Honeywell International Inc.

- Company Overview

- Financial Overview

- Products/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AIRCRAFT CABIN INTERIOR MARKET: REGULATORY LANDSCAPE

-

GRANTED PATENTS ON AIRCRAFT CABIN INTERIOR

-

AIRCRAFT CABIN INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

(USD MILLION)

-

CABIN INTERIOR MARKET, BY REGION, 2024-2032 (USD MILLION)

-

LIGHTING: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY REGION, 2024-2032 (USD MILLION)

-

2024-2032 (USD MILLION)

-

INTERIOR MARKET, BY REGION, 2024-2032 (USD MILLION)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY REGION, 2024-2032 (USD MILLION)

-

(USD MILLION)

-

BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY REGION, 2024-2032 (USD MILLION)

-

BY REGION, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY REGION, 2024-2032 (USD MILLION)

-

2024-2032 (USD MILLION)

-

INTERIOR MARKET, BY REGION, 2024-2032 (USD MILLION)

-

AMERICA: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

2024-2032 (USD MILLION)

-

MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

AIRCRAFT CABIN INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

(USD MILLION)

-

MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

2024-2032 (USD MILLION)

-

INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

EUROPE: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

BY FIT, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY COUNTRY, 2024-2032 (USD MILLION)

-

FRANCE: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

AIRCRAFT CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

TYPE, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

TYPE, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

OF EUROPE: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

EUROPE: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

AIRCRAFT CABIN INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY COUNTRY, 2024-2032 (USD MILLION)

-

CHINA: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

AIRCRAFT CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

AIRCRAFT CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

AIRCRAFT CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

MARKET, BY FIT, 2024-2032 (USD MILLION)

-

AIRCRAFT CABIN INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

TYPE, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

AMERICA: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY COUNTRY, 2024-2032 (USD MILLION)

-

TYPE, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

TYPE, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

LATIN AMERICA: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

EAST & AFRICA: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

2024-2032 (USD MILLION)

-

AIRCRAFT CABIN INTERIOR MARKET, BY COUNTRY, 2024-2032 (USD MILLION)

-

(USD MILLION)

-

BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

AIRCRAFT CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

ARABIA: COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY FIT, 2024-2032 (USD MILLION)

-

BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

AIRCRAFT CABIN INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

2024-2032 (USD MILLION)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET, BY PRODUCT TYPE, 2024-2032 (USD MILLION)

-

INTERIOR MARKET, BY AIRCRAFT TYPE, 2024-2032 (USD MILLION)

-

BY FIT, 2024-2032 (USD MILLION)

-

CABIN INTERIOR MARKET: MERGERS & ACQUISITIONS

-

OF THE MAJOR COMPETITORS

-

OFFERED

-

AVIONICS CORPORATION: PRODUCT/SERVICES OFFERED

-

AVIONICS CORPORATION: KEY DEVELOPMENTS

-

CO. KG: PRODUCT/SERVICES OFFERED

-

KG: KEY DEVELOPMENTS

-

CORPORATION: PRODUCTS/SERVICES OFFERED

-

KEY DEVELOPMENTS

-

OFFERED

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET

-

PASSENGERS CARRIED (2024-2032)

-

AIRCRAFT CABIN INTERIOR MARKET

-

BACKLOG, BOEING VS AIRBUS, 2023

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET

-

FIVE FORCES: GLOBAL COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET

-

TYPE, 2023 (% SHARE)

-

MARKET, BY FIT, 2023 (% SHARE)

-

CABIN INTERIOR MARKET SHARE, BY REGION, 2023 (% SHARE)

-

AMERICA COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET SHARE, BY COUNTRY, 2023 (% SHARE)

-

BY COUNTRY, 2023 (% SHARE)

-

CABIN INTERIOR MARKET SHARE, BY COUNTRY, 2023 (% SHARE)

-

LATIN AMERICA COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET SHARE, BY COUNTRY, 2023 (% SHARE)

-

INTERIOR MARKET SHARE, BY COUNTRY, 2023 (% SHARE)

-

COMMERCIAL AIRCRAFT CABIN INTERIOR MARKET SHARE, 2023 (%)

-

COLLINS: SEGMENTAL SHARE, 2023 (%)

-

ANALYSIS

-

ANALYSIS

-

MILLION)

-

TOTAL SALES, 2024-2032 (USD MILLION)

-

GEOGRAPHICAL SHARE, 2023 (%)

-

SHARE, 2023 (%)

-

2023 (%)

-

2023 (%)

-

PLC: GEOGRAPHICAL SHARE, 2023 (%)

-

CORPORATION: GLOBAL SALES, 2024-2032 (USD MILLION)

-

CORPORATION: SEGMENTAL SHARE, 2023 (%)

-

GEOGRAPHICAL SHARE, 2023 (%)

-

ANALYSIS

-

(USD MILLION)

-

(%)

-

INTERNATIONAL INC.: TOTAL REVENUE, 2024-2032 (USD MILLION)

Commercial Aircraft Cabin Interior Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment