Market Trends

Key Emerging Trends in the Automotive Front end Module Market

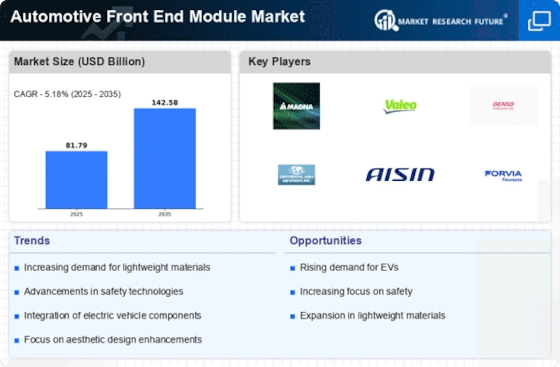

The automotive industry has been witnessing significant market trends in the realm of Automotive Front End Modules (FEM). These modules, comprising various components like bumpers, grilles, headlights, and radiators, play a crucial role in enhancing the aesthetics and functionality of vehicles. One prominent trend shaping the Automotive Front End Module Market is the increasing demand for lightweight materials. As manufacturers strive to meet stringent fuel efficiency standards and reduce overall vehicle weight, there is a growing preference for materials such as high-strength plastics and composites in FEM production. This shift not only aids in achieving weight reduction but also contributes to improved fuel efficiency and lower emissions. Another noteworthy trend is the integration of advanced technologies in front end modules. With the automotive industry embracing the era of electric and autonomous vehicles, FEMs are evolving to accommodate sensors, cameras, and other electronic components essential for these advanced functionalities. This trend is driven by the rising consumer demand for safety features and the industry's pursuit of innovation to stay competitive. As a result, Automotive Front End Modules are becoming more sophisticated, serving not only as structural elements but also as technology hubs that support the integration of advanced driver assistance systems. The global push towards sustainable practices has also influenced the Automotive Front End Module Market. In order to comply with environmental rules and consumer expectations, manufacturers are progressively implementing eco-friendly materials and production techniques. Reducing the environmental effect of automotive components is demonstrated by the use of sustainable production methods in conjunction with the integration of recyclable materials in FEMs. The increasing understanding and eco-consciousness of customers is fueling the sustainability movement in addition to legislative restrictions. Furthermore, regional variations in market trends add nuance to the global landscape. In developed markets, where safety regulations are stringent and consumers prioritize advanced features, there is a higher demand for FEMs with integrated sensor technologies. On the other hand, in emerging markets, cost considerations often play a more significant role, driving manufacturers to focus on producing cost-effective yet reliable front end modules. This dichotomy in regional preferences highlights the importance of understanding diverse market dynamics and tailoring FEM offerings to meet specific regional requirements. The Automotive Front End Module Market is also witnessing a shift in supply chain strategies. Manufacturers are increasingly exploring collaborative approaches and forming strategic partnerships to enhance their production capabilities and meet the growing demand for FEMs. This trend is driven by the need for agility in responding to market changes, ensuring a stable supply of components, and accessing complementary expertise. Collaborations between automakers and FEM suppliers are becoming more commonplace, fostering innovation and efficiency throughout the supply chain.

Leave a Comment