Calcined Bauxite Market Trends

Calcined Bauxite Market Research Report Information By Purity (High Purity [>85%], Low Purity [<85%]), By Application (Abrasives, Refractory Materials, Metallurgy, Road Surfacing, Others) And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2032

Market Summary

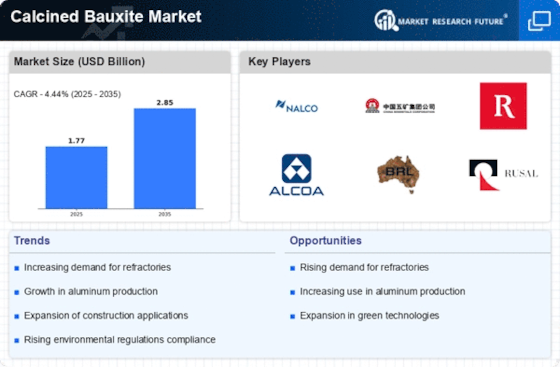

As per Market Research Future Analysis, the global Calcined Bauxite market was valued at USD 1.68 billion in 2023 and is projected to reach USD 2.5 billion by 2032, growing at a CAGR of 4.44% from 2024 to 2032. The demand for calcined bauxite is driven by its applications in the renewable energy sector, abrasives, metallurgy, and refractory materials. Major players in the market include Alcoa, Bain Capital, and Cornerstone Capital, with significant growth expected in the Asia-Pacific region due to rapid industrialization and rising foreign investments.

Key Market Trends & Highlights

The Calcined Bauxite market is witnessing significant growth driven by various factors.

- Market Size in 2023: USD 1.68 billion

- Projected Market Size by 2032: USD 2.5 billion

- CAGR from 2024 to 2032: 4.44%

- Asia-Pacific region expected to dominate market revenue due to industrialization

Market Size & Forecast

| 2023 Market Size | USD 1.68 billion |

| 2024 Market Size | USD 1.77 billion |

| 2032 Market Size | USD 2.5 billion |

| CAGR (2024-2032) | 4.44% |

| Largest Regional Market Share in 2024 | Asia-Pacific |

Major Players

Key players include Great Lakes Minerals LLC (US), LKAB (Sweden), EK-COMPANY AG (Germany), Bosai Group (China), First Bauxite LLC (US), Boud Minerals Limited (UK), Sinocean Industrial Limited (China).

Market Trends

Increased use in the renewable energy sector is driving the market growth

Bauxite that has been treated and calcined has a high alumina content. However, some operations use fluid bed calcination instead of the rotary kiln that the bulk of calciners uses for the thermal treatment procedure. This item, among others, is used in the abrasives, cement, metallurgy, and refractory sectors. Bauxite consumption is rising as a result of the renewable energy industry. The increased production of aluminum in industrialized nations is another factor contributing to the expansion of the calcined bauxite industry. Alcoa, Bain Capital, and Cornerstone Capital are the major players in the market for calcined Bauxite.

The manufacture and selling of calcined Bauxite is the main business of these organizations. North America, Europe, and Asia Pacific are the main geographical areas where the calcined bauxite market is expanding. The calcined bauxite market is thoroughly examined in the study, along with market size, market share, and market trends. As a result, the worldwide calcined bauxite market CAGR is expanding due to soaring demand for renewable energy.

The expanding automotive and construction industries also help fuel market expansion. Due to its high demand from numerous sectors, including those that utilize it frequently, such as abrasives, metallurgy, refractories, and road surfacing, the aggregate segment is anticipated to dominate the market over the projection period. Bauxite has been dried out and sintered at temperatures above 15,000 °C to up its alumina content, refractoriness, iron content, hardness, and toughness. This is the raw Bauxite that has been calcined.

It is also referred to as refractory Bauxite and has a high level of heat resistance due to its high aluminum concentration and low impurity level. Bauxite that has been calcined has an alumina content of 84–88 percent compared to raw Bauxite, which has an alumina content of around 55–58 percent. Due to its exceptional heat resistance, durability, and resistance to molten slag, it is a raw material for refractory products in many industries. Thus, driving the Calcined Bauxite market revenue.

The global calcined bauxite market is poised for growth, driven by increasing demand in the aluminum and refractory sectors, which underscores its critical role in industrial applications.

U.S. Geological Survey

Calcined Bauxite Market Market Drivers

Market Trends and Projections

Expansion in Aluminum Production

The Global Calcined Bauxite Market Industry is significantly influenced by the expansion of aluminum production. Calcined bauxite serves as a vital feedstock in the aluminum industry, particularly in the production of aluminum oxide. With the global aluminum production expected to increase, driven by rising demand in automotive and aerospace applications, the market for calcined bauxite is poised for growth. The aluminum sector's expansion is likely to enhance the market's value, potentially reaching 2.85 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 4.42% from 2025 to 2035, reflecting the increasing reliance on calcined bauxite in aluminum manufacturing.

Rising Infrastructure Development

The Global Calcined Bauxite Market Industry is expected to benefit from the rising infrastructure development across various regions. As governments and private sectors invest in infrastructure projects, the demand for construction materials, including those that utilize calcined bauxite, is likely to increase. The construction industry is a significant consumer of calcined bauxite, particularly in the production of cement and concrete. With global infrastructure spending projected to reach trillions of dollars in the coming years, the market for calcined bauxite is anticipated to grow substantially, reflecting the industry's integral role in supporting construction and development initiatives.

Technological Advancements in Processing

Technological advancements in the processing of calcined bauxite are poised to enhance the efficiency and quality of production within the Global Calcined Bauxite Market Industry. Innovations such as improved calcination techniques and enhanced purification processes may lead to higher yields and reduced energy consumption. These advancements not only optimize production but also contribute to sustainability efforts, aligning with global environmental standards. As industries increasingly prioritize eco-friendly practices, the demand for high-quality calcined bauxite is likely to rise, further propelling market growth. This trend indicates a potential increase in market value, supporting the industry's long-term viability.

Increasing Demand from Refractory Industry

The Global Calcined Bauxite Market Industry experiences robust growth driven by the increasing demand from the refractory sector. Calcined bauxite is a critical raw material in the production of refractory materials, which are essential for high-temperature applications in industries such as steel and cement. As global steel production is projected to reach approximately 1.9 billion tons in 2024, the need for high-quality refractory materials is likely to surge. This trend indicates a strong correlation between the growth of the refractory industry and the demand for calcined bauxite, contributing to the market's anticipated value of 1.77 USD Billion in 2024.

Growing Awareness of Environmental Sustainability

The Global Calcined Bauxite Market Industry is increasingly influenced by the growing awareness of environmental sustainability. Industries are under pressure to adopt sustainable practices, leading to a shift towards eco-friendly materials, including calcined bauxite. This shift is driven by regulatory frameworks and consumer preferences favoring sustainable products. As companies seek to minimize their environmental footprint, the demand for calcined bauxite, known for its lower environmental impact compared to alternative materials, is likely to rise. This trend suggests a positive outlook for the market, as sustainability becomes a key driver of growth in various sectors.

Market Segment Insights

Calcined Bauxite Purity Insights

The Calcined Bauxite market segmentation, based on purity, includes High Purity [>85%], Low Purity [<85%]. The high Purity [>85%] category held the largest share. High-purity calcined Bauxite is obtained by calcining (heating) superior-grade bauxite at high temperatures (from 85OC to 1600C). Eliminating moisture raises the alumina content. Calcined Bauxite has an alumina content of 84% to 88%, whereas raw Bauxite has an alumina content of roughly 57% to 58%. Rotating kilns are used to carry out the heating.

Calcined Bauxite Application Insights

The Calcined Bauxite market segmentation, based on application, includes Abrasives, Refractory Materials, Metallurgy, Road Surfacing, and Others. The metallurgy category led the market in 2023 due to rising end-use industry demand from numerous worldwide areas, including metallurgy and construction. The demand for renewable sources, such as calcined bauxite, is also anticipated to rise in the coming years due to growing concerns about warming brought on by increased carbon emissions. This is expected to have a significant positive impact on industry growth over the forecast period

Figure1: Calcined Bauxite Market, by Applications, 2024 & 2032 (USD million)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Calcined Bauxite Market Research Report—Global Forecast till 2032

Regional Insights

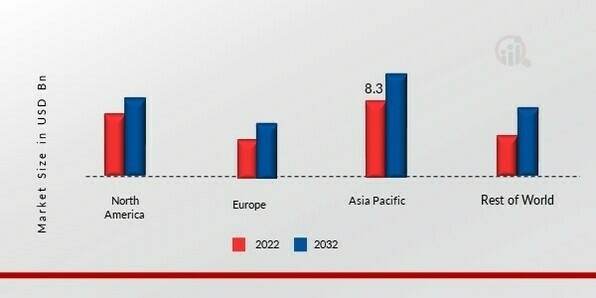

By Region, the study provides market insights into North America, Europe, Asia-Pacific and Rest of the World. The Asia-Pacific Calcined Bauxite market area will dominate this market. A substantial portion of the market's revenue for calcined Bauxite is expected to come from this region over the forecast period due to the area's rapid industrialization and rising foreign investment in developing nations like China and India. The expansion of the business will also be aided by the rising population and consumer disposable income levels.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure2: CALCINED BAUXITE MARKET SHARE BY REGION 2023 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

The North America Calcined Bauxite Market is expected to grow at the fastest CAGR from 2023 to 2032. The development of the calcined bauxite market is aided by the expanding machinery, automotive, electronics, electrical, medical, metal, and construction sectors in the United States. Abrasives are also utilized in the automotive industry for a variety of purposes, including lacquer and coarse sanding, which has increased demand for calcined Bauxite manufacture of abrasives. Moreover, the US Calcined Bauxite market held the largest market share, and the Canada Calcined Bauxite market was the fastest-growing market in the Asia-Pacific region.

Europe Calcined Bauxite market accounts for the second-largest market share. The market is anticipated to grow due to brown fused ammonia. Further, the German Calcined Bauxite market held the largest market share, and the UK Calcined Bauxite market was the fastest-growing market in the European region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Calcined Bauxite market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Calcined Bauxite industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Calcined Bauxite industry to benefit clients and increase the market sector. In recent years, the Calcined Bauxite industry has offered some of the most significant advantages to medicine. Major players in the Calcined Bauxite market attempting to increase market demand by investing in research and development operations are Great Lakes Minerals LLC(US), LKAB (Sweden), EK-COMPANY AG (Germany), Bosai Group (China), First Bauxite LLC (US), Boud Minerals Limited (UK), Sinocean Industrial Limited (China).

Great Lakes Minerals, LLC (GLM), a privately held company, has offered customers the highest quality processed industrial minerals in the refractory and abrasive industries since 1999. The main business goal of GLM depends on ITS dedication to quality and customer service. Quality is checked throughout the entire production process, from the mine and chemical processing to the US entrance and GLM plant ports, and finally, until the finished product is packaged and prepared for shipping. It invest in improving plant production procedures and broadening product offers as it keep an eye on the future.

Making sound judgments swiftly enables us to respond to its customers' material and product needs immediately, establishing GLM as a reliable partner and reaffirming its dedication to providing superior customer service.

An industrial minerals firm, First Bauxite, operates mines in Guyana and has state-of-the-art processing facilities in the USA. The combination of superior Bauxite, kaolin, and silica reserves in Guyana with cutting-edge industrial processing in the USA makes it unique. It is the only non-Chinese firm that mines and processes high-quality Bauxite for non-metallurgical purposes. Resource Capital Funds own it and has its headquarters in Colorado, USA. Mining operations produce high-purity bauxite with exceptionally low silica and other impurity levels in Guyana. This Bauxite is easily sintered to achieve an alumina content above 93%.

First, Bauxite can provide a wide range of customers by combining its mineral alternatives with adaptable processing capabilities in the USA (at its US Ceramics subsidiary).

Key Companies in the Calcined Bauxite Market market include

Industry Developments

May 2022: The U.S. calcination facilities were first bought by Bauxite. The deal includes the two manufacturing facilities owned by USC, with rotary kilns, at Wrens (250,000 tpa proppant capacity) and Andersonville, Georgia (100,000 tpa). The acquisition is significant because it would give FBX access to calcination facilities that will allow it to offer calcined refractory grades to the American market.

October 2021: When it first entered the non-metallurgical Bauxite and refractory clay markets, Bautek Minerais Industriais Ltda. Worked with MINERALS from the Cofermin Group for downstream help on the marketing and distribution side.

Future Outlook

Calcined Bauxite Market Future Outlook

The Global Calcined Bauxite Market is projected to grow at 4.42% CAGR from 2024 to 2035, driven by increasing demand in aluminum production and refractories.

New opportunities lie in:

- Invest in advanced calcination technologies to enhance product quality and reduce energy consumption.

- Expand into emerging markets with rising aluminum production to capture new customer bases.

- Develop sustainable sourcing strategies to meet growing environmental regulations and consumer preferences.

By 2035, the market is expected to demonstrate robust growth, positioning itself as a key player in the global materials industry.

Market Segmentation

Calcined Bauxite Purity Outlook

- High purity [>85%]

- Low purity [<85%]

Calcined Bauxite Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

Calcined Bauxite Application Outlook

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | USD 1.68 billion |

| Market Size 2024 | USD 1.77 billion |

| Market Size 2032 | USD 2.5 billion |

| Compound Annual Growth Rate (CAGR) | 4.44% (2024-2032) |

| Base Year | 2023 |

| Market Forecast Period | 2024-2032 |

| Historical Data | 2019- 2021 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Purity, Application and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Great Lakes Minerals LLC(US), LKAB (Sweden), EK-COMPANY AG (Germany), Bosai Group (China), First Bauxite LLC (US), Boud Minerals Limited (UK), Sinocean Industrial Limited (China). |

| Key Market Opportunities | its widespread application to brown fused alumina |

| Key Market Dynamics | utilized to create refractory materials |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Calcined Bauxite market?

The Calcined Bauxite market size was valued at USD 1.68 billion in 2023

What is the growth rate of the Calcined Bauxite market?

The market is projected to grow at a CAGR of 4.44% during the forecast period, 2024-2032

Which region held the largest market share in the Calcined Bauxite market?

Asia Pacific had the largest share of the market

Who are the key players in the Calcined Bauxite market?

The key players in the market are Great Lakes Minerals LLC(US), LKAB (Sweden), EK-COMPANY AG (Germany), Bosai Group (China), First Bauxite LLC (US), Boud Minerals Limited (UK), Sinocean Industrial Limited (China)

Which application led the Calcined Bauxite market?

The Refractory materials category dominated the market in 2023

-

GLOBAL CALCINED BAUXITE MARKET, BY APPLICATION

- GLOBAL CALCINED

-

BAUXITE MARKET, BY REGION

- DEFINITION

- SCOPE OF STUDY

- MARKET STRUCTURE

- RESEARCH PROCESS

- PRIMARY RESEARCH

- SECONDARY RESEARCH

- MARKET SIZE ESTIMATION

- TOP-DOWN AND BOTTOM-UP APPROACH

- FORECAST MODEL

- LIST OF ASSUMPTIONS & LIMITATIONS

- INTRODUCTION

-

DRIVERS

- GROWING

-

DEMAND FOR BROWN FUSED ALUMINA

-

INCREASING DEMAND FOR CALCIUM ALUMINATE CEMENT

- DRIVERS IMPACT ANALYSIS

-

RESTRAINTS

- ENVIRONMENTAL CONCERNS ASSOCIATED WITH BAUXITE MINING ACTIVITIES

- RESTRAINTS IMPACT ANALYSIS

- OPPORTUNITIES

-

INCREASING DEMAND FOR CALCIUM ALUMINATE CEMENT

-

GROWING USE OF RENEWABLE ENERGY IN CALCINATION PROCESS

-

SUPPLY CHAIN ANALYSIS

- RAW MATERIALS SUPPLIERS

- CALCINED BAUXITE MANUFACTURERS

- DISTRIBUTION

-

SUPPLY CHAIN ANALYSIS

-

& SALES CHANNELS

- END-USE INDUSTRIES

- PORTER'S FIVE FORCES MODEL

-

THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

-

THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

-

INTENSITY OF RIVALRY

- PRICING OVERVIEW, BY REGION (USD/TON)

-

AVERAGE VALUE OF COUNTRY IMPORTS/EXPORTS OF BAUXITE (USD/TON)

- IMPACT

-

OF COVID-19 OUTBREAK ON THE GLOBAL CALCINED BAUXITE MARKET

- IMPACT

-

ON SUPPLY CHAIN

-

RAW MATERIAL SUPPLY

- MANUFACTURING

-

RAW MATERIAL SUPPLY

-

IMPACT ON END-USE INDUSTRY DEMAND

- AUTOMOTIVE

-

BUILDING & CONSTRUCTION

- OIL & GAS

-

AEROSPACE & DEFENSE

-

MARINE

- POWER GENERATION

- MAJOR GOVERNMENT POLICIES TO COUNTER IMPACT OF COVID-19

- INTRODUCTION

- HIGH PURITY (>85%)

- LOW PURITY (<85%)

-

MARINE

-

GLOBAL CALCINED BAUXITE MARKET, BY APPLICATION

- INTRODUCTION

- ABRASIVES

- REFRACTORY MATERIALS

- METALLURGY

- ROAD SURFACING

- OTHERS

- INTRODUCTION

-

NORTH AMERICA

- US

- CANADA

-

EUROPE

- GERMANY

- RUSSIA

- UK

- ITALY

- FRANCE

- SPAIN

- NETHERLANDS

-

REST OF EUROPE

-

ASIA-PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

-

ASIA-PACIFIC

-

AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

-

LATIN AMERICA

- BRAZIL

- MEXICO

- ARGENTINA

- REST OF LATIN AMERICA

-

MIDDLE EAST & AFRICA

- TURKEY

- GCC COUNTRIES

- SOUTH AFRICA

- REST OF THE MIDDLE EAST & AFRICA

- INTRODUCTION

- MARKET STRATEGY ANALYSIS

- KEY DEVELOPMENTS & GROWTH STRATEGIES

- COMPETITIVE BENCHMARKING

- GREAT

-

LAKES MINERALS, LLC

-

COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

LKAB

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

EK-COMPANY AG

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENT

- SWOT ANALYSIS

- KEY STRATEGIES

-

BOSAI GROUP

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

FIRST BAUXITE LLC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

BOUD MINERALS LIMITED

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

- SAURASHTRA CALCINE

-

COMPANY OVERVIEW

-

BAUXITE & ALLIED INDUSTRIES LTD

-

COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

SINOCEAN INDUSTRIAL LIMITED

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

- REFERENCES

- RELATED REPORTS

-

COMPANY OVERVIEW

-

-

ASSUMPTIONS & LIMITATIONS

-

IMPORTS/EXPORTS OF BAUXITE (USD/TON)

-

BY PURITY, 2023-2032 (USD BILLION)

-

MARKET, BY PURITY, 2023-2032 (KILOTONS)

-

MARKET FOR HIGH PURITY (>85%), BY REGION, 2023-2032 (USD BILLION)

-

BY REGION, 2023-2032 (USD BILLION)

-

MARKET FOR LOW PURITY (<85%), BY REGION, 2023-2032 (KILOTONS)

-

BY REGION, 2023-2032 (USD BILLION)

-

MARKET FOR REFRACTORY MATERIALS, BY REGION, 2023-2032 (KILOTONS)

-

2023-2032 (KILOTONS)

-

SURFACING, BY REGION, 2023-2032 (USD BILLION)

-

BAUXITE MARKET FOR ROAD SURFACING, BY REGION, 2023-2032 (KILOTONS)

-

(USD BILLION)

-

(KILOTONS)

-

2023-2032 (USD BILLION)

-

BY COUNTRY, 2023-2032 (KILOTONS)

-

MARKET, BY PURITY, 2023-2032 (USD BILLION)

-

BAUXITE MARKET, BY PURITY, 2023-2032 (KILOTONS)

-

CALCINED BAUXITE MARKET, BY APPLICATION, 2023-2032 (USD BILLION)

-

2023-2032 (USD BILLION)

-

BY PURITY, 2023-2032 (KILOTONS)

-

MARKET, BY APPLICATION, 2023-2032 (USD BILLION)

-

CALCINED BAUXITE MARKET, BY APPLICATION, 2023-2032 (KILOTONS)

-

(USD BILLION)

-

(KILOTONS)

-

2023-2032 (USD BILLION)

-

APPLICATION, 2023-2032 (KILOTONS)

-

BY PURITY, 2023-2032 (USD BILLION)

-

MARKET, BY PURITY, 2023-2032 (KILOTONS)

-

MARKET, BY APPLICATION, 2023-2032 (USD BILLION)

-

BAUXITE MARKET, BY APPLICATION, 2023-2032 (KILOTONS)

-

CALCINED BAUXITE MARKET, BY PURITY, 2023-2032 (USD BILLION)

-

INDIA CALCINED BAUXITE MARKET, BY PURITY, 2023-2032 (KILOTONS)

-

BY PURITY, 2023-2032 (USD BILLION)

-

CALCINED BAUXITE MARKET, BY PURITY, 2023-2032 (KILOTONS)

-

AUSTRALIA & NEW ZEALAND CALCINED BAUXITE MARKET, BY APPLICATION, 2023-2032 (USD BILLION)

-

BY APPLICATION, 2023-2032 (KILOTONS)

-

CALCINED BAUXITE MARKET, BY PURITY, 2023-2032 (USD BILLION)

-

REST OF ASIA-PACIFIC CALCINED BAUXITE MARKET, BY PURITY, 2023-2032 (KILOTONS)

-

APPLICATION, 2023-2032 (KILOTONS)

-

BAUXITE MARKET, BY COUNTRY, 2023-2032 (USD BILLION)

-

AMERICA CALCINED BAUXITE MARKET, BY COUNTRY, 2023-2032 (KILOTONS)

-

(USD BILLION)

-

2023-2032 (KILOTONS)

-

2023-2032 (USD BILLION)

-

APPLICATION, 2023-2032 (KILOTONS)

-

MARKET, BY PURITY, 2023-2032 (USD BILLION)

-

BAUXITE MARKET, BY PURITY, 2023-2032 (KILOTONS)

-

BAUXITE MARKET, BY APPLICATION, 2023-2032 (USD BILLION)

-

CALCINED BAUXITE MARKET, BY APPLICATION, 2023-2032 (KILOTONS)

-

2023-2032 (KILOTONS)

-

MARKET, BY APPLICATION, 2023-2032 (USD BILLION)

-

AMERICA CALCINED BAUXITE MARKET, BY APPLICATION, 2023-2032 (KILOTONS)

-

BY COUNTRY, 2023-2032 (KILOTONS)

-

CALCINED BAUXITE MARKET, BY PURITY, 2023-2032 (USD BILLION)

-

MIDDLE EAST & AFRICA CALCINED BAUXITE MARKET, BY PURITY, 2023-2032 (KILOTONS)

-

2023-2032 (USD BILLION)

-

BAUXITE MARKET, BY APPLICATION, 2023-2032 (KILOTONS)

-

CALCINED BAUXITE MARKET, BY PURITY, 2023-2032 (USD BILLION)

-

TURKEY CALCINED BAUXITE MARKET, BY PURITY, 2023-2032 (KILOTONS)

-

2023-2032 (USD BILLION)

-

BY PURITY, 2023-2032 (KILOTONS)

-

MARKET, BY APPLICATION, 2023-2032 (USD BILLION)

-

CALCINED BAUXITE MARKET, BY APPLICATION, 2023-2032 (KILOTONS)

-

BAUXITE MARKET, BY PURITY, 2023-2032 (KILOTONS)

-

THE MIDDLE EAST & AFRICA CALCINED BAUXITE MARKET, BY APPLICATION, 2023-2032 (USD BILLION)

-

BAUXITE MARKET, BY APPLICATION, 2023-2032 (KILOTONS)

-

DEVELOPMENTS & GROWTH STRATEGIES

-

LLC: PRODUCTS OFFERED

-

OFFERED

-

PRODUCTS OFFERED

-

INDUSTRIES LTD: PRODUCTS OFFERED

-

PRODUCTS OFFERED

-

-

BAUXITE MARKET, 2020

-

BY PURITY

-

OF MRFR

-

BAUXITE MARKET

-

BAUXITE MARKET

-

(USD BILLION)

-

2023-2032 (KILOTONS)

-

2023-2032 (USD BILLION)

-

APPLICATION, 2023-2032 (KILOTONS)

-

MARKET BY REGION, 2023-2032 (USD BILLION)

-

BAUXITE MARKET BY REGION, 2023-2032 (KILOTONS)

-

BENCHMARKING

-

GROUP: SWOT ANALYSIS

-

BAUXITE & ALLIED INDUSTRIES LTD: FINANCIAL OVERVIEW SNAPSHOT

Calcined Bauxite Market Segmentation

Calcined Bauxite Purity Outlook (USD Billion, 2018-2032)

- High Purity [>85%]

- Low Purity [<85%]

Calcined Bauxite Application Outlook (USD Billion, 2018-2032)

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

Calcined Bauxite Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

- North America Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- North America Calcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

USOutlook (USD Billion, 2018-2032)

- US Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- USCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

CANADAOutlook (USD Billion, 2018-2032)

- CANADA Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- CANADACalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

- North America Calcined Bauxite by Purity

EuropeOutlook (USD Billion, 2018-2032)

- Europe Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- EuropeCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

GermanyOutlook (USD Billion, 2018-2032)

- Germany Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- GermanyCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

FranceOutlook (USD Billion, 2018-2032)

- France Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- FranceCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

UKOutlook (USD Billion, 2018-2032)

- UK Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- UKCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

ITALYOutlook (USD Billion, 2018-2032)

- ITALY Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- ITALYCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

SPAINOutlook (USD Billion, 2018-2032)

- Spain Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- SpainCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

Rest Of EuropeOutlook (USD Billion, 2018-2032)

- Rest Of Europe Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- REST OF EUROPECalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

- Europe Calcined Bauxite by Purity

Asia-PacificOutlook (USD Billion, 2018-2032)

- Asia-Pacific Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- Asia-PacificCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

ChinaOutlook (USD Billion, 2018-2032)

- China Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- ChinaCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

JapanOutlook (USD Billion, 2018-2032)

- Japan Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- JapanCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

India Outlook (USD Billion, 2018-2032)

- India Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- IndiaCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

AustraliaOutlook (USD Billion, 2018-2032)

- Australia Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- AustraliaCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

Rest of Asia-PacificOutlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- Rest of Asia-PacificCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

- Asia-Pacific Calcined Bauxite by Purity

Rest of the WorldOutlook (USD Billion, 2018-2032)

- Rest of the World Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- Rest of the WorldCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

Middle EastOutlook (USD Billion, 2018-2032)

- Middle East Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- Middle EastCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

AfricaOutlook (USD Billion, 2018-2032)

- Africa Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- AfricaCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

Latin AmericaOutlook (USD Billion, 2018-2032)

- Latin America Calcined Bauxite by Purity

- High Purity [>85%]

- Low Purity [<85%]

- Latin AmericaCalcined Bauxite by Application

- Abrasives

- Refractory Materials

- Metallurgy

- Road Surfacing

- Others

- Rest of the World Calcined Bauxite by Purity

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment