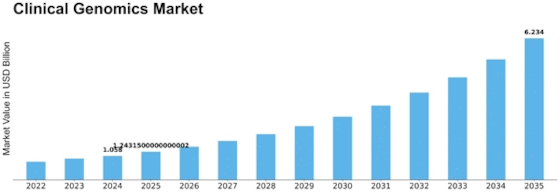

Clinical Genomics Size

Clinical Genomics Market Growth Projections and Opportunities

The Clinical Genomics market is closely encouraged by using fast technological improvements. Continuous innovations in sequencing technologies, bioinformatics, and statistics evaluation gear pressure the market forward, allowing more accurate and green genomic analysis. The reduced fee of genomic sequencing is a pivotal component shaping the clinical genomics market. As the price of sequencing genomes declines, accessibility to genomic offerings increases, fostering a broader adoption of Clinical Genomics in research and healthcare packages. The prevalence of genetic disorders globally has a right away impact on the Clinical Genomics market. As cognizance and understanding of genetic diseases grow, there may be an increasing demand for genomic testing and diagnostic services, propelling the market's expansion. Strategic collaborations between genomics organizations, healthcare carriers, and studies establishments notably impact the market. Partnerships facilitate understanding exchange, resource sharing, and the improvement of innovative answers, contributing to the overall growth of Clinical Genomics. Support from authorities, our bodies, and investment companies quickens studies and improvement in Clinical Genomics. Grants and incentives for genomics projects create conducive surroundings for market growth by providing economic backing and regulatory guidance. With the increasing quantity of genomic records being generated, saved, and analyzed, records protection and privacy concerns end up as crucial market factors. Implementing sturdy measures to guard affected persons' facts is crucial to advantage and hold the belief, fostering endured market growth. The integration of synthetic intelligence in genomic information analysis complements the performance and accuracy of interpretation. AI algorithms are a resource for figuring out patterns, institutions, and capacity therapeutic goals, making genomic statistics more precious for clinicians and researchers. The developing demand for comprehensive genetic testing drives the worldwide growth of genomic checking-out services. Increased consciousness and accessibility to genomic checking-out services globally contribute to the market's expansion. The regulatory surroundings play a vital function in shaping the Clinical Genomics market. Adherence to regulatory guidelines ensures the satisfaction and reliability of genomic checking-out offerings, influencing market dynamics and purchaser self-belief. As patients turn out to be extra actively involved in their healthcare decisions, there may be a rising demand for genomic statistics to guide customized healthcare choices. This trend contributes to the market's boom as individuals are trying to find and understand their genetic predispositions and ability fitness risks. Ongoing research and development activities in genomics drive innovation and the advent of recent technology and packages.

Leave a Comment