Cardiopulmonary Disease Diagnostics Treatment Market Trends

Cardiopulmonary Disease Diagnostics and Treatment Market Research Report Information By Disease Type (Cardiovascular and Respiratory Diseases), By Type (Diagnosis-Electrocardiogram and Treatment -Medication), By End-Users (Diagnostic Centers and Hospitals), and By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2035

Market Summary

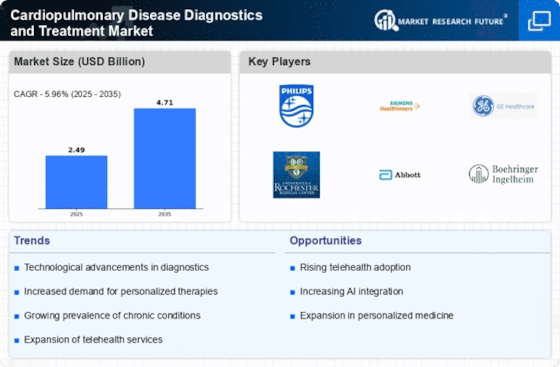

As per Market Research Future Analysis, the Global Cardiopulmonary Disease Diagnostics and Treatment Market was valued at USD 2.49 Billion in 2024 and is projected to reach USD 4.71 Billion by 2035, growing at a CAGR of 5.96% from 2025 to 2035. Key drivers include the increasing geriatric population, rising prevalence of cardiovascular diseases, and advancements in diagnostic and treatment technologies. The cardiovascular segment accounted for 50.8% of market revenue in 2023, while the treatment-medication segment is expected to grow rapidly due to the availability of various cardiovascular drugs. North America is anticipated to dominate the market, driven by high cardiovascular disease incidence and technological adoption.

Key Market Trends & Highlights

The cardiopulmonary disease diagnostics and treatment market is witnessing significant growth due to various factors.

- Market Size in 2024: USD 2.49 Billion. Projected Market Size by 2035: USD 4.71 Billion. CAGR from 2025 to 2035: 5.96%. Cardiovascular segment revenue share: 50.8% in 2023.

Market Size & Forecast

| 2024 Market Size | USD 2.49 Billion |

| 2035 Market Size | USD 4.71 Billion |

| CAGR from 2024 to 2035 | 5.96% |

| Largest Regional Market Share in 2024 | North America. |

Major Players

<p>Key players include Cardinal Health, GE Healthcare, Koninklijke Philips N.V., Medtronic plc, and GSK plc.</p>

Market Trends

Rising cardiovascular disease prevalence is driving the market growth

Market CAGR for cardiopulmonary disease diagnostics and treatment is driven by the growing prevalence of cardiovascular diseases. The increasing prevalence of chronic cardiovascular illnesses worldwide is a major driver of cardiopulmonary disease diagnostics and treatment in the market. According to World Health Organisation, cardiovascular disease is the leading cause of mortality worldwide. ly, 17.9 million people die from cardiovascular disorders each year. High salt intake in the diet, increased tobacco use, increased smoking prevalence, and increased alcohol use are the main contributors to cardiovascular illnesses. By catching cardiovascular disorders early, they can be efficiently treated.

Therefore, the market for cardiopulmonary disease diagnostics and treatment is predicted to rise due to the increasing demand for early identification of cardiovascular disorders.

The rising number of persons with diabetes and obesity drives the market for cardiopulmonary disease diagnostics and treatment. Obesity is linked to risk factors like high blood pressure and high cholesterol, and diabetes increases the risk of cardiovascular illnesses. For instance, as per a study by American Heart Association (AMA), CVD cases will increase to 22.2 million by 2030. Another study by the American Medical Association (AMA) in the U.S. found that 26 million people have had diabetes diagnosed and that an additional 9 million people have the condition but have not yet received a diagnosis.

Thus, driving the cardiopulmonary disease diagnostics and treatment market revenue.

<p>The increasing prevalence of cardiopulmonary diseases underscores the urgent need for innovative diagnostic and treatment solutions, as healthcare systems strive to enhance patient outcomes and reduce the burden of these conditions.</p>

Centers for Disease Control and Prevention (CDC)

Cardiopulmonary Disease Diagnostics Treatment Market Market Drivers

Market Growth Projections

Growing Awareness and Education

There is a notable increase in public awareness and education regarding cardiopulmonary diseases, which serves as a catalyst for the Global Cardiopulmonary Disease Diagnostics and Treatment Market Industry. Campaigns aimed at educating the public about risk factors, symptoms, and the importance of early diagnosis are becoming more prevalent. This heightened awareness encourages individuals to seek medical attention sooner, leading to increased demand for diagnostic services and treatment options. As a result, healthcare providers are likely to expand their offerings to meet this growing need, further propelling market growth.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure and funding for cardiopulmonary disease research are pivotal to the Global Cardiopulmonary Disease Diagnostics and Treatment Market Industry. Various countries are implementing policies to enhance healthcare access and promote research in cardiopulmonary health. For instance, increased funding for public health programs and research grants is fostering innovation in diagnostics and treatment methodologies. Such initiatives not only support the development of new technologies but also encourage collaboration between public and private sectors, ultimately contributing to market expansion and improved patient care.

Aging Population and Lifestyle Changes

The demographic shift towards an aging population, coupled with lifestyle changes, is a significant driver of the Global Cardiopulmonary Disease Diagnostics and Treatment Market Industry. Older adults are more susceptible to cardiopulmonary diseases, and as life expectancy increases, the demand for effective diagnostics and treatments rises correspondingly. Additionally, lifestyle factors such as sedentary behavior and poor dietary habits contribute to the prevalence of these diseases. This demographic trend underscores the necessity for innovative solutions in diagnostics and treatment, thereby fueling market growth.

Rising Prevalence of Cardiopulmonary Diseases

The increasing incidence of cardiopulmonary diseases globally is a primary driver for the Global Cardiopulmonary Disease Diagnostics and Treatment Market Industry. Conditions such as chronic obstructive pulmonary disease and heart failure are becoming more prevalent, largely due to aging populations and lifestyle factors. For instance, the World Health Organization indicates that respiratory diseases are among the leading causes of mortality worldwide. This rising prevalence necessitates enhanced diagnostic and treatment solutions, contributing to the market's projected growth from 2.49 USD Billion in 2024 to an estimated 4.72 USD Billion by 2035, reflecting a compound annual growth rate of 5.99% from 2025 to 2035.

Technological Advancements in Diagnostic Tools

Innovations in diagnostic technologies are significantly shaping the Global Cardiopulmonary Disease Diagnostics and Treatment Market Industry. The introduction of advanced imaging techniques, such as high-resolution computed tomography and portable echocardiography devices, enhances the accuracy and efficiency of diagnosing cardiopulmonary conditions. These advancements not only facilitate early detection but also improve patient outcomes. For example, the integration of artificial intelligence in imaging analysis is streamlining the diagnostic process. As these technologies become more accessible, they are likely to drive market growth, aligning with the increasing demand for precise and timely diagnostics.

Market Segment Insights

Cardiopulmonary Disease Diagnostics and Treatment Disease Type Insights

<p>The cardiopulmonary disease diagnostics and treatment market segmentation, based on disease type, include cardiovascular and respiratory diseases. The cardiovascular segment dominated the market, accounting for 50.8% of market revenue (1.1 Billion). The main sector drivers are rapid technical development, increased prevalence of cardiovascular illnesses worldwide, and rising demand for minimally invasive procedures. The increasing prevalence of heart illnesses such as cardiomyopathy and stroke is the main contributor to cardiovascular-related mortality. Furthermore, the respiratory diseases sector saw considerable growth. Air pollution is a serious issue, and COPD prevalence is rising ly, especially in developing nations with high smoking rates.</p>

<p>The aging population, urbanization, and lifestyle modifications are a few causes of the rise in respiratory disease prevalence. People are more prone to respiratory diseases as they get older.</p>

<p>Figure 1 Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease Type, 2023 & 2032 (USD Billion)</p>

Cardiopulmonary Disease Diagnostics and Treatment TypeInsights

<p>The cardiopulmonary disease diagnostics and treatment market segmentation, based on type, includes diagnosis-electrocardiogram and treatment-medication. In 2022, the diagnosis-electrocardiograms segment dominated the market. Due to the growing usage of ECG diagnostic techniques in diagnosing cardiac illnesses such as arrhythmia, congenital heart anomalies, and coronary occlusion, the Electrocardiogram (ECG or EKG) segment accounted for a sizably substantial revenue share.</p>

<p>September 2020 AliveCor, announced its entry into the Indian market with the breakthrough introduction of KardiaMobile 6L, the most clinically-validated personal ECG device. Because of the country's access issues to excellent healthcare and COVID-related infection fears, the portable and technology-enabled ECG gadget will assist in providing inexpensive and easy heart care to over 260 million heart patients and those at risk without requiring them to visit a hospital.</p>

<p>Additionally, in 2022, the treatment-medication segment witnessed the fastest growth rate. The sector for cardiovascular drugs is projected to grow due to the availability of medication classes used to treat cardiovascular indications such as hyperlipidemia and hypertension.</p>

Cardiopulmonary Disease Diagnostics and Treatment End-User Insights

<p>The cardiopulmonary disease diagnostics and treatment market segmentation, based on end-user, includes diagnostic centers and hospitals. Over the projection period in 2022, the hospital segment's revenue share was higher. Greater utilization of cutting-edge imaging and diagnostic technology for workflow automation and accurate cardiac disease identification is fueling the segment's revenue growth. Because laboratory testing is more sophisticated and fully integrated with the technology required to ensure that results are accurate, analyzed, validated, and recorded, the diagnostic center's segment is predicted to hold the largest market share in 2022 and continue to dominate during the forecast period.</p>

Get more detailed insights about Cardiopulmonary Disease Diagnostics and Treatment Market Research Report – Forecast to 2032

Regional Insights

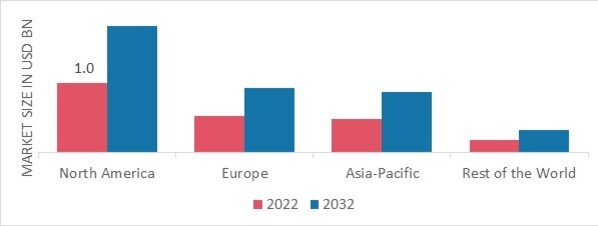

By region, the study provides market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American cardiopulmonary disease diagnostics and treatment market area will dominate this market due to the high incidence of cardiovascular diseases, the rapid adoption of minimally invasive procedures, the existence of reimbursements, the growing geriatric population, and the high demand for continuous and home-based monitoring. According to the CDC's most recent statistics, released in October 2022, a heart attack happens in the US every 40 seconds, and over 805,000 people experience one yearly.

Further, the major countries studied in the market report are US, Canada, France, German, Italy, UK, Spain, Japan, China, Australia, India, South Korea, and Brazil.

Figure 2 CARDIOPULMONARY DISEASE DIAGNOSTICS AND TREATMENT MARKET SHARE BY REGION 2022 (USD Billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe’s cardiopulmonary disease diagnostics and treatment market accounts for the second-largest market share due, among other things, to a constant increase in the number of patients with CAD and peripheral artery disorders. According to figures made available by the European Union on March 21, 2022, heart attacks were a significant cause of fatalities in the EU. Additionally, technical developments enable portable characteristics in testing equipment, supporting the expansion of the market's revenue.

Further, the German cardiopulmonary disease diagnostics and treatment market held the major market share, and the UK cardiopulmonary disease diagnostics and treatment market was the rapidly growing market in the European region.

The Asia-Pacific Cardiopulmonary Disease Diagnostics and Treatment Market is anticipated to grow quickly from 2024 to 2032. It is due to a high prevalence of heart illnesses in some areas and a sizable patient base needing treatment in nations like China and India. According to a report released by BioSpectrum on June 23, 2022, the number of heart attacks among people under 50 has dramatically grown in China over the past ten years. All age groups, including those under 50, have shown a rise in the age-specific incidence rate of heart attacks per 100,000 persons.

Moreover, China’s cardiopulmonary disease diagnostics and treatment market held the major market share, and the Indian cardiopulmonary disease diagnostics and treatment market was the rapidly growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are largely investing in research and development to expand their product lines, which will help the cardiopulmonary disease diagnostics and treatment market grow even more. The launch of new products, larger-scale mergers and acquisitions, contractual agreements, and collaboration with other organizations are significant market developments in which market participants engage to increase their presence. The cardiopulmonary disease diagnostics and treatment industry must provide affordable products to expand and thrive in a more competitive and challenging market environment.

One of the major business strategies manufacturers use in the cardiopulmonary disease diagnostics and treatment industry to increase market sector and benefits customers is local manufacturing to lower operational costs. In recent years, the cardiopulmonary disease diagnostics and treatment industry has stipulated some of the most important medicinal benefits. Major players in the cardiopulmonary disease diagnostics and treatment industry, including Cosmed Medical, Cardinal Health, GE Healthcare, Schiller AG, Koninklijke Philips N.V., and others, are funding operations for research and development to boost market demand.

Medtronic plc is a medical device firm based in the United States. The operational and executive headquarters of the corporation are in Minneapolis, Minnesota, and the legal headquarters are in Ireland. Medtronic PLC creates medical products that are both therapeutic and diagnostic. Products for bradycardia pacing, tachyarrhythmia management, atrial fibrillation management, heart failure management, heart valve replacement, malignant and non-malignant pain, and movement disorders are among the company's mainstays.

In October 2022, Medtronic plc received FDA approval for expanded labeling of a cardiac lead that taps into the heart's natural electrical system, providing needed therapy while avoiding complications associated with traditional pacing methods, such as cardiomyopathy. Medtronic was the first and only firm to approve conduction system pacing therapy.

GSK plc, formerly GlaxoSmithKline plc, is a multinational pharmaceutical and biotechnology corporation based in London, England. GSK is one of the major pharmaceutical firms in terms of total sales. The company has clout in various therapeutic areas, including respiratory, cancer, antiviral drugs, and vaccines. GSK employs joint ventures to develop scale in some industries, such as HIV. In April 2022, GlaxoSmithKline Pharmaceuticals Limited introduced Trelegy Ellipta (fluticasone furoate/umeclidinium/vilanterol), the first single-inhaler triple treatment (SITT) in India for Chronic Obstructive Pulmonary Disease (COPD) patients on a once-daily basis.

Drugs Controller General of India approved the medicine as a maintenance treatment to prevent and relieve Chronic Obstructive Pulmonary Disease symptoms in patients aged 18 and above.

Key Companies in the Cardiopulmonary Disease Diagnostics Treatment Market market include

Industry Developments

February 2021 Remo Care Solutions has created a new AI-based remote monitoring gadget for cardiac patients that analyses the patient's cardiovascular status in real-time. Patients can easily use this lightweight wireless device in their rooms or ICU. During a Covid pandemic, the technology allows patients to avoid physically seeing doctors, allowing doctors to diagnose disease through remote monitoring.

April 2021 Phoenix Cardiac Devices has received regulatory CE mark certification for their BACE (basal annuloplasty of the cardiac externally) device, which will be used to treat functional mitral regurgitation. Compared to other devices that treat mitral regurgitation by replacing or repairing the mitral valve, the BACE device is unique.

Future Outlook

Cardiopulmonary Disease Diagnostics Treatment Market Future Outlook

<p>The Global Cardiopulmonary Disease Diagnostics and Treatment Market is projected to grow at a 5.96% CAGR from 2025 to 2035, driven by technological advancements, increasing prevalence of cardiopulmonary diseases, and rising healthcare expenditure.</p>

New opportunities lie in:

- <p>Develop AI-driven diagnostic tools to enhance early detection and treatment efficacy. Expand telehealth services for remote monitoring of cardiopulmonary patients. Invest in personalized medicine approaches to tailor treatments based on genetic profiles.</p>

<p>By 2035, the market is expected to achieve substantial growth, reflecting advancements in diagnostics and treatment methodologies.</p>

Market Segmentation

Cardiopulmonary Disease Diagnostics and Treatment Type Outlook

- Diagnosis-Electrocardiogram

- Treatment -Medication

Cardiopulmonary Disease Diagnostics and Treatment End-User Outlook

- Diagnostic Centers

- Hospitals

Cardiopulmonary Disease Diagnostics and Treatment Regional Outlook

- {""=>["US"

- "Canada"]}

- {""=>["Germany"

- "France"

- "UK"

- "Italy"

- "Spain"

- "Rest of Europe"]}

- {""=>["China"

- "Japan"

- "India"

- "Australia"

- "South Korea"

- "Rest of Asia-Pacific"]}

- {""=>["Middle East"

- "Africa"

- "Latin America"]}

Cardiopulmonary Disease Diagnostics and Treatment DiseaseType Outlook

- Cardiovascular

- Respiratory Diseases

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 2.49 Billion |

| Market Size 2035 | 4.71 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 5.96% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Market Competitive Landscape, Growth Factors, Revenue Forecast, and Trends |

| Segments Covered | Disease Type, Type, and End-user |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | US, Canada, France, German, Italy, UK, Spain, Japan, China, Australia, India, South Korea, and Brazil. |

| Key Companies Profiled | Cosmed Medical, Cardinal Health, GE Healthcare, Schiller AG, and Koninklijke Philips N.V. |

| Key Market Opportunities | Rapid technological advancements |

| Key Market Dynamics | Increasing prevalence of coronary artery diseases |

| Market Size 2025 | 2.64 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the cardiopulmonary disease diagnostics and treatment market?

The market size of the cardiopulmonary disease diagnostics and treatment market was prized at USD 2.34 Billion in 2023.

What is the growth rate of the cardiopulmonary disease diagnostics and treatment market?

From 2024 to 2032, the anticipated CAGR for the market is 5.96%.

Which region held the major market share in the cardiopulmonary disease diagnostics and treatment market?

The major portion of the market was accounted for by North America.

Who are the notable players in the cardiopulmonary disease diagnostics and treatment market?

The notable players in the market are Cosmed Medical, Cardinal Health, GE Healthcare, Schiller AG, and Koninklijke Philips N.V.

Which disease type led the cardiopulmonary disease diagnostics and treatment market?

The cardiovascular disease type dominated the market in 2023.

Which type had the major market share in the cardiopulmonary disease diagnostics and treatment market?

The echocardiogram sector had the largest share of the market.

-

Table of Contents:

-

Chapter 1. Report Prologue

-

Chapter 2. Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Chapter 3. Research Methodology

- Introduction

- Primary Research

- Secondary Research

- Market Size Estimation

-

Chapter 4. Market Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- Macroeconomic Indicators

- Technology Trends & Assessment

-

Chapter 5. Market Factor Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

- Value Chain Analysis

- Investment Feasibility Analysis

- Pricing Analysis

-

Porter’s Five Forces Analysis

-

Chapter 6. Global Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease Type

- Introduction

- Cardiovascular diseases

-

6.2.1 Coronary artery disease

-

Market Estimates & Forecast, by Region, 2023-2032

-

Market Estimates & Forecast, by Country, 2023-2032

-

6.2.2 Angina pectoris

-

6.2.3 Myocardial infraction

-

6.2.4 Dysrhythmia

-

6.2.5 Hypertension

-

6.2.6 Others

- Respiratory diseases

-

6.3.1 Influenza

-

6.3.2 Asthma

-

6.3.3 Bronchitis

-

6.3.4 Emphysema

-

6.3.5 Cystic fibrosis

-

6.3.6 Others

-

Chapter 7. Global Cardiopulmonary Disease Diagnostics and Treatment Market, by Type

- Introduction

- Diagnostics

-

7.2.1 Electrocardiogram (ECG)

-

Market Estimates & Forecast, by Region, 2023-2032

-

7.2.2 Holter monitoring

-

7.2.3 Echocardiogram

-

7.2.4 Stress test

-

7.2.5 Cardiac catheterization

-

7.2.6 Cardiac computerized tomography (CT) scan

-

7.2.7 Cardiac magnetic resonance imaging (MRI)

-

7.2.8 Single-photon emission computed tomography (SPECT)

-

7.2.9 Stress blood pressure monitors

-

7.2.10 Pulse oximeters

-

7.2.10 Spirometry

- Treatment

-

7.3.1 Medication

-

7.3.1.1 Angiotensin-converting enzyme (ACE) inhibitors

-

Market Estimates & Forecast, by Region, 2023-2032

-

Market Estimates & Forecast, by Country, 2023-2032

-

7.3.1.2 Angiotensin II receptor blockers (ARBS)

-

7.3.1.3 Anticoagulants

-

7.3.1.4 Antiplatelet agents

-

7.3.1.5 Others

-

Chapter 8. Global Cardiopulmonary Disease Diagnostics and Treatment Market, by End-Users

- Introduction

- Hospitals

- Clinics

- Diagnostic centers

- Specialty Clinics and Rehab Centers

- Research Institutes

- Others

-

Chapter 9. Global Cardiopulmonary Disease Diagnostics and Treatment, by Region

- Introduction

-

Americas

- North America

- South America

-

Europe

- Western Europe

- Eastern Europe

-

Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Chapter 10. Company Landscape

- Introduction

- Market Share Analysis

- Key Development & Strategies

-

Chapter 11. Company Profiles

-

Cardinal Health

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

-

Cosmed Medical

- Company Overview

- Type Overview

- Financial Overview

- Key Developments

- SWOT Analysis

-

GE Healthcare

- Company Overview

- Type Overview

- Financial Overview

- Key Development

- SWOT Analysis

-

Halma plc.

- Company Overview

- Technology/Business Segment Overview

- Financial Overview

- Key Development

- SWOT Analysis

-

Hill-Rom Holdings, Inc.

- Company Overview

- Type Overview

- Financial overview

- Key Developments

- SWOT Analysis

-

Koninklijke Philips N.V.

- Company Overview

- Type Overview

- Financial Overview

- Key Developments

- SWOT Analysis

-

MGC Diagnostics Corporation

- Overview

- Type Overview

- Financial Overview

- Key Developments

- SWOT Analysis

-

NIHON KOHDEN CORPORATION

- Overview

- Type/ Technology Overview

- Financials

- Key Developments

- SWOT Analysis

-

Schiller AG

- Overview

- Type Overview

- Financials

- Key Developments

- SWOT Analysis

- Masimo Corporation

-

Vyaire Medical Inc.

- Overview

- Type Overview

- Financials

- Key Developments

- SWOT Analysis

-

Cardinal Health

-

Chapter 12 MRFR Conclusion

-

Key Findings

- From CEO’s Viewpoint

- Unmet Needs of the Market

- Key Companies to Watch

- Predictions for the Cardiopulmonary Disease Diagnostics and Treatment Industry

-

Key Findings

-

Chapter 13. Appendix

-

List of Tables and Figures

- LIST OF TABLES

- Table 1 Global Cardiopulmonary Disease Diagnostics and Treatment Market Synopsis, 2023-2032

- Table 2 Global Cardiopulmonary Disease Diagnostics and Treatment Market Estimates and Forecast, 2023-2032 (USD Million)

- Table 3 Global Cardiopulmonary Disease Diagnostics and Treatment Market, by Region, 2023-2032 (USD Million)

- Table 4 Global Cardiopulmonary Disease Diagnostics and Treatment Market, by Type, 2023-2032 (USD Million)

- Table 5 Global Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease type, 2023-2032 (USD Million)

- Table 6 Global Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million)

- Table 7 North America: Cardiopulmonary Disease Diagnostics and Treatment Market, by Type, 2023-2032 (USD Million)

- Table 8 North America: Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease type, 2023-2032 (USD Million)

- Table 9 North America: Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million)

- Table 10 US: Cardiopulmonary Disease Diagnostics and Treatment Market, by Type, 2023-2032 (USD Million)

- Table 11 US: Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease type, 2023-2032 (USD Million)

- Table 12 US: Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million)

- Table 13 Canada: Cardiopulmonary Disease Diagnostics and Treatment Market, by Type, 2023-2032 (USD Million)

- Table 14 Canada: Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease type, 2023-2032 (USD Million)

- Table 15 Canada Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million)

- Table 16 South America: Cardiopulmonary Disease Diagnostics and Treatment Market, by Type, 2023-2032 (USD Million)

- Table 17 South America: Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease type, 2023-2032 (USD Million)

- Table 18 South America: Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million)

- Table 19 Europe: Cardiopulmonary Disease Diagnostics and Treatment Market, by Type, 2023-2032 (USD Million)

- Table 20 Europe: Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease type, 2023-2032 (USD Million)

- Table 21 Europe: Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million)

- Table 22 Western Europe: Cardiopulmonary Disease Diagnostics and Treatment Market, by Type, 2023-2032 (USD Million)

- Table 23 Western Europe: Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease type, 2023-2032 (USD Million)

- Table 24 Western Europe: Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million)

- Table 25 Eastern Europe Cardiopulmonary Disease Diagnostics and Treatment Market, by Type, 2023-2032 (USD Million)

- Table 26 Eastern Europe: Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease type, 2023-2032 (USD Million)

- Table 27 Eastern Europe: Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million)

- Table 28 Asia-Pacific: Cardiopulmonary Disease Diagnostics and Treatment Market, by Type, 2023-2032 (USD Million)

- Table 29 Asia-Pacific: Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease type, 2023-2032 (USD Million)

- Table 30 Asia-Pacific: Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million)

- Table 31 Middle East & Africa: Cardiopulmonary Disease Diagnostics and Treatment Market, by Type, 2023-2032 (USD Million)

- Table 32 Middle East & Africa: Cardiopulmonary Disease Diagnostics and Treatment Market, by Disease type, 2023-2032 (USD Million)

- Table 33 Middle East & Africa Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million) LIST OF FIGURES

- Figure 1 Research Process

- Figure 2 Segmentation for Global Cardiopulmonary Disease Diagnostics and Treatment Market

- Figure 3 Segmentation Market Dynamics for Global Cardiopulmonary Disease Diagnostics and Treatment Market

- Figure 4 Global Cardiopulmonary Disease Diagnostics and Treatment Market Share, by Type, 2020

- Figure 5 Global Cardiopulmonary Disease Diagnostics and Treatment Market Share, by Disease type, 2020

- Figure 6 Global Cardiopulmonary Disease Diagnostics and Treatment Market, by End-users, 2023-2032 (USD Million)

- Figure 7 Global Cardiopulmonary Disease Diagnostics and Treatment Market Share, by Region, 2020

- Figure 8 North America: Cardiopulmonary Disease Diagnostics and Treatment Market Share, by Country, 2020

- Figure 9 Europe: Cardiopulmonary Disease Diagnostics and Treatment Market Share, by Country, 2020

- Figure 10 Asia-Pacific: Cardiopulmonary Disease Diagnostics and Treatment Market Share, by Country, 2020

- Figure 11 Middle East & Africa: Cardiopulmonary Disease Diagnostics and Treatment Market Share, by Country, 2020

- Figure 12 Global Cardiopulmonary Disease Diagnostics and Treatment Market: Company Share Analysis, 2020 (%)

- Figure 13 Cardinal Health: Key Financials

- Figure 14 Cardinal Health: Segmental Revenue

- Figure 15 Cardinal Health: Geographical Revenue

- Figure 16 Cosmed Medical: Key Financials

- Figure 17 Cosmed Medical: Segmental Revenue

- Figure 18 Cosmed Medical: Geographical Revenue

- Figure 19 GE Healthcare: Key Financials

- Figure 20 GE Healthcare: Segmental Revenue

- Figure 21 GE Healthcare: Geographical Revenue

- Figure 22 Halma plc: Key Financials

- Figure 23 Halma plc: Segmental Revenue

- Figure 24 Halma plc: Geographical Revenue

- Figure 25 Hill-Rom Holdings, Inc.: Key Financials

- Figure 26 Hill-Rom Holdings, Inc.: Segmental Revenue

- Figure 27 Hill-Rom Holdings, Inc.: Geographical Revenue

- Figure 28 Koninklijke Philips N.V.: Key Financials

- Figure 29 Koninklijke Philips N.V: Segmental Revenue

- Figure 30 Koninklijke Philips N.V.: Geographical Revenue

- Figure 31 MGC Diagnostics Corporation: Key Financials

- Figure 32 MGC Diagnostics Corporation: Segmental Revenue

- Figure 33 MGC Diagnostics Corporation: Geographical Revenue

- Figure 34 NIHON KOHDEN CORPORATION: Key Financials

- Figure 35 NIHON KOHDEN CORPORATION: Segmental Revenue

- Figure 36 NIHON KOHDEN CORPORATION: Geographical Revenue

- Figure 37 Schiller AG: Key Financials

- Figure 38 Schiller AG Segmental Revenue

- Figure 39 Schiller AG: Geographical Revenue

- Figure 40 Masimo Corporation: Key Financials

- Figure 41 Masimo Corporation: Segmental Revenue

- Figure 42 Masimo Corporation: Geographical Revenue

- Figure 43 Vyaire Medical Inc.: Key Financials

- Figure 44 Vyaire Medical Inc.: Segmental Revenue

- Figure 45 Vyaire Medical Inc.: Geographical Revenue

Cardiopulmonary Disease Diagnostics and Treatment Market Segmentation

Cardiopulmonary Disease Diagnostics and Treatment Disease Type Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

Cardiopulmonary Disease Diagnostics and Treatment Type Outlook (USD Billion, 2018-2032)

Diagnosis-Electrocardiogram

Treatment -Medication

Cardiopulmonary Disease Diagnostics and Treatment End-User Outlook (USD Billion, 2018-2032)

Diagnostic Centers

Hospitals

Cardiopulmonary Disease Diagnostics and Treatment Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

North America Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

North America Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

US Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

US Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

US Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

CANADA Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

CANADA Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

CANADA Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Europe Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

Europe Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

Europe Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Germany Outlook (USD Billion, 2018-2032)

Germany Cardiopulmonary Disease Diagnostics and Treatment by Disease Type

Cardiovascular

Respiratory Diseases

Germany Cardiopulmonary Disease Diagnostics and Treatment by Type

Diagnosis-Electrocardiogram

Treatment -Medication

Germany Cardiopulmonary Disease Diagnostics and Treatment by End-User

Diagnostic Centers

Hospitals

France Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

France Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

France Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

UK Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

UK Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

UK Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

ITALY Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

ITALY Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

ITALY Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

SPAIN Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

SPAIN Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

SPAIN Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Rest Of Europe Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

Rest Of Europe Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

Rest Of Europe Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Asia-Pacific Outlook (USD Billion, 2018-2032)

Asia-Pacific Cardiopulmonary Disease Diagnostics and Treatment by Disease Type

Cardiovascular

Respiratory Diseases

Asia-Pacific Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

Asia-Pacific Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

China Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

China Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

China Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Japan Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

Japan Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

Japan Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

India Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

India Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

India Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Australia Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

Australia Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

Australia Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

Rest of Asia-Pacific Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

Rest of Asia-Pacific Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Rest of the World Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

Rest of the World Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

Rest of the World Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Middle East Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

Middle East Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

Middle East Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Africa Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

Africa Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

Africa Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Latin America Outlook (USD Billion, 2018-2032)

Cardiovascular

Respiratory Diseases

Latin America Cardiopulmonary Disease Diagnostics and Treatment by TypeDiagnosis-Electrocardiogram

Treatment -Medication

Latin America Cardiopulmonary Disease Diagnostics and Treatment by End-UserDiagnostic Centers

Hospitals

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment