Automotive Sensor Market Trends

Automotive Sensors Market Research Report Information By Sensors Type (Pressure, Temperature, Position, Motion, Optical, Torque, Gas, Level, and Other Sensors), By Technology (Micro-Electro-Mechanical Systems (MEMS), Non-Mechanical Systems (NON-MEMS), Nano-Electro-Mechanical Systems (NEMS), By Vehicle Type (Conventional Fuel Cars, Alternative Fuel Cars, and Heavy Vehicles), And By Region (North...

Market Summary

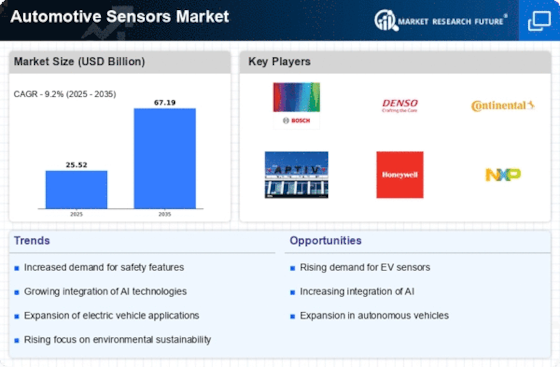

The Global Automotive Sensors Market is projected to grow from 24.6 USD Billion in 2024 to 61.5 USD Billion by 2035.

Key Market Trends & Highlights

Automotive Sensors Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 8.68 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 61.5 USD Billion, indicating robust growth potential.

- In 2024, the market is valued at 24.6 USD Billion, reflecting a strong foundation for future expansion.

- Growing adoption of advanced driver assistance systems due to increasing safety regulations is a major market driver.

Market Size & Forecast

| 2024 Market Size | 24.6 (USD Billion) |

| 2035 Market Size | 61.5 (USD Billion) |

| CAGR (2025-2035) | 8.68% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

Bosch Sensortec GmbH, Analog Technologies, Avago Technologies, Hella KGaA Hueck & Co., TRW Automotive, Continental AG, CTS Corporation, Delphi Automotive, Denso Corporation, Infineon Technologies, Micronas Semiconductor INC

Market Trends

Growing Prevalence of using alternative fuels to boost market growth

A vehicle that uses fuels other than common petroleum fuels, such gasoline or diesel, is referred to as an alternative fuel vehicle. Any technology utilised to power an engine without using petroleum is commonly referred to as an alternative fuel vehicle (e.g., electric vehicles, hybrid electric vehicles, solar-powered vehicles). Growing adoption of alternative fuels and vehicles will lower consumer gasoline costs, reduce emissions, and improve national energy security. With the adoption of alternative fuel vehicles, there will be a sharp rise in the demand for Car sensors.

Further, the application of new systems and technology in cars has widened the electrification's scope. The usage of sensors in automobiles has advanced thanks to the installation of ADAS systems. Vehicle electrification in the automotive sector has grown in a promising way, especially in the transmission, temperature control, powertrain, safety, and exhaust systems.

The introduction of cutting-edge technologies like the anti-lock braking system (ABS), electronic brake distribution (EBD), airbags, and traction control has led to an increase in the installation of such systems in passenger cars over the years, which is largely due to rising economic status, changing customer preferences for improved safety standards and comfort, and these factors. As a result, the market for passenger automobiles has also seen an increase in sensor demand.

The ongoing evolution of automotive technology appears to drive a substantial increase in the demand for advanced sensors, which are integral to enhancing vehicle safety and efficiency.

U.S. Department of Transportation

Automotive Sensor Market Market Drivers

Regulatory Compliance

Regulatory compliance is a significant driver for the Global Automotive Sensors Market Industry, as governments worldwide impose stringent safety and environmental regulations. For instance, the European Union has mandated the installation of advanced driver-assistance systems (ADAS) in new vehicles, which necessitates the use of various sensors. This regulatory push is expected to contribute to the market's growth, with projections indicating an increase to 61.5 USD Billion by 2035. Compliance with these regulations not only enhances vehicle safety but also promotes the adoption of innovative sensor technologies, further driving market expansion.

Consumer Safety Awareness

Consumer safety awareness is increasingly shaping the Global Automotive Sensors Market Industry. As individuals become more informed about vehicle safety features, there is a growing demand for advanced safety technologies, including sensors that support features like lane departure warnings and automatic emergency braking. This heightened awareness is likely to drive market growth, as manufacturers prioritize the integration of such technologies into their vehicles. The emphasis on safety not only enhances consumer confidence but also aligns with regulatory trends, further propelling the market forward in the coming years.

Market Growth Projections

The Global Automotive Sensors Market Industry is poised for substantial growth, with projections indicating a rise from 24.6 USD Billion in 2024 to 61.5 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 8.68% from 2025 to 2035, underscoring the increasing reliance on sensors in automotive applications. The expansion of the market is driven by various factors, including technological advancements, regulatory compliance, and the growing demand for electric vehicles. These dynamics collectively suggest a robust future for the automotive sensors sector.

Technological Advancements

The Global Automotive Sensors Market Industry is experiencing rapid technological advancements that enhance vehicle safety and efficiency. Innovations in sensor technology, such as LiDAR and advanced radar systems, are becoming increasingly prevalent. These technologies improve functionalities like adaptive cruise control and collision avoidance systems. As a result, the market is projected to reach 24.6 USD Billion in 2024, driven by the demand for smarter vehicles. Furthermore, the integration of Internet of Things (IoT) capabilities into automotive sensors is likely to create new opportunities for growth, as vehicles become more connected and automated.

Growing Demand for Electric Vehicles

The shift towards electric vehicles (EVs) is a pivotal factor influencing the Global Automotive Sensors Market Industry. As the automotive sector transitions to electrification, the need for advanced sensors to monitor battery performance, thermal management, and energy efficiency becomes paramount. This trend is likely to propel the market, with a projected compound annual growth rate (CAGR) of 8.68% from 2025 to 2035. The increasing adoption of EVs is expected to drive demand for specialized sensors, thereby creating new avenues for manufacturers and suppliers within the automotive sensor landscape.

Integration of Advanced Driver Assistance Systems

The integration of advanced driver assistance systems (ADAS) is a crucial driver for the Global Automotive Sensors Market Industry. ADAS relies heavily on various sensors, including cameras, ultrasonic sensors, and radar, to enhance vehicle safety and automation. As automakers increasingly incorporate these systems into their vehicles, the demand for automotive sensors is expected to rise significantly. This trend is indicative of a broader shift towards automation in the automotive sector, which is likely to contribute to the market's growth trajectory, reinforcing the importance of sensors in modern vehicle design.

Market Segment Insights

Automotive Sensors Type Insights

The Automotive Sensors Market segmentation, based on Sensors type, includes pressure, temperature, position, motion, optical, torque, gas, level, and other sensors. The position sensors segment held the majority share in 2021 contribution to around ~20.3% in respect to the Automotive Sensors Market revenue. This is primarily owing to the rising prevalence of autonomous cars and autopilot applications across the globe. Moreover, the increasing demand for cameras, image sensors, and radar-based sensors in advanced vehicles, such as electric cars and autonomous cars, is responsible for the growth of the position sensor in the market.

Pressure sensor is the fastest growing segment in the automotive sensors market in the coming years. Owing to increasing adoption in many safety concerns of passengers, such as advanced driver assistance systems (ADAS), pressure monitoring systems(TPMS), and manifold absolute pressure sensors(MAPS), surge in demand for vehicle sensors in electric and hybrid cars. The expansion of the automotive sensor market is anticipated to boost by an increase in the use of custom made electronics devices since it is widely employed in navigation systems (GPS) and advanced driver assistance systems (ADAS).

In addition, the global automotive sensor market is anticipated to benefit from technical developments in the auto industry and the expansion of the automotive sector.

March 2021:

Indian Brand Equity Foundation (IBEF), sale of passenger vehicles in India is 28.39%.Due to increasing sale of passenger cars and rising demand for adaptive cruise control sensors, major car manufacturers are focus on fitting those sensors in economic cars. This will support the growth of the automotive sensor market.

Automotive Sensors Technology Insights

The Automotive Sensors Market segmentation, based on technology, includes micro-electro-mechanical systems (MEMS), non-electro-mechanical Systems (NON-MEMS), nano-electro-mechanical systems (NEMS). The Micro-electro-mechanical system dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. This is due to the increasing preference for MEMS devices such as airbags, vehicle dynamics control (VDC), roll over detection systems, and tire pressure monitoring(TPMS) for passenger safety in an automobile. Hence, increasing use of auto sensors in automobiles support the market growth.

Automotive Vehicle Type Insights

The Automotive Sensors Market data has been bifurcated by vehicle type into conventional fuel cars, alternative fuel cars, and heavy vehicles. The conventional fuel car segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. The conventional fuel car segment is growing due to rising demand for technological advances, safety features and higher functionality.

Figure 2: Automotive Sensors Market Share By Vehicle Type 2021 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Automotive Sensor Market Research Report - Global Forecast To 2030

Regional Insights

By Region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. Asia-Pacific automotive sensors market accounted for USD 8.29 billion in 2021 and is expected to exhibit a significant CAGR growth during the study period. This is attributed to the growing demand for automobiles due to rising population and per capita income across the region. Moreover, China automotive sensors market held the largest market share, and the India automotive sensors market was the fastest growing market in the Asia-Pacific region

Further, the major countries studied in the market report are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: Automotive Sensors Market Share By Region 2021 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe Automotive Sensors market accounts for the second-largest market share due to the increasing demand for the vehicles. Further, the Germany automotive sensors market held the largest market share, and the UK automotive sensors market was the fastest growing market in the European region.

The North-America automotive sensors Market is expected to grow at the fastest CAGR from 2022 to 2030. This is due to increasing population, technology advancement, rising income of the consumers.

Key Players and Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the automotive sensors market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the automotive sensors industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies adopted by manufacturers in the global Car sensors industry to benefit clients and expand the market sector is to manufacture locally to reduce operating costs. In recent years, Vehicle sensors industry has provided security with some of the most significant benefits. The automotive sensors market major player such as, Bosch Sensortec GmbH, Analog Technologies, Avago Technologies, Hella KGaA Hueck & Co., TRW Automotive, Continental AG, CTS Corporation, Delphi Automotive, Denso Corporation, Freescale Semiconductor Holdings Ltd., GE Measurement & Control Solutios, Gill Sensors & Controls, NGK Spark Plugs Co.

Ltd., NXP Semiconductors, Panasonic Corporation, Sensata Technologies, Infineon Technologies, Micronas Semiconductor INC, and others are working to expand the market demand by investing in research and development activities.

November 2021:

Robert Bosch GmbH’s goods and services are intended to arouse enthusiasm, enhance quality of life, and aid in resource conservation. Company’s goal is to develop technology that was "invented for life. Robert Bosch GmbH developed an advanced and innovative driver-assistantance system for rail transportation. In the situation of a possible collision, system first warns the team driver by means of a signal. If the driver does so late or does not intercede, the system automatically brakes the tram until it comes to a stop to prevent from the impact.

Also, October 2021:

Infineon Technologies AG, is the main leader in semiconductor solutions. Its main mission is to make life easier, safer and greener. Company establish a connection between the real and the digital world. Company’s values are to commit, innovate, partner and perform. Infineon Technologies AG launched an automotive current sensor-XENIVTLE4972. It’s a coreless current sensor uses Infineon’s well-proven Hall technology for stable and precise current measurement.

Key Companies in the Automotive Sensor Market market include

Industry Developments

Texas Instruments (TI) published new semiconductors in January 2024 with the intention of enhancing the intelligence and safety of automobiles. The AWR2544 77GHz mm-wave radar sensor chip is the first of its kind in the industry to be designed for satellite radar architectures. By enhancing sensor integration and ADAS decision-making, it enables greater levels of autonomy. The DRV3946-Q1 integrated contactor driver and DRV3901-Q1 integrated squib driver for pyro fuses, two new software-programmable driver processors from TI, support functional safety for battery management and powertrain systems and include built-in diagnostics.

These new products are being displayed by TI at the Consumer Electronics Show (CES) in the United States in 2024.

TI and manufacturers are collaborating to reimagine the ways in which intelligent and dependable technology can facilitate safer vehicles, from more sophisticated driver assistance systems to smarter electric vehicle powertrain systems. Numerous manufacturers are equipping vehicles with additional sensors in an effort to enhance their safety and autonomy. The industry's first single-chip radar sensor designed specifically for satellite architectures is the AWR2544 from TI. Satellite architectures utilise sensor fusion algorithms to process semi-processed data from radarSony Semiconductor Solutions Corporation (SSS) declared the forthcoming implementation of the IMX735, a novel CMOS image sensor designed exclusively for automotive cameras.

Boasting an unprecedented 17.42 effective megapixels, this sensor sets a new standard in the industry. By facilitating the development of automotive camera systems with sophisticated sensing and recognition capabilities, the new sensor product will promote the security and safety of automated driving. In order to facilitate autonomous driving, automated systems must possess advanced, accurate sensing and recognition capabilities that comprise the entire 360-degree environment surrounding the vehicle. As a result, there is a significant demand for image sensors that can facilitate the advancement of automotive camera systems and aid in attaining this level of performance.

Future Outlook

Automotive Sensor Market Future Outlook

The Automotive Sensors Market is projected to grow at an 8.68% CAGR from 2024 to 2035, driven by advancements in autonomous driving technology, increasing vehicle electrification, and stringent safety regulations.

New opportunities lie in:

- Develop advanced sensor fusion technologies for enhanced vehicle perception.

- Invest in AI-driven analytics for predictive maintenance solutions.

- Explore partnerships with EV manufacturers to integrate innovative sensor systems.

By 2035, the Automotive Sensors Market is expected to be robust, reflecting substantial growth and innovation.

Market Segmentation

Car Sensors Type Outlook

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

Car Sensors Regional Outlook

- US

- Canada

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- Middle East

- Africa

- Latin America

Car Sensors Technology Outlook

- Micro-Electro-Mechanical Systems (MEMS)

- Non-Electro-Mechanical Systems (NON-MEMS)

- Nano-Electro-Mechanical Systems (NEMS)

Car Sensors Vehicle Type Outlook

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

Report Scope

| Attribute/Metric | Details |

| Market Size 2021 | USD 19.6 billion |

| Market Size 2022 | USD 21.4 billion |

| Market Size 2030 | USD 39.6 billion |

| Compound Annual Growth Rate (CAGR) | 9.20% (2022-2030) |

| Base Year | 2021 |

| Market Forecast Period | 2022-2030 |

| Historical Data | 2018 & 2020 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Service Provider, Technology, Vehicle Type and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered | The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Bosch Sensortec GmbH, Analog Devices Inc., Avago Technologies, Hella KGaA Hueck & Co., TRW Automotive, Continental AG, CTS Corporation, Delphi Automotive, Denso Corporation, Freescale Semiconductor Holdings Ltd., GE Measurement & Control Solutios, Gill Sensors & Controls, Infineon Technologies, NGK Spark Plugs Co. Ltd., NXP Semiconductors, Panasonic Corporation, Sensata Technologies among others |

| Key Market Opportunities | Improvement in safety standards Developing customer Preferences |

| Key Market Dynamics | Vehicles will help reduce fuel costs of consumers Increasing use of alternative fuels Rise the energy security of nations Use of alternative fuel cars |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the automotive sensors market?

The Automotive Sensors Market size was valued at USD 19.6 Billion in 2021.

What is the growth rate of the automotive sensors market?

The global market is projected to grow at a CAGR of 9.2% during the forecast period, 2022-2030.

Which region held the largest market share in the automotive sensors market?

Asia-Pacific had the largest share in the global market.

Who are the key players in the Automotive Sensors market?

The key players in the market are Bosch Sensortec GmbH, Analog Devices Inc., Avago Technologies, Hella KGaA Hueck & Co., TRW Automotive, Continental AG, CTS Corporation, Delphi Automotive, Denso Corporation, Freescale Semiconductor Holdings Ltd., GE Measurement & Control Solutios, Gill Sensors & Controls, Infineon Technologies, NGK Spark Plugs Co. Ltd., NXP Semiconductors, Panasonic Corporation, Sensata Technologies among others.

Which sensors type led the automotive sensors market?

The Position automotive sensors category dominated the market in 2021.

Which technology type had the largest market share in the automotive sensors market?

The Micro-Electro-Mechanism had the largest share in the global market.

-

Demand For High And Medium End Vehicles

- Expansion Of Global Auto-Manufacturers

-

Into New Emerging Markets

- Rising Sensor Content In An Automobile As

-

Per Moore’s Law

-

CHALLENGES

- Increasing Pricing Pressures

- Underdeveloped Aftermarket Services

-

OPPORTUNITIES

- Electromobility

- Future Demand For Autonomous Cars And Connected Vehicles

- Emerging Technologies Such As Combo Sensors:

-

Porter’s Five Forces Analysis

- Threat From New Entrants

- Bargaining Power Of Buyers

- Bargaining Power Of Suppliers

- Threat From Substitutes

- Intensity Of Competitive Rivalry

-

Automotive Consortium

- Center For Automotive Research

-

CHALLENGES

-

(Car) Industrial Consortium

-

Genivi Alliance

- Japan Automobile

-

Genivi Alliance

-

Manufacturers Association (JAMA)

- Open Automotive Alliance

-

Alliance Of Automobile Manufacturers

- United States Council For Automotive Research (USCAR)

-

Introduction

- Market Statistics

-

Pressure Sensor

- Pressure Sensor Types—Chassis

- Pressure Sensor Types—Power Train

- Pressure Sensor Types—Body Systems

- Key Trends

- Key Challenges

- Key Market Players

- Market Statistics

-

Temperature Sensor

- Temperature Sensor In Chassis

- Temperature Sensor In Power Train

- Temperature Sensor

-

In Body System

-

Key Market Players

- Market Statistics

-

Position Sensor

- Position Sensor In Chassis

-

Key Market Players

-

Position Sensor In Power Train

-

Position Sensor In Body System

- Key Trends

- Key Market Players

- Market Statistics

-

Motion Sensor

- Motion Sensor In Chassis

- Motion

-

Position Sensor In Body System

-

Sensor In Power Train

-

Motion Sensor In Body System

- Key Trends

- Key Challenges

- Key Market Players

- Market Statistics

-

Optical Sensor

- Optical Sensor In Chassis

- Optical Sensor In Power Train

- Optical Sensor In Body System

- Key Trends

- Key Challenges

- Key Market Players

- Market Statistics

-

Torque Sensor

- Torque Sensor Types—Chassis

- Torque Sensor Types—Power Train

- Key Trends

- Key Market Players

- Market Statistics

-

Gas Sensor

- Gas Sensor In Power Train

- Key Trends

- Key Market Players

- Market Statistics

-

Level Sensor

- Level Sensor Types—Power Train

- Market Statistics

- Other Sensors

-

Motion Sensor In Body System

-

Electric Current Sensor

-

Mass Air Flow Sensors

- Market Statistics

-

Introduction

- Micro-Electro-Mechanical Systems (MEMS)

-

Mass Air Flow Sensors

-

Sensors And Automotive Applications

-

Fuel Injector Pressure Sensor

- Tire Pressure Sensor

-

Fuel Injector Pressure Sensor

-

Automotive Applications For MEMS Based Sensors

-

Vehicle Security Systems

- Infotainment

- Non-Electro-Mechanical Systems (Non-Mems)

- Nano-Electro-Mechanical Systems (NEMS)

- Introduction

-

Vehicle Security Systems

-

Conventional Fuel Cars

-

Sensors In Chassis By Conventional Fuel Vehicle Type

- Market Statistics

- Sensors In Power Train By

-

Sensors In Chassis By Conventional Fuel Vehicle Type

-

Conventional Fuel Vehicle Type

- Market Statistics

-

Sensors In Body System By Conventional Fuel Vehicle Type

- Market Statistics

-

Alternative Fuel Car

- Sensors In Chassis By

-

Alternative Fuel Vehicle Type

- Market Statistics

-

Sensors In Power Train By Alternative Fuel Vehicle Type

-

Market Statistics

- Sensors In Body System By Alternative Fuel Vehicle Type

-

Heavy Vehicles

- Market Statistics

- Sensor In Trucks

- Sensors In Off-Road Vehicle

-

Introduction

- Market Statistics

-

America

- Market Statistics

- US.

- Mexico

-

Asia-Pacific (APAC)

- Market Statistics

- Japan

- China 167

- India 170

- South Korea 172

-

Europe 174

- Market Statistics 174

- Germany 175

-

Market Statistics

-

176

-

Market Statistics 176

- UK. 177

-

Rest Of The World 179

- Market Statistics 179

- Africa 180

-

Market Statistics 176

-

180

- Market Statistics 180

- Introduction 182

- Mergers & Acquisitions 182

- New Product Launch/ Development 184

- Partnership

-

Collaboration & Joint Venture 185

- Others (Awards, Recognitions, Events)

-

186

-

Analog Devices Inc. 188

- Company Overview 188

- Product Portfolio 189

- Financials 190

- Key Developments

-

Analog Devices Inc. 188

-

194

-

AVAgo Technologies 195

- Company Overview 195

- Product Portfolio 196

- Financials 197

-

AVAgo Technologies 195

-

197

-

Financials By Region 198

- Financials By Segment 199

- Key Developments 200

- Analyst Insight 201

-

Bosch Sensortec GmbH 202

- Company Overview 202

- Product Portfolio 202

- Financials 204

- Key Developments

-

Financials By Region 198

-

207

- Analyst Insight 207

-

Bourns INC. 208

- Company Overview 208

- Product Portfolio 208

- Key Developments 209

- Analyst Insight 211

-

Continental Corporation 212

- Company Overview 212

- Product Portfolio 212

- Financials 213

- Key Developments 217

-

CTS Corporation 219

- COMPANY OVERVIEW 219

- Product Portfolio 219

- Financials

-

221

-

Overall Financials 221

- Financials By Business Segment

-

Overall Financials 221

-

222

-

Financials By Region 223

- Key Developments 223

- Analyst Insight 224

-

Delphi Automotive LLP 225

- Company Overview

-

Financials By Region 223

-

225

-

Product Portfolio 225

- Financials 227

- Key Developments 229

- Analyst Insight 231

-

Denso Corporation 232

- Company Overview 232

- Product Portfolio 232

- Financials 234

- Key Developments 236

- Analyst Insight 238

- FREESCALE

-

Product Portfolio 225

-

Semiconductor Holdings Ltd 239

-

Company Overview 239

- Product Portfolio 240

- Financials 241

- Key Developments 243

-

GE Measurement & Control Solutions 245

- Company Overview 245

- Product Portfolio 245

- Financials

-

Company Overview 239

-

247

-

Overall Financials 247

- Financials By Segment 248

- Key Developments 249

- Analyst Insight 250

-

Gill Sensors & Controls 251

- Company Overview 251

- Product Portfolio 251

- Key Developments 253

-

Hella KGaA Hueck & Co. 254

- Company Overview 254

- Product Portfolio 254

- Financials 256

-

Overall Financials 247

-

256

-

Financials By Segments 257

- Financials By Region

-

Financials By Segments 257

-

258

-

Key Developments 259

- Analyst Insight 260

-

Key Developments 259

-

Infineon Technologies Summary 261

-

Company Overview 261

- Product Portfolio 262

- Financials 263

-

Company Overview 261

-

263

-

Financials By Segment 264

- Financials By Region

-

Financials By Segment 264

-

266

-

Key Developments 267

- Analyst Insight 268

-

Key Developments 267

-

Melexis Microelectronic Integrated Systems 269

- Melexis Microelectronic

-

Integrated Systems Summary 269

- Product Portfolio 270

-

Products By Category 270

-

Products By Application 271

- Financials 272

- Key Developments

-

Products By Application 271

-

275

-

Micronas Semiconductor INC. 276

- Company Overview 276

- Product Portfolio 276

- Financials 278

- Financials By Segment 279

- Key Developments 280

-

Murata Manufacturing Co. Ltd. 282

- Overview 282

- Product Portfolio 283

- Financials 284

- Key Developments

-

Micronas Semiconductor INC. 276

-

287

- Analyst Insight 288

- NGK Spark Plugs Co. Ltd. Summary

-

289

-

Overview 289

- Product Portfolio 289

- Financials

-

Overview 289

-

291

-

Overall Financials 291

- Financials By Segments

-

Overall Financials 291

-

292

-

Financials By Region 293

- Key Developments 293

- Analyst Insight 294

-

NXP Semiconductors 295

- Overview

-

Financials By Region 293

-

295

-

Product Portfolio 295

- Financials 297

- Key Developments 300

-

PANASONIC CORPORATION Summary 301

- Product Portfolio 302

- Financials 303

- Key Developments 306

- SWOT Analysis 307

-

Sensata Technologies Summary 308

- Product Portfolio 308

- Financials 310

- Key Developments

-

Product Portfolio 295

-

313

- Analyst Insight 313

-

Stoneridge Inc. Summary 314

- Product Portfolio 314

- Financials 316

-

316

-

Financials By Segments 317

- Financials By Region

-

Financials By Segments 317

-

318

-

Key Developments 319

- Analyst Insight 319

-

Key Developments 319

-

Takata Corporation Summary 320

-

Product Portfolio 320

- Financials

-

Product Portfolio 320

-

322

-

Overall Financials 322

- Financials By Segments

-

Overall Financials 322

-

323

-

Financials By Region 324

- Key Developments 325

- Analyst Insight 326

-

TRW Automotive , Inc. Summary 326

- Product Portfolio 327

- Financials 329

-

Financials By Region 324

-

329

-

Financials By Segments 330

- Financials By Region

-

Financials By Segments 330

-

331

-

Key Developments 332

- Analyst Insight 333

-

Key Developments 332

-

Vishay Intertechnology Summary 334

-

Product Portfolio 334

- Financials 336

- Key Developments

-

Product Portfolio 334

-

339

- Analyst Insight 340

-

CONTENT IN ONE CAR ($)

-

TILL Q1 2018

-

TYPE IN DEVELOPED COUNTRIES

-

CARS BY VEHICLE TYPE IN DEVELOPING COUNTRIES

-

FOR AUTOMOTIVE SENSORS IN PASSENGER CARS (MILLION UNITS), 2022–2030

-

2022–2030

-

(MILLION UNITS), 2022–2030

-

PRESSURE SENSORS IN PASSENGER CARS ($MILLION), 2022–2030

-

GLOBAL MARKET VOLUME FOR AUTOMOTIVE TEMPERATURE SENSORS IN PASSENGER CARS (MILLION UNITS), 2022–2030

-

SENSORS ($ MILLION), 2022–2030

-

POSITION SENSOR

-

IN PASSENGER CARS (MILLION UNITS), 2022–2030

-

VALUE FOR AUTOMOTIVE POSITION SENSORS IN PASSENGER CARS ($MILLION), 2022–2030

-

MARKET VOLUME FOR AUTOMOTIVE MOTION SENSORS IN PASSENGER CARS (MILLION UNITS), 2022–2030

-

CARS ($MILLION), 2022–2030

-

CARS (MILLION UNITS), 2022–2030

-

AUTOMOTIVE OPTICAL SENSORS IN PASSENGER CARS ($MILLION), 2022–2030

-

FOR AUTOMOTIVE TORQUE SENSORS IN PASSENGER CARS(MILLION UNITS), 2022–2030

-

SENSORS

-

CARS (MILLION UNITS), 2022–2030

-

AUTOMOTIVE GAS SENSORS IN PASSENGER CARS ($MILLION), 2022–2030

-

IN PASSENGER CARS ($MILLION), 2022–2030

-

FOR AUTOMOTIVE OTHER SENSORS IN PASSENGER CARS (MILLION UNITS), 2022–2030

-

MEMS SENSOR MARKET

-

MARKET

-

IN DEVELOPED REGIONS

-

CONVENTIONAL VEHICLES IN DEVELOPING REGIONS

-

OF SENSORS IN CHASSIS OF CONVENTIONAL FUEL CARS (MILLION UNITS), 2022–2030

-

CARS ($ MILLION), 2022–2030

-

POWER TRAIN FOR CONVENTIONAL VEHICLES IN DEVELOPED REGIONS

-

NUMBER OF SENSORS IN POWER TRAIN FOR CONVENTIONAL VEHICLES IN DEVELOPING REGIONS

-

FUEL CARS (MILLION UNITS)

-

SYSTEM OF CONVENTIONAL FUEL CARS ($ MILLION), 2022–2030

-

AVERAGE NUMBER OF SENSORS IN BODY SYSTEM FOR CONVENTIONAL VEHICLES IN DEVELOPED REGIONS

-

VEHICLES IN DEVELOPING REGIONS

-

IN BODY SYSTEM OF CONVENTIONAL FUEL CARS (MILLION UNITS), 2022–2030

-

($ MILLION), 2022–2030

-

OF ALTERNATIVE FUEL VEHICLES BY REGION TYPE

-

OF SENSORS IN CHASSIS OF ELECTRIC CARS (MILLION UNITS), 2022–2030

-

BY REGION TYPE

-

OF ELECTRIC CARS(MILLION UNITS), 2022–2030

-

VALUE OF SENSORS IN POWER TRAIN OF ELECTRIC CARS ($ MILLION), 2022–2030

-

BY REGION TYPE

-

OF ELECTRIC CARS (MILLION UNITS), 2022–2030

-

VALUE OF SENSORS IN BODY SYSTEM OF ELECTRIC CARS ($ MILLION), 2022–2030

-

CAR, BY GEOGRAPHY, 2022–2030

-

VALUE ($ MILLION) FOR HEAVY VEHICLES, BY GEOGRAPHY, 2022–2030

-

CARS($ MILLION), 2022–2030

-

VALUE FOR PASSENGER CAR ($ MILLION), 2022–2030

-

SENSOR MARKET VALUE FOR PASSENGER CAR ($ MILLION), 2022–2030 167

-

PASSENGER CAR($ MILLION), 2022–2030 173

-

MARKET VALUE IN PASSENGER CAR ($ MILLION), 2022–2030 174

-

AUTOMOTIVE SENSOR MARKET VALUE ($ MILLION), 2022–2030 176

-

UK AUTOMOTIVE SENSOR MARKET VALUE FOR PASSENGER CAR ($ MILLION), 2022–2030

-

178

-

CAR($ MILLION), 2022–2030 179

-

VALUE FOR PASSENGER CAR ($ MILLION), 2022–2030 180

-

METHODOLOGY FOR GLOBAL MARKET

-

CATEGORIES

-

VEHICLE TYPE, 2022–2030

-

($ MILLION) BY GEOGRAPHY, 2022–2030

-

VALUE FOR PASSENGER CARS SENSOR MARKET VALUE, BY SENSOR TYPE (2018 AND 2025)

-

OF GENIVI MEMBERSHIP

-

PRESSURE SENSORS

-

BODY SYSTEMPRESSURE SENSOR

-

BY FUNCTIONAL APPLICATION

-

SENSORS

-

SENSOR

-

UP: BY FUNCTIONAL APPLICATION

-

AUTOMATION SYSTEM

-

APPLICATION

-

ON-ROAD VISION BASED SYSTEM

-

: BY FUNCTIONAL APPLICATION

-

BY FUNCTIONAL APPLICATION

-

BREAKDOWN FOR THE GLOBAL AUTOMOTIVE SENSOR MARKET

-

& ACQUISITIONS: 183

-

2022–2030 192

-

FINANCIALS ($MILLION), 2022–2030 197

-

2022–2030 198

-

($ MILLION), 2022–2030 204

-

BY REGION, 2022–2030 216

-

REVENUE BY BUSINESS SEGMENTS, 2022–2030 222

-

REGION, 2022–2030 223

-

227

-

233

-

234

-

SNAPSHOT 240

-

BY REGION, 2022–2030 243

-

PRODUCTS 246

-

247

-

REVENUE BY REGION, 2022–2030 249

-

252

-

HELLA OVERALL FINANCIALS ($MILLION), 2022–2030 256

-

BY SEGMENT, 2022–2030 257

-

258

-

FINANCIALS($ MILLION), 2022–2030 263

-

2022–2030 264

-

FINANCIALS ($ MILLION), 2022–2030 272

-

2022–2030 273

-

OVERALL FINANCIALS ($ MILLION), 2022–2030 278

-

BY SEGMENT, 2022–2030 279

-

280

-

BY SEGMENT, 2022–2030 285

-

286

-

NGK SPARK PLUGS CO. LTD.: OVERALL FINANCIALS ($MILLION), 2022–2030 291

-

BY REGION, 2011-14 293

-

297

-

NET REVENUE BY REGION, 2022–2030 299

-

SEGMENTS 302

-

BY REGION, 2022–2030 305

-

FINANCIALS ($MILLION), 2022–2030 310

-

2022–2030 311

-

2022–2030 316

-

PRODUCT DIVISIONS 321

-

2022–2030 322

-

BUSINESS SEGMENT 327

-

2022–2030 329

-

FINANCIALS ($MILLION), 2022–2030 336

-

SEGMENTS, 2022–2030 337

-

338

Automotive Sensors Market Segmentation

Automotive Sensors Type Outlook (USD Million, 2018-2030)

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

Automotive Sensors Technology Outlook (USD Million, 2018-2030)

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

Automotive Sensors Vehicle Type Outlook (USD Million, 2018-2030)

- Conventional Fuel Cars

- Alternative Fuel Cars Heavy Vehicles

Automotive Sensors Regional Outlook (USD Million, 2018-2030)

North America Outlook (USD Million, 2018-2030)

- North America Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- North America Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- North America Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

US Outlook (USD Million, 2018-2030)

- US Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- US Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- US Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

CANADA Outlook (USD Million, 2018-2030)

- CANADA Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- CANADA Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- CANADA Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

- North America Automotive Sensors by Type

Europe Outlook (USD Million, 2018-2030)

- Europe Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Europe Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Europe Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars Heavy Vehicles

Germany Outlook (USD Million, 2018-2030)

- Germany Automotive Sensors by Fusion Technology

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Germany Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Germany Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars Heavy Vehicles

France Outlook (USD Million, 2018-2030)

- France Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- France Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- France Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

UK Outlook (USD Million, 2018-2030)

- UK Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- UK Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- UK Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

ITALY Outlook (USD Million, 2018-2030)

- ITALY Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- ITALY Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- ITALY Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

- Europe Automotive Sensors by Type

SPAIN Outlook (USD Million, 2018-2030)

- Spain Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Spain Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Spain Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

Rest Of Europe Outlook (USD Million, 2018-2030)

- Rest Of Europe Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- REST OF EUROPE Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- REST OF EUROPE Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

Asia-Pacific Outlook (USD Million, 2018-2030)

- Asia-Pacific Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Asia-Pacific Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Asia-Pacific Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

China Outlook (USD Million, 2018-2030)

- China Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- China Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- China Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

Japan Outlook (USD Million, 2018-2030)

- Japan Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Japan Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Japan Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

India Outlook (USD Million, 2018-2030)

- India Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- India Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- India Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

Australia Outlook (USD Million, 2018-2030)

- Australia Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Australia Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Australia Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

Rest of Asia-Pacific Outlook (USD Million, 2018-2030)

- Rest of Asia-Pacific Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Rest of Asia-Pacific Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Rest of Asia-Pacific Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

- Asia-Pacific Automotive Sensors by Type

Rest of the World Outlook (USD Million, 2018-2030)

- Rest of the World Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Rest of the World Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Rest of the World Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

- Rest of the World Automotive Sensors by Type

Middle East Outlook (USD Million, 2018-2030)

- Middle East Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Middle East Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Middle East Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

Africa Outlook (USD Million, 2018-2030)

- Africa Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Africa Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Africa Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

Latin America Outlook (USD Million, 2018-2030)

- Latin America Automotive Sensors by Type

- Pressure

- Temperature

- Position

- Motion

- Optical

- Torque

- Gas

- Level

- Other Sensors

- Latin America Automotive Sensors by Technology

- Micro-Electro-Mechanical Systems(MEMS)

- Non-Electro-Mechanical Systems(Non-MEMS)

- Nano-Electro-Mechanical Systems(NEMS)

- Latin America Automotive Sensors by Vehicle Type

- Conventional Fuel Cars

- Alternative Fuel Cars

- Heavy Vehicles

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment